Is Ethereum’s market bottom in? Price indicators point to a $5K target

- Ethereum’s worth motion lastly turned bullish within the final 24 hours.

- Promoting strain on Ethereum elevated final week.

The actions of whales have a serious affect on crypto costs, together with these of high cash like Ethereum [ETH]. The most recent evaluation rightfully identified one such fascinating improvement. Individually, a key ETH metric means that buyers may quickly witness a worth hike.

Ethereum and Bitmex’s connection

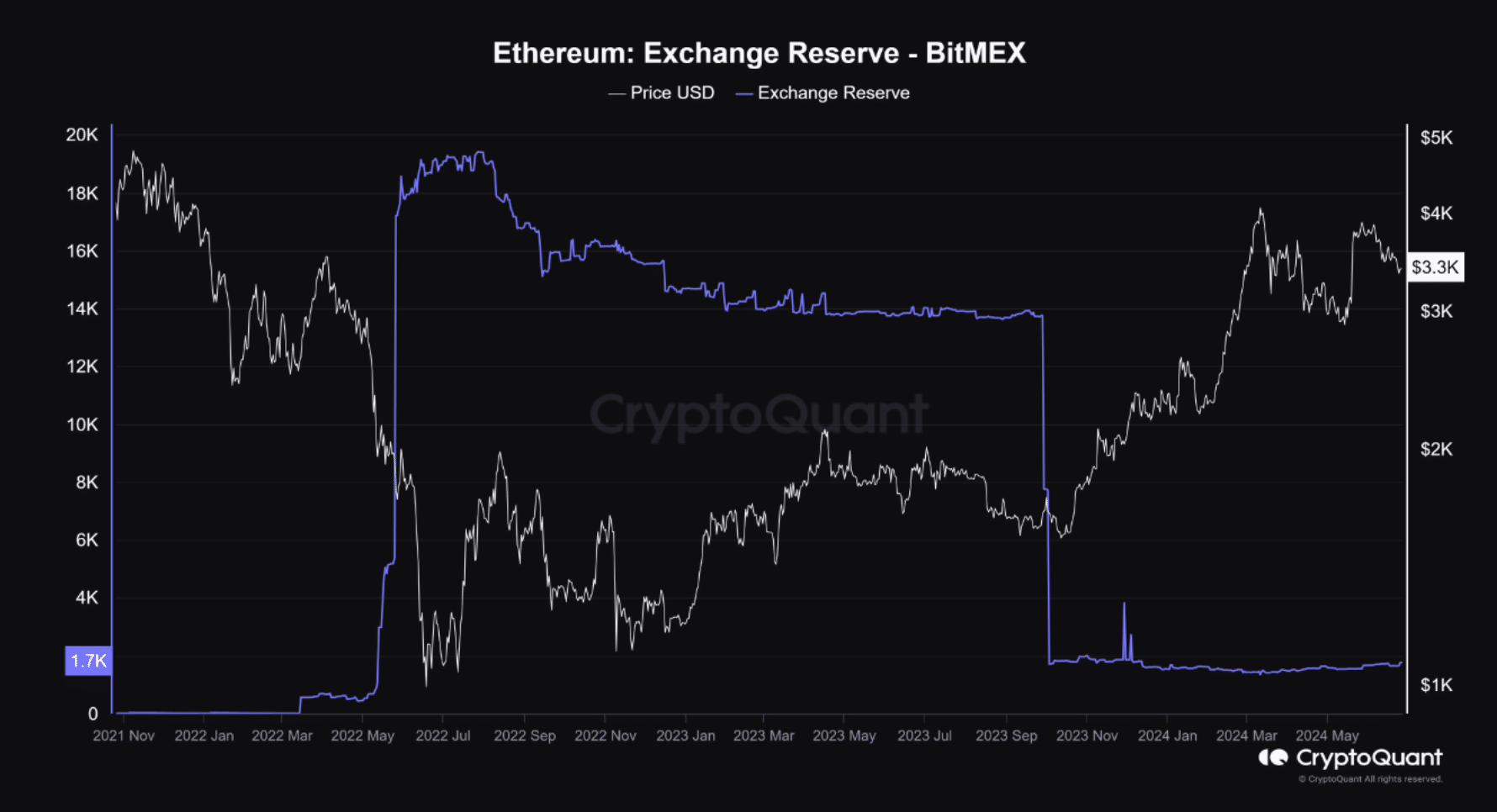

BlitzzTrading, an analyst and creator at CryptoQuant, lately posted an analysis highlighting a novel development. As per the evaluation, following sharp will increase in Ethereum reserves, noticeable decreases within the ETH worth are noticed.

