Is Ethereum local bottom in? Options market signals…

- Choices market information indicated that ETH value may have stabilized.

- Nevertheless, market sentiment was nonetheless destructive amid overhangs from Center-East tensions.

Ethereum’s [ETH] value appeared to stabilize after current volatility following geopolitical escalations within the Center East that spooked crypto markets.

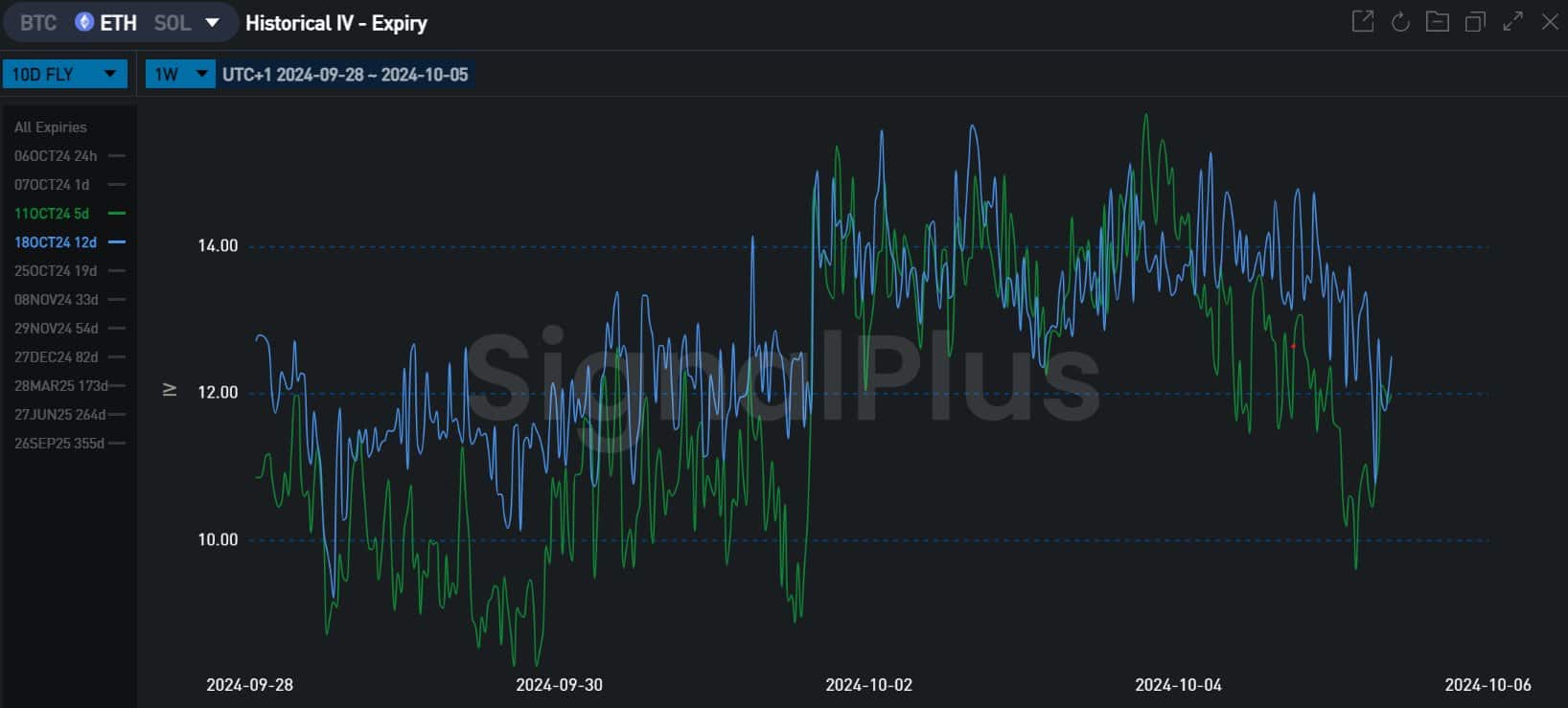

In keeping with Jake Ostrovskis, a crypto dealer at Wintermute, choices market information urged {that a} native backside could possibly be in for the biggest altcoin. He noted,

“From Tuesday (1st Oct.), the biggest hedging move was observable in #ETH in shorter-dated contracts, and these flows at the moment are unwinding because the market seems to be to agency.”

