How macro trends are shaping BNB’s price movements today

- Binance Coin noticed important retracement in its latest worth motion, coinciding with Bitcoin’s ongoing market correction

- As BNB approached the $733.42 resistance, quantity spikes indicated heightened promoting stress

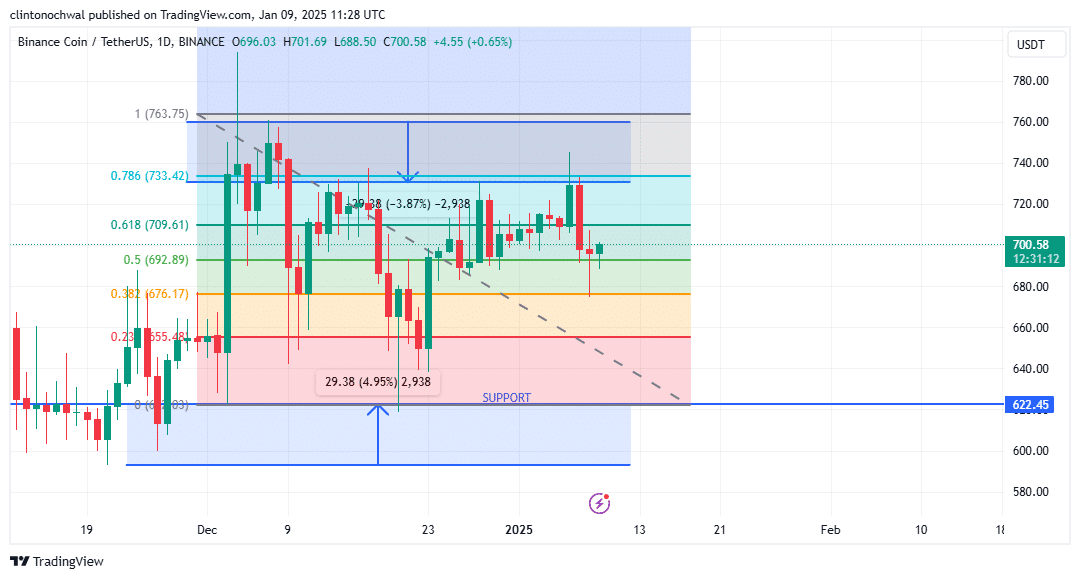

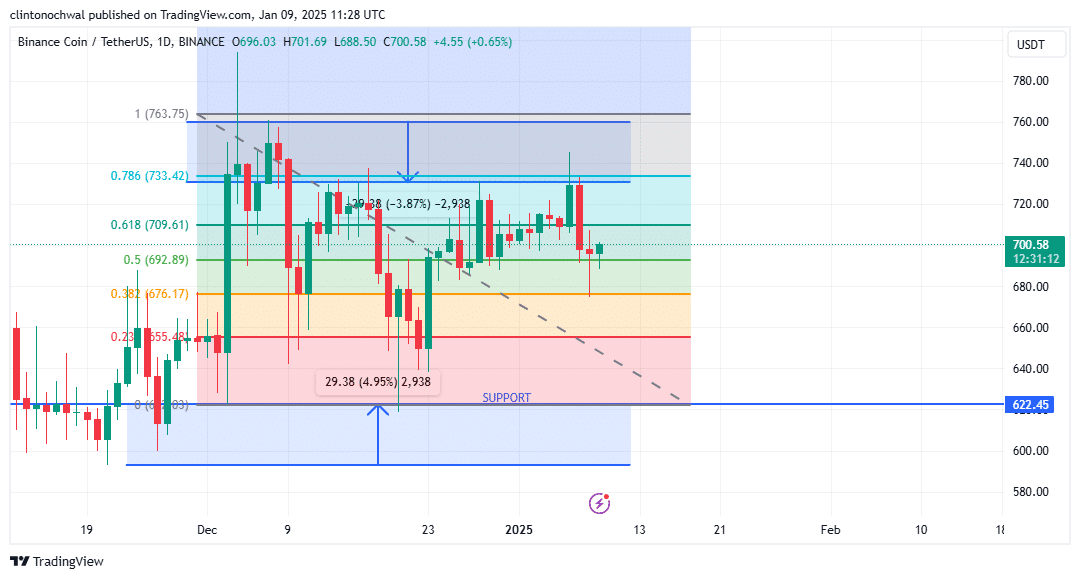

Binance Coin (BNB) has seen important retracement in its latest worth motion, with the identical coinciding with Bitcoin’s ongoing market correction. Merchants have been carefully monitoring key ranges on the day by day timeframe, as BNB’s rejection on the Fibonacci Twice Space hinted at potential alternatives for strategic entries.

Fibonacci retracement ranges

Fibonacci retracement ranges give us very important insights into BNB’s worth actions, appearing as benchmarks for potential reversals and continuations. In response to BNB’s worth chart, as an illustration, the 0.618-level at $709.61, the 0.5-level at $692.89, and the 0.382-level at $676.17 have emerged as pivotal help zones.

Supply: TradingView

BNB not too long ago failed to keep up momentum above the 0.786-level at $733.42, highlighting waning bullish stress. This rejection triggered a retracement in direction of the 0.5-level, the place consolidation pointed to a brief pause in bearish momentum.

Traditionally, the 0.618-level has acted as a powerful help in bullish setups. If BNB retraces to $709.61 and varieties a bounce, it could sign renewed shopping for curiosity.

