‘Fearful’ Solana LTHs should count on THESE factors in the short term!

- Lengthy-term Solana holders are exhibiting indicators of worry, however these are the moments when good cash steps in

- SOL hit a brand new ATH in community adoption, with 11.09 million addresses now holding the token

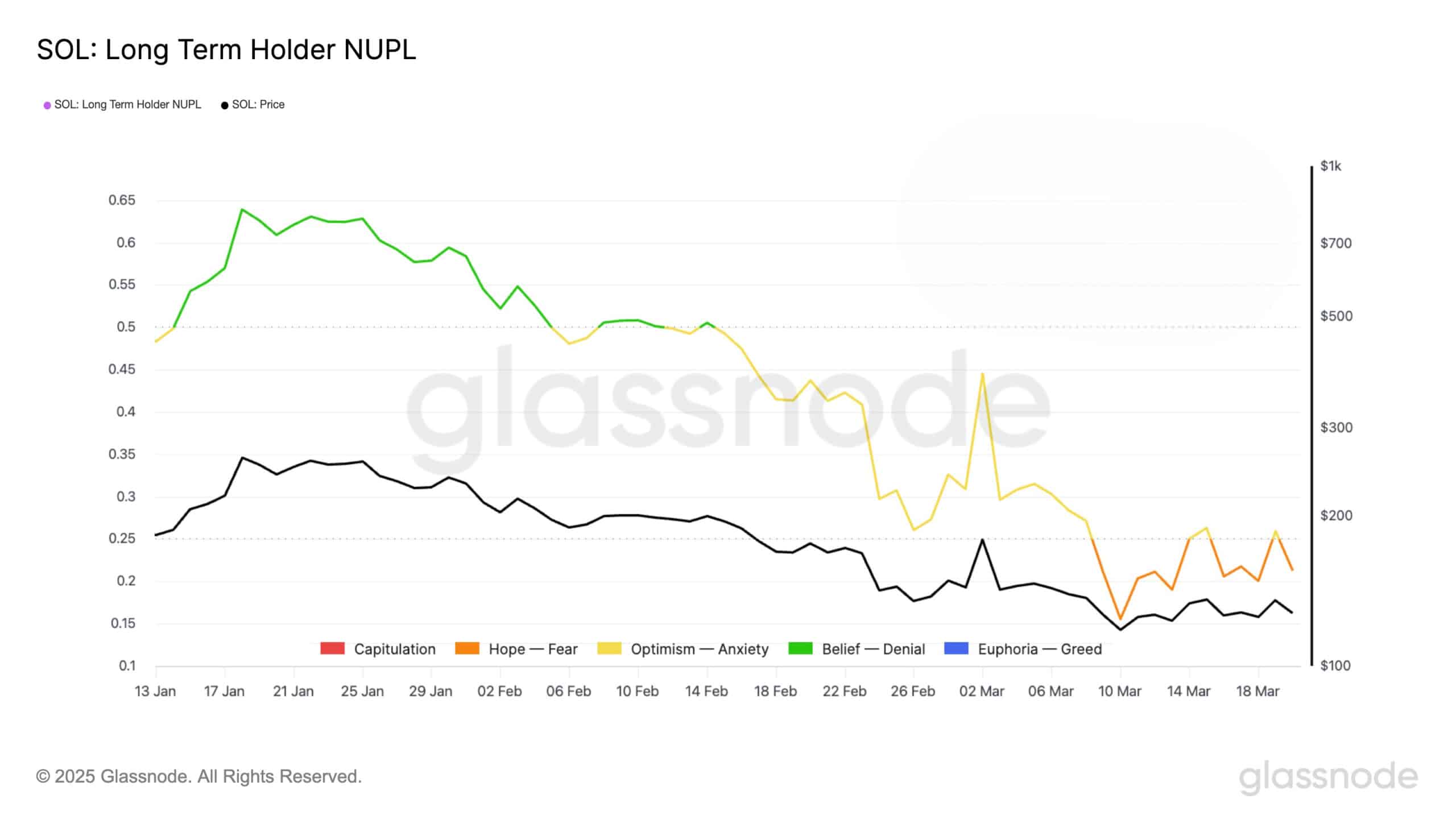

Solana’s (SOL) long-term holder Web Unrealized Revenue/Loss (NUPL), alongside SOL’s worth, indicated completely different emotional states by means of zones starting from 0.1 to 0.65. This corresponded with capitulation as a result of panic promoting throughout the board.

