Ethereum’s promised upgrades could aid price recovery, but until then…

- Ethereum has confronted rejection from the $2.7k resistance zone since August

- The climbing leverage ratio metric highlighted why a breakout is likely to be unlikely

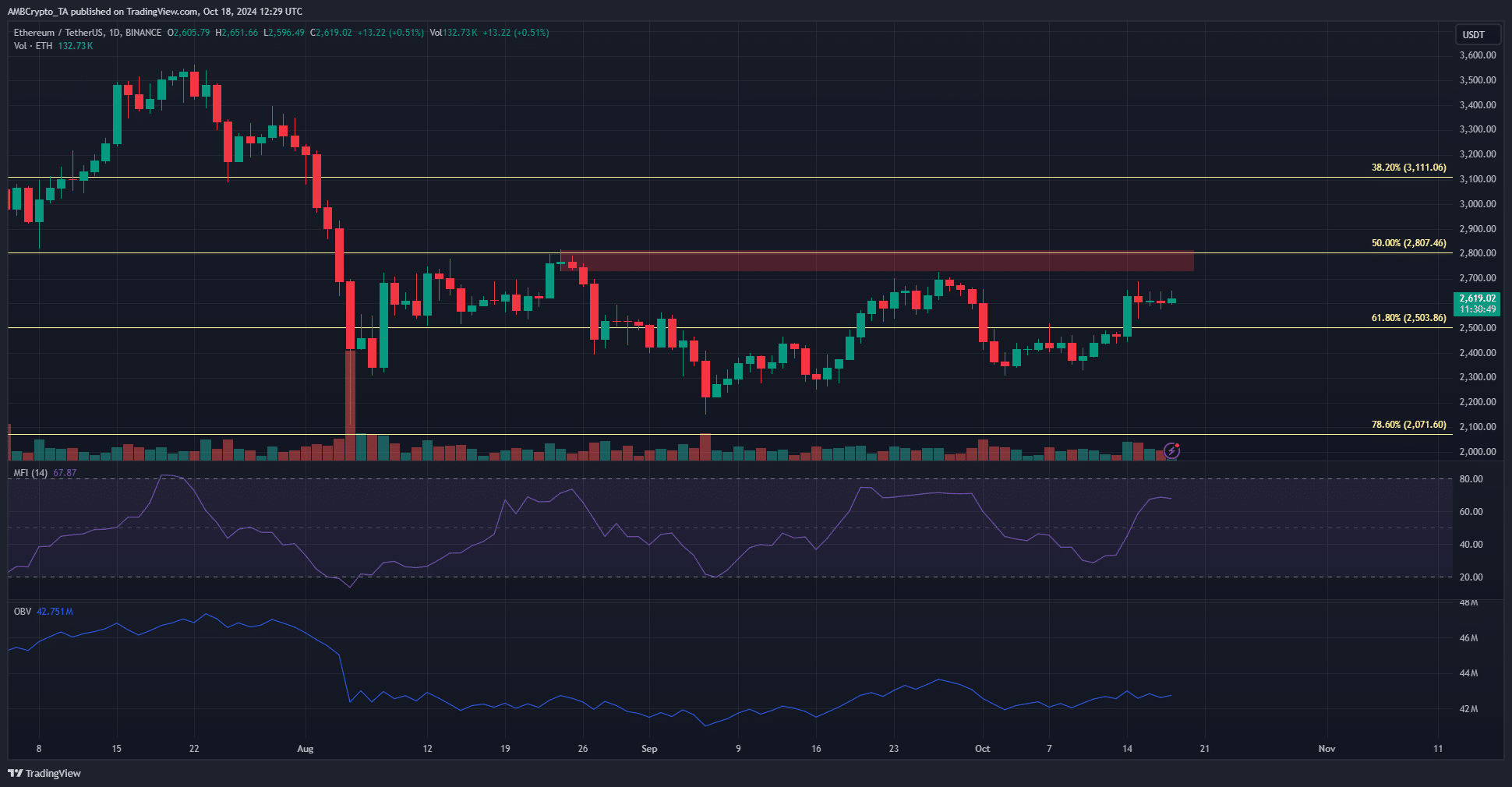

Ethereum [ETH], at press time, was buying and selling inside a variety that reached from $2.8k to $2.2k. Particularly, the $2.8k area has served as a gradual provide zone since early August. It additionally has confluence with the 50% Fibonacci retracement degree.

Inspecting the worrying value tendencies

The ETH/BTC chart has been trending south for simply over 18 months. Whereas Bitcoin [BTC] is buying and selling 8% beneath its ATH, Ethereum is 46.3% away from its ATH. The altcoin’s efficiency should be checked out throughout the context of Vitalik Buterin’s imaginative and prescient for the following attainable improve, “The Surge.” Particularly a few of its targets concerning transactions per second and maximizing interoperability between L2s.

