Ethereum’s bullish surge cools off – How much longer for $4k?

- Ethereum reveals indicators of consolidation amid ETF hype, indicating no sturdy market route.

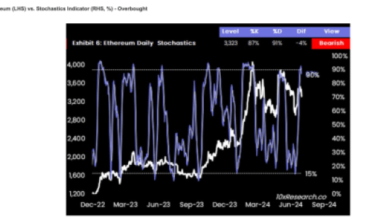

- General sentiment and technical indicators recommend that the consolidation section has already begun.

Coming off the excessive of spot ETF hype, Ethereum’s [ETH] rally appears to be slowing down by the minute. What was a rise of 17% final week has turned to lower than 1% this week. Is the world’s second-largest cryptocurrency vulnerable to consolidating?

Let’s take a look.

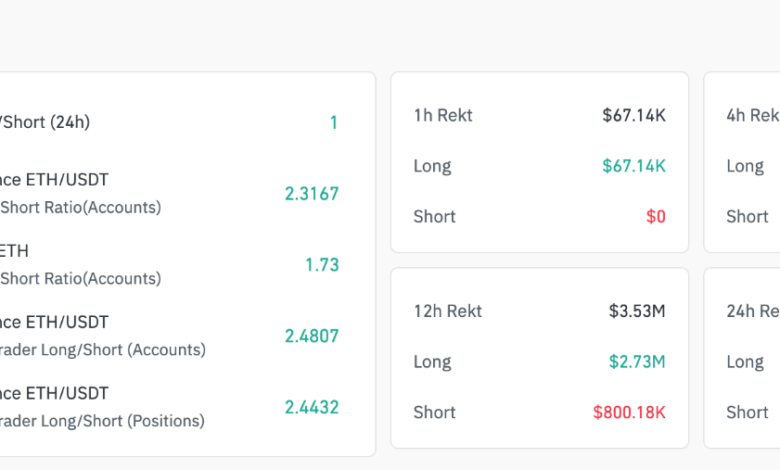

The Ethereum derivatives data presents a combined sentiment, probably indicating a slowdown in Ethereum’s rally. The elevated buying and selling quantity by 10.32% and open curiosity by 1.19% reveals that merchants are nonetheless fairly lively with ETH.

Supply: Coinglass

Trying on the lengthy/brief ratios, we see a predominance of lengthy positions over shorts, indicating that regardless of the slowdown, many merchants are nonetheless betting on Ethereum’s bull run as ETFs prepare to start out buying and selling subsequent week.

Supply: Coinglass

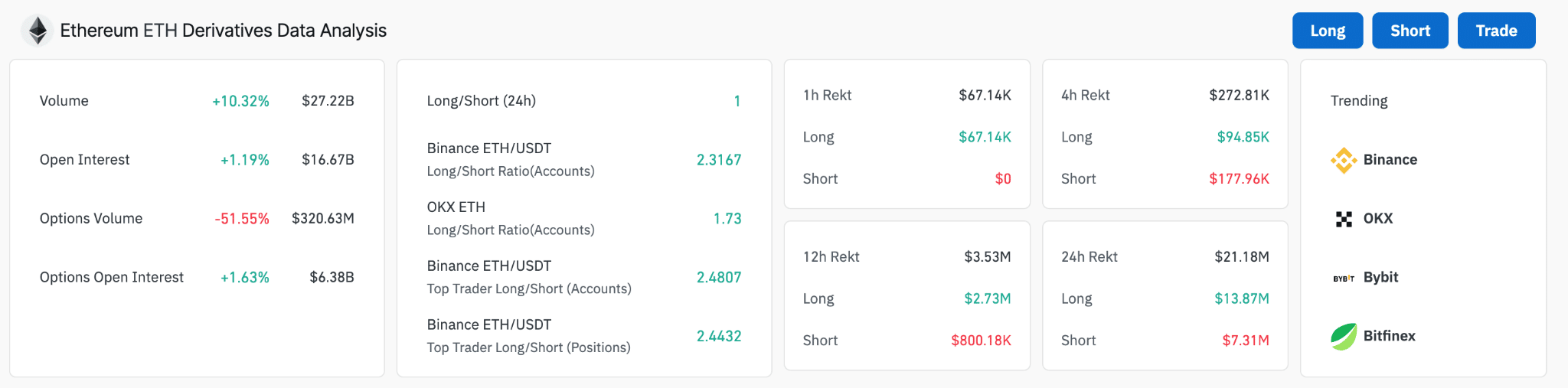

Ether’s present liquidation sample may sign that regardless of the predominant bullish sentiment, ETH is dealing with elevated market warning. This sometimes precedes a short-term consolidation, as was seen from Bitcoin after breaking all-time highs earlier this yr.

