Ethereum’s transaction size falls 54%: Why it’s not bad news for ETH

- ETH may very well be near its backside after the transaction dimension did not spike.

- Whereas the value may slip, merchants are satisfied of a fast restoration.

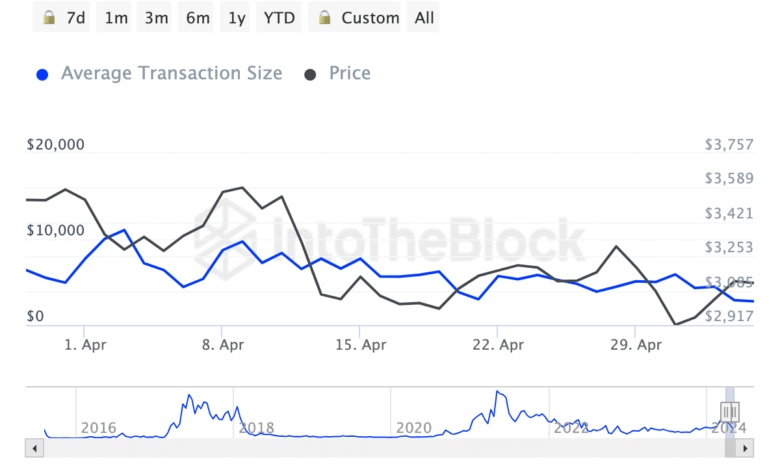

On the nineteenth of Could, AMBCrypto noticed that Ethereum’s [ETH] common transaction dimension had fallen to $2,767. This was a 54.13% decline from the metric when the month started.

At the moment, the common transaction dimension was $5,893, in accordance with knowledge from IntoTheBlock.

For the uninitiated, the common transaction dimension checks in greenback phrases the imply transaction worth for an asset on a specific day.

Traditionally, spikes on this metric sign excessive person exercise—Particularly from massive traders and establishments. However when it decreases, it implies an absence of institutional interplay.

Establishments out, retail in

As such, the latest state of Ethereum implies a presence of extra retail customers. Other than that, this indicator identifies potential tops and bottoms.

From the worth talked about, it was apparent that ETH appeared nearer to its backside than the highest. At press time, ETH’s worth was $3,106, indicating that it had swung across the identical vary within the final 24 hours.

Supply: IntoTheBlock

Going by the evaluation above, the value of the cryptocurrency may very well be set to hit the next worth within the quick time period. Nonetheless, different metrics have to be thought of.

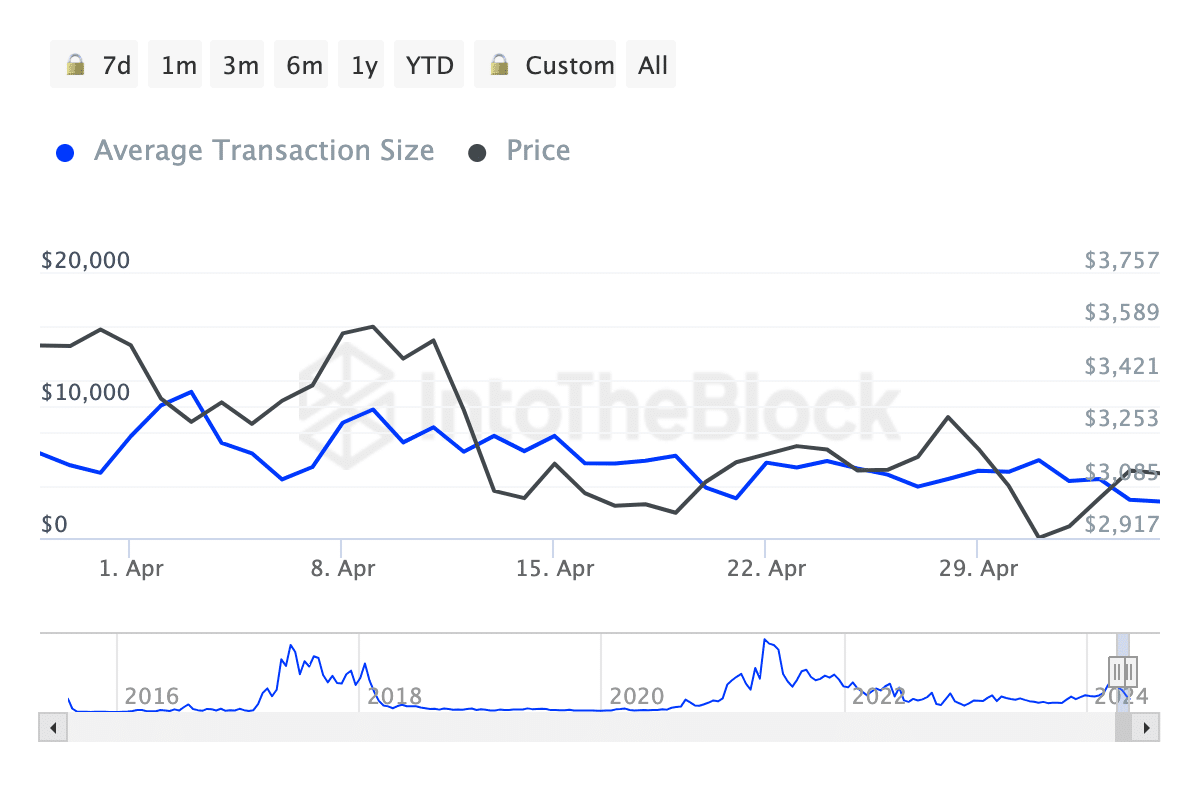

On account of this, AMBCrypto seemed on the Ethereum Change Web Place Change. In keeping with knowledge obtained from Glassnode, the Change Web Place Change has been within the detrimental area for many of the final 30 days.