As an illustration, on the twenty eighth of September, there was an enormous decline in Bitmex alternate reserves, which was adopted by a rise within the ETH worth.

This correlation between ETH and Bitmex meant that when Bitmex Ethereum whales purchase by Bitmex, we observe a lower in reserves.

Conversely, once they promote, we see a rise in Bitmex reserves. At press time as nicely, Bitmex’s ETH reserves remained comparatively low.

Supply: CryptoQuant

Ethereum at a market backside

Within the meantime, Ethereum’s worth lastly managed to show bullish after a number of days of corrections. In line with CoinMarketCap, ETH’s worth elevated by almost 2% within the final 24 hours.

On the time of writing, ETH was buying and selling at $3,428.69 with a market capitalization of over $412 billion. AMBCrypto’s have a look at Glassnode’s information additionally identified a bullish metric.

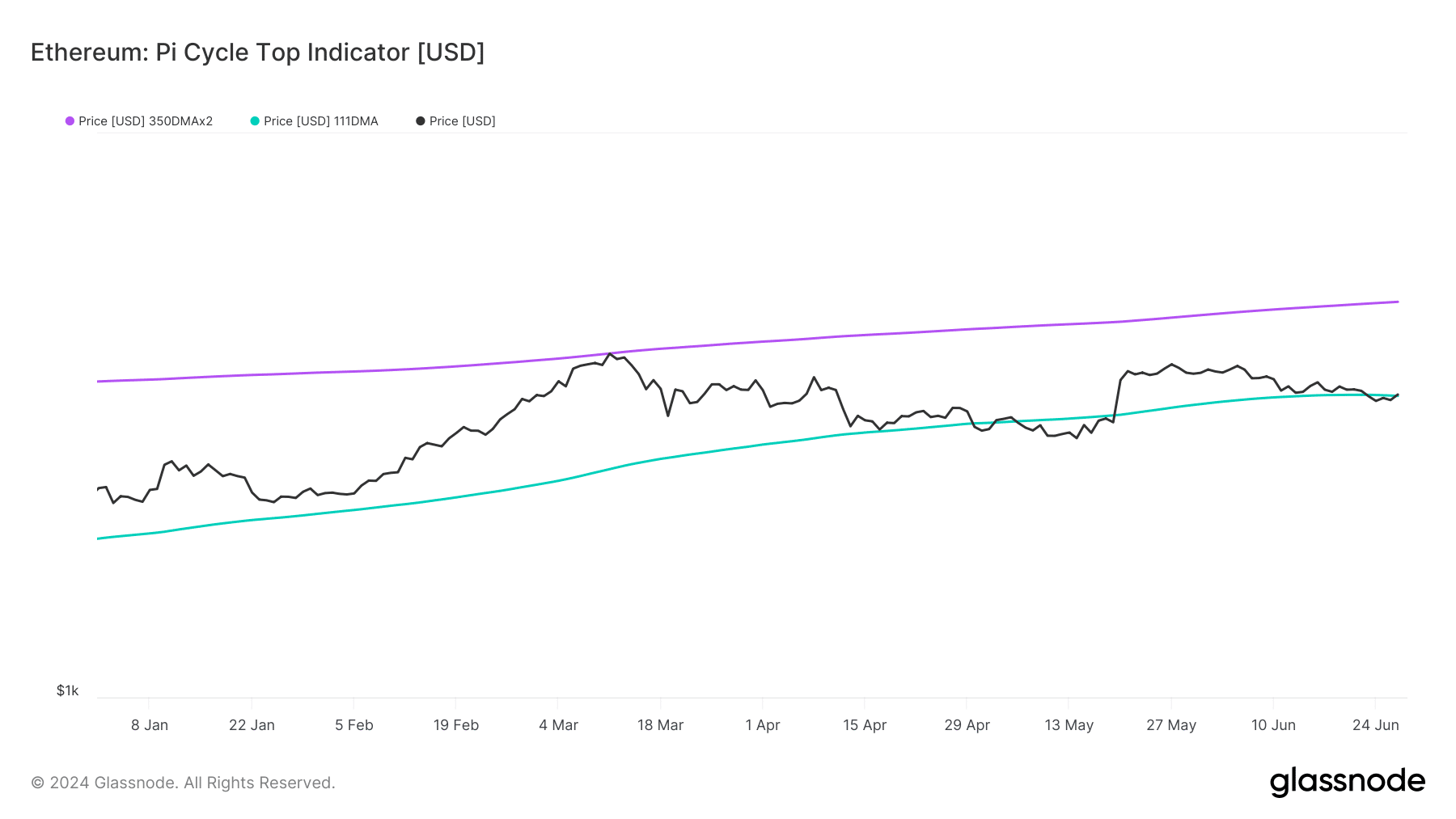

The Pi Cycle Prime indicator revealed that ETH’s worth had hit a market backside, which hinted at a bull rally. If that seems to be true on this event, then ETH may quickly contact $5,000.

Supply: Glassnode

Other than this, Ethereum’s fear and greed index had a price of 32% at press time, that means that the market was in a “worry” section. Each time the metric reaches this degree, it signifies that the possibilities of a worth enhance are excessive.

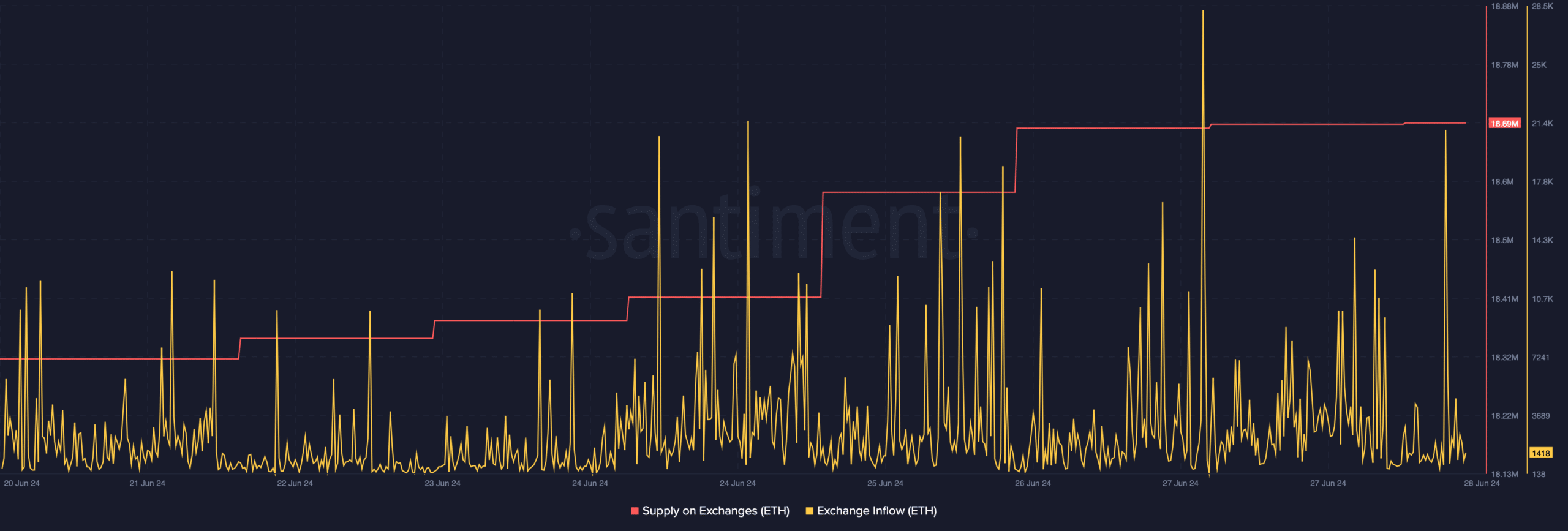

Nonetheless, Santiment’s information revealed that promoting strain on the token was excessive. This appeared to be the case as ETH’s provide on exchanges elevated.

Moreover, its alternate influx additionally spiked, signaling an increase in promoting strain, which could limit ETH’s worth from transferring up.

