Bitcoin moves past $28k, is BTC ready to go on a bullish spree?

- BTC breached the $ 27,900 mark, which led to the anticipation of huge positive aspects.

- Quick-term holders could also be again in revenue.

Bitcoin [BTC] might be in for a bullish pivot within the close to time period if the predictions of well-known on-chain sleuth Ali Martinez had been to be trusted.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Is Bitcoin prepared for a bull market?

The king coin rose to just about $30,000 earlier this week after an unverified declare by a preferred information platform went viral. Though it retreated from the highs, Bitcoin consolidated within the $28,000 zone and hasn’t slipped beneath, per knowledge from CoinMarketCap.

Nonetheless, of explicit curiosity had been the degrees that Bitcoin breached within the dramatic episode. As per an X submit dated 18 October, Martinez highlighted that the world’s largest cryptocurrency broke by way of the “essential psychological benchmark” of $27,900.

He went on to state that if BTC manages to remain above this stage, bullish market forces would get emboldened.

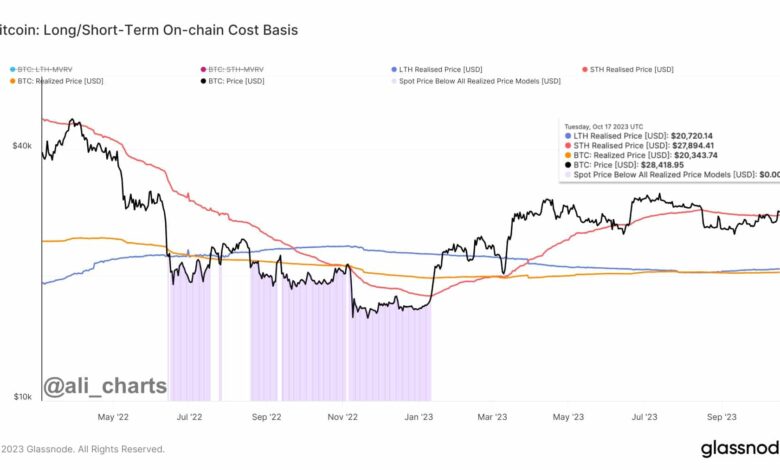

Supply: @ali_charts/Glassnode

Significance of the extent

The important value level highlighted was the short-term holder value foundation or the Quick-term Holder Realized Value (STH RP). The STH RP calculates the typical value at which Bitcoin was bought by buyers who held their holdings for lower than 155 days.

It has traditionally served as a dependable help stage throughout sturdy uptrends. It is because earlier breaches of this stage injected appreciable bullish energy into Bitcoin.

The STH RP, due to this fact, has been a barometer of market sentiment. A chance of beforehand underwater short-term holders tasting revenue implied a decisive shift towards a bull market.

As of this writing, nearly 12% of Bitcoin’s whole circulating provide was within the arms of short-term holders. Nonetheless, since these gamers are the primary to answer market volatility, their habits exerts an even bigger impression on Bitcoin’s value actions. Lengthy-term holders (LTH) however keep unmoved throughout intermittent bouts of rallies and crashes.

Supply: Glassnode

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The market sentiment was within the stability, as per the most recent replace from the Concern and Greed Index. With bears and bulls locked in an in depth tussle, key value factors as mentioned above could possibly be the important thing to speculating on Bitcoin’s subsequent strikes.

Bitcoin Concern and Greed Index is 52. Impartial

Present value: $28,492 pic.twitter.com/EJdXHexJYg— Bitcoin Concern and Greed Index (@BitcoinFear) October 19, 2023