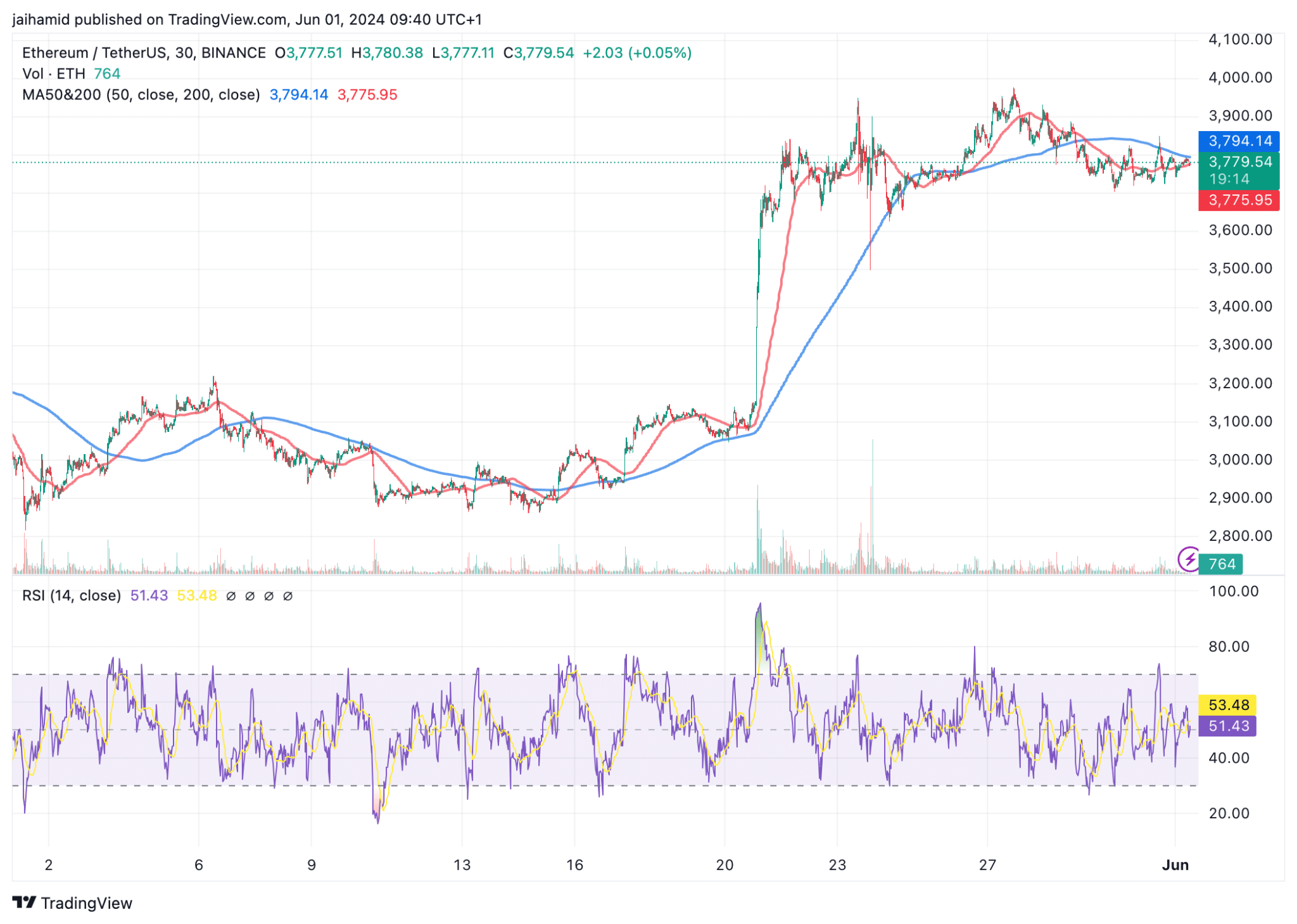

The ETH/USDt chart reveals an incoming consolidation much more. After peaking round $3,980, Ethereum confronted resistance and has since shaped a consolidation sample, typically fluctuating between $3,770 and $3,900.

