Key Levels to Watch Amid Whale Surge

- Ethereum’s bullish construction hinges on holding the crucial help stage at $1,721.40.

- Massive traders shift to Ethereum ETFs, boosting transaction volumes and market curiosity.

Ethereum [ETH] has skilled a value decline of three.60% over the previous seven days, underperforming the worldwide crypto market, which noticed a modest improve of 0.70%.

At press time, Ethereum traded at $3,316.71, with a 24-hour buying and selling quantity of $13,185,794,355. This marks a 0.73% decline within the final 24 hours.

Ethereum: Key help and resistance ranges

Ethereum’s major help zone is round $1,721.40, aligning with the 0.618 Fibonacci retracement stage. This help stage is crucial for sustaining the bullish construction of the market.

On the upside, the important thing resistance stage to observe is at $3,600.00. A break above this resistance might pave the way in which for ETH to focus on its all-time excessive of $4,867.81, suggesting a big potential for positive aspects.

The latest value motion noticed Ethereum retesting the weekly Honest Worth Hole (FVG) extending from $2,896.74 to $3,036.62, adopted by a 20.42% rally.

Nonetheless, the worth confronted rejection on the weekly resistance stage of $3,545.90 and traded barely down by 7.62% to $3,086.13. The FVG coincides with the 50% Fibonacci retracement, forming a strong help zone.

If this stage holds, there’s potential for a 57.87% rally to retest the all-time excessive.

Supply: TradingView

At press time, the Relative Power Index (RSI) on the weekly chart is buying and selling above its impartial stage of fifty, indicating a bullish momentum. Moreover, the Superior Oscillator (AO) is above zero, signaling sturdy market sentiment.

These indicators counsel a continuation of the bullish pattern if Ethereum maintains its present ranges and doesn’t break beneath the important thing help zones.

Whale exercise and ETF affect

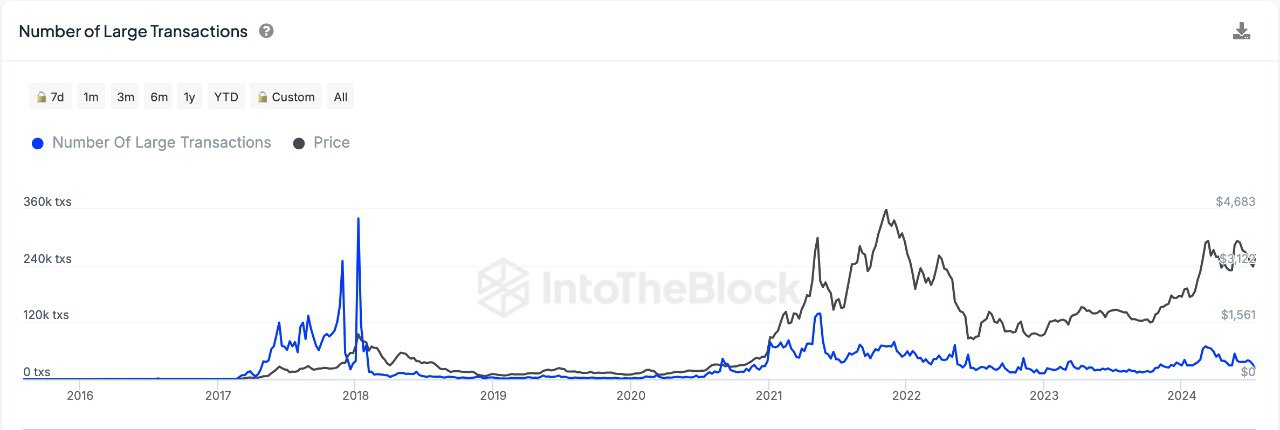

Ethereum is witnessing a surge in giant transaction volumes, indicative of elevated whale exercise. This pattern is probably going linked to the launch of ETH ETFs.

Massive traders seem like buying and selling Ethereum actively, presumably shifting their publicity from direct blockchain transactions to ETFs.

Supply: IntoTheBlock

This motion suggests a desire for the regulated and doubtlessly extra accessible funding car supplied by ETFs.

In keeping with DefiLlama, the entire worth locked (TVL) in Ethereum is $59.414 billion, reflecting the general exercise and worth throughout the Ethereum ecosystem. The market capitalization of stablecoins on Ethereum stands at $78.742 billion.

Learn Ethereum (ETH) Worth Prediction 2024-25

Up to now 24 hours, ETH generated $3.61 million in charges and $2.29 million in income.

Furthermore, lively addresses throughout the final 24 hours totaled 368,579, indicating substantial person engagement.