FTX offloads another $22.9M SOL – Will it dent Solana’s recovery?

- FTX unstaked and offloaded one other $22.9 million SOL to completely different addresses.

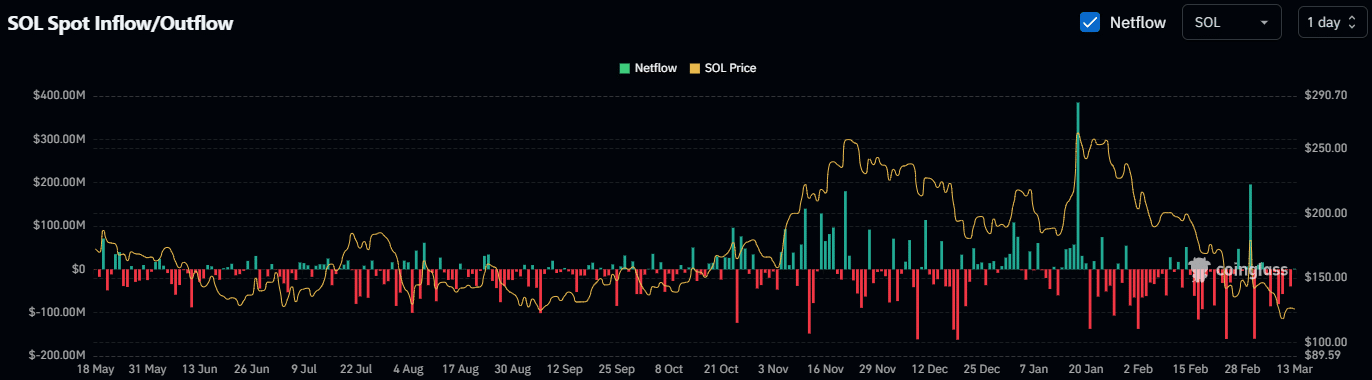

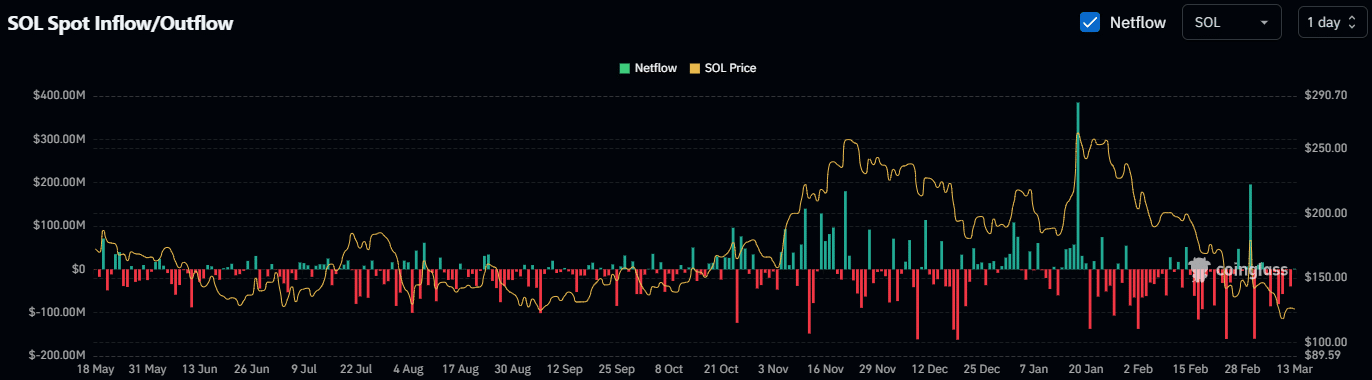

- Thus far in March, SOL has seen about $400M in outflows per Coinglass information.

