Here’s what happened in crypto today -Mantra’s 90% crash, BTC, and more!

- BTC might drop to $76K, in keeping with Peter Brandt.

- Mantra crashed by 90% in 24 hours, however the founder denied ‘rug-pull’ claims.

Regardless of slipping to a low of $74K final week, Bitcoin [BTC] rebounded and posted a formidable 7% acquire. It briefly surged above $85K, however analysts have been divided on its mid-term projection.

BTC blended views

For his half, famend dealer Peter Brandt anticipated it to drop to $76K, citing the bearish rising wedge sample on the 4-hour sample.

Supply: X

Nonetheless, others, like Coinbase analysts, have been optimistic, citing bullish RSI divergence and renewed curiosity from long-term holders.

That mentioned, Robert Kiyosaki urged buyers to contemplate BTC to guard wealth amid ongoing tariff-driven sell-off.

“Those that take motion and purchase actual gold, silver, and Bitcoin….MAY come out of this premeditated catastrophe…”

Jack Dorsey, CEO of Sq., echoed comparable sentiments and stated that BTC retains the U.S. and China in examine.

Mantra saga, Digital, SOL/ETH ratio rebound

This week’s high headline was Mantra [OM] 90% crash over the weekend. Jack Mullin, Mantra founder, blamed ‘compelled liquidations’ on centralized exchanges.

“OM market actions have been triggered by reckless compelled closures initiated by centralized exchanges on OM account holders.”

Though analytics agency Lookonchain flagged some dumping wallets linked to early buyers like Laser Digital, Mullen denied these claims. He vowed to behave proper ‘for the group’, however the particulars remained to be seen.

The market dimension of the real-world asset (RWA) platform dropped from $6B to beneath $700 million in hours, exposing buyers to large losses. In actual fact, Quinn Thompson of Lekker Capital warned of a probable meltdown on Ondo[ONDO] — one other RWA mission.

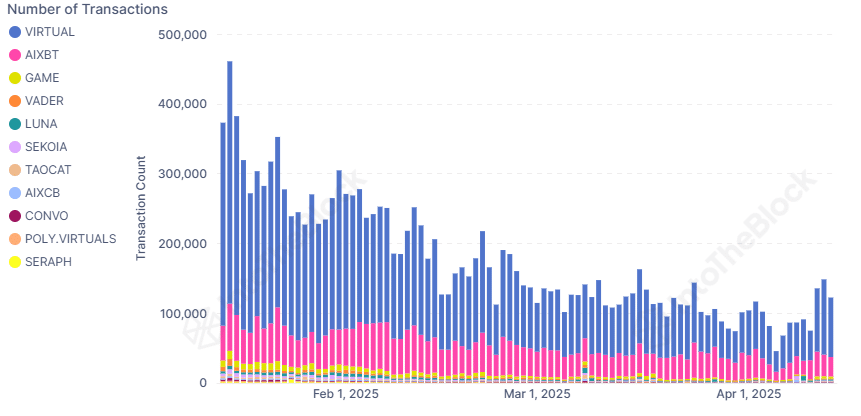

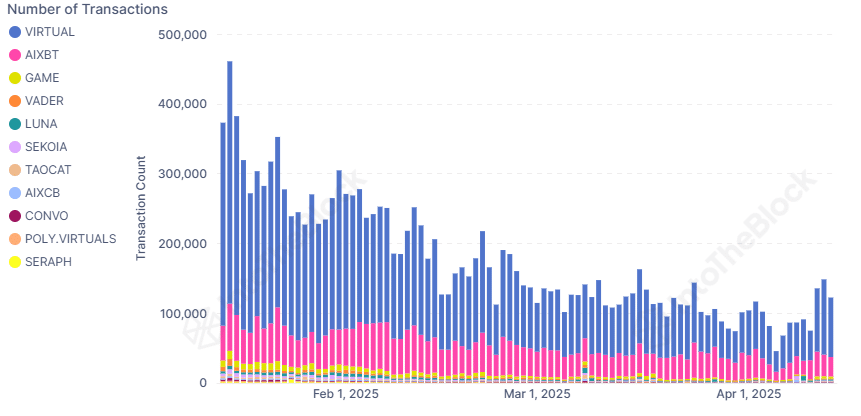

Away from RWA implosion, the Digital ecosystem rebounded after over 90% crash in community exercise and traction.