Supply: TradingView

The Relative Power Index (RSI) at present reads at 51.43, indicating a impartial momentum that aligns with the continuing value consolidation.

This means neither overbought nor oversold situations, offering no sturdy bias in the direction of both bullish or bearish momentum within the close to time period.

From a technical evaluation perspective, the important thing assist stage to look at is round $3,770, marked by a number of touches over the previous few days, which have prevented additional declines.

On the upside, resistance is about close to $4,000, the place Ethereum has struggled to maintain upward actions.

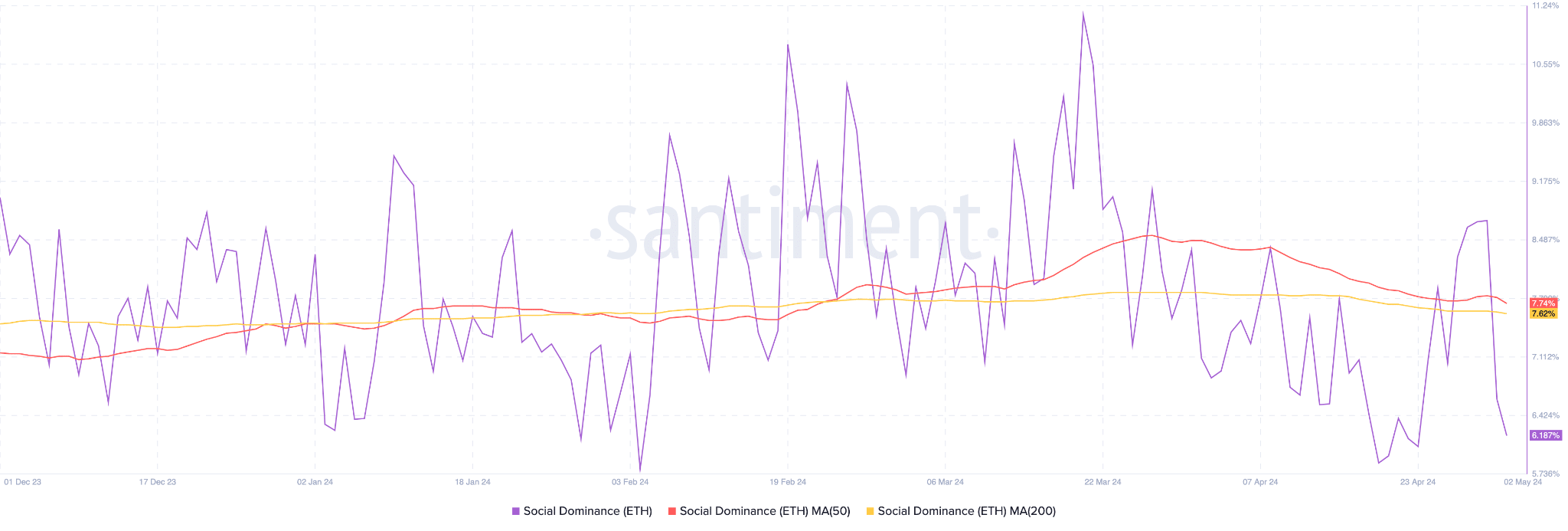

Supply: Santiment

In the meantime, a notable peak in social dominance suggests a current surge in discussions or curiosity round Ethereum, which is clearly pushed by the ETF hype.

Is your portfolio inexperienced? Verify the Ethereum Revenue Calculator

The shifting averages, nevertheless, present a downward development in the long run, predicting an general decreased curiosity stage in Ethereum.

All in all, Ethereum isn’t vulnerable to consolidation. It’s already consolidating.