Supply: SignalPlus

Is ETH’s native backside in?

For context, the hike in hedging move in short-dated ETH contracts up to now few days meant that merchants took hedging positions to guard towards value fluctuations, epecially amid Israel-Iran escalations.

They used short-term choices to attain this.

Nevertheless, there was a notable unwinding of the hedging flows and declining implied volatility for these short-term choices into the weekend.

This urged that merchants have been changing into assured of ETH market stability and that hedging was pointless.

Put in a different way, ETH’s native backside may quickly be in, particularly as Israel hasn’t retaliated towards the current Iran assault.

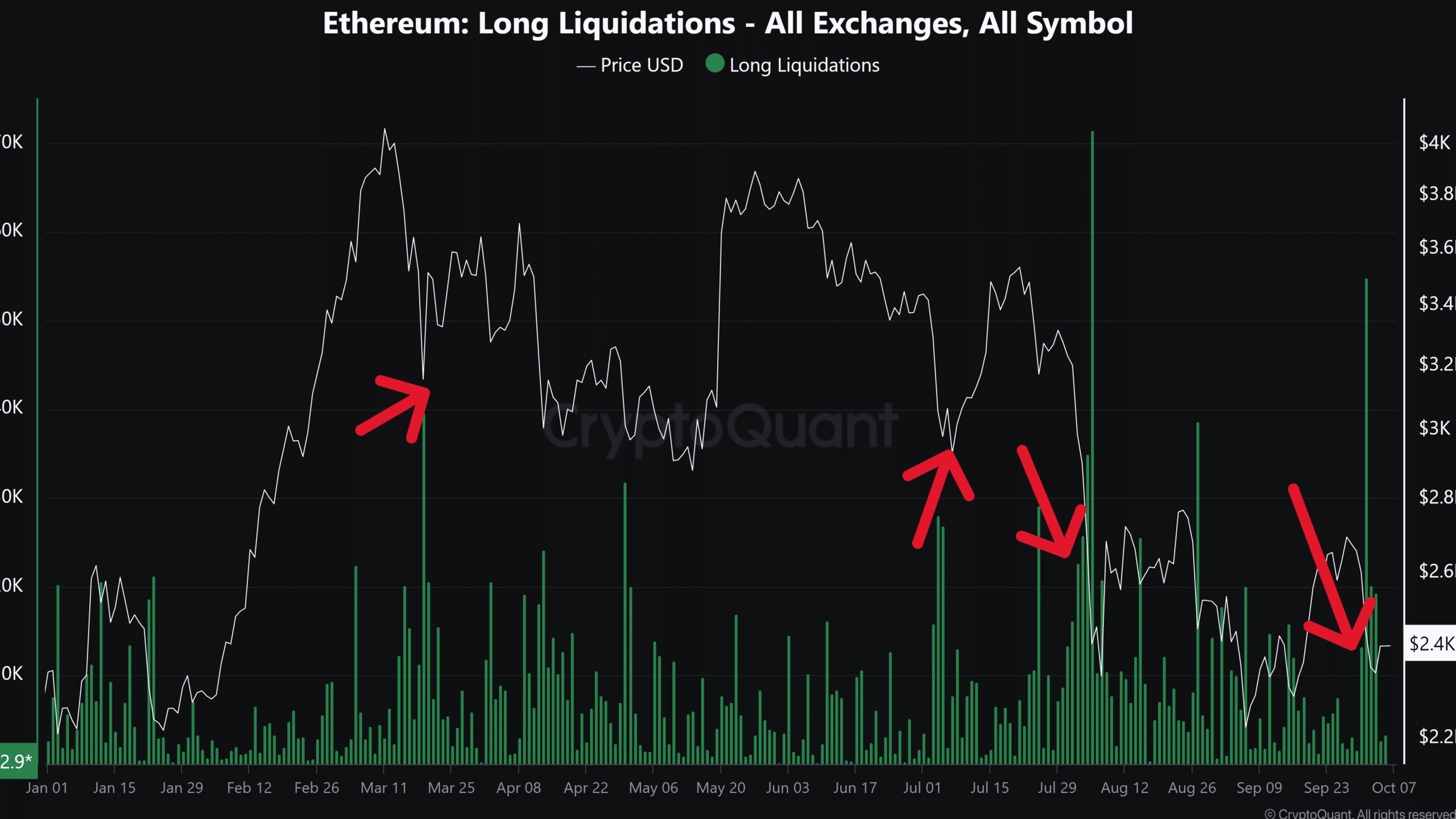

Supply: CryptoQuant

One other information set that urged ETH may need hit backside was the hike in lengthy liquidations. The current plunge liquidated over $50 million price of ETH lengthy positions.

In most previous traits, a spike in ETH lengthy liquidations coincided with native bottoms. This sample was seen in March, July and August.

