Institutional Bitcoin sales loom large: $90K to be the next local bottom?

- BTC’ largest menace proper now could be a decline in institutional backing at a time when volatility is growing.

- If this pattern continues, $90K might function the native assist stage.

Bitcoin’s current value motion has demonstrated resilience, with the market staying bullish regardless of Bitcoin [BTC] coming into the final month of the yr with out breaking by the $100K barrier. Robust demand continues to soak up sell-side stress, reinforcing this optimism.

Moreover, whereas numerous weak arms have exited the cycle after securing huge income, absence of a stable pullback highlights a strong sense of FOMO amongst traders.

Nevertheless, even with metrics indicating a gradual trajectory towards $100K and the anticipated Fed price reduce including to the optimism, AMBCrypto delves into whether or not a possible retracement to $90K might act as the required catalyst for Bitcoin’s subsequent main transfer.

Lack of institutional assist might pose a significant menace

Presently, Bitcoin stands at a essential crossroads, with its trajectory hinging on sustained assist fueled by regular accumulation from each retail and institutional traders.

Microstrategy, being an organization closely invested in BTC, sees its inventory [MSTR] react extra dramatically to adjustments in Bitcoin’s worth.

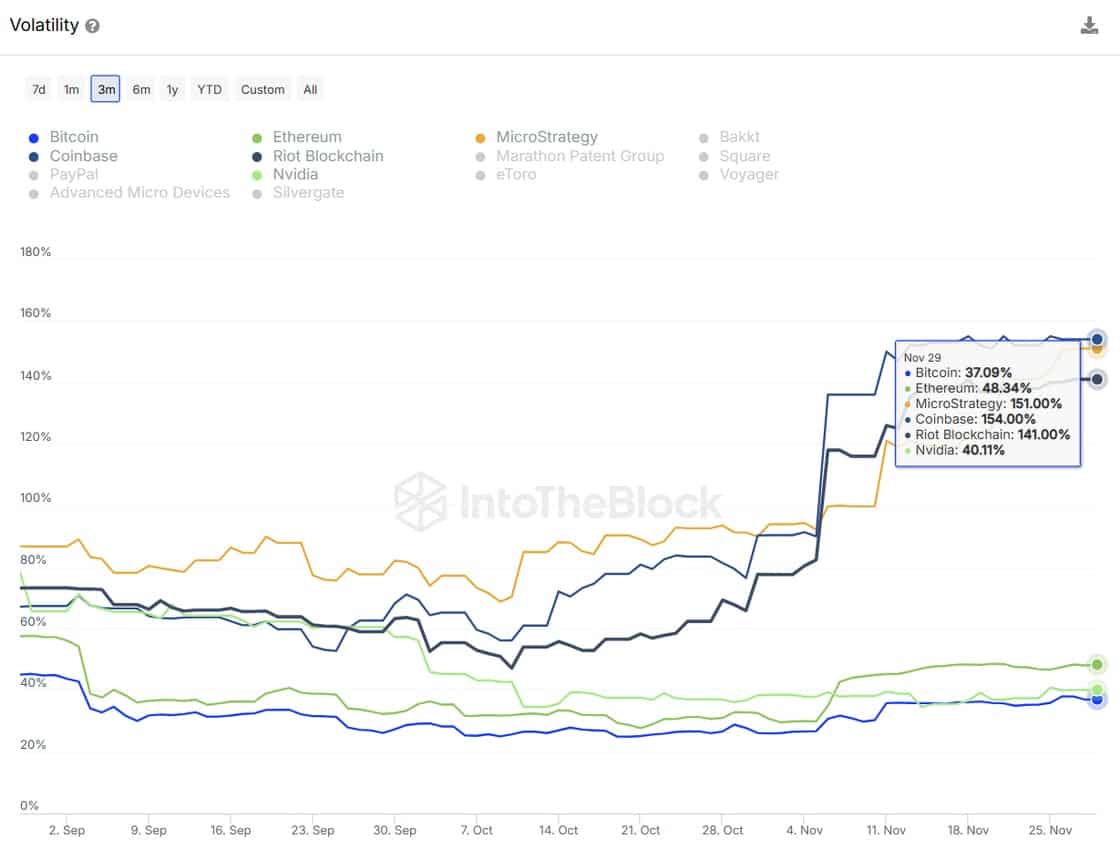

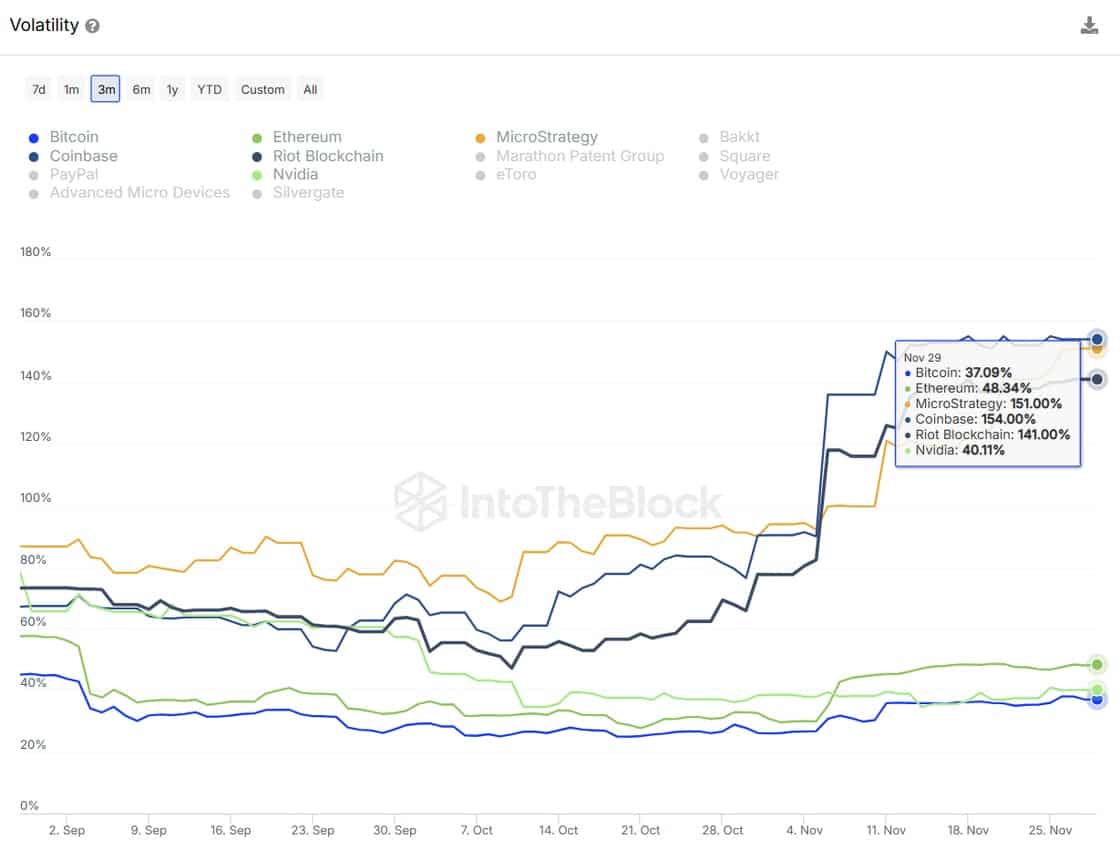

As highlighted within the chart under, MSTR’s volatility being 4 instances that of BTC signifies that MicroStrategy’s inventory value is predicted to fluctuate roughly 4 instances as a lot as Bitcoin’s, introducing a heightened and calculable danger for its traders.

Supply : IntoTheBlock

On this local weather, Bitcoin’s enchantment as a retailer of worth might weaken, probably triggering institutional sell-offs and liquidations.

This comes as MicroStrategy’s inventory turns into extra risky, prompting traders to reassess their publicity to BTC, significantly by MSTR, which might result in a broader market correction.

Because of this, MSTR’s premium BTC holdings have dropped from a peak of 240 on twentieth November to 135 in slightly below seven buying and selling days. If this promoting stress continues unchecked, it might set off vital losses for Bitcoin holders, probably driving the worth right into a deeper pullback.

