HNT’s bullish patterns suggest a surge to $20: Here’s what to watch

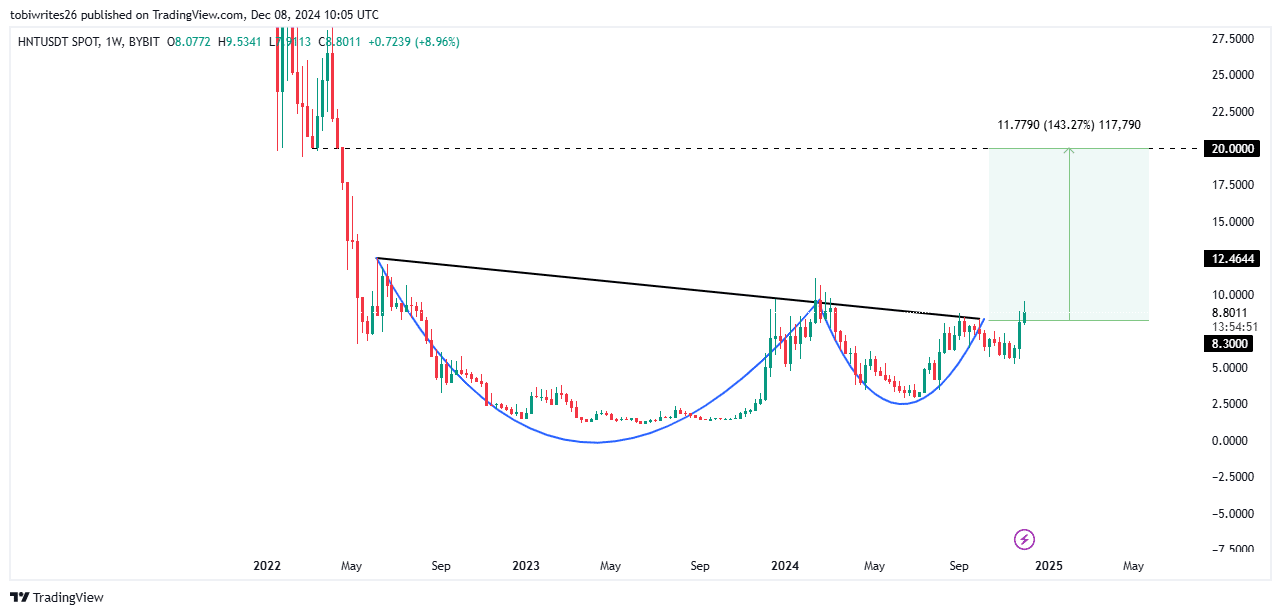

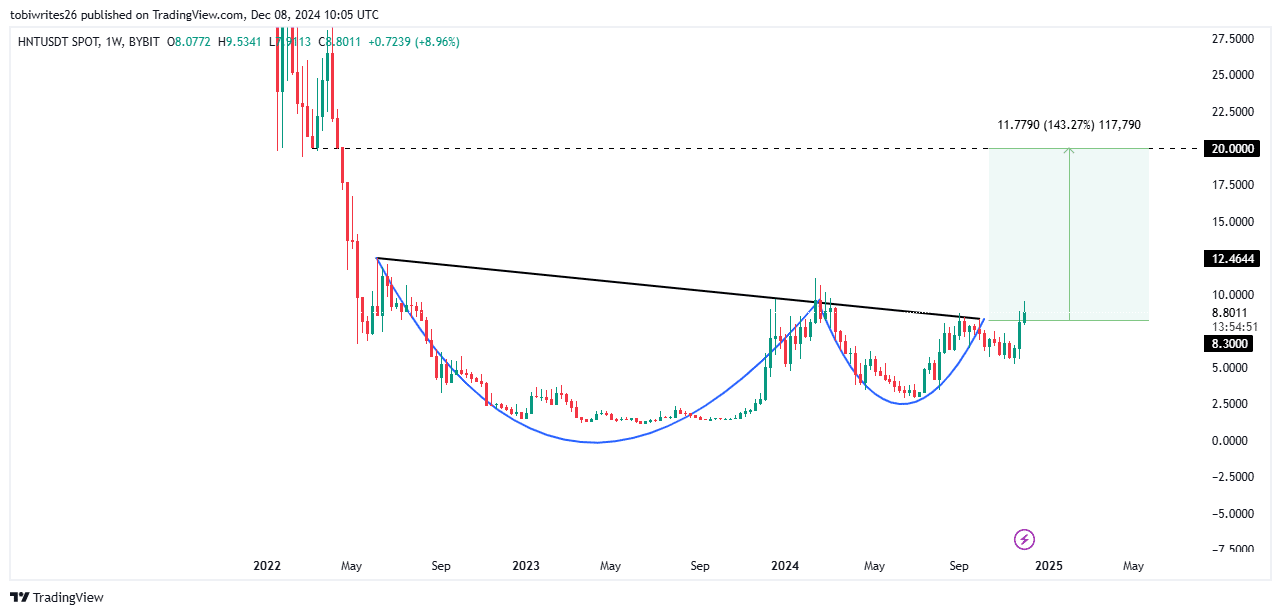

- HNT was buying and selling inside a basic cup and deal with sample at press time, a formation usually related to value rallies.