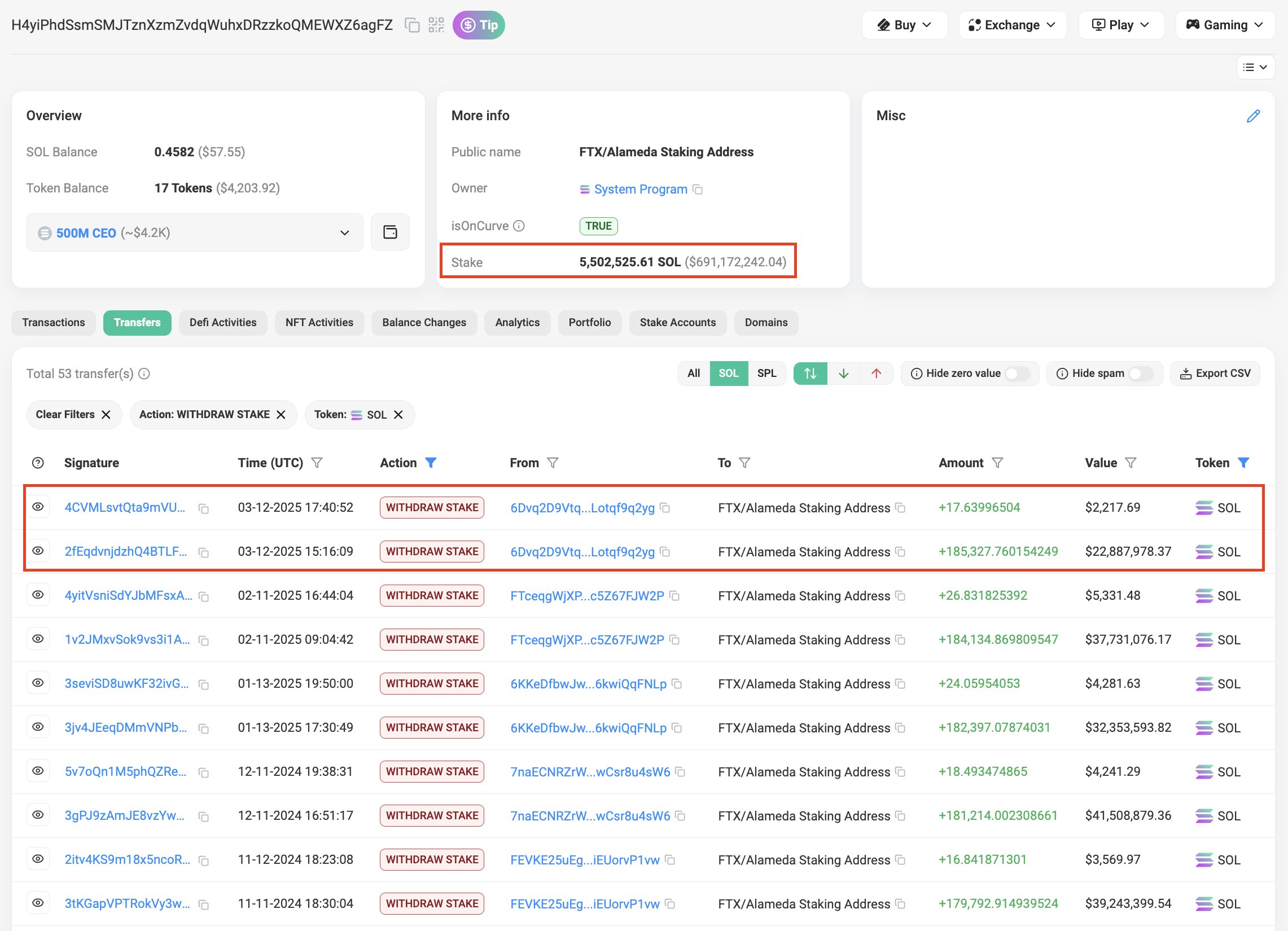

FTX/Alameda offloaded one other 185,345 Solana [SOL] ($22.9M) tranche, elevating sell-off fears.