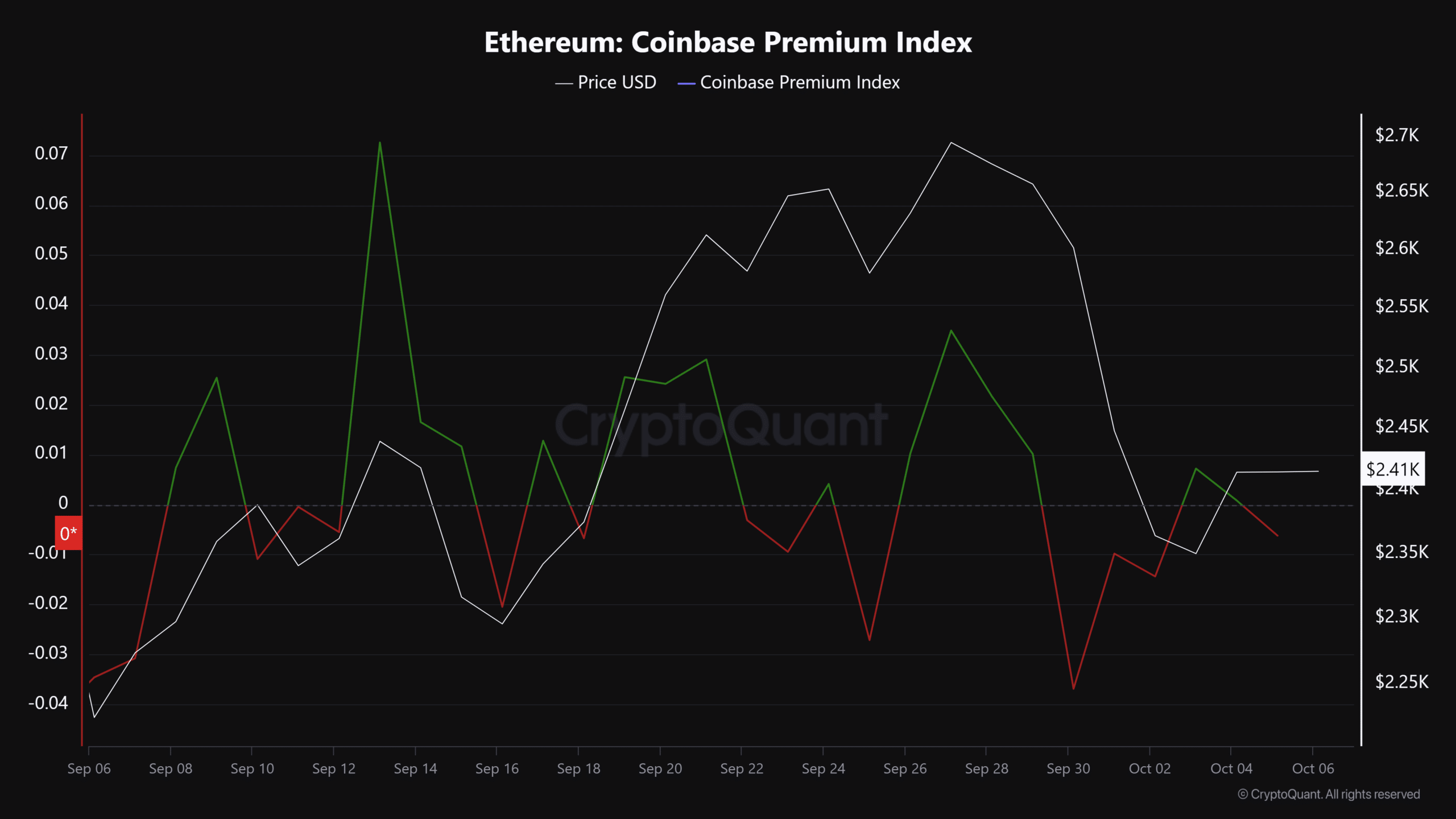

That stated, there was no vital demand from US traders, as demonstrated by a destructive studying on the Coinbase Premium Index. As a rule, hikes within the Coinbase Premium Index correlate with a powerful ETH restoration.

Supply: CryptoQuant

Ergo, regardless of potential stability within the ETH market, monitoring US traders’ demand may sign whether or not the underside was in and if a aid restoration may observe.

