Ethereum staking reaches new ATH of $65B – Details inside

- Ethereum’s staking market cap surged to $65.45 billion.

- ETH’s liquid provide has been going downhill over the past two years.

Ethereum [ETH] staking confirmed no indicators of saturation as the whole provide locked in ETH’s deposit contract surged to a recent all-time excessive (ATH).

ETH staking on a roll

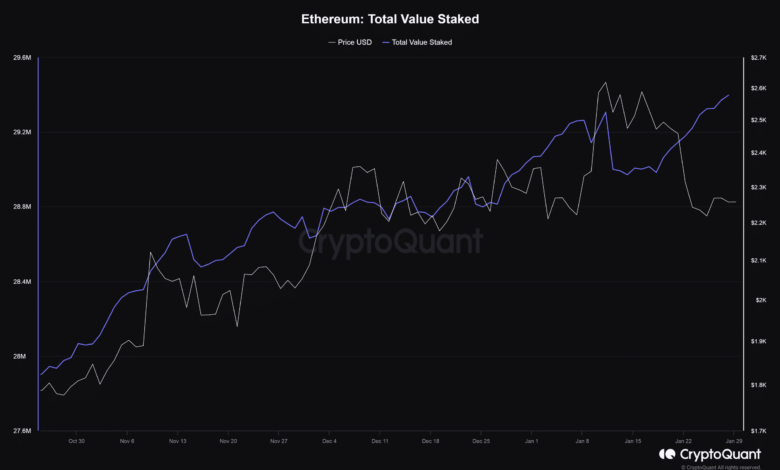

In response to AMBCrypto’s evaluation of CryptoQuant knowledge, about 29.39 million ETH cash had been staked on the blockchain as of this writing, equating to just about 1 / 4 of the whole circulating provide.

Supply: CryptoQuant

With this, the whole USD worth of the staked cash surged to $65.45 billion, accounting for roughly 35% of the whole market cap of all proof-of-stake (PoS) asserts, AMBCrypto found utilizing knowledge from Staking Rewards.

Customers have proven heightened curiosity in staking because the Shapella Improve was launched final April.

Staking, which was thought-about a dangerous proposition owing to withdrawal ambiguity, acquired a lift after the unlocking of ETH was permitted.

Certainly, ETH staked provide has jumped by 55% since Shapella.

An fascinating side of the rise was how holders’ staking selections grew to become unbiased of ETH’s value efficiency. Notice within the above graph how staked provide elevated in January regardless of ETH’s drop.

Will depleting rewards stem the stream?

Whereas ETH staking has grown in reputation over the months, it has decreased the staking yields, in pursuit of which customers participated within the exercise within the first place.

As seen from Staking Rewards knowledge, the annualized common reward fee dipped from 5% in the beginning of January to three.54% as of this writing.

Nonetheless, this was anticipated because the rewards are inversely associated to the quantity of ETH deposited on the community and the variety of stakers concerned.

Supply: Staking Rewards

It remained to be seen if the staking fee can be sustained in the long term because the yields proceed to fall.

Nonetheless, one factor was clear — ETH holders had been prioritizing assured, steady returns over risk-laden market buying and selling.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

ETH’s notion adjustments drastically

ETH’s liquid provide, which is supposed for energetic buying and selling, has been going downhill over the past two years, in line with CryptoQuant.

A rotation of capital from buying and selling to staking implied that the second-largest cryptocurrency was being perceived as a long-term funding asset.

Supply: CryptoQuant