Supply: ETH/USDT on TradingView

The efficiency of an asset is a transparent perception into what the market believes the asset’s worth is, and what it may be. Generally, hype and misinformation can skew these beliefs, resulting in overvalued or undervalued property.

The efficiency of Ethereum will be partly defined by inflationary considerations for the reason that Dencun improve, however it’s only a small a part of the puzzle. The proposed enhancements for the Proof of Stake system and the upgrades thought-about for the community at giant might, when carried out, handle community income, person development, adoption, and different points.

In flip, this might drive demand. As issues stand, a rocky journey could possibly be forward for ETH on the value charts.

Clues from the derivatives market

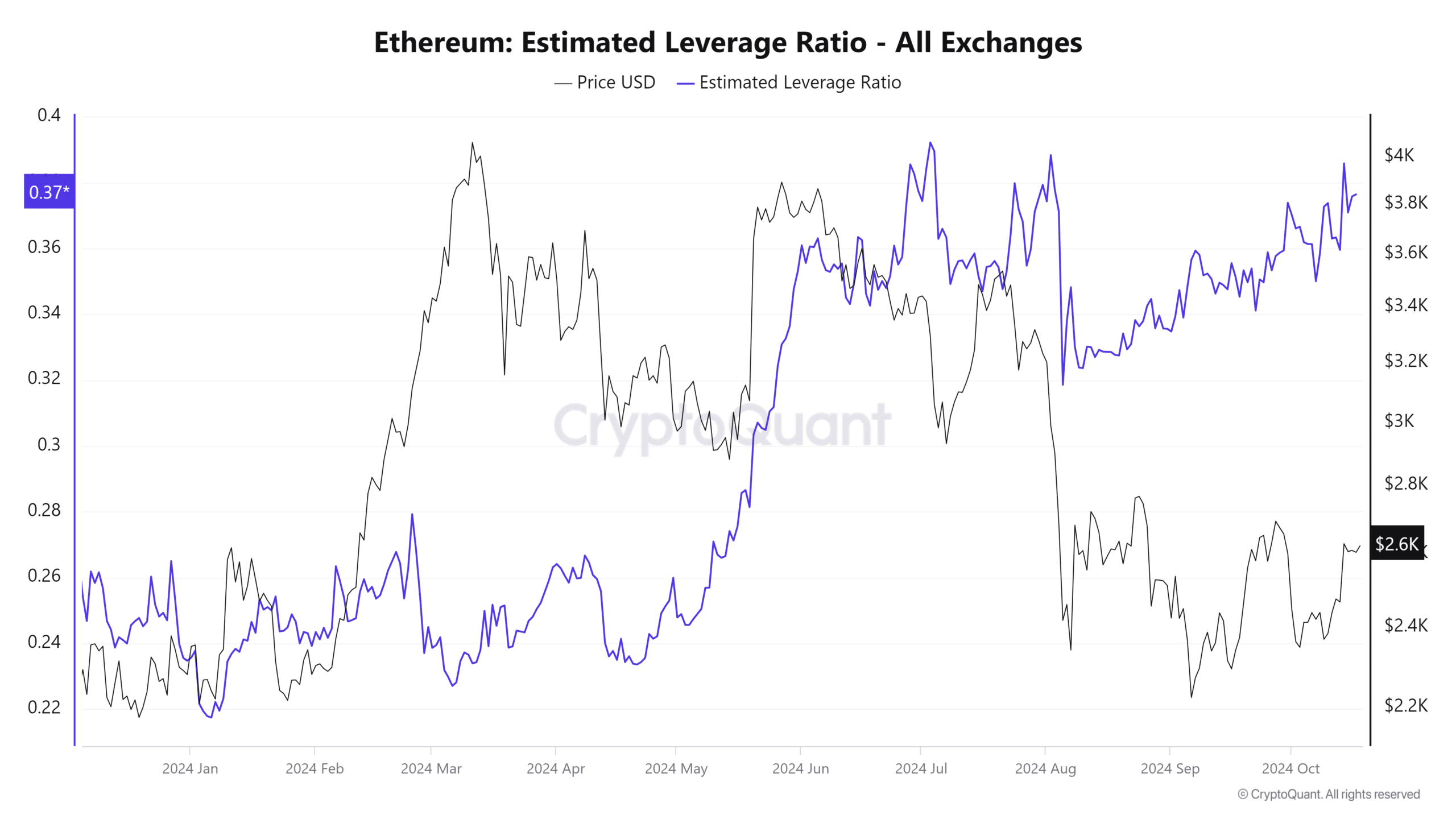

Supply: CryptoQuant

The estimated leverage ratio (ELR) is calculated by dividing the Open Curiosity by the change’s coin reserves. Coinglass knowledge additionally revealed that Open Curiosity has risen from $10 billion to $13 billion for ETH for the reason that second week of August.