The 0.5-level at $692.89 is especially important because of its proximity to the press time worth. Holding above this stage may point out consolidation earlier than a possible upward breakout.

Conversely, a breach beneath the 0.382-level at $676.17 could pave the best way for deeper corrections in direction of the crucial help zone at $607.16.

Given the Fibonacci evaluation, merchants ought to look ahead to bullish candlestick patterns or quantity spikes close to these ranges to verify potential reversals. If BNB regains momentum and climbs again in direction of the 0.786-level at $733.42, it may goal the $763.75 resistance, aligning with the 1.0 Fibonacci extension.

Assist and resistance zones

Assist and resistance zones stay important metrics for assessing BNB’s potential worth trajectory. On the time of writing, the $607.16 help zone stood out as a vital stage for potential accumulation. Traditionally, BNB has seen robust shopping for curiosity on this space, making it a focus for merchants anticipating a rebound.

Along with the $607.16-level, the $572.85 zone appeared to supply additional draw back safety. A drop to this stage could appeal to long-term consumers in search of to capitalize on discounted costs. On the upside, resistance at $733.42 aligned with the 0.786 Fibonacci stage, serving as a barrier to additional bullish progress. Past this, the $763.75 goal appeared to characterize a major milestone, providing merchants a possible profit-taking alternative.

BNB’s worth motion inside these zones will largely depend upon exterior elements, equivalent to Bitcoin’s efficiency and macroeconomic developments..

