Ethereum whales dive in: Long-term recovery or short-term spike?

- Whales started to point out large curiosity in ETH together with retail buyers.

- The value of ETH gained considerably, and brief positions have been liquidated.

Ethereum [ETH] stagnated for fairly a while under the $3,200 stage mark, nevertheless, a current resurgence in curiosity has pushed ETH previous its earlier value ranges.

Whales transfer in

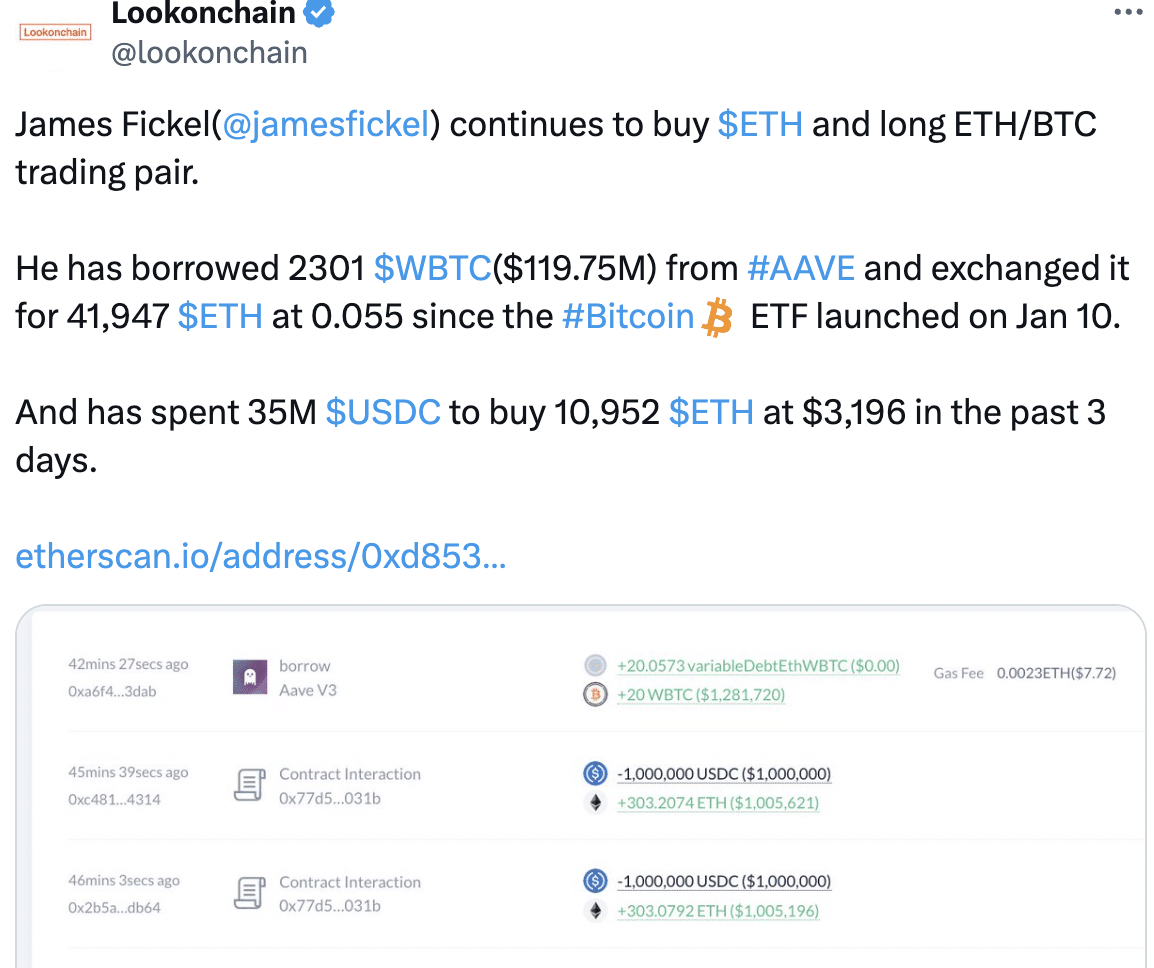

As per Lookonchain’s knowledge, a major whale continued in buying ETH and coming into lengthy positions within the ETH/BTC buying and selling pair.

The investor borrowed 2301 WBTC (equal to $119.75M) from AAVE and transformed it into 41,947 ETH at a price of 0.055, following the launch of the Bitcoin ETF on the tenth of January.

Inside the final three days, the whale expended 35 million USDC to amass 10,952 ETH at $3,196.

A big investor with substantial capital inserting an enormous wager on ETH can increase general confidence within the cryptocurrency.

This could appeal to different buyers who could be on the fence, resulting in a snowball impact of shopping for strain.