This helped clarify the rising ELR. Nevertheless, with the value buying and selling beneath a key resistance, it may be interpreted as a warning signal for merchants.

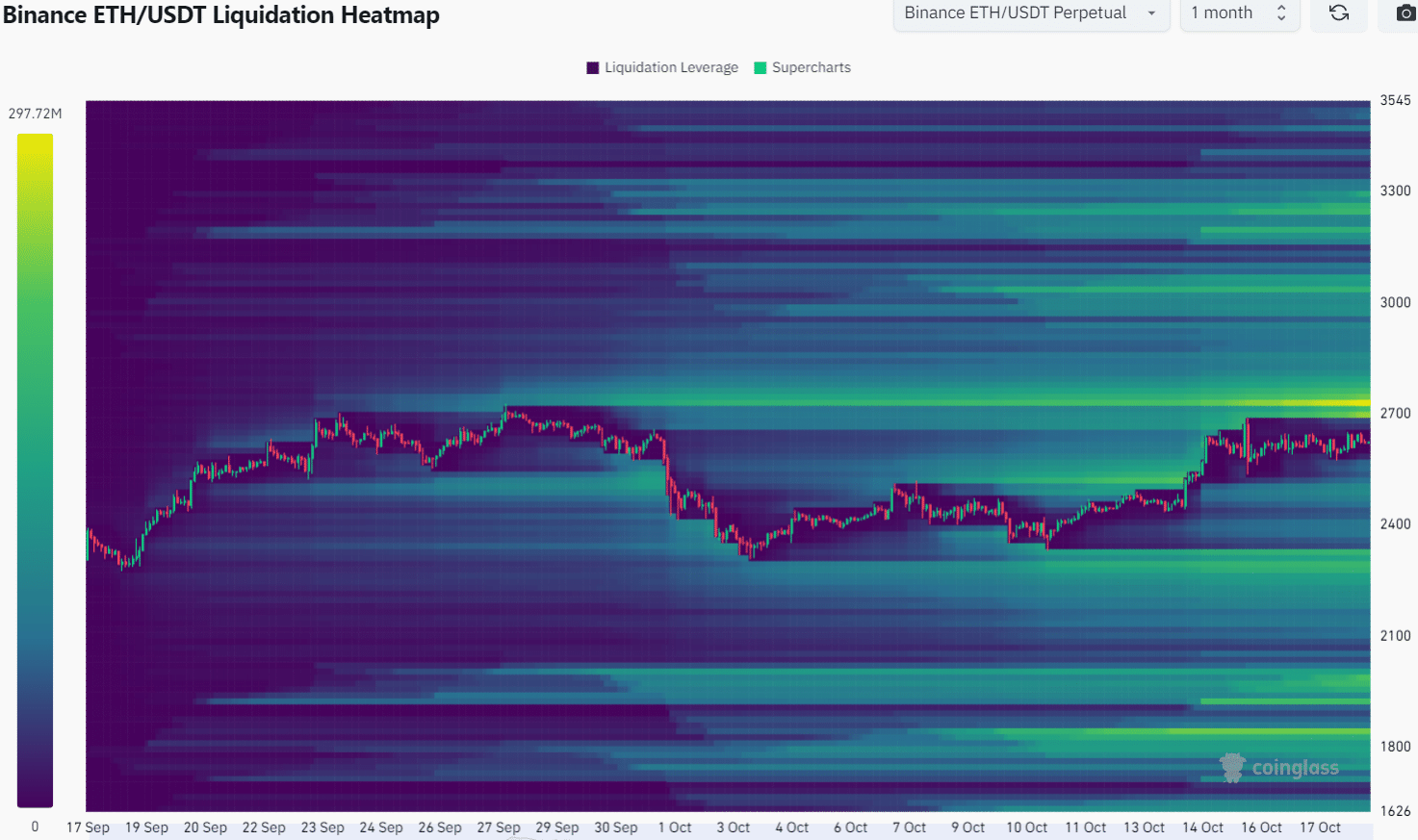

Supply: Coinglass

The liquidation heatmap with a 1-month lookback interval famous that the $2,730 zone is cluttered with liquidation ranges. The three-month chart confirmed that the $2,730-$2,850 space is essential.

Along with the value motion, we are able to see {that a} bearish reversal from these ranges is a chance that merchants should be ready for.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

General, the shortage of natural demand and L2s capturing extra members and transaction exercise stays an issue for the mainnet and its buyers. Technical evaluation gave clues that ETH bulls would possibly lack the energy to drive the crypto’s value past $2.9k too.