Ethereum struggles at $1,750 – Assessing odds of ETH recovery

ETH diverges sharply from BTC as Q1 drawdown widens

Ethereum bore the brunt of Q1’s crypto correction, shedding 44.83% of its worth in comparison with Bitcoin’s extra reasonable 14.67% decline, as proven in knowledge from IntoTheBlock.

Supply: IntoTheBlock

The divergence underscores Ethereum’s vulnerability as threat appetites shift, regulatory considerations come up, and demand for Ethereum-based property weakens.

Whereas Bitcoin’s decline displays broader macroeconomic volatility, Ethereum’s sharper drop signifies a confidence hole. Merchants seem like redirecting capital into Bitcoin, thought of the “safer” cryptocurrency choice.

Even conventional markets just like the S&P 500 outperformed Ethereum, emphasizing its underperformance as one of many quarter’s most notable traits.

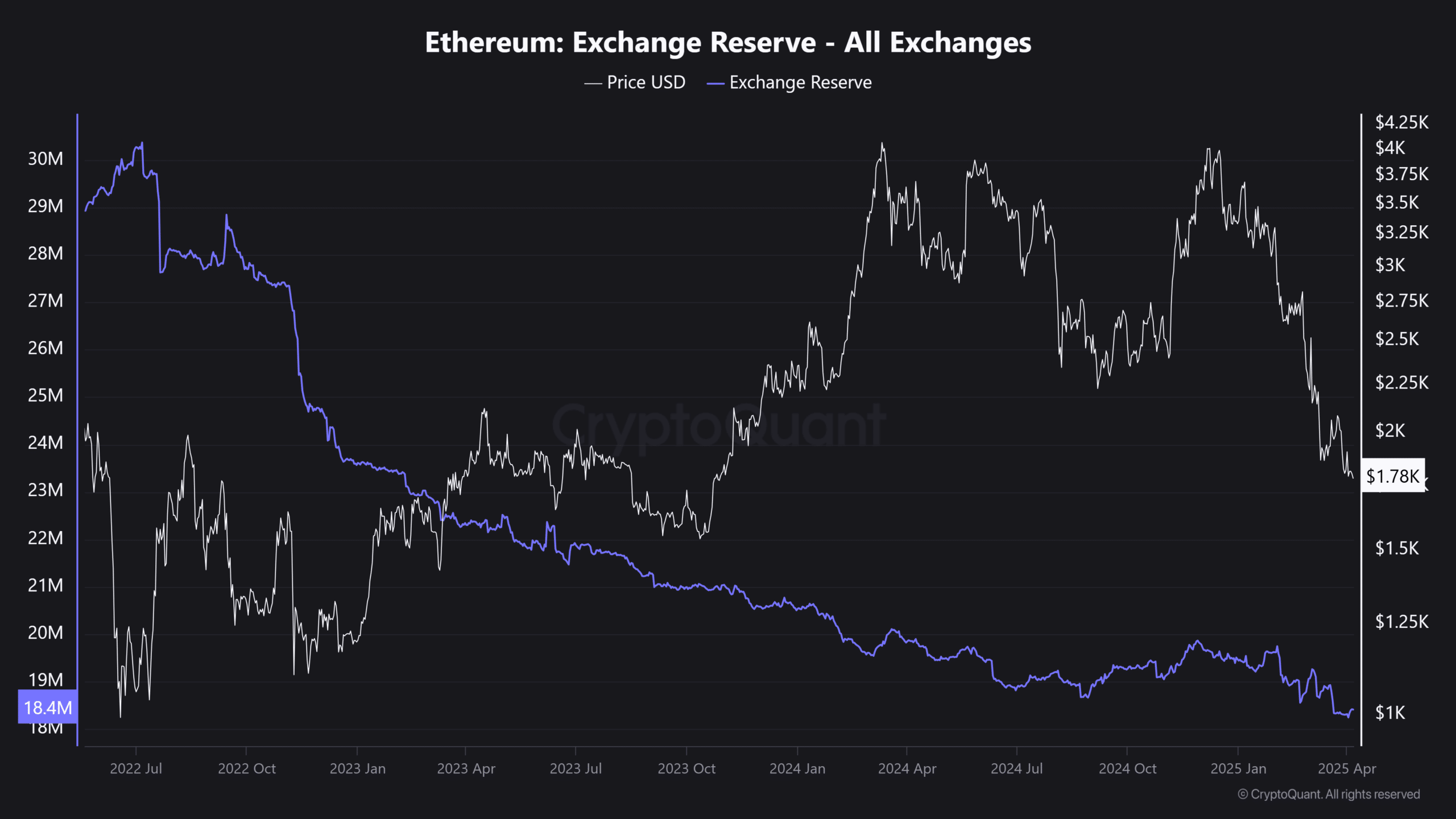

Trade reserves hit new lows

Including to Ethereum’s regarding quarter is a continued drop in alternate reserves, which have now fallen to only 18.4 million ETH — the bottom stage in over three years, in accordance with CryptoQuant knowledge.