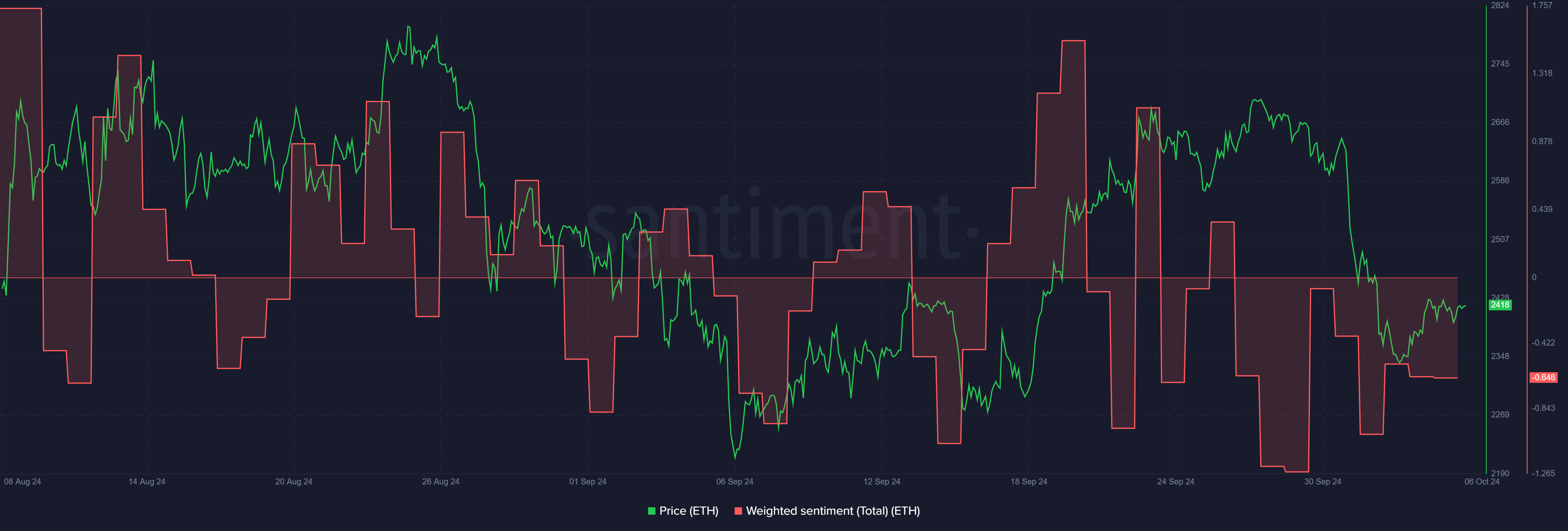

Moreover, a cautious outlook was nonetheless obvious, as denoted by ETH’s destructive market sentiment.

Supply: Santiment

This highlighted that traders took to the sidelines, most likely to attend for Israel’s reactions to final week’s Iran transfer. At press time, ETH traded at $2.4K, down 8.4% up to now seven buying and selling days.