Is Ethereum Set for Recovery? Significant Drop in Open Interest May Tell

- Ethereum’s Open Curiosity has decreased, probably easing market tensions.

- The asset’s value reveals indicators of restoration, with a present rise to $3,585.

In current developments throughout the cryptocurrency markets, Ethereum [ETH] has proven indicators of a modest restoration after a turbulent interval.

During the last 24 hours, ETH has seen an increase of 1.5%, marking a possible turnaround from its week-long downtrend which has now culminated in a 2.5% drop.

This resurgence has allowed Ethereum to cross the numerous value threshold of $3,500, buying and selling round $3,585 at press time.

This enchancment in value accompanies a notable lower in market strain, as evidenced by modifications in Ethereum’s Open Curiosity (OI).

Open Curiosity, which aggregates the whole of all open positions out there, whether or not lengthy or quick, serves as a barometer for market exercise and sentiment.

Market eases as Ethereum’s OI dips

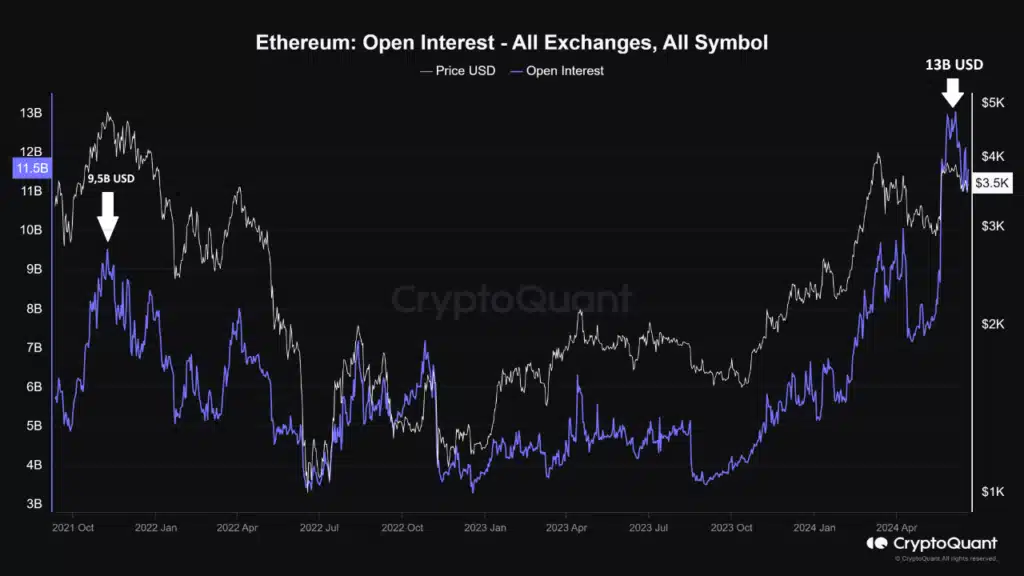

Not too long ago, knowledge from CryptoQuant has highlighted a big discount in Ethereum’s Open Curiosity, which dropped from a excessive of $13 billion to $11.5 billion.

This discount grants the market much-needed respiration house, probably assuaging a number of the speculative pressures which have overheated the market in current occasions.

The CryptoQuant analyst notably famous,

“Whether or not this pullback in OI knowledge is ample can be decided by market makers, however we will say that the boiling water has cooled down a bit.”

In the meantime, the height in Ethereum’s Open Curiosity beforehand coincided with its all-time excessive value of $4,891 in 2021, reaching as much as $9.5 billion throughout that bull run.

In distinction, the present cycle noticed the OI escalate to a file $13 billion with out renewing the all-time excessive, indicating a heightened stage of market leverage and speculative curiosity.

Supply: CryptoQuant

This excessive stage of Open Curiosity led to vital market corrections, with about $400 million in Ethereum positions liquidated since early June.

$285 million of those have been lengthy positions, and $113 million have been shorts, the analyst revealed.

Traders trudge on

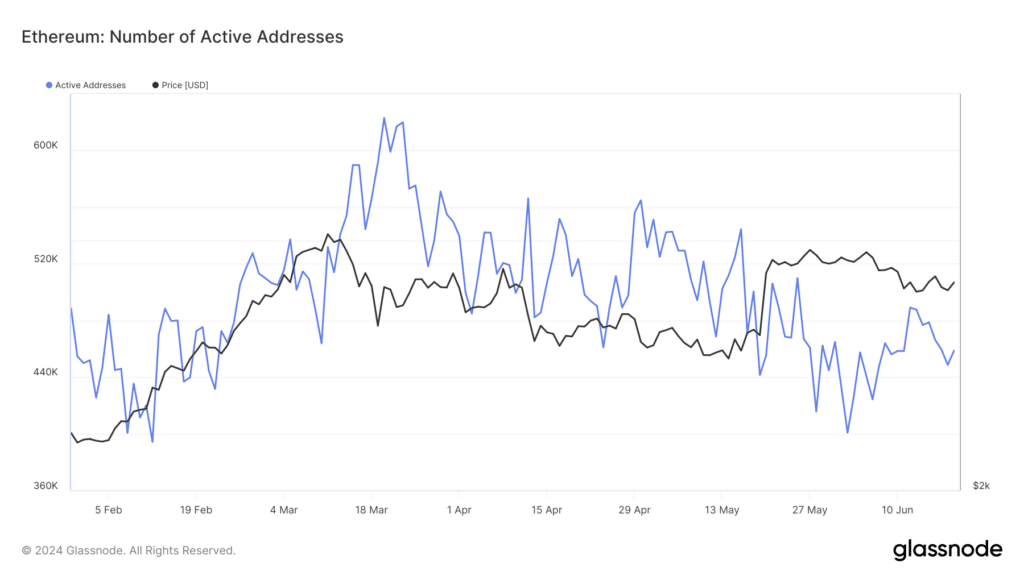

Including complexity to the market’s habits, Ethereum’s lively addresses have proven a decline, suggesting a lower in person engagement or community exercise.

