Ethereum struggles amid ETH ETF outflows and rising supply – What now?

- Outflows from spot Ether ETFs have totaled $433M after three consecutive days of outflows.

- The declining demand for ETH alongside a rising provide has hampered Ethereum’s efforts to realize.

The cryptocurrency market made a robust rebound on Tuesday in the course of the Asian buying and selling session. Ethereum [ETH] has gained round 2% to commerce at $2,678 on the time of writing.

Nonetheless, regardless of the current beneficial properties, the biggest altcoin has misplaced 23% of its worth since spot Ether exchange-traded funds (ETFs) launched within the US final month.

So, what’s weighing down Ethereum’s worth?

Ethereum ETF outflows hit $433M

The cumulative web outflows from spot Ethereum ETFs stood at $433M at press time.

The Grayscale Ethereum Belief ETF (ETHE), that launched with $10 billion in belongings, has posted a constant destructive stream since its launch. The ETF nonetheless holds $4.84 billion in web belongings, elevating additional draw back danger.

Supply: SoSoValue

Final week, Framework Ventures co-founder, Vance Spencer predicted that traders may finally allocate their portfolios with a 50-50 cut up between Bitcoin and Ether ETFs.

Nonetheless, over the past three buying and selling days, Bitcoin ETFs have had consecutive inflows whereas Ethereum ETFs noticed consecutive outflows.

Declining community exercise will increase ETH provide

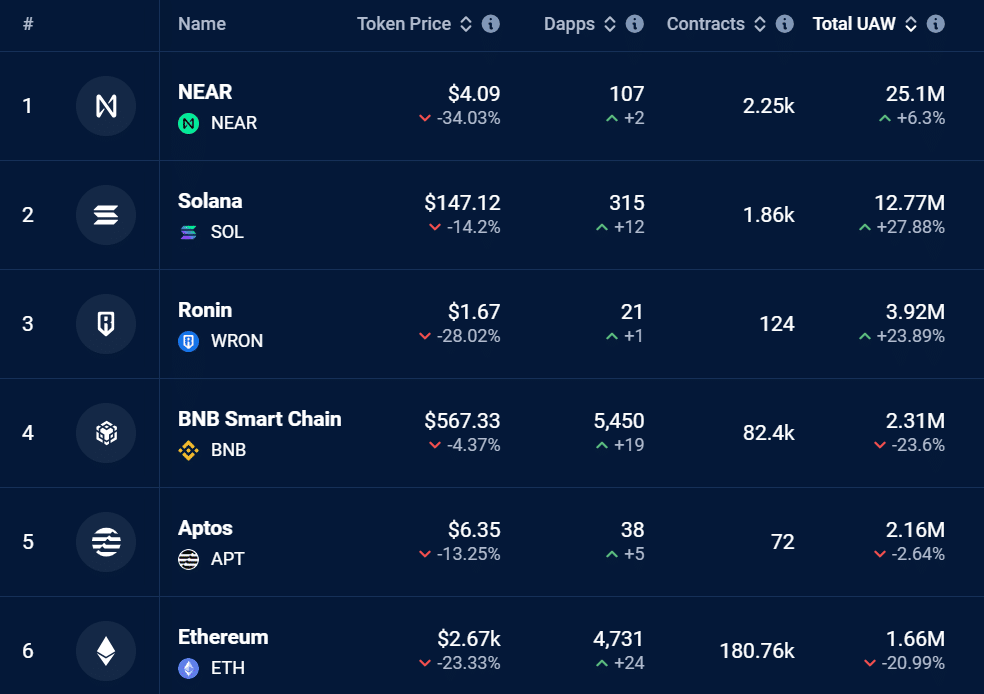

Ethereum’s community has additionally seen a decline in utilization, as seen on DappRadar.

The variety of distinctive lively wallets (UAW) on the Ethereum community has dropped by 20% within the final 30 days. The 30-day consumer depend on Ethereum stands at 1.66 million, rating it sixth by this metric.

Supply: DappRadar

The declining community utilization has additionally affected the quantity of ETH tokens burned, which has, in flip, elevated provide, making Ethereum inflationary.

Knowledge from Ultrasound Money confirmed that within the final seven days, round 18,000 ETH tokens had been issued, whereas only one,500 had been burned.

This meant that ETH’s provide has elevated by greater than 16,000 tokens inside seven days. The rising provide on the again of decreasing demand has exerted downward strain on ETH.

