Ethereum traders, watch out for THIS level to avoid the next sell-off!

- ETH made reasonable positive aspects on the month-to-month charts, mountaineering by simply 2.89%

- Analyst believes ETH should keep above $2300 to keep away from mass sell-offs

Whereas Bitcoin [BTC] has declined over the previous week, Ethereum [ETH] has taken a unique path. By doing so ETH registered reasonable positive aspects on its month-to-month worth charts.

On the time of writing, Ethereum was buying and selling at $2,404. This marked a 1.06% hike on the weekly charts, with the altcoin gaining on the every day charts too.

Regardless of these positive aspects, nevertheless, ETH stays considerably under its latest excessive of $2,700 and 50.7% from its ATH of $4878. As anticipated, these market situations have left analysts speaking. One in every of them is widespread crypto analyst Ali Martinez, in response to whom, $2,300 stays ETH’s key help stage.

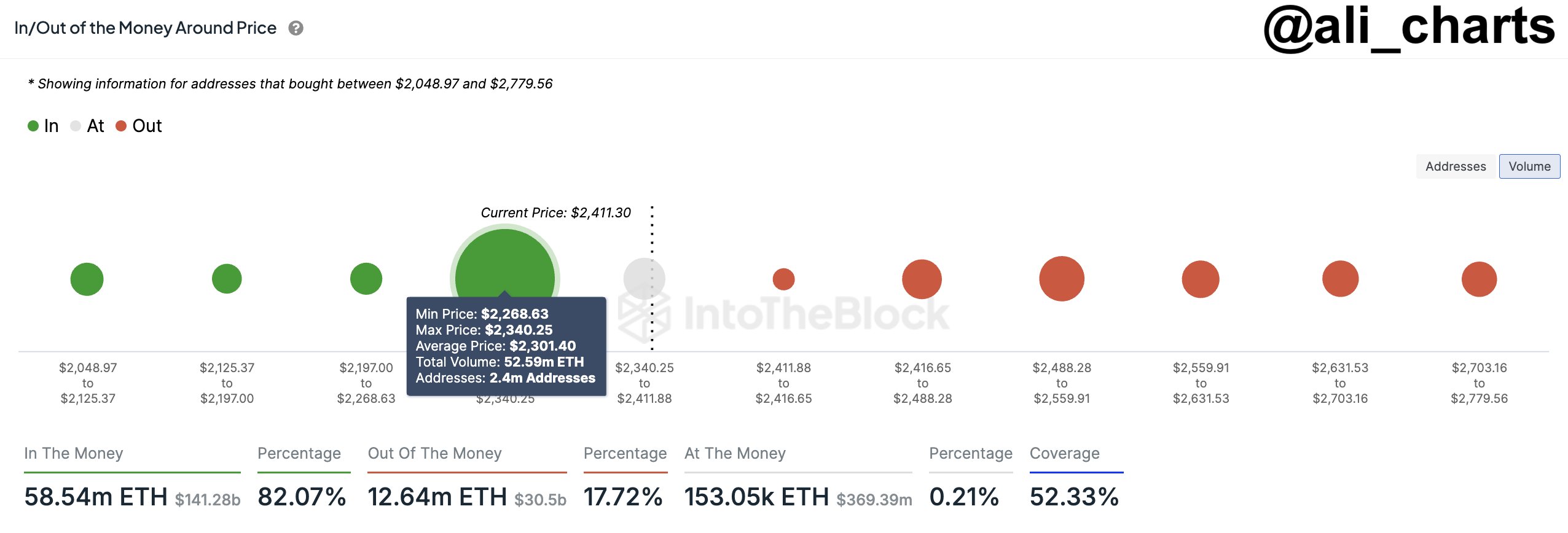

Why 2.4 million addresses are key

In his evaluation, Martinez cited 2.4 million addresses that bought 52.6 million ETH tokens at $2,300. In response to him, ETH should maintain above this stage because it stays essentially the most vital help stage for the altcoin.

Supply: X

Consequently, if the altcoin fails to carry this demand zone, ETH will report an enormous sell-off. A drop under this stage will push buyers into panic promoting as they try to reduce losses.

