Is there more to the crypto market crash than meets the eye

- Media amplification of the ETF rejection report precipitated the liquidations, not the report itself.

- Analysts famous that the spot Bitcoin ETF approval is inside attain.

The crypto market skilled considered one of its darkest hours on the third of January as the value of Bitcoin [BTC] plunged under $42,000. The collapse occurred so quick amid rumors that every one Bitcoin ETF functions have been denied.

The main points

In a report revealed by Matrixport, the digital-asset agency opined that the functions didn’t meet the specified necessities. It additionally talked about that SEC Chair Gary Gensler’s hesitation to embrace crypto might play an element within the rejection.

Nonetheless, AMBCrypto’s investigation confirmed that Matrixport was not the main purpose for the value response.

This was as a result of the piece was an opinion and Matrixport didn’t have the “clout” to nuke the market. Additionally, there have been posts explaining how the agency’s CEO Jihan Wu didn’t have the credibility for issues associated to the ETFs.

Crypto investor and analyst Scott Melker shared an analogous opinion in his publish on the identical day.

The @realMatrixport report isn’t “faux information” as many are reporting. It’s an analyst giving an opinion. All of us do it every day.

We’re principally mistaken.

It went viral.

They’re allowed their opinion.

They couldn’t know that their analysis report would rock the market.

— The Wolf Of All Streets (@scottmelker) January 3, 2024

Once more, misinformation triggers the market

From AMBCrypto’s findings, the report grew to become faux information as a result of a significant publication amplified it. So, individuals panicked and began taking drastic actions whereas inflicting over $500 million in liquidation.

This incident was similar to the one which occurred in October 2023. On the time, one other main publication posted that BlackRock was given the go-ahead to launch its ETF. Consequently, the Bitcoin value jumped from $27,000 to $30,000 throughout the twinkle of an eye fixed.

Moments later, the publication apologized for “deceptive” the market. The apology then despatched BTC again to $28,000. However in between all that, merchants with open contracts felt the warmth as $85 million was worn out.

Throughout that point, Michael O’Rourke, chief market strategist at JonesTrading said that:

“The faux information concerning the Bitcoin ETF being permitted highlights the problem of defending buyers in an unregulated house that pulls shady operators and rampant hypothesis.”

As an especially unstable market, faux information poses a critical menace to gamers genuinely involved concerning the improvement of the business. Nonetheless, it is usually vital to say that your entire blame shouldn’t be handed to publications pushing out misguided data.

The choice attracts nearer and it could possibly be optimistic

Concerning the newest episode, folks aware of the matter have cleared the air on the event. For example, Fox Enterprise reporter Eleanor Terret, posted that proceedings relating to the Bitcoin ETFs have been approaching the ultimate phases.

The replace supplied on the third of January learn:

“Whereas the ultimate determination has not been made, sources near the proceedings say the SEC might start notifying issuers of approval on Friday with buying and selling starting as early as subsequent week. ETF analysts and issuers alike stay assured {that a} favorable determination from the SEC will likely be made on or earlier than Jan. 10, because the SEC continues to satisfy with key gamers on the matter.”

At press time, the Bitcoin value had recovered, altering arms at $43,129. Ought to the SEC make a optimistic declaration concerning the ETFs by the above date, gamers are optimistic that BTC would climb above $50,000.

A kind of projecting the hike is Christopher Inks.

Inks is a dealer and prides himself as a market psychology knowledgeable. In keeping with him, Bitcoin may break and hit $53, 267 inside a brief interval.

As talked about on the present with @scottmelker this morning, we’re seeing a pleasant rally off this morning’s flush. The H4 candle closed above the hourly pivot. Day by day is trying even higher. Breaking out increased ought to see a goal of ~53267, no less than, on this chart. #Bitcoin $BTC pic.twitter.com/ykocFr3Ueo

— Christopher Inks (Dealer/Market Psychology Coach) (@TXWestCapital) January 3, 2024

On the similar time, the rising experiences weren’t affirmation that the SEC wouldn’t deny the functions.

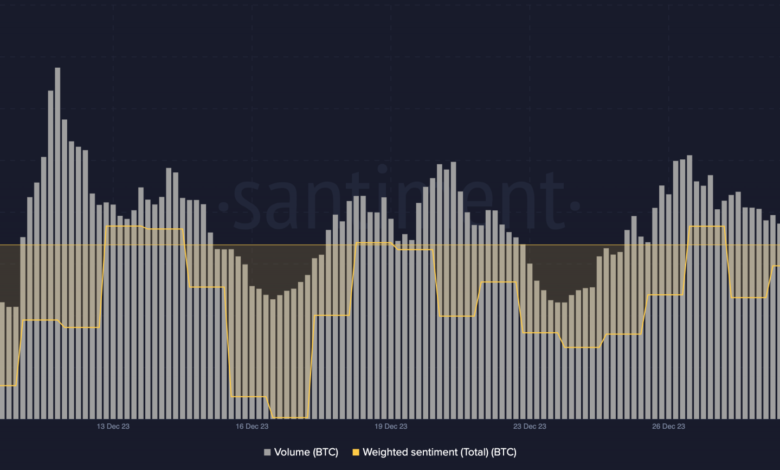

Within the meantime, on-chain information showed that BTC’s buying and selling quantity reached an unbelievable peak. At press time, the amount was $47.38 billion.

The surge in quantity was an indication that the dip was getting stuffed very quick. Like the amount, Bitcoin’s Weighted Sentiment climbed to 2.19.

Supply: Santiment

Weighted Sentiment exhibits the distinctive social quantity or feedback linked to a mission. So, the optimistic studying means that the broader market has its eyes set on a possible ETF approval over the following few days.

Who will get flushed ultimately?

The metrics implied that gamers have moved on from the faux information, and at the moment are standing their floor based mostly on private sentiment. Nonetheless, each longs and shorts threat liquidation as proven by the Liquidation Heatmap.

The Liquidation Heatmap predicts the value ranges the place large-scale liquidation occasions might happen. In keeping with AMBCrypto’s evaluation of the HyblockCapital indicator, shorts with targets between $40,750 and $41.,250 could possibly be liquidated.

Additionally, these with open positions believing that Bitcoin would drop to $36,000 could possibly be affected by a flush. For longs, there was a cluster of liquidity round $47,100. So, merchants might must be cautious round that degree.

Supply: HyblockCapital

In conclusion, latest occasions have proven that cryptocurrencies are nonetheless susceptible to inaccurate data.

Regardless of Jihan Wu’s clarification that its evaluation was not meant to break down costs, crypto media must shoulder the duty of not partaking on this intentional or unintentional misrepresentation.

Learn Bitcoin’s Worth Prediction 2023-2024

Nonetheless, it’s unlikely that the tremor of the third of January would affect the SEC’s determination per the spot Bitcoin ETFs.

Although the pathway appears like a promising one for approval, it is very important wait until the regulator itself confirms its stance.