At press time, the emotion of worry reigned on Solana holders as a result of uncertainty, with glimpses of optimism because of the steadiness between beneficial properties and nerves. The NUPL rose to 0.6 in late January, marking perception ranges of market confidence. Nevertheless, it then fell to 0.3 in mid-February, triggering an optimism-anxiety section of worry.

Supply: Glassnode

The NUPL’s place in March hit hope-fear ranges, whereas SOL maintained a worth of round $120 and continued its downtrend from a peak worth of about $280.

In actual fact, Glassnode’s information recommended that intervals of worry have traditionally marked recoveries. These implied that savvy traders could purchase SOL, hinting at some upside on the worth charts.

Community adoption and quantity

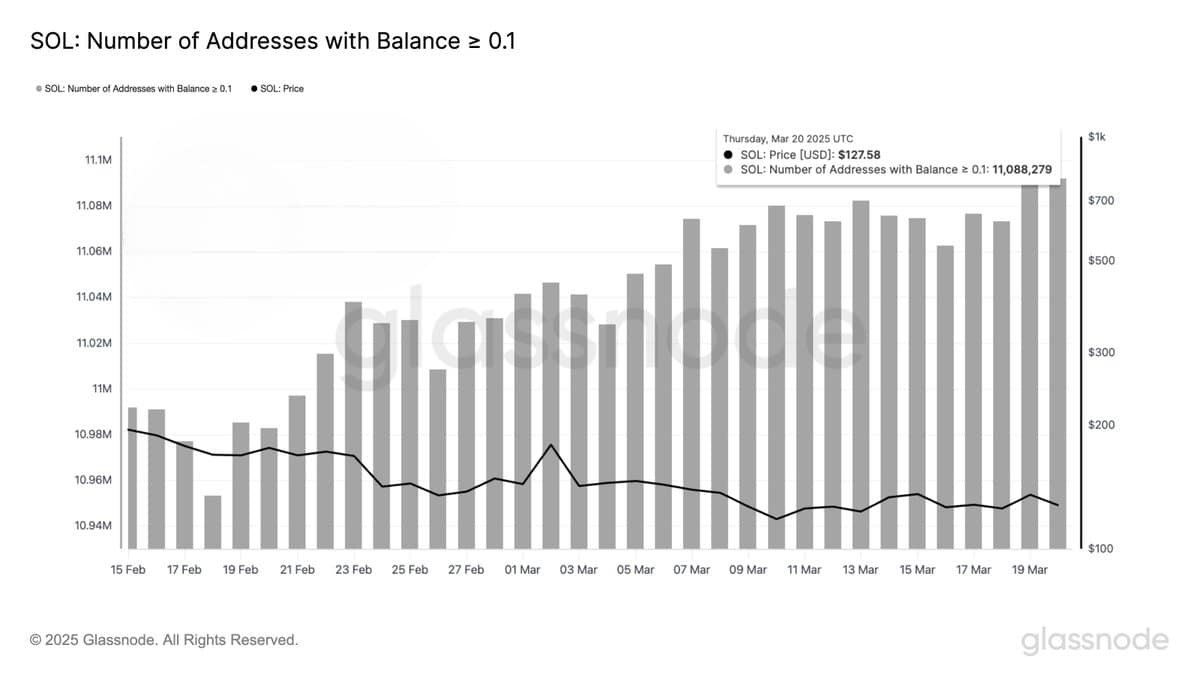

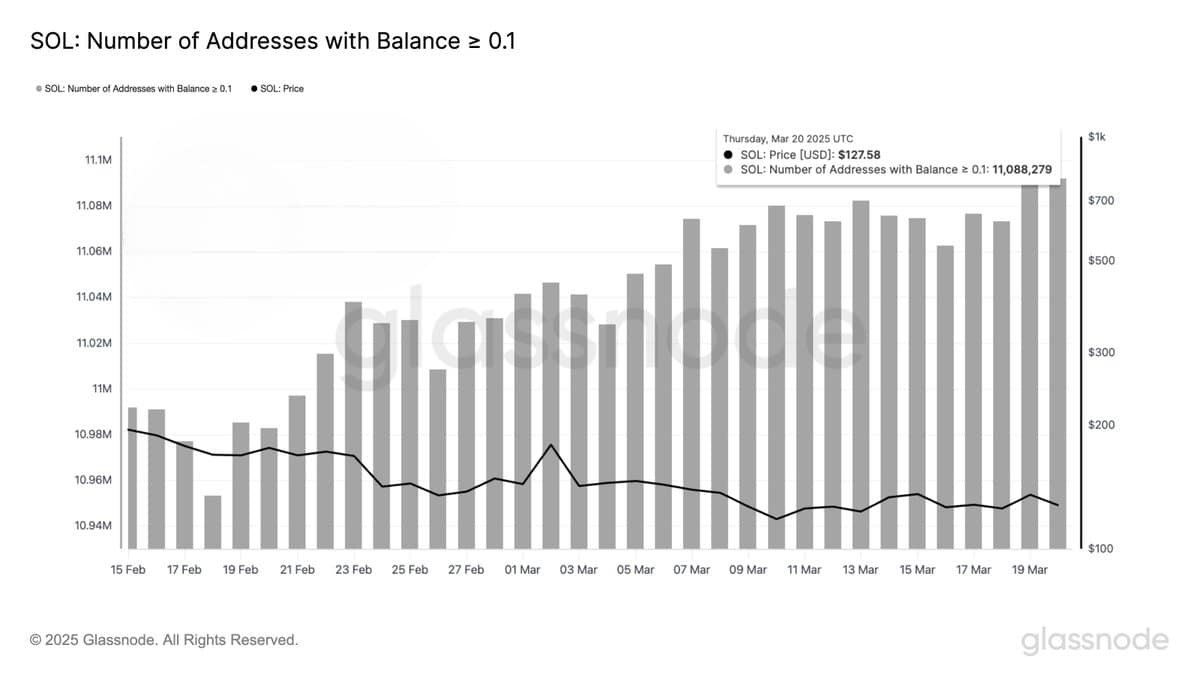

Regardless of the worry, nevertheless, all will not be misplaced. Particularly as constructive alerts is perhaps rising with a document excessive variety of 11,088,279 SOL wallets with balances of at the very least 0.1 SOL – Up from 10,986 million in mid-February.

This metric for adoption hit its highest level in mid-March, regardless of the altcoin’s worth declining from $200 to $127.58. This divergence probably stemmed from adverse market sentiment and revenue withdrawal.

Now, sturdy long-term perception has pushed this hike as greater SOL holders and new traders are coming into the market. This was confirmed by the uptick in community adoption.

Soure: Glassnode

The autumn in worth appeared to provide anxious reactions amongst customers, hinting at unpredictable outcomes and doubts. If perceptions keep favorable, future adoption may push the worth north.

Value noting, nevertheless, that the prevailing market hesitation exists as a result of constructive fundamentals.