Supply: X

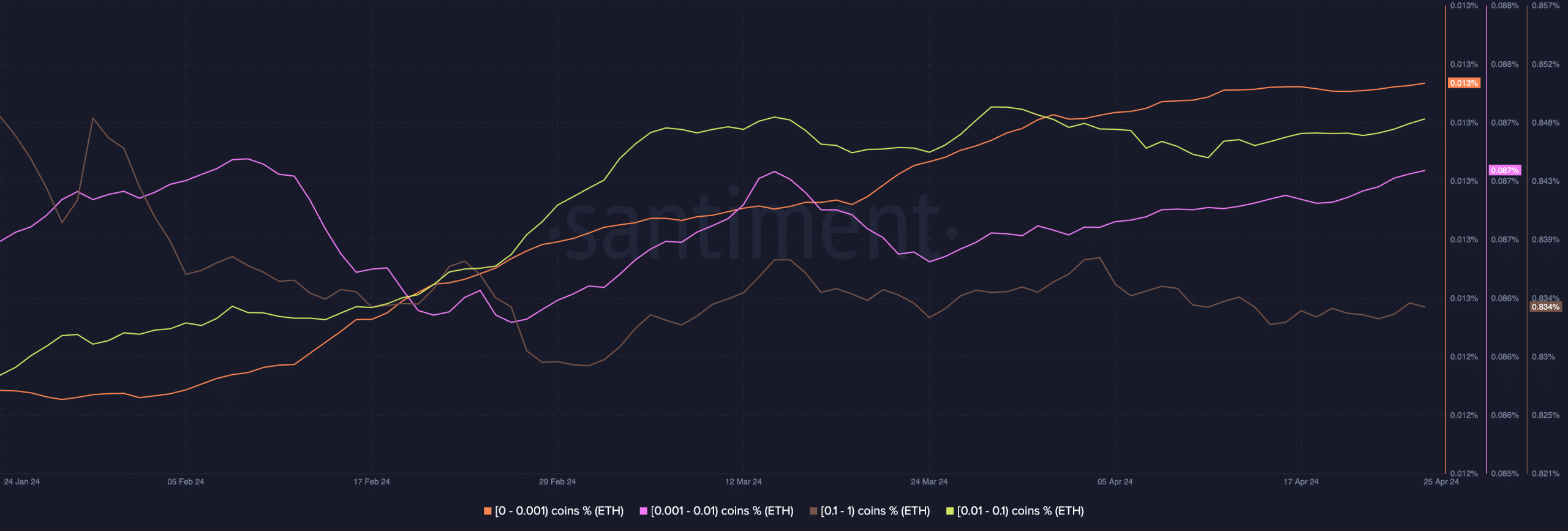

It wasn’t simply whales that have been displaying curiosity in ETH, retail buyers’ demand for Ethereum was additionally noticed to be rising.

Addresses holding anyplace between 0.001 to 1 ETH had began to build up giant quantities of ETH, in line with AMBCrypto’s evaluation of Santiment’s knowledge.

The curiosity showcased in ETH from each whales and retail buyers steered that sentiment throughout all sectors of the crypto market is comparatively bullish round ETH.

Supply: Santiment

Because of these components, the value of ETH surged considerably. At press time, ETH was buying and selling at $3,311.78 and its value had surged by 6.08% within the final 24 hours.

How are holders doing?

This transfer led to extra bullish hypothesis round ETH ETF’s which added extra momentum to ETH’s rally.