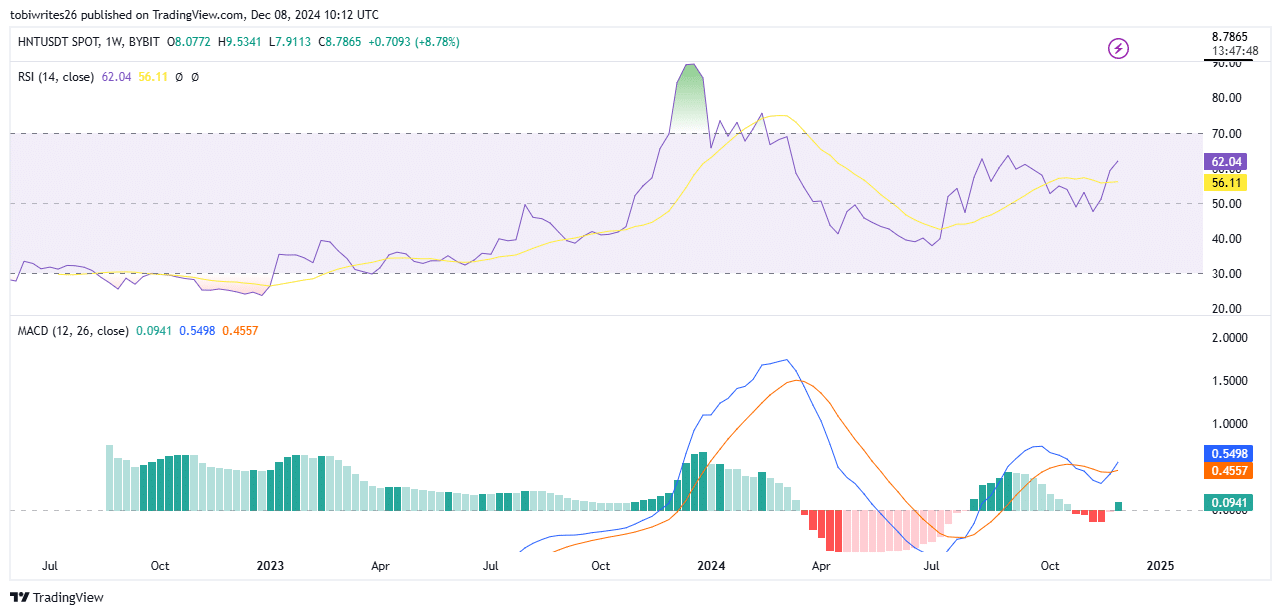

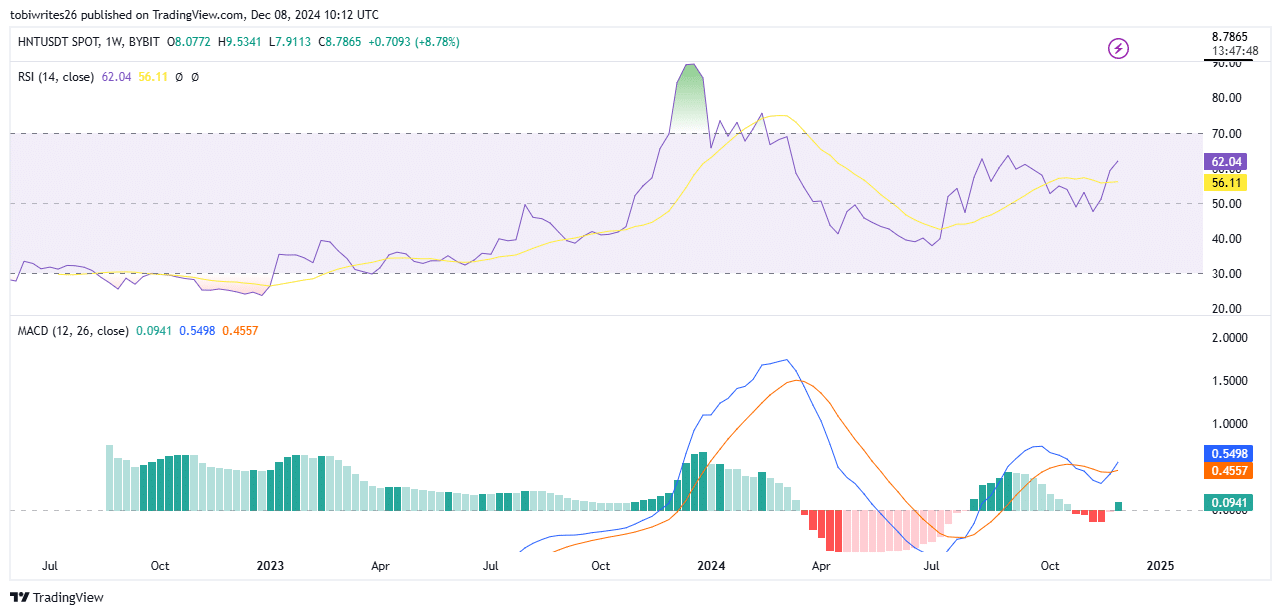

- The MACD has additionally shaped a golden cross, signaling potential upward momentum.

Helium’s [HNT] current market efficiency has proven some weak point. The asset has dropped by 4.76% prior to now 24 hours, decreasing its month-to-month achieve to 42.97% from earlier highs.

Regardless of this short-term decline, evaluation suggests the broader market construction stays intact, leaving room for additional upside potential.

HNT’s pending rally

HNT is presently buying and selling inside a cup and deal with sample, a construction usually related to important value rallies.

Though HNT has already begun its upward motion, evaluation suggests {that a} rally may drive the asset to $20, which represents a 143.27% achieve and marking the completion of the sample.

Supply: Buying and selling View

At this stage, additional upward momentum is feasible, however it is going to rely available on the market’s potential to beat anticipated promote strain round $20.

A golden cross: A golden alternative?

On the time of writing, a golden cross has shaped on the worth chart, an indication for a major momentum and a possible rally that helps the continuing bullish development.

This sample happens when the blue MACD line crosses above the orange sign line. The MACD was at 0.5498 at press time, whereas the sign line hit 0.4557, as proven on the chart.

Supply: Buying and selling View

Moreover, the Relative Power Index (RSI)—an indicator used to measure the velocity of value adjustments primarily based on purchaser and vendor exercise—confirms the bullish sentiment.

The RSI was at 62.04, indicating energetic shopping for out there. If the RSI stays beneath the overbought threshold—70, additional positive factors may observe because the asset continues its upward trajectory.

Patrons on the rise

The derivatives market indicators a bullish outlook for HNT, supporting expectations of additional value will increase.

Is your portfolio inexperienced? Try the Helium Revenue Calculator

Information from Coinglass reveals that the long-to-short ratio has climbed to 0.9976. This shift displays an increase in lengthy contracts, indicating a powerful probability that the asset will proceed its upward development.

The funding fee for HNT additionally stays optimistic at 0.0353%, displaying that lengthy positions assist maintain the worth hole between the spot and derivatives markets.