In a such situation, Ethereum will see promoting strain, thus driving costs additional down the charts.

What does ETH’s chart say?

Now, though the aforementioned remark by Martinez pointed to a possible market sell-off, it’s important to cross-check and decide what different market indicators counsel.

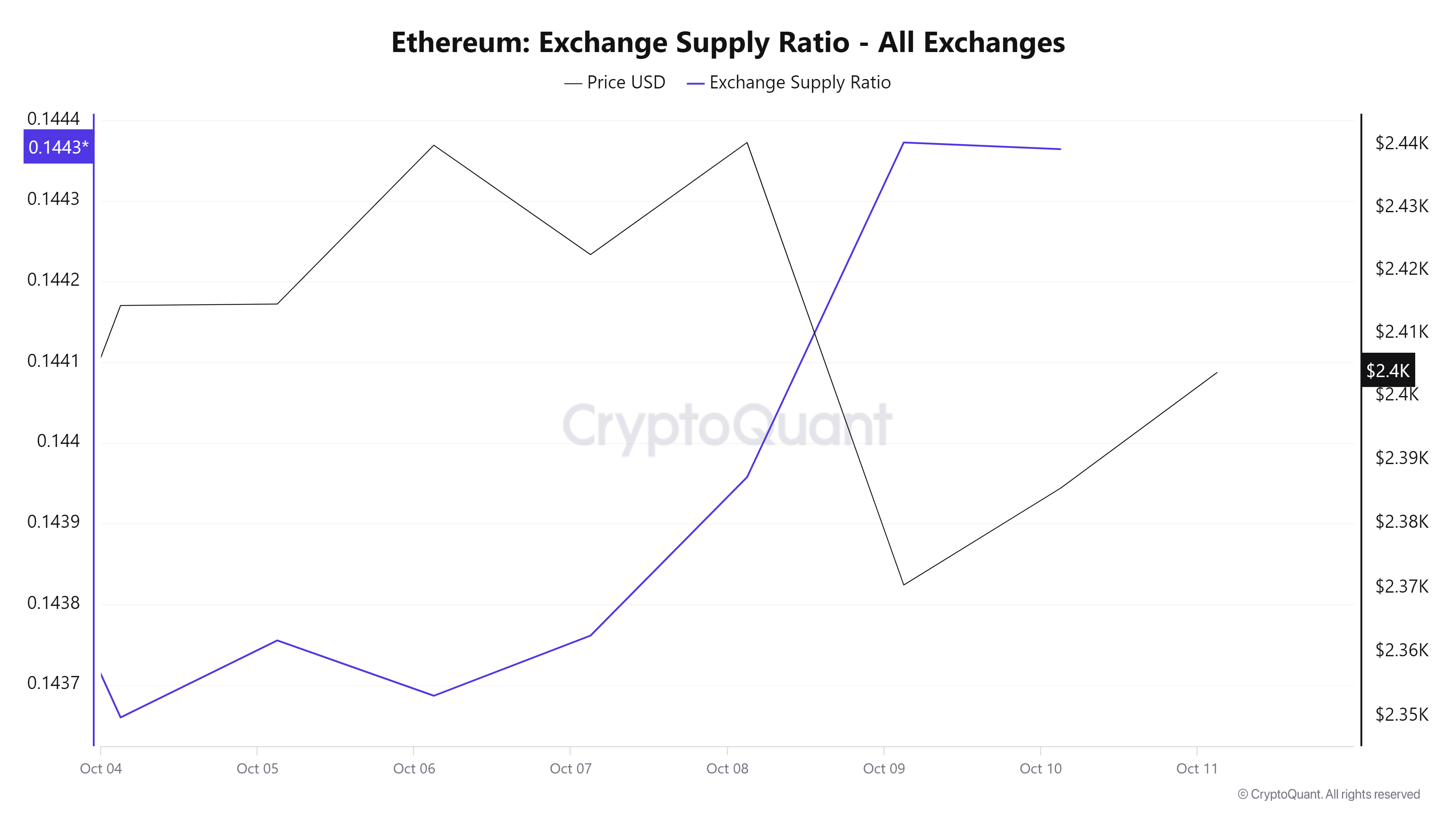

Supply: Cryptoquant

For instance, Ethereum’s Change Provide ratio spiked over the previous week from 0.143 to 0.1443. The uptick within the change provide ratio advised that holders could also be making ready to promote or take earnings.