Supply: Santiment

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

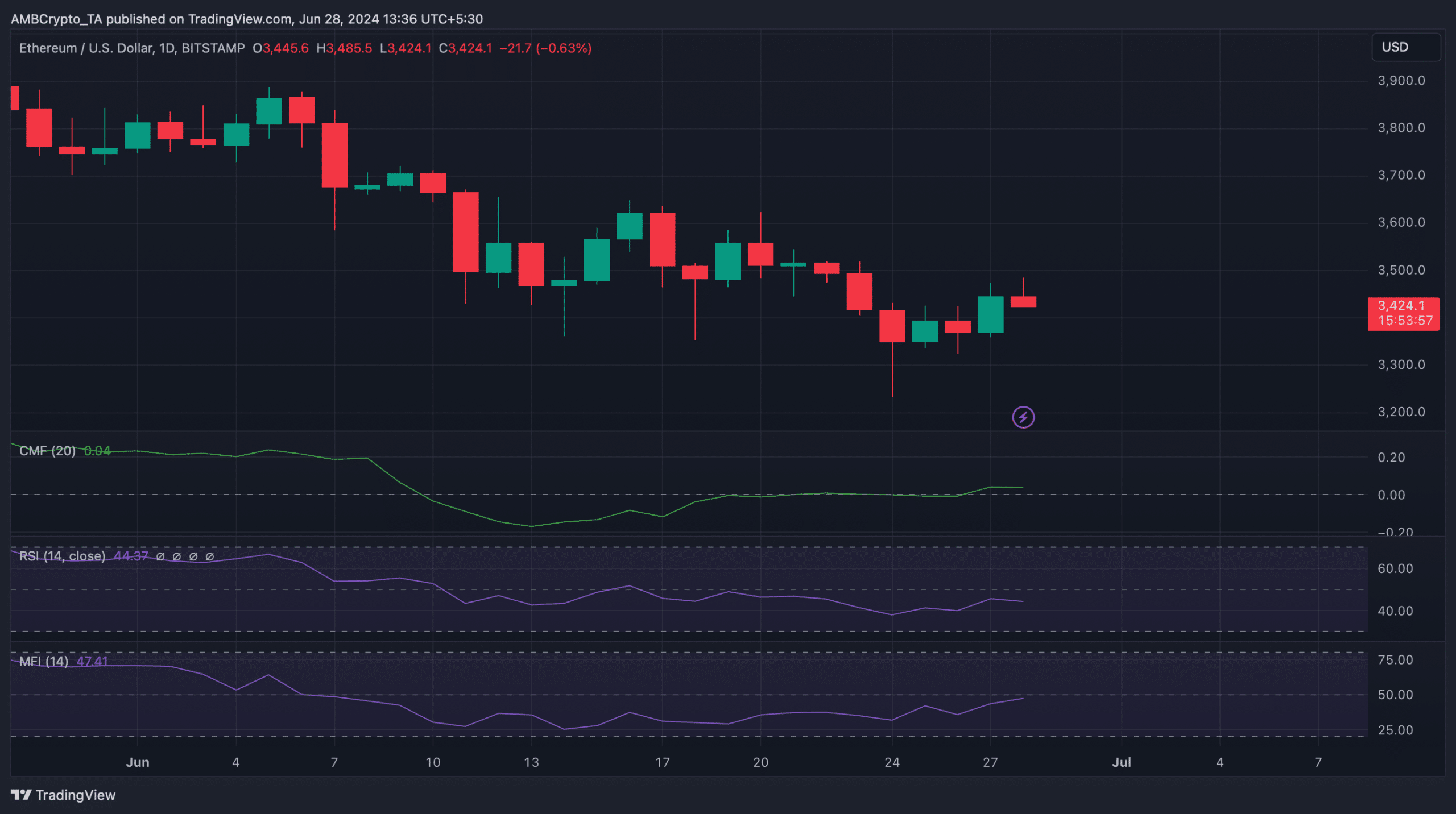

Just like the aforementioned metrics, just a few of the market indicators additionally remained bearish on the token. As an illustration, each Ethereum’s Relative Power Index (RSI) and Chaikin Cash Circulate (CMF) went sideways close to their respective impartial marks.

Nonetheless, the Cash Circulate Index (MFI) seemed bullish because it moved northward, indicating a continued worth rise.

Supply: TradingView