In keeping with blockchain analytics platform Spot On Chain, the defunct trade moved the SOL to 38 wallets for distribution, which is a part of its month-to-month unloading.

Supply: Spot On Chain

The bankrupt trade nonetheless had 5.5 million SOL (price $696M) staked. Since November 2023, the agency has unloaded about $1B of SOL, added Spot On Chain.

On the 4th of March, FTX unstaked and offloaded over 3M SOL ($432M), doubtless a part of the scheduled 11.2M SOL unlock.

Though SOL priced within the unlock and dipped to $125 on the finish of February, the CME Solana Futures announcement at the moment boosted the altcoin to $180.

SOL on the sting

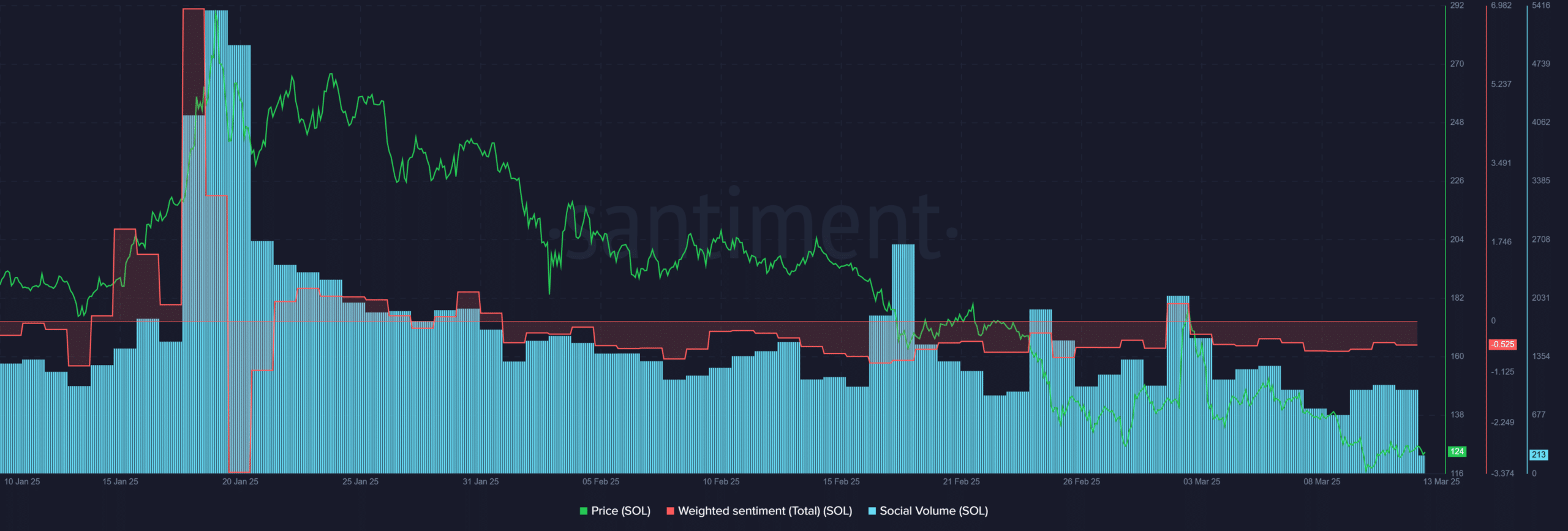

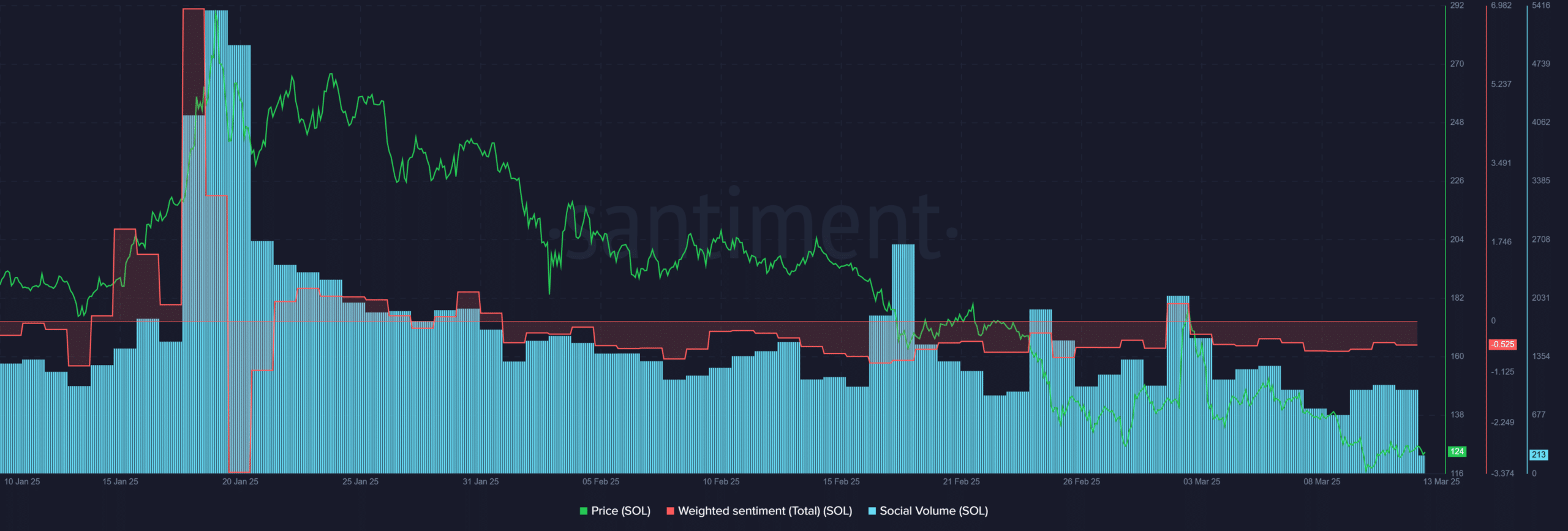

Because the liquidity squeeze by TRUMP memecoin in mid-January, the altcoin’s market sentiment hasn’t been strongly constructive.

After the CME Futures replace, SOL’s sentiment briefly turned constructive however remained unfavorable afterward. Social quantity, which tracks on-line market curiosity, additionally remained muted in Q1 2025.