Indicators sign weak demand

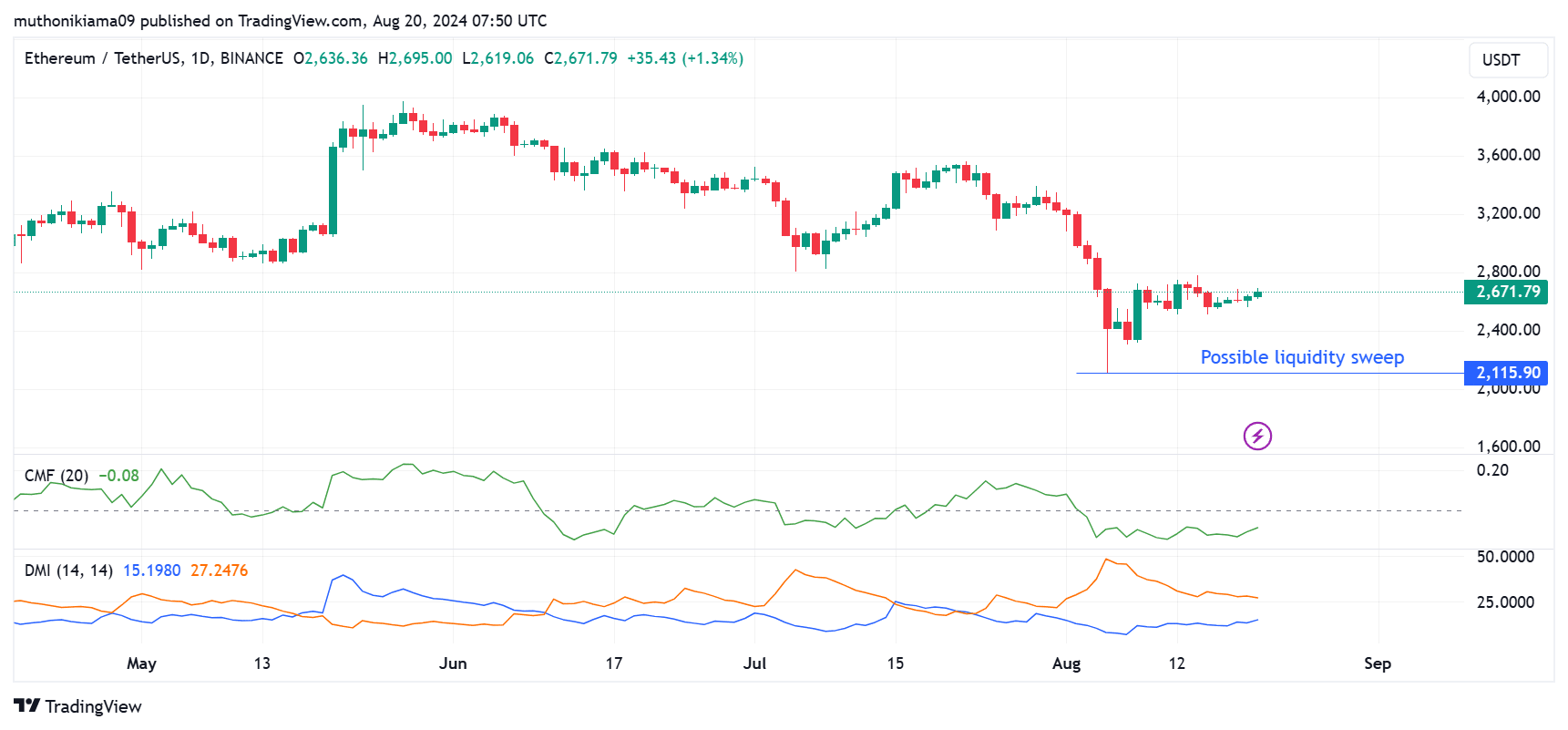

ETH was dealing with weak demand at press time, which may doubtlessly overwhelm on costs. The Chaikin Cash Movement, which measures accumulation and distribution, was destructive right now.

So, promoting strain has outweighed shopping for strain since early August.

Supply: TradingView

The constructive Directional Motion Index (DMI) additionally confirmed a downtrend, because the constructive Directional Indicator has been under the destructive Directional Indicator since July.

Nonetheless, the gap between the 2 strains has been narrowing, hinting at a possible reversal. Merchants also needs to be careful for a possible liquidity sweep at $2,115 as the worth makes a robust rebound.

Reasonable or not, right here’s ETH’s market cap in BTC’s phrases

Per AMBCrypto’s have a look at CryptoQuant, ETH wants a return of leverage merchants for an upward correction.

Additionally, in response to Coinglass, Ethereum’s Open Curiosity has dropped from a peak of $17 billion in Might to the present $10 billion.