‘Ethereum’s price hits a mid-term price bottom every time…’ – Analyst

- BlackRock holds extra ETH than the Ethereum Basis now

- BlackRock’s ETHA now on monitor to hit $1B mark in web inflows

BlackRock has maintained its dominance within the Ethereum [ETH] ETF area, much like its exceptional efficiency in U.S spot Bitcoin [BTC] ETFs. The truth is, the agency’s ETH holdings have reached figures of 318k, surpassing even the Ethereum Basis’s 308k cash.

Supply: Kairos Analysis

BlackRock eyes $1B web inflows – Will ETH’s value comply with?

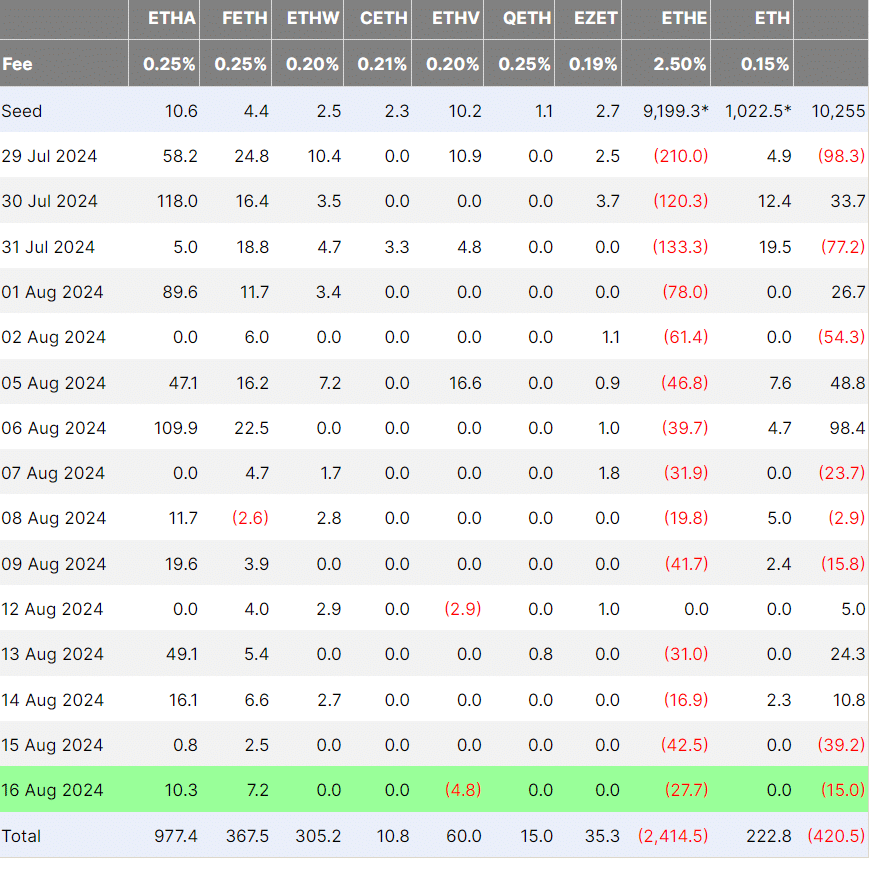

Moreover flipping Ethereum Basis in its ETH holdings, BlackRock might quickly cross the $1 billion web inflows mark. As of 16 August, the agency’s ETHA product had a complete of $977 million in web flows and was the one product above $500M.

This performance was achieved in lower than a month.

Supply: Farside Traders

Apparently, the ETH ETFs noticed web inflows in the direction of the start of the week. As noted by Coinbase analysts of their weekly report lately, this may be interpreted as a optimistic catalyst for ETH’s value.

Nonetheless, the analysts additionally stated that the low community exercise illustrated by the droop in ETH gasoline charges to a five-year low might complicate value restoration.

That being stated, Ryan Lee, Chief Analyst at Bitget Analysis, informed AMBCrypto that the droop in ETH gasoline charges might be an indication of ETH’s value backside within the mid-term.

“Traditionally, each time ETH gasoline charges have dropped to all-time low; it has typically signalled a value backside within the mid-term. ETH costs are likely to strongly rebound after this cycle.”

Lee added that ETH’s gasoline charges droop is a optimistic, particularly given the anticipated Fed fee lower in September.

“When this second coincides with an rate of interest lower cycle, the market’s wealth impact is stuffed with prospects. Due to this fact, we’re sustaining a optimistic outlook on this information.”

So far as the altcoin’s value motion is anxious, it has been range-bound between $2500 and $2750 all through the week. Its indicators appeared to be flashing very blended indicators too.

Therefore, the altcoin’s subsequent value transfer may simply depend upon Bitcoin’s [BTC] subsequent value course on the charts.