Ethereum Whales Rapidly Accumulate ETH Amid Price Decline

Ethereum whales have been busy out there, as on-chain knowledge exhibits that these traders have been closely accumulating the second-largest crypto token by market cap. This comes amid a value decline in ETH’s value, with historical past suggesting that the crypto token would possibly endure extra value declines within the quick time period.

Whales Accumulate Extra ETH

Information from the market intelligence platform IntoTheBlock exhibits that Ethereum Whales purchased 297,670 ETH ($1 billion) on July 24. The day past, these whales additionally purchased nearly 400,000 ETH. Additional knowledge exhibits a rise of over 28% within the inflows into these whales’ addresses within the final seven days.

Associated Studying

The decline in outflows from these addresses additional highlights these traders’ bullish sentiment in direction of Ethereum regardless of its underperformance. Outflows from these accounts have declined by over 14% within the final seven days and down by over 16% within the final 30 days.

The large holders’ netflow metric on IntoTheBlock additionally highlights this wave of accumulation amongst Ethereum whales, as internet flows have elevated by over 313%. Because of this these traders are closely accumulating slightly than opting to promote their ETH holdings.

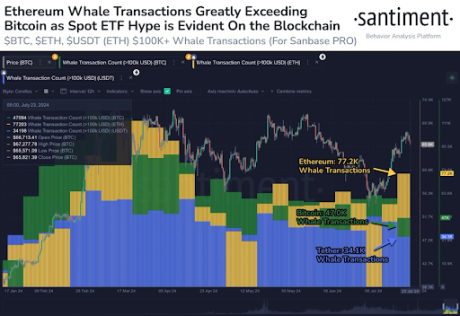

On-chain analytics platform Santiment famous that this important improve in ETH’s whale exercise is because of the Spot Ethereum ETFs, which started buying and selling on July 23. The platform made this commentary whereas revealing that since July 17, the quantity of ETH transfers has exceeded over $100,000 in worth, which is over 64% greater than the variety of BTC transfers and over 126% greater than the USDT transfers on the Ethereum network.

The Spot Ethereum ETFs had undoubtedly introduced a bullish outlook for Ethereum even earlier than they launched, as crypto analysts like RLinda predicted that ETH might rise to $4,000 thanks to those funds. As such, it’s no shock that Ethereum whales proceed to build up the crypto token in anticipation of upper costs from ETH.

The Spot Ethereum ETFs Launch May Be A Headwind At First

The Spot Ethereum ETFs have been projected to be the catalyst that will spark a massive rally in ETH’s value, and that’s more likely to occur sooner or later. Nonetheless, historical past suggests these funds might act as a headwind for Ethereum at first, just like the destiny that Bitcoin suffered instantly after the Spot Bitcoin ETFs launched earlier this yr.

Associated Studying

Bitcoin skilled important value declines, largely because of the outflows from Grayscale’s Bitcoin Trust (GBTC). The same state of affairs is already taking part in out for ETH with Grayscale’s Ethereum Belief (ETHE). Apparently, Grayscale’s ETHE experienced a internet outflow of $484.1 million on day 1 of buying and selling, a lot bigger than the online outflows GBTC skilled on day 1, and GBTC is greater.

Contemplating this, Ethereum might face important promoting strain from Grayscale’s ETHE. Data from Farside Buyers exhibits that the Spot Ethereum ETF skilled a internet outflow of $326.9 million on July 24 (day 2), seemingly simply the beginning of the large outflows that might ultimately pour out from the fund.

Featured picture created with Dall.E, chart from Tradingview.com