That is normally a bearish sign as buyers transfer their ETH from personal wallets to exchanges.

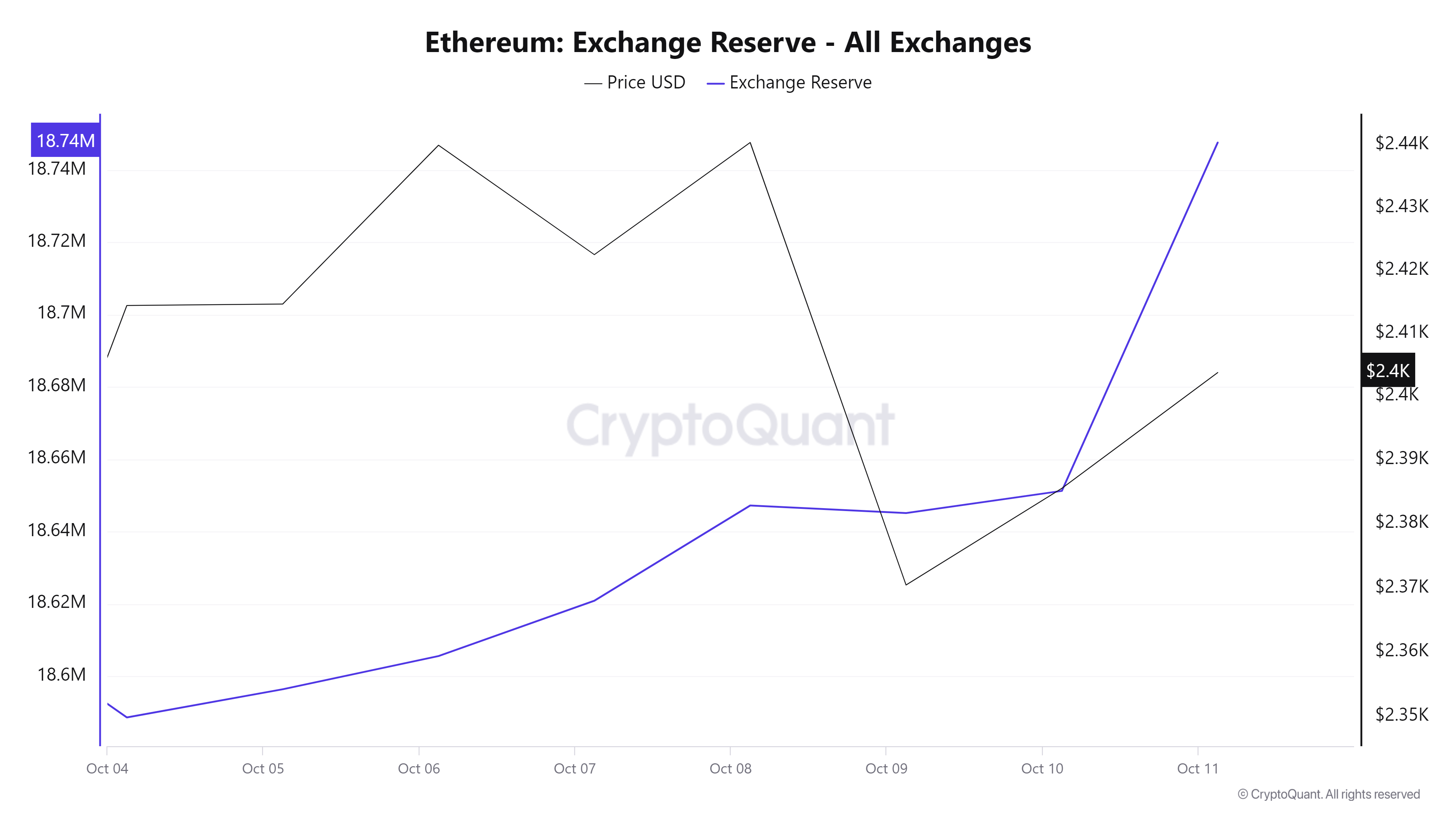

Supply: Cryptoquant

Moreover, Ethereum’s Change Reserve has been rising all through the week, with the identical hitting figures of $18.7 million at press time. As noticed earlier with a spike in change provide ratio, this additional supported our remark that buyers are transferring their ETH to exchanges.

The sort of market habits would doubtlessly result in promoting strain, thus pushing costs down.

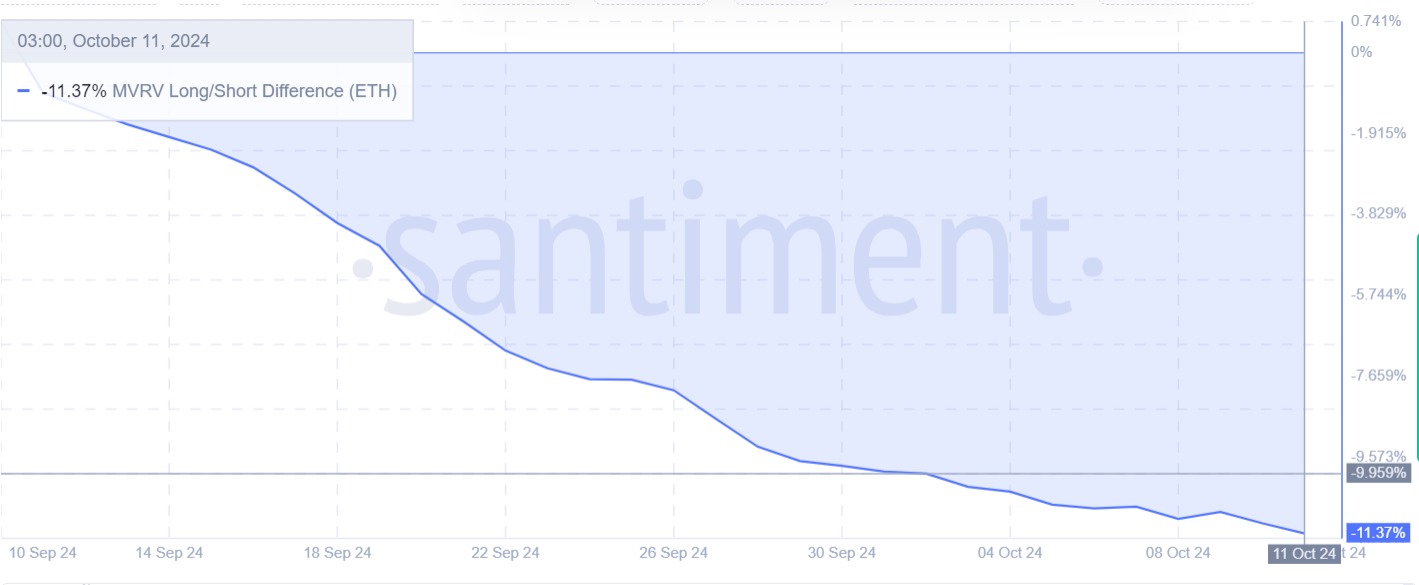

Supply: Santiment

Lastly, Ethereum’s MVRV lengthy/quick distinction has remained adverse over the previous month. Often, when long-term holders are seeing losses whereas short-term holders are worthwhile, it results in long-term holder capitulation. This leads to higher promoting strain as they try to reduce their losses.

As such, capitulation by long-term holders leads to a short lived backside as they shut their positions, risking driving costs decrease within the quick time period.

Merely put, in response to AMBCrypto’s evaluation, ETH has been buying and selling inside a multi-month descending channel. Accompanied by adverse market sentiment, Ethereum might decline earlier than a breakout from this development. If it sees a pullback, ETH will discover the web help at $2,325.