ETH will get set for an enormous transfer

This metric tracks the 30-day change of the provision held in alternate wallets. A optimistic worth signifies that extra cash are in exchanges.

However, a detrimental worth signifies elevated withdrawals from exchanges.

One factor we seen was that the metric suddenly became positive on the 18th of Could. As of this writing, the ETH web place change was 81,715.

This improve may very well be an indication that Ethereum individuals are taking earnings off the 6.50% improve throughout the final week.

If this quantity continues to extend, then ETH’s worth may lower under $3,000 earlier than the potential rally occurs.

Supply: Santiment

Nonetheless, if alternate withdrawals intensify as soon as extra, the value may start a gradual improve towards $3,500. In a extremely bullish scenario, a rise to $4,000 may very well be an choice.

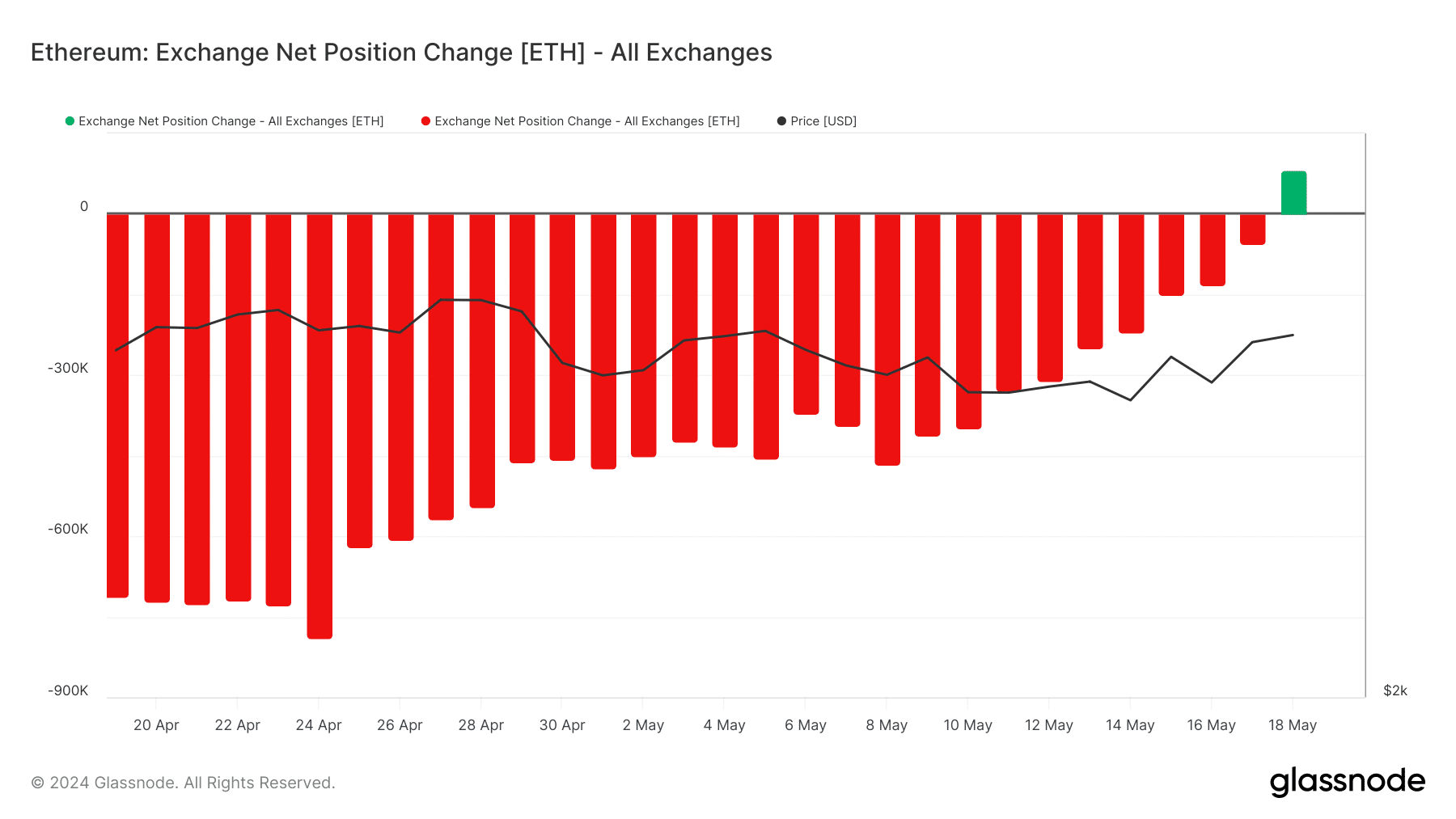

On Friday, the seventeenth of Could, AMBCrypto reported how choices merchants have been anticipating ETH’s worth to hit $3,600 between Could and the top of June.

At press time, Glassnode data showed that the sentiment had not modified. That is due to the alerts from the Put/Name Ratio (PCR).

Is your portfolio inexperienced? Test the Ethereum Revenue Calculator

If the PCR is over 0.70, it implies a bearish sentiment and there are extra places than calls.

Nonetheless, a studying under 0.50 implies in any other case. At press time, Ethereum’s Put/Name Ratio was 0.35, that means that almost all merchants anticipate the worth of the cryptocurrency to extend within the coming weeks.