‘I don’t think Ethereum ETFs will match Bitcoin ETFs, but…’ – Exec

- SEC authorized the 19b-4 itemizing for Ethereum ETFs, however S-1 approval is awaited

- Bitcoin ETFs have been seeing large inflows, with Ethereum anticipated to draw hundreds of thousands too

After a lot hypothesis surrounding the approval of Spot Ethereum [ETH] ETFs, the SEC gave a inexperienced gentle to those monetary merchandise just a few days in the past.

Nevertheless, what’s vital right here is that they’ve solely authorized the 19b-4 itemizing requests for ETH ETFs, not the vital S-1 registration statements.

What’s behind the break up?

This break up approval raises questions, with some suggesting a possible political affect fairly than a cautious overview of the ETF proposals. Sharing an analogous line of thought, Matt Hougan, CIO at Bitwise, throughout a current episode of the ‘Bankless’ podcast mentioned,

“I haven’t seen an instance of individuals having no expectation of approval and flipping to anticipating approval so rapidly on an successfully in a single day foundation. So, to the extent that this has by no means occurred once more, one thing was stunning at work right here.”

Reiterating the identical, James Seyffart, Analysis Analyst at Bloomberg Intelligence, added,

Supply: James Seyffart/X

When requested in regards to the subsequent steps by way of an ETF, Hougan famous,

“The method between type of the place we’re and these ETFs itemizing is: Issuers must commute with the division of funding administration round precisely what’s on this doc.”

Right here, he highlighted that whereas the SEC’s approval of the 19b-4s is a big step ahead, the complete launch of ETH ETFs depends upon the S-1 doc approval. This might take weeks to months.

Affect on ETH’s worth

For sure, these developments contributed to vital fluctuations in Ethereum’s market cap, initially resulting in a decline on the charts. Nevertheless, at press time, ETH had rebounded to $3,752, up 1.65% within the final 24 hours. The broader market sentiment, led by Bitcoin climbing previous $69k, had turned bullish too.

Bitwise CIO lent some insights to this matter too by stating,

“There’s no new provide, internet provide is successfully zero and what meaning is that this new demand shock has to purchase ethereum from individuals who don’t must promote it and that’s simply an awfully bullish setup.”

BTC inflows vs. ETH inflows

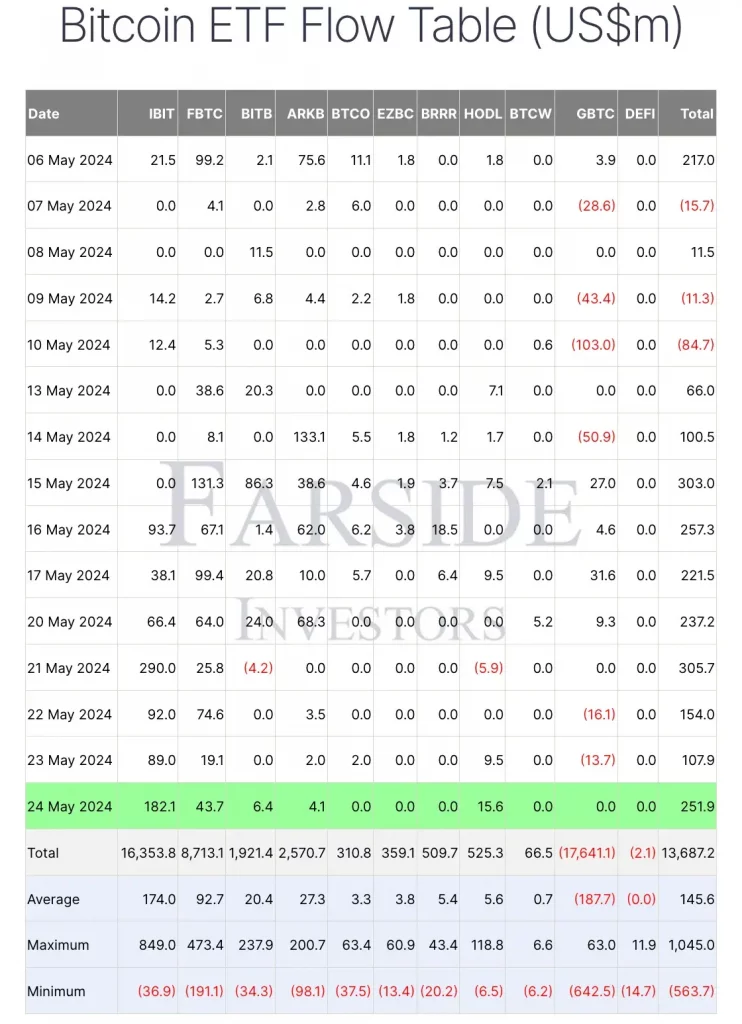

So far as spot Bitcoin [BTC] ETFs are involved, since their debut on 11 January, the inflows have been phenomenal. In truth, current information by Farside Traders revealed that on 24 Could, Bitcoin ETFs noticed whole inflows of $251.9 million.

Supply: Farside Traders

Will Ethereum see related numbers although? In keeping with Hougan, no. He went on to say,

“I don’t assume Ethereum ETFs will match Bitcoin ETFs however I do assume it will likely be measured by way of many billions of {dollars}.”

The exec expanded on this level by emphasizing that Bitcoin’s simplicity as “digital gold” makes it simply comprehensible, whereas Ethereum’s position as a platform for decentralized purposes is extra complicated.

Institutional buyers, nonetheless, are more likely to see the worth of diversifying and diving into each BTC and ETH ETFs.