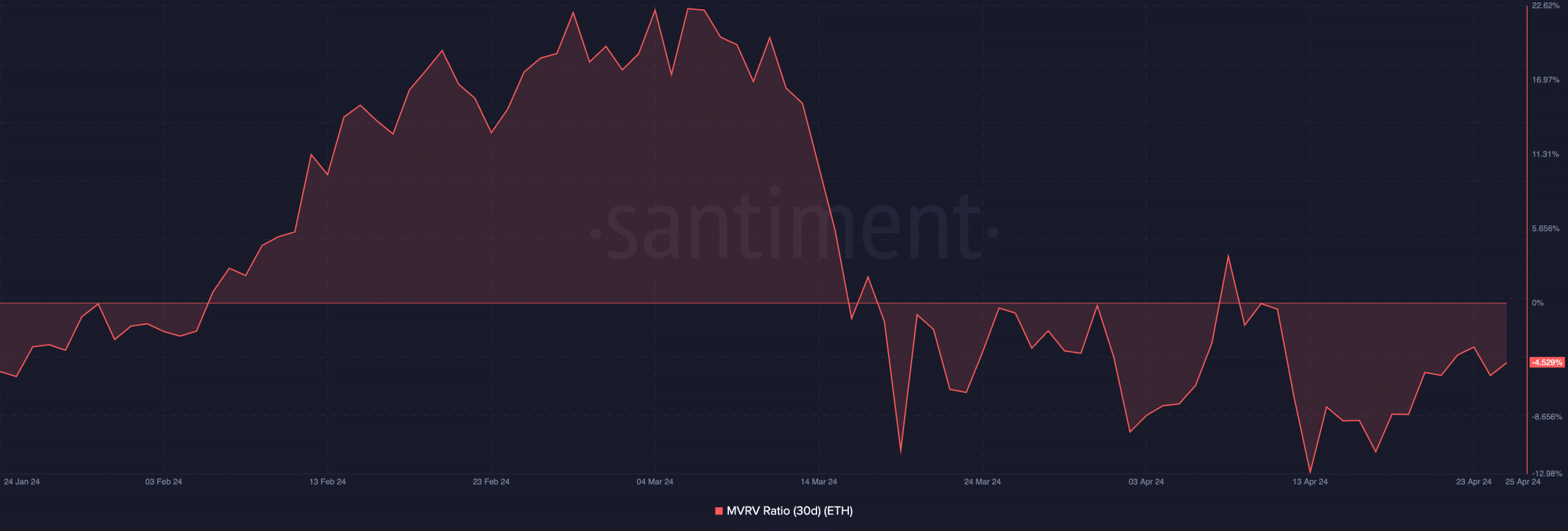

Surprisingly, regardless of the current surge in value, the MVRV ratio for ETH remained detrimental, indicating that the majority holders remained unprofitable.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

It may be secure to imagine that these holders would possibly watch for costs to understand additional earlier than indulging in revenue taking.

Supply: Santiment

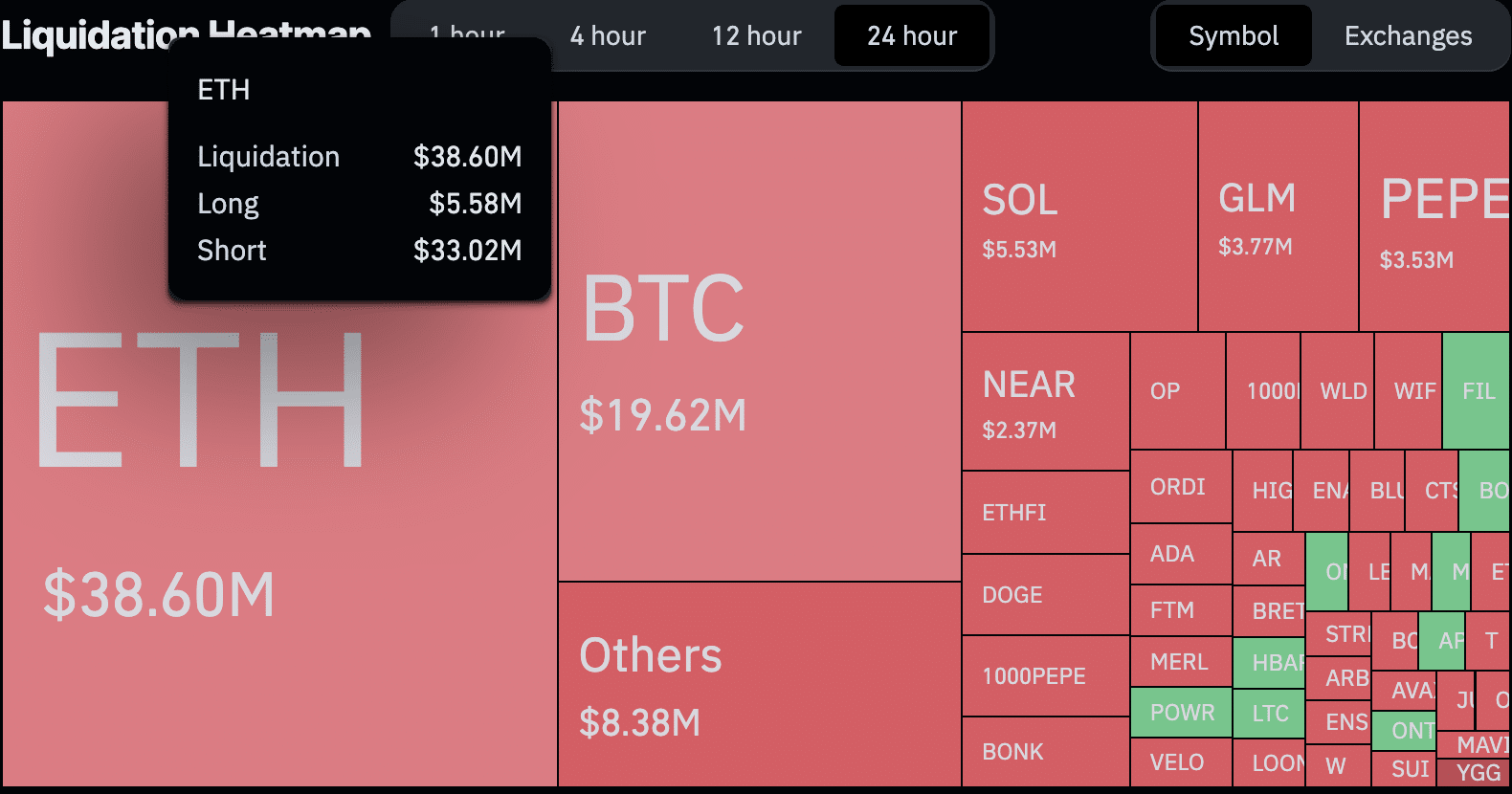

The sudden uptick in ETH’s value additionally prompted a lot of brief positions to get liquidated amounting to $33.02 million.

Supply: Coinglass