Gauging how much Bitcoin will shed before its next bull run

- Bitcoin was down by greater than 2.5% within the final seven days.

- Metrics urged that promoting strain on BTC was excessive.

Bitcoin [BTC] did not register positive factors over the previous few weeks as its worth continued to drop. The worth of the king coin, after touching $48,000 on the eleventh of January, fell below the $42,000 mark at press time.

This worth drop brought about a significant change in one among BTC’s key metrics.

Additional worth drop incoming?

Final week was not the very best for Bitcoin, as its worth plummeted by greater than 2.5% in seven days. In accordance with CoinMarketCap, on the time of writing, BTC was buying and selling at $41,595.04 with a market capitalization of over $815 billion.

BTC’s buying and selling quantity additionally dropped, reflecting much less curiosity from buyers whereas buying and selling the coin. In the meantime, Bitcoin’s Worry and Greed Index turned pure, because it had a price of 52.

Bitcoin Worry and Greed Index is 52. Impartial

Present worth: $41,713 pic.twitter.com/j8Wmxl3uH1— Bitcoin Worry and Greed Index (@BitcoinFear) January 20, 2024

The Worry and Greed Index is a device for gauging the overall temper of the cryptocurrency market, utilizing social alerts and market patterns. Every time the index reaches the greed zone, it suggests a worth correction.

Then again, when the metric strikes into the worry zone, it signifies that the potential of a worth uptick is excessive. Due to this fact, the above index exhibits that BTC’s worth would possibly plummet extra earlier than it begins a bull rally.

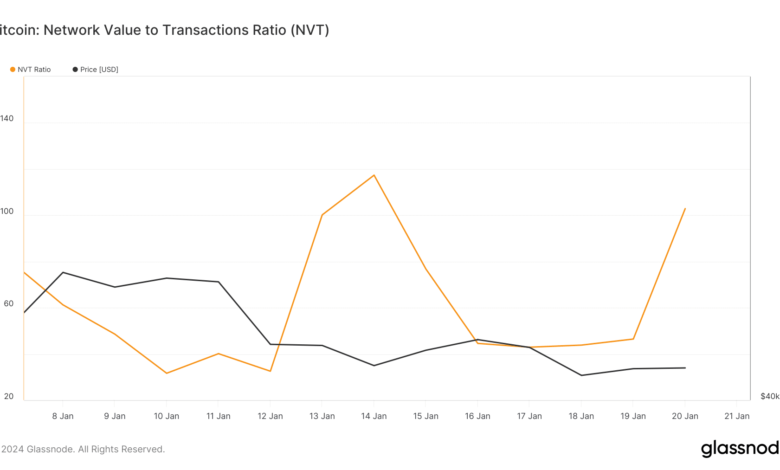

One other key metric urged an identical end result. Notably, AMBCrypto’s have a look at Glassnode’s information identified that Bitcoin’s Community Worth to Transactions (NVT) Ratio registered a pointy uptick.

For the uninitiated, a excessive NTC ratio usually hints that an asset is overvalued.

Supply: Glassnode

Bitcoin buyers needs to be cautious

A number of extra metrics additionally hinted at a doable worth drop. AMBCrypto’s evaluation of CryptoQuant’s data revealed that BTC’s Trade Reserve was growing at press time.

Its internet deposit on exchanges was additionally excessive in comparison with the final seven-day common.

This meant that promoting strain on the coin was excessive on the time of writing. Moreover, BTC’s aSORP was within the crimson, which means that extra buyers had been promoting at a revenue, which is by and enormous a bearish sign because it signifies a market high.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Issues on the derivatives entrance additionally didn’t look very favorable for BTC. For instance, its taker purchase/promote ratio was crimson, suggesting that promoting sentiment was dominant out there.

As per Coinglass, BTC’s Futures Open Curiosity additionally remained considerably flat on the time of the report, probably indicating a slow-moving market.

Supply: Coinglass