MakerDAO: DAI supply hits new lows whereas MKR stands…

- DAI provide fell to its lowest this yr.

- MKR’s MVRV ratio confirmed that the majority holders had been in revenue at press time.

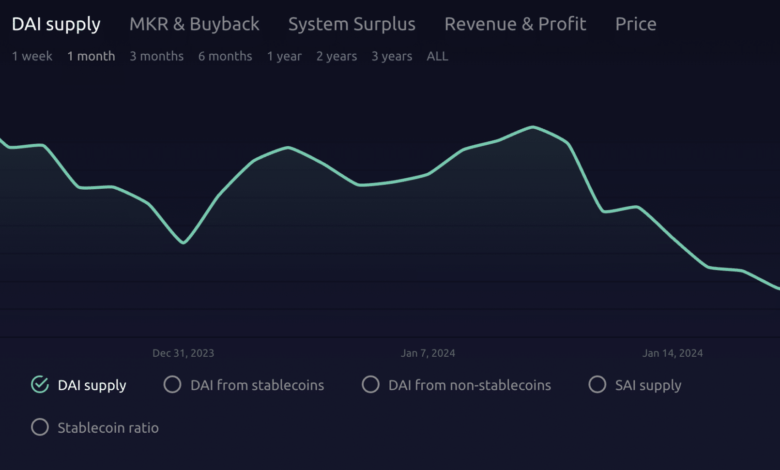

The full provide of MakerDAO’s [MKR] decentralized stablecoin, DAI, has fallen to its lowest degree because the yr started, in keeping with information from MakerBurn.

AMBCrypto reported earlier that the stablecoin’s provide rebounded within the first two weeks of the yr after hitting a four-month low on the thirty first of December 2023.

Nevertheless, as a result of fall within the costs of a few of DAI’s underlying belongings, its provide has declined steadily because the eleventh of January.

Supply: MakerBurn

The decline in DAI’s provide is as a result of protocol’s Collateralized Debt Place (CDP) mannequin. The CDP system acts like a self-regulating market. When the costs of belongings backing DAI drop, the rate of interest for borrowing robotically rises.

Due to this fact, borrowing turns into dearer as new debtors keep away from taking out loans, and current debtors repay their loans to keep away from excessive charges, discouraging new DAI creation.

Assessing Maker’s consumer exercise

To date this yr, the rely of lively month-to-month customers on MakerDAO has totaled 2000, in keeping with information from Token Terminal.

Though this stands at a 40% decline from the 2800 lively customers recorded in December, the transaction charges recorded from these customers have surpassed the full recorded in December.

Information from Token a Terminal confirmed that previously 20 days, transaction charges on MakerDAO have totaled $16.5 million, marking a 9% uptick from the $15.1 million registered throughout December.

AMBCrypto discovered that MakerDAO’s charges and the income generated from the identical have risen steadily within the final yr. Within the final twelve months, these have every grown by 35%. Within the final six months, they’ve risen by over 400%.

Lifelike or not, right here’s MKR’s market cap in BTC’s phrases

MKR holders are all smiles

At press time, MakerDAO’s native token MKR traded at $1,990. Whereas the values of many crypto belongings have both declined or trended inside a slender vary within the final month, MKR’s worth has elevated by 53%, in keeping with information from CoinMarketCap.

Supply: CoinMarketCap

As a result of value surge, MKR transactions have been predominantly worthwhile within the final month. An evaluation of the token’s ratio of day by day transaction quantity in revenue to loss returned a worth of two.21. This meant that for each MKR transaction that resulted in a loss, 2.21 transactions noticed revenue.

Supply: Santiment

Likewise, a Market Worth to Realized Worth (MVRV) ratio of 40.94% at press time meant that the token’s market worth was 40.94% greater than the typical value at which holders had acquired the asset. Therefore, they held at a revenue.