Quantity metrics

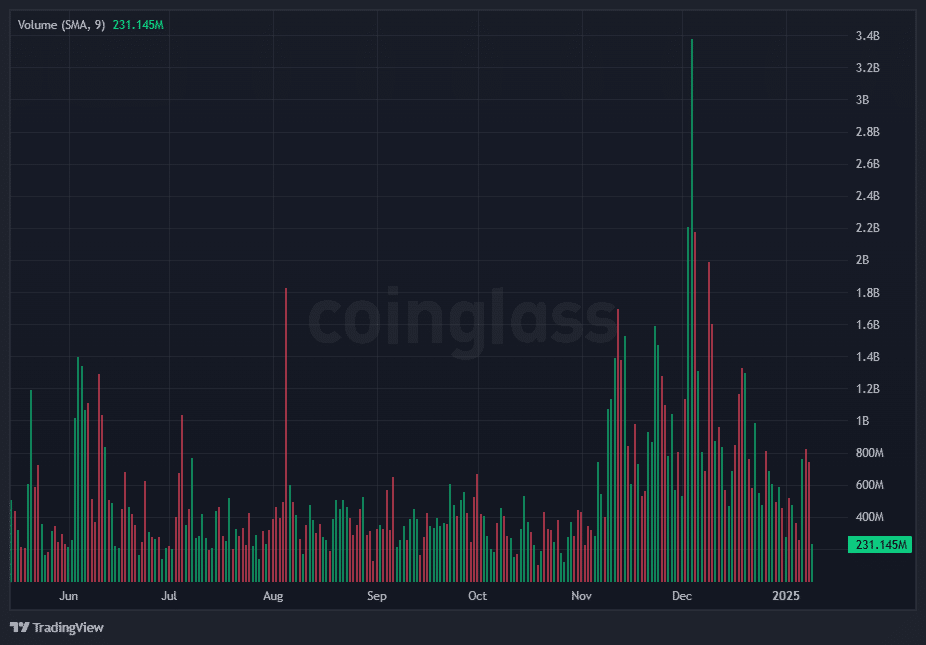

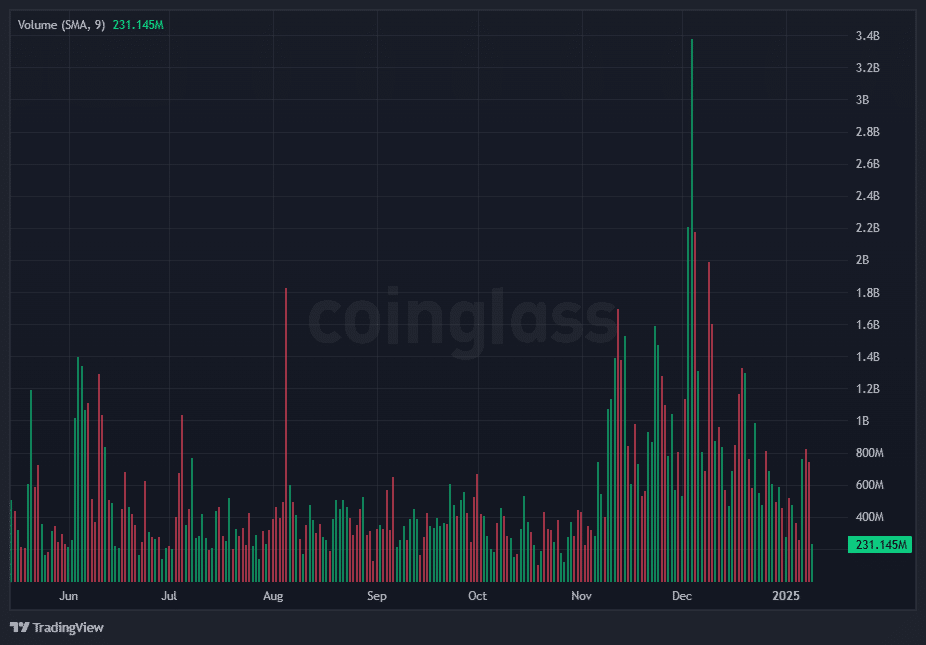

Latest worth actions in BNB have been accompanied by fluctuating quantity ranges, revealing precious insights into market sentiment.

Supply: Santiment

As BNB approached the $733.42 resistance, quantity spikes indicated heightened promoting stress, finally leading to a rejection. Conversely, as the worth retraced in direction of $692.89, quantity ranges started to stabilize – An indication of diminished promoting depth.

Due to this fact, a surge in quantity at tendencies $607.16 help zone could point out accumulation by long-term buyers, signaling a possible worth reversal.

Moreover, an absence of quantity close to crucial help zones may counsel weak shopping for curiosity, rising the danger of additional declines. On the upside, a breakout above $733.42 with accompanying quantity spikes would affirm bullish momentum, paving the best way for a rally in direction of $763.75.

Combining Fibonacci retracement ranges, help and resistance zones, and quantity metrics, may also help develop a complete technique for navigating BNB’s evolving market panorama. As at all times, exterior elements and market sentiment ought to be factored into decision-making to maximise buying and selling success.