Is Bitcoin at risk from Ethereum ETFs? Peter Schiff explains

- Schiff’s remarks come amid Bitcoin’s temporary transfer above $70k.

- Bitcoin spot ETFs entice vital institutional funding regardless of the considerations.

Because the world awaits the approval of an Ethereum [ETH] spot exchange-traded fund (ETF), outstanding Bitcoin critic Peter Schiff has taken the chance to assault Bitcoin [BTC].

Schiff sees an upcoming bearish pattern for BTC

In a twenty first Might put up on X (previously Twitter), Schiff recommended that Bitcoin might turn out to be bearish if the Ethereum spot ETF is authorized. He mentioned,

“#Bitcoin gained renewed power from rumors that an #Ethereum ETF will seemingly be authorized. However any cash to purchase new Ether ETFs will almost definitely come from present Bitcoin ETFs. Traders who determined to make an allocation to #crypto gained’t improve that allocation to purchase Ether.”

Schiff highlighted that though the latest rumors about an Ethereum ETF approval have boosted Bitcoin’s worth briefly, issues might end up in another way.

He believes that the funds for these new Ethereum ETFs will seemingly come from the cash at present invested in present Bitcoin ETFs.

In his view, buyers who’ve already allotted funds to cryptocurrency are unlikely to extend their total funding within the crypto market simply to purchase Ethereum ETFs.

As an alternative, they may shift their investments from Bitcoin to Ethereum, which might negatively affect Bitcoin’s worth.

Do you have to belief Schiff’s remarks?

Evidently, Schiff’s remarks sparked quite a lot of criticism, beginning with Rajat Soni, a Bitcoin educator, who claimed,

“Peter… Bitcoin’s worth doesn’t go up due to Ether. Ether’s worth goes up due to Bitcoin. In the event you don’t perceive this, your opinion is irrelevant.”

Nonetheless, Santiment’s newest tweet echoed Schiff’s remarks.

“#Ethereum is seeing essentially the most #bullish crowd sentiment since September with the #SEC prone to approve the primary #ETF’s, and $ETH’s worth surge. In the meantime, #Bitcoin & #Solana sentiment is barely #bearish.”

Supply: Santiment

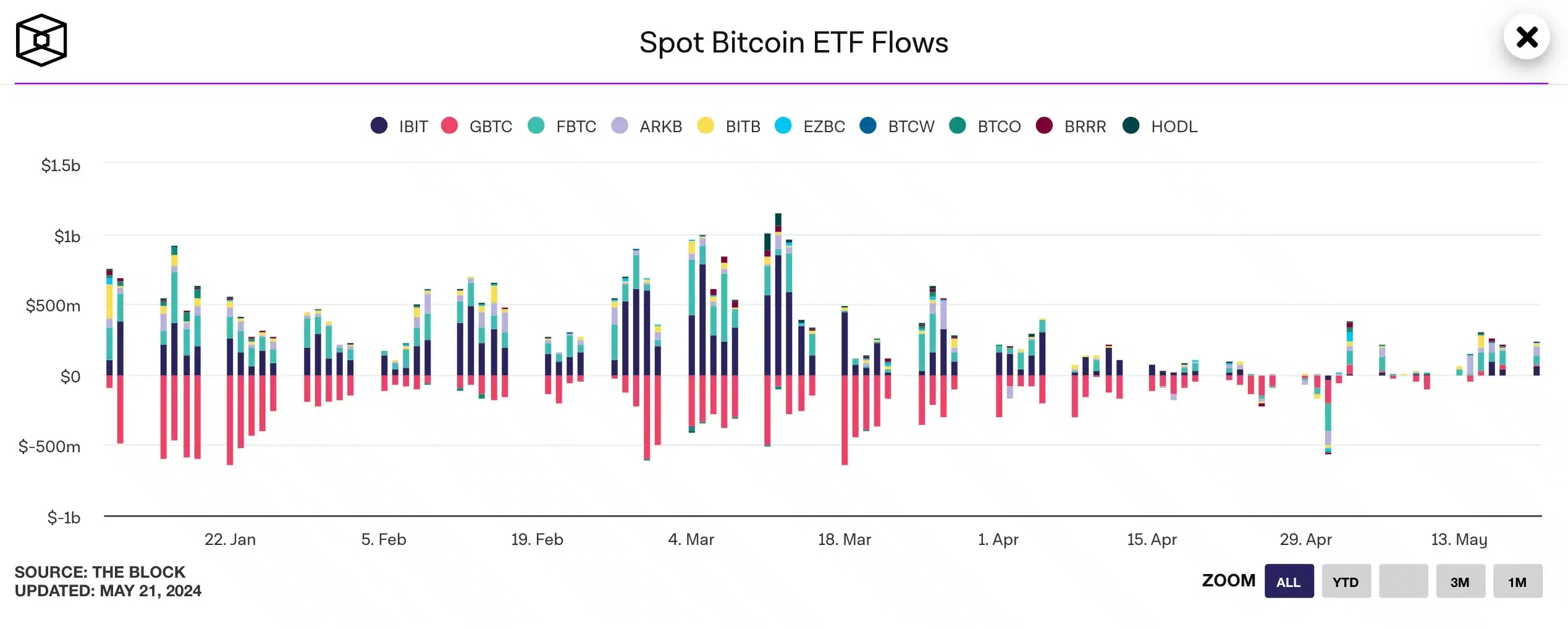

Bitcoin ETFs see large inflows

Regardless of the criticism and uncertainty, Bitcoin spot ETFs have remained a favourite amongst establishments. On twenty first Might, Bitcoin ETFs skilled web inflows totaling $305.7 million.

Main the pack was BlackRock with an funding of $290.0 million, adopted by Constancy with $25.8 million. Bitwise and VanEck, nevertheless, noticed outflows of $4.2 million and $5.9 million, respectively.

Supply: The Block