Ethereum whale accumulates 15K ETH: Will this finally help prices?

- Ethereum whales enhance holdings, however community development slows.

- ETH beneficial properties barely, however traders maintain out for a $4k milestone.

Ethereum[ETH] witnessed a big uptick over the previous few days, regardless of the rumors of a attainable rejection of its Spot ETF approval.

Whale curiosity on the rise

One issue contributing to the surge in ETH’s worth was the exercise of huge holders.

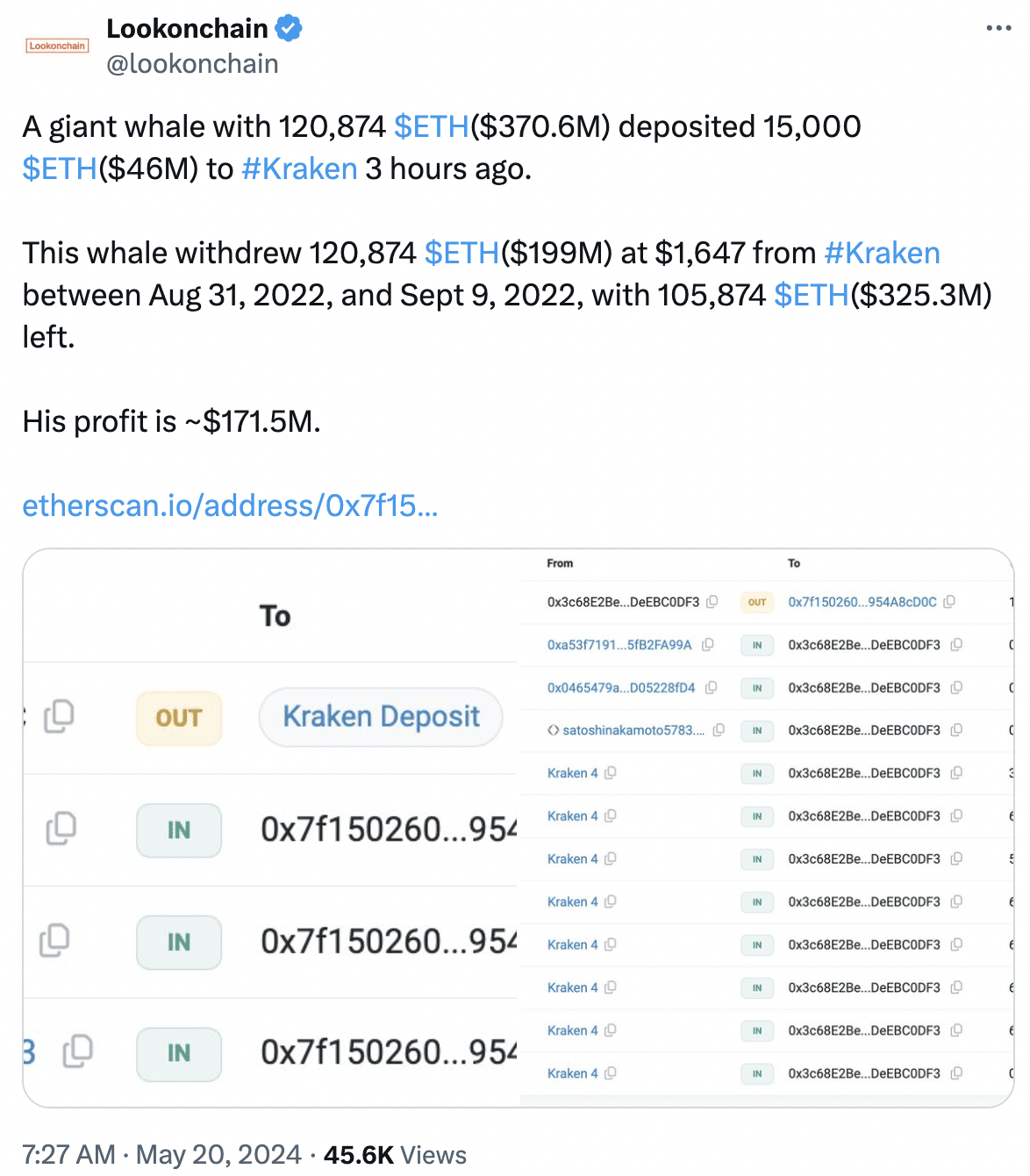

In line with Lookonchain’s knowledge, a big whale possessing 120,874 ETH, valued at $370.6 million, deposited 15,000 ETH price $46 million into Kraken on the twentieth of Might.

This similar whale withdrew 120,874 ETH valued at $199 million, priced at $1,647 every, from Kraken between the thirty first of August 2022, and the ninth of September 2022, leaving 105,874 ETH valued at $325.3 million.

Consequently, the investor’s revenue amounted to $171.5 million.

Supply: X

Issues forward

The numerous whale accumulation might additional push the value of ETH to new ranges. The value could possibly reclaim $3,500 quickly if bullish momentum persists.

Nevertheless, there could also be some challenges that ETH might face going ahead.