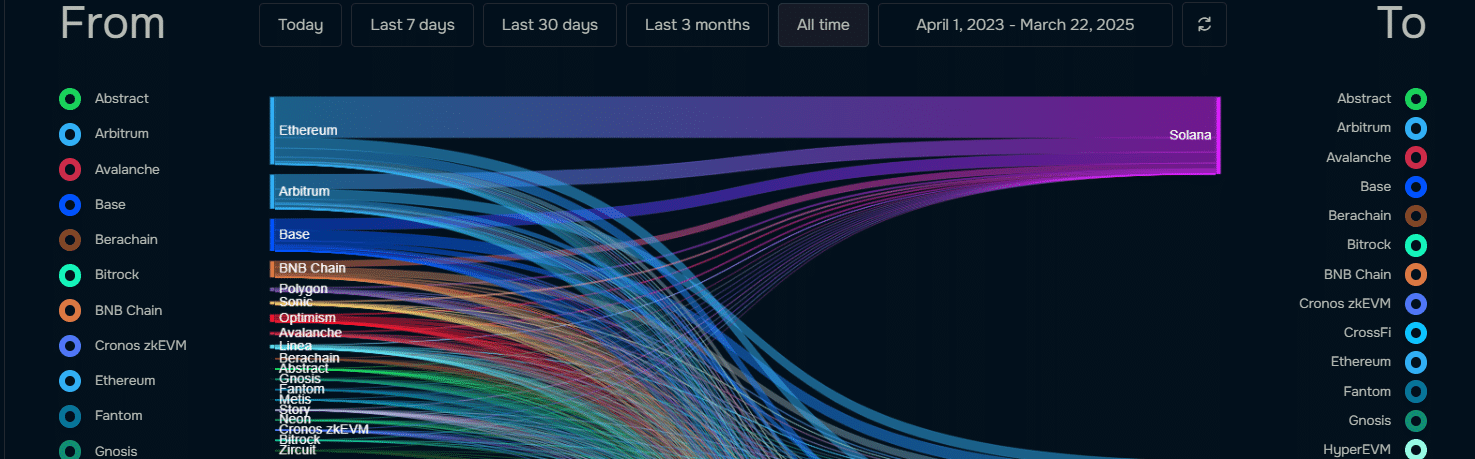

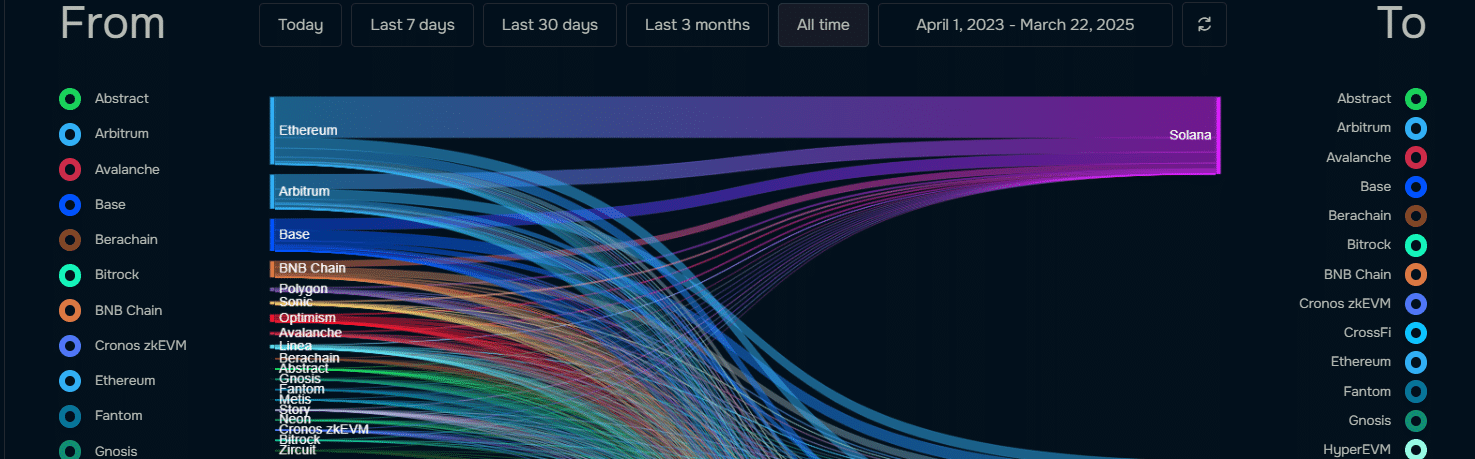

Moreover, Solana obtained substantial cross-chain transfers, primarily from Ethereum and Arbitrum, amongst different chains. This information confirmed that SOL reclaimed its market share because it functioned as the primary beneficiary of returning transaction volumes from cross-chain flows.

Supply: deBridge

The large inflows of blockchain belongings to SOL, supported by its monumental scalability and minimal transaction charges, surpassed different chains.

SOL continues to take care of its place because the prevailing recipient of interchain visitors. As anticipated, this attracts extra customers, which results in constructive worth dynamics.

Can the constructive indicators counter the worry in SOL’s LTHs?

The record-high community adoption, mixed with robust cross-chain inflows, revealed Solana’s growing confidence and scalability. Therefore, it would do its half in decreasing the nervousness of long-term holders. Worry-driven market circumstances have traditionally paved the way in which for crypto worth recoveries which can current a super second to buy.

The worth decline indicated short-term market wariness, in addition to momentary cautiousness. So far as bullish market components are involved, it’s nonetheless not clear whether or not they’ll be capable of overcome market worry in the long run.

This makes it tough to foretell the result of this uncertainty between optimism and doubt. Nevertheless, it may be anticipated to have some influence on SOL going ahead.