So, preserve the volatility in examine

At 63, the crypto volatility index signifies noticeable, however not excessive, market volatility. Nevertheless, this follows a rebound simply two days in the past from the 60 threshold, which has traditionally been a major assist stage.

Supply : CryptoVolatilityIndex

In easy phrases, if the volatility index rebounds strongly, it might rise in the direction of or above the earlier rejection level of round 70. A CVI above 70 indicators increased anticipated value fluctuations and higher market uncertainty.

Whereas this could possibly be both bullish or bearish, analyzing Bitcoin’s present value chart, which exhibits extreme fluctuations over the previous week, means that heightened volatility would possibly undermine institutional confidence in a parabolic run.

Traditionally, a volatility index hitting a peak has coincided with Bitcoin reaching a backside.

This additional helps AMBCrypto’s earlier thesis that Bitcoin might hit a neighborhood backside, resulting in a wholesome retracement, decrease volatility, elevated institutional FOMO, and a possible breakout from inconsistent value motion.

The place might BTC see a wholesome retracement?

In a current report, $90K was recognized as a key assist stage, marking a major backside formation, pushed by strong retail accumulation and backing from ETFs.

This means that if volatility strikes into the ‘excessive’ zone, the place vital swings can happen in a short while, the probability of a pullback stays excessive.

In such a state of affairs, $90K might function a powerful liquidity pool, attracting each swing merchants and institutional exercise, resulting in a possible uptick in value.

Furthermore, with the upcoming Fed assembly, merchants are growing their bets on a 25-basis level price reduce in December. The market is now pricing in a 64.7% probability of this taking place, up from 55.7% only a week in the past.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Definitely, this macroeconomic transfer is prone to set off sudden swings within the spinoff market, with the opportunity of a brief squeeze remaining excessive. A pointy uptick in value might pressure short-sellers to shut their positions.

Because of this, market volatility is prone to rise, creating favorable circumstances for a wholesome retracement as many establishments could pull again from accumulating Bitcoin on this ‘high-risk’ atmosphere.