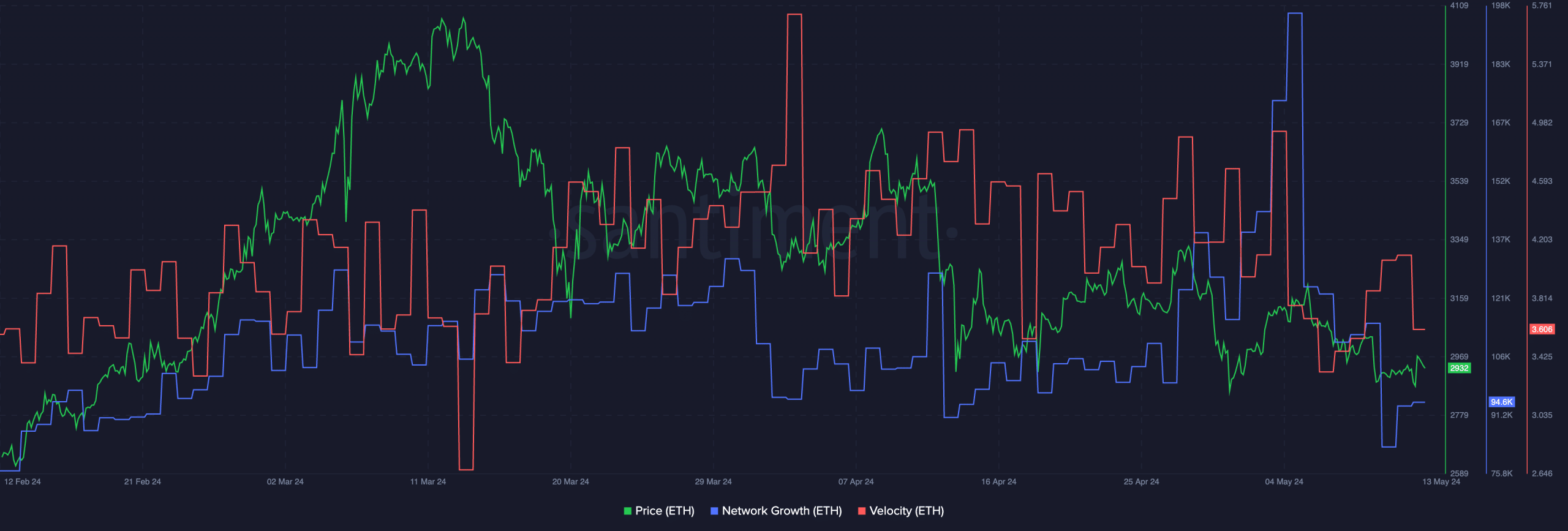

On the time of writing, the Community Development for ETH had plummeted, which meant that new addresses had been slowly shedding curiosity within the altcoin.

Although this may occasionally assist ETH’s case within the quick time period, ETH wants to have the ability to appeal to new addresses for long-term development.

Coupled with that, the rate of ETH had additionally fallen, which implied that the frequency with which ETH was buying and selling at had additionally declined.

Supply: Santiment

How are holders doing?

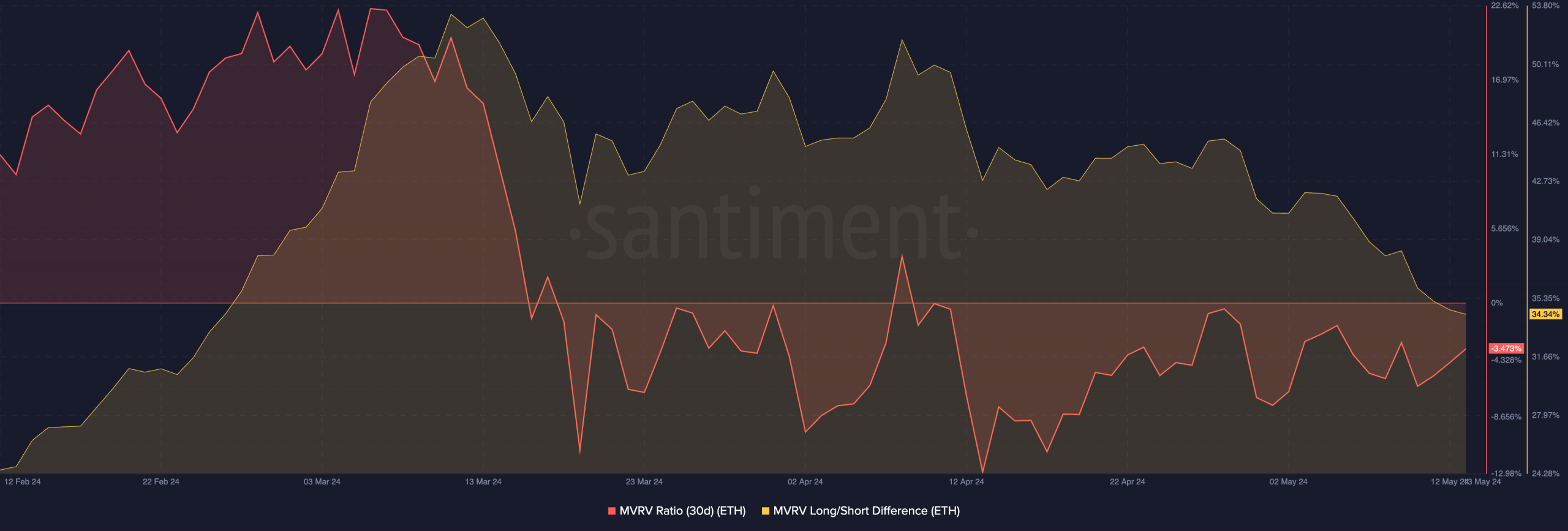

Regardless of the value surge, most ETH holders had been unprofitable at press time. This was indicated by the MVRV ratio of ETH, which had declined.

A destructive MVRV ratio meant that ETH nonetheless had room to develop earlier than profit-taking might happen and a slight surge in worth could possibly be anticipated.

Nevertheless, the Lengthy/Quick ratio for ETH had fallen considerably, displaying that the variety of long-term holders accumulating ETH had fallen.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

A prevalence of short-term holders might end in a surge in volatility for ETH sooner or later as they’re extra more likely to promote their holdings in occasions of uncertainty, whereas long run holders are extra resilient.

Supply: Santiment

At press time, ETH was buying and selling at $3,107.09 and its worth had grown by 0.67% within the final 24 hours.