Usually, such a decline can be learn as bullish, signaling long-term conviction and decreased promote strain.

Supply: Cryptoquant

The continued decline in ETH’s value tells a special story. A discount in tokens on exchanges has not led to elevated shopping for momentum.

As a substitute, it could point out broader investor disengagement, a shift towards passive holding, staking, and even potential exit methods.

Whereas the availability is lowering, investor confidence seems to be fading as properly.

Ethereum: Caught in no man’s land?

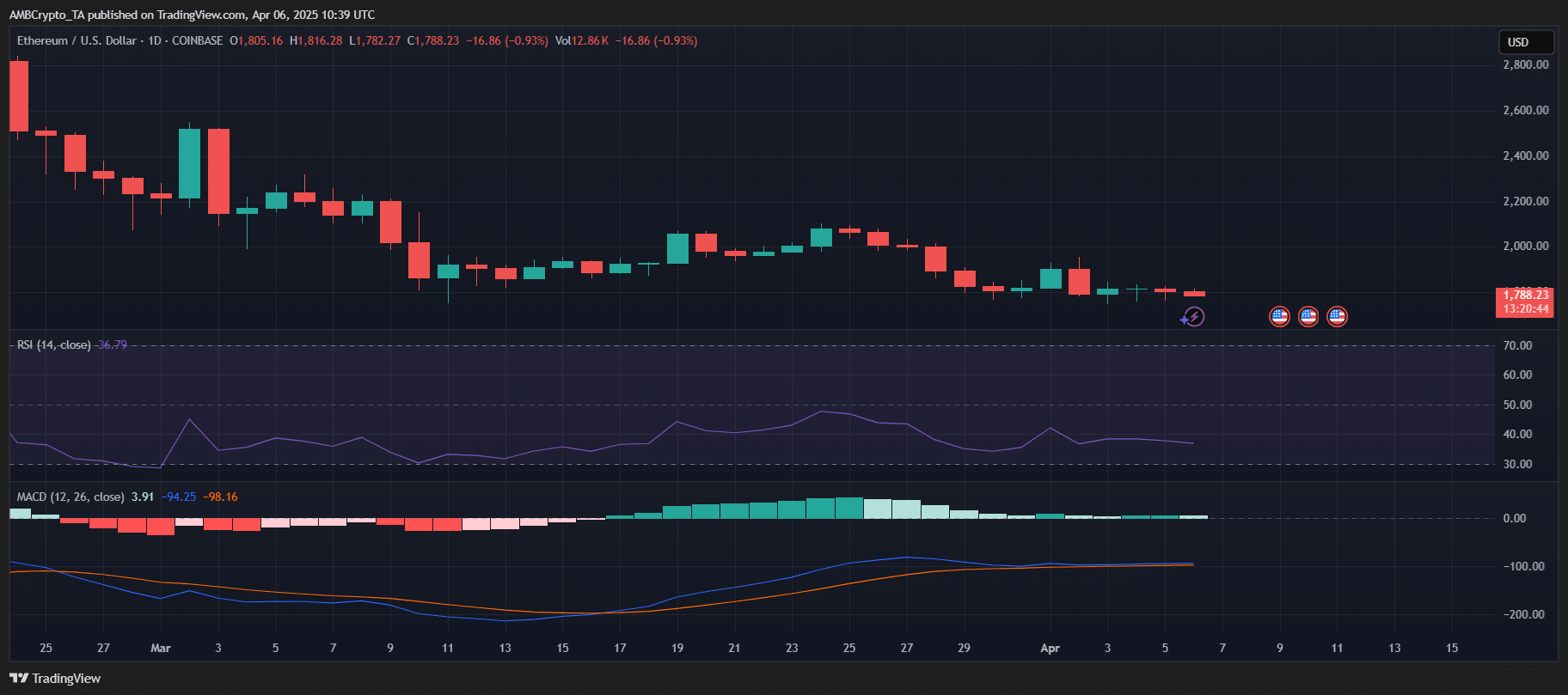

Buying and selling at $1,788 at press time, ETH sat simply above a key psychological stage of $1,750, with no clear indicators of bullish momentum.

The RSI hovered at 36.7 — edging towards oversold territory, but missing sufficient shopping for strain to spark a reversal. In the meantime, the MACD was exhibiting weak upward momentum, with the histogram barely flipping inexperienced.

Supply: TradingView

The value has been range-bound for over two weeks, hinting at indecision quite than accumulation.

Except ETH can reclaim the $1,850-$1,900 zone with quantity help, draw back threat stays. Within the brief time period, a break under $1,750 may set off a retest of $1,650.