Supply: Santiment

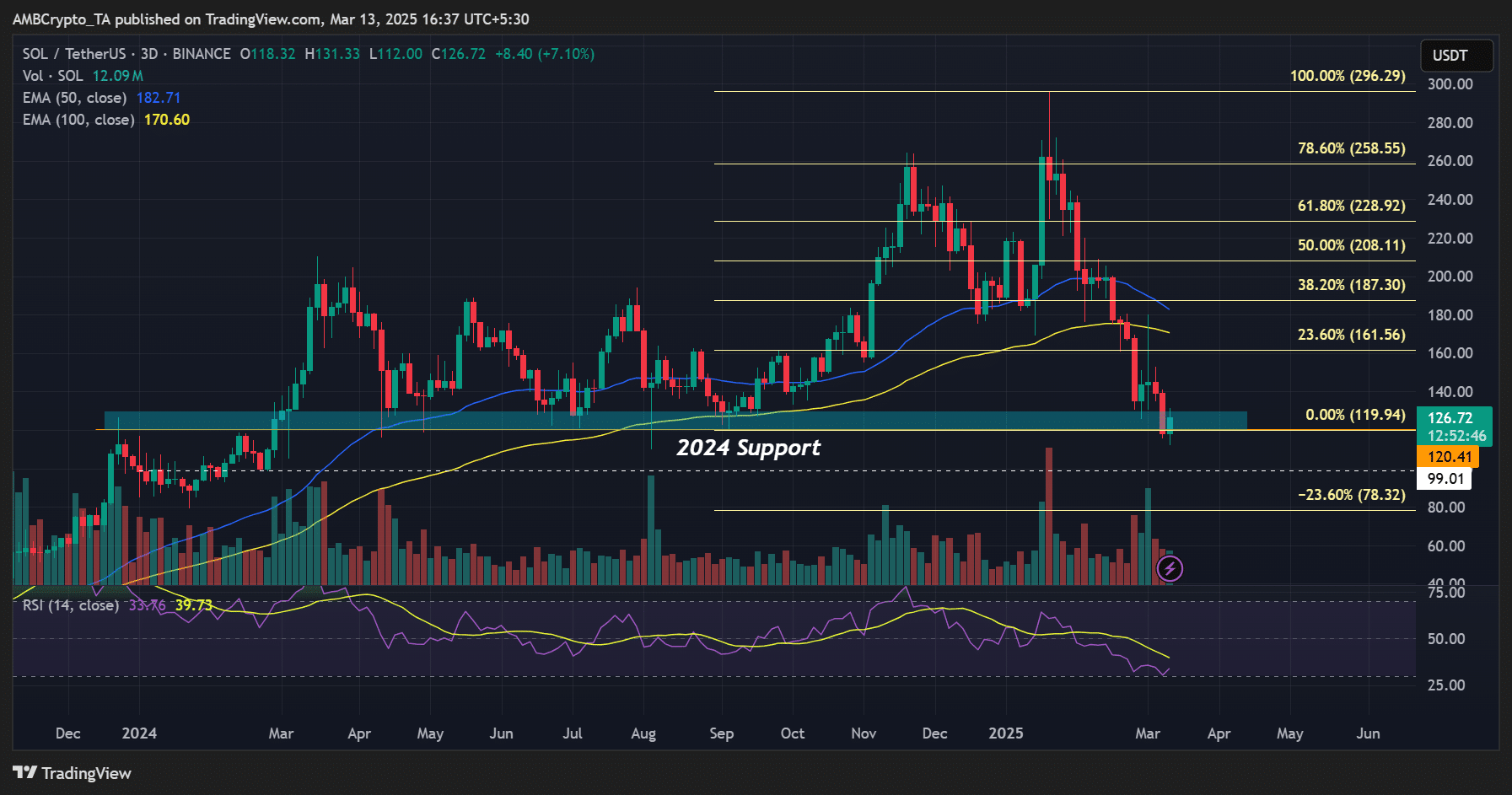

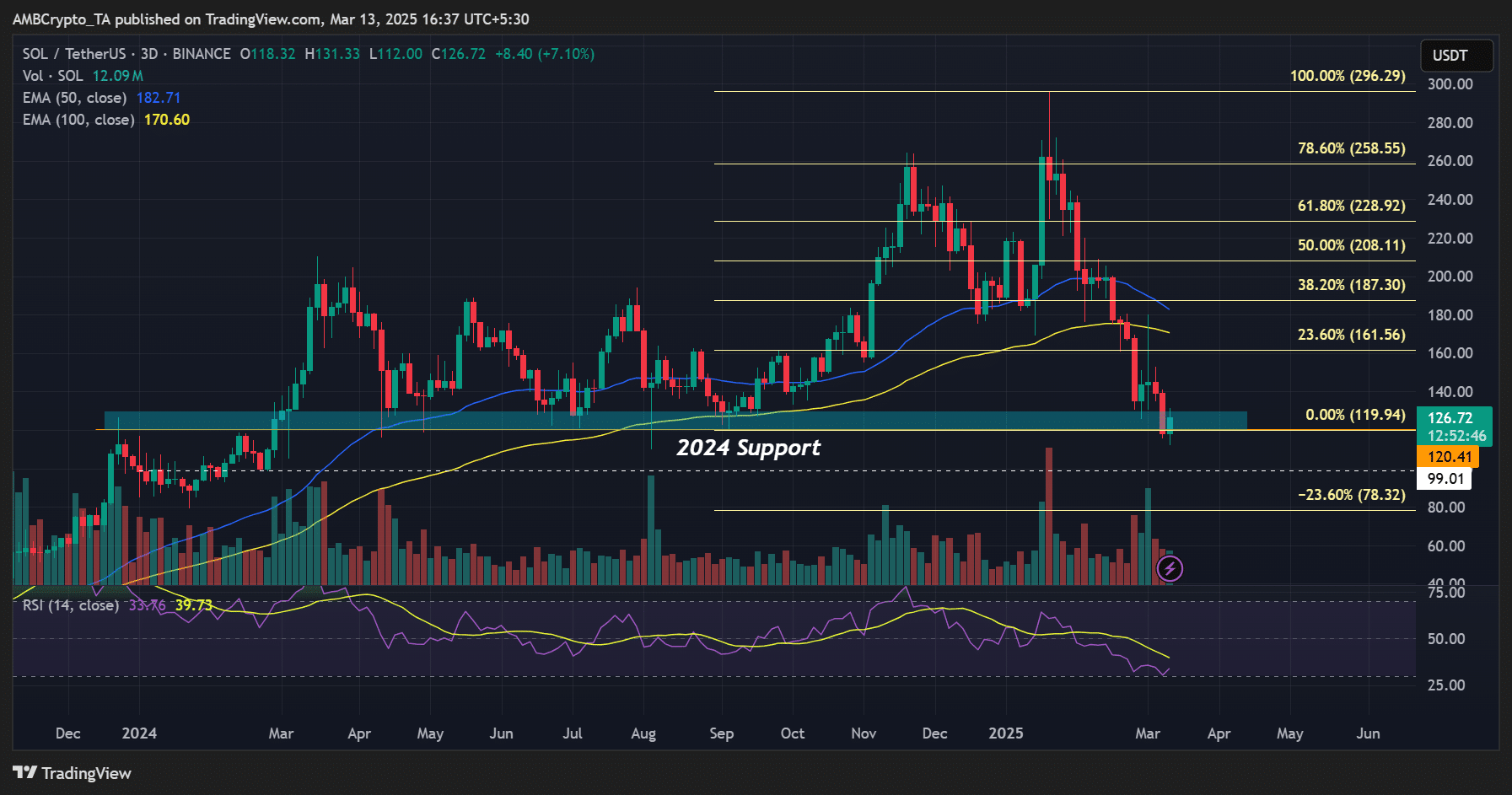

On the time of writing, SOL was valued at $127, down 57% from a report excessive of $295. Mixed with the unfavorable sentiment, it may very well be much less enticing for short-term merchants, particularly with macro uncertainty.

Nevertheless, the altcoin may very well be undervalued for long-term traders and a fantastic purchase at present ranges.

Actually, a LookOnChain report noted {that a} just lately created pockets scooped $25M SOL from Binance, far more than the FTX’s unstaked quantity.

Nevertheless, the general development amongst traders was a risk-off method. Per Coinglass information, SOL has seen practically $100M outflows this week.

Within the earlier week, the unlock interval, $319 million was withdrawn from SOL markets, reinforcing a bearish sentiment.

Supply: Coinglass

Though the outflows have sponsored, SOL would wish a large demand to reverse 57% losses.

From a worth chart perspective, present ranges could be a purchase if the $120 and essential 2024 assist degree is defended strongly.

Supply: SOL/USDT, TradingView

Nevertheless, the second and comparatively safer entry for a SOL lengthy place could be if the value reclaims the transferring averages, particularly for short-term merchants.

On the flip aspect, a crack beneath $120 assist would drag SOL to $100.