This, per Glassnode, just lately dipped from a excessive of 489,000 lively addresses, reflecting potential shifts in investor habits and market participation.

Supply: Glassnode

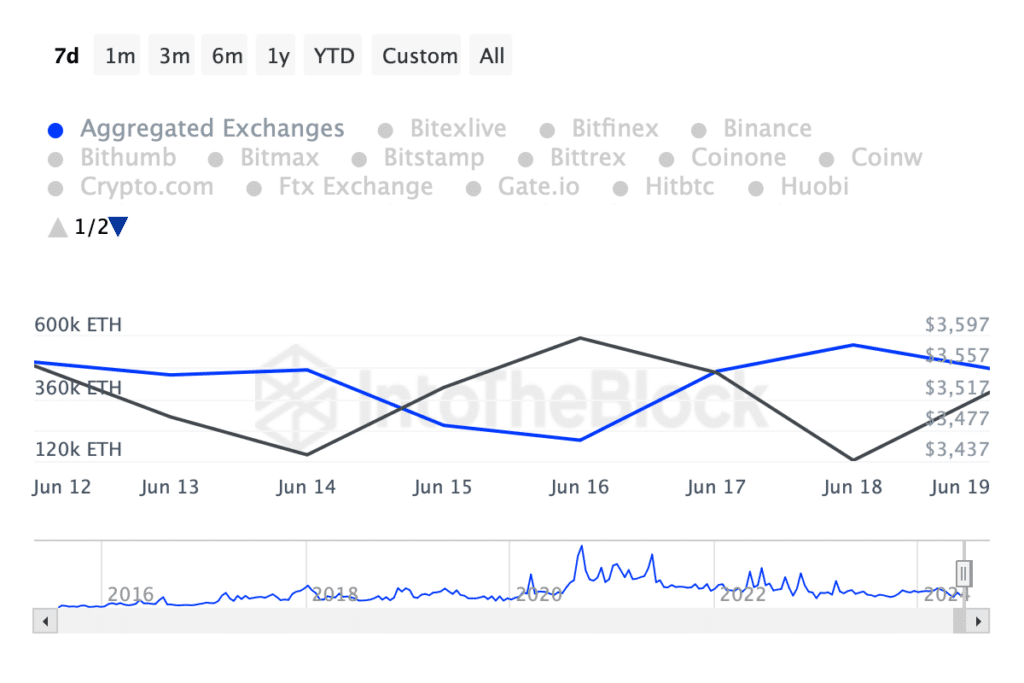

Concurrently, IntoTheBlock’s data indicated ongoing accumulation actions amongst Ethereum buyers, regardless of the market’s challenges.

Over the previous week, Ethereum noticed a internet outflow from exchanges exceeding 400,000 ETH, signaling sturdy investor confidence and potential anticipation of value appreciation.

Supply: IntoTheBlock

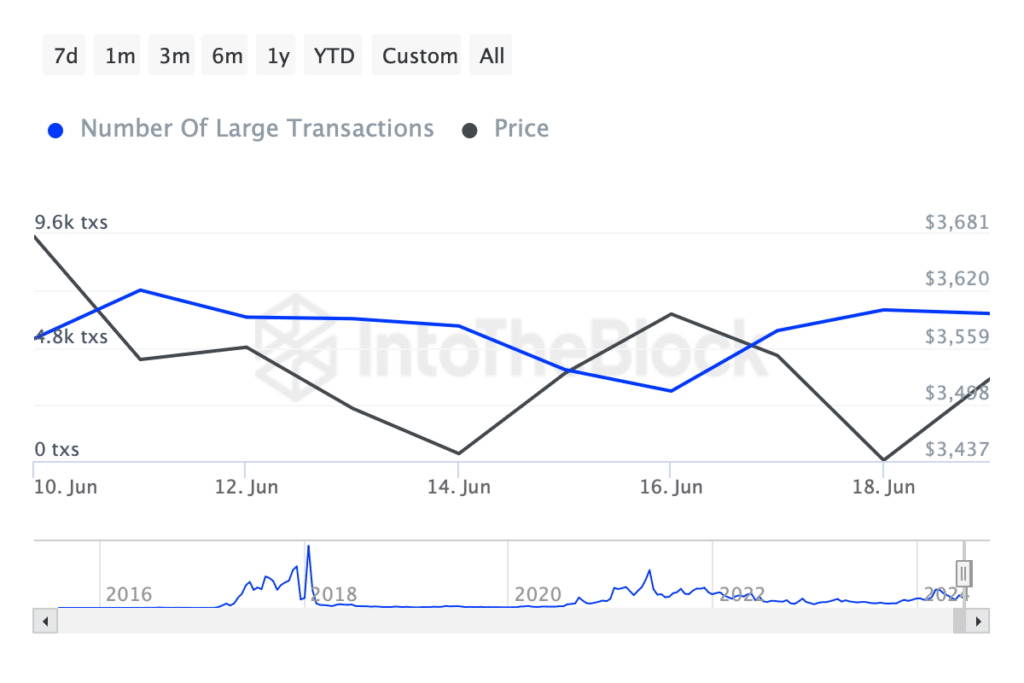

Learn Ethereum’s [ETH] Value Prediction 2024-2025

The development is supported by a report from AMBCrypto, which noted that Ethereum’s alternate provide has hit an eight-year low.

This coincided with a surge in giant transactions (over $100k), which have elevated considerably in simply the previous week.

Supply: IntoTheBlock