In keeping with analytics agency IntoTheBlock, the ecosystem recovered above 100K transaction depend in April, a sign that AI tokens would possibly make a comeback.

Supply: IntoTheBlock

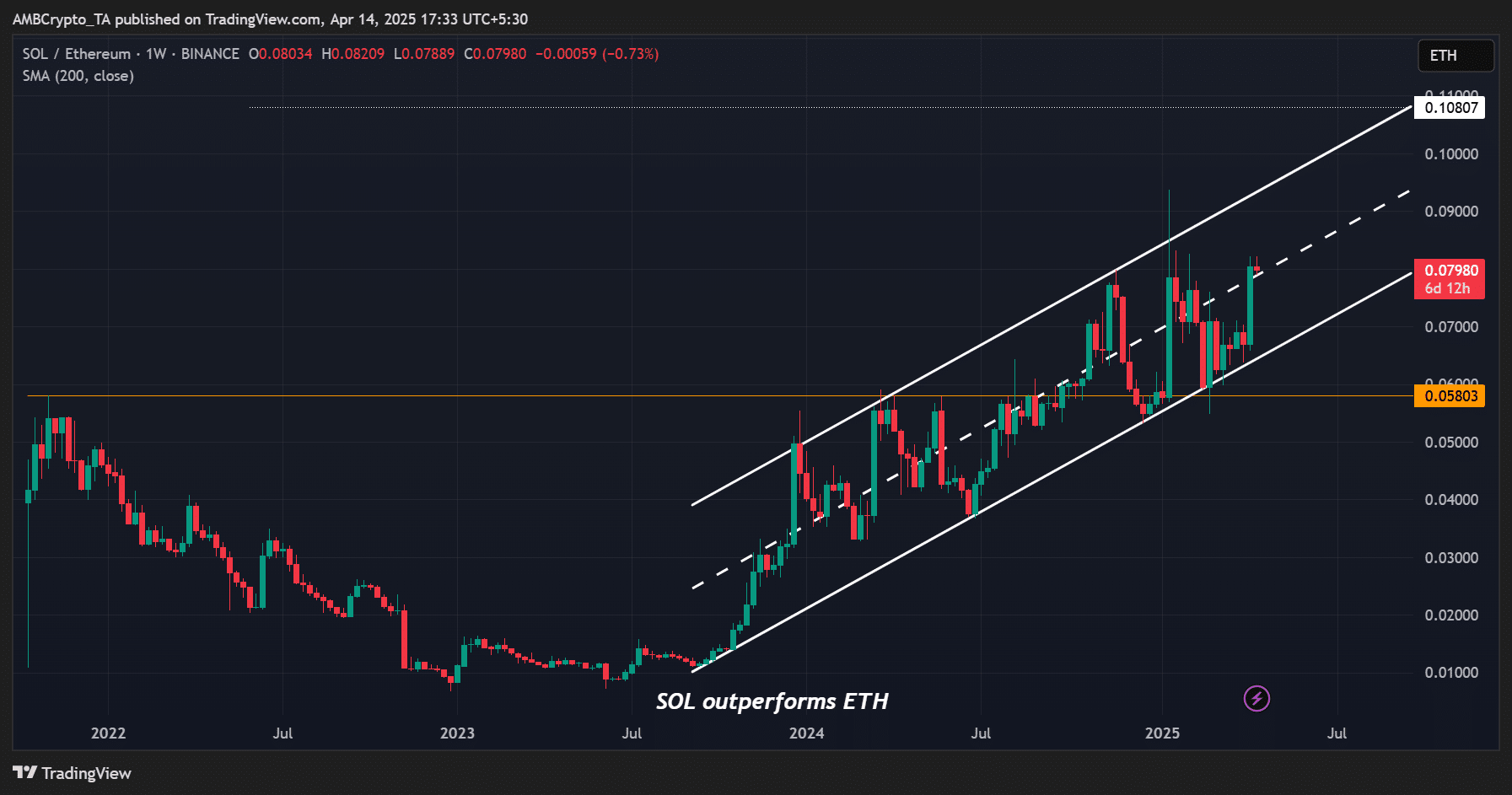

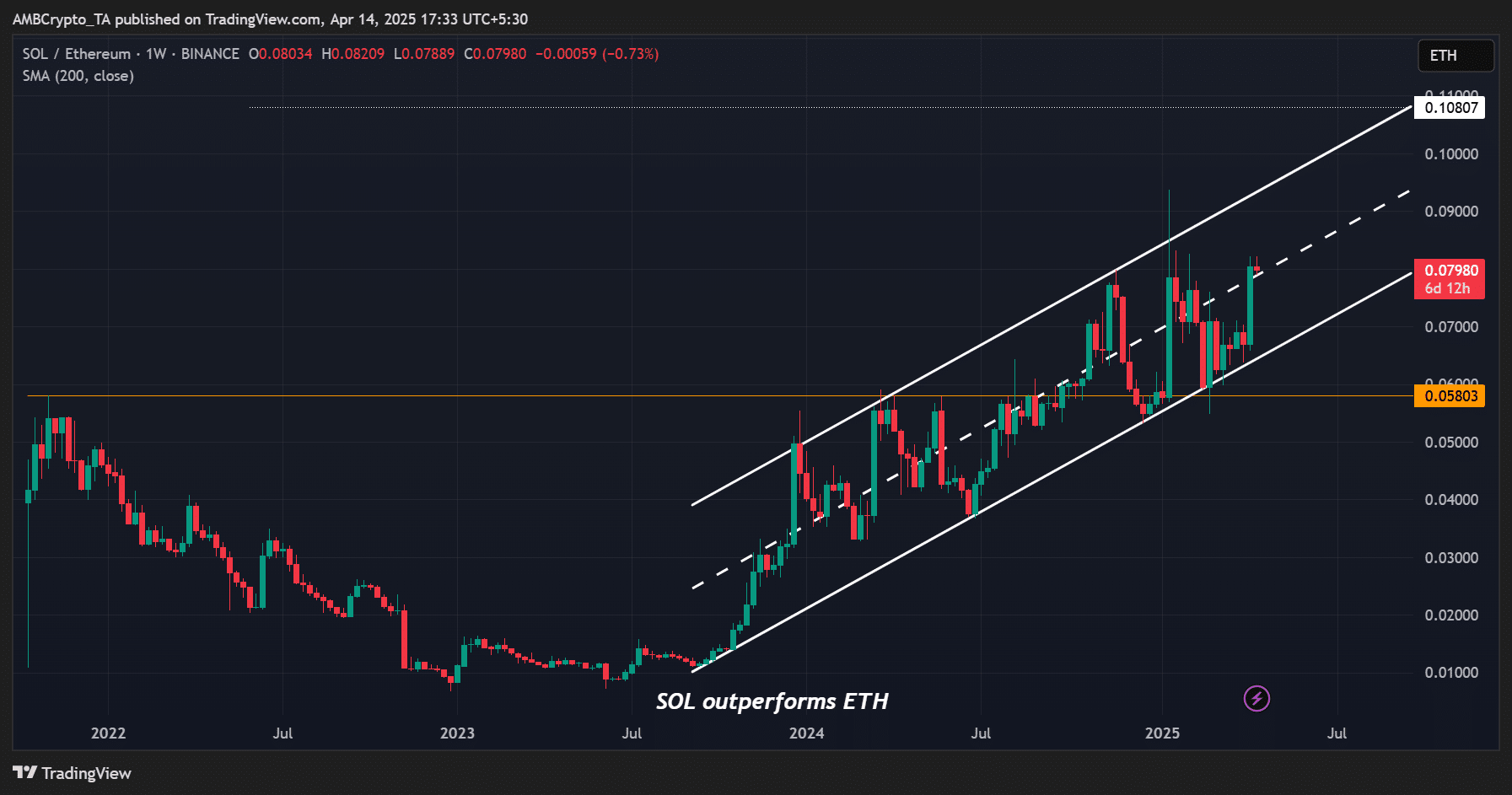

Lastly, the SOL/ETH ratio hit a file each day and a historic weekly session shut. Final week, the ratio rallied 20%, indicating that SOL outperformed ETH.

It closed at 0.08 and reclaimed the mid-range, which might push the ratio larger to the higher channel of 0.09.

Supply: SOL/ETH, TradingView

Over the identical interval, SOL rallied over 21% from $95 to $133, whereas ETH posted a 1% acquire. In keeping with Kyle Samani of MultiCoin Capital, SOL ETF approval might tip the altcoin to outperform ETH massively.