Miners may shape Bitcoin’s fate – But first, ETF outflows need to stop

- Bitcoin miners ramp up exercise as MARA Digital mines 950 BTC in Might with out promoting.

- As BTC sees over $1.2B in outflows, elevated miner inflows may assist stabilize costs amid ETF-driven exits.

Bitcoin mining big MARA Digital Holdings reported a strong Might, including 950 BTC to its reserves. It is a 35% larger April mining outcome and emphasizes the corporate’s rising hash energy and effectivity.

MARA had a mixed complete of 49,179 BTC on the finish of Might, and bought none of its Bitcoin holdings through the month.

This regular accumulation mirrors MARA’s confidence in BTC long-term, as market volatility continues to weigh on investor sentiment.

The high-profile miner not offering promote stress is an important sentiment in at this time’s market circumstances.

Larger miner inflows versus ETF outflows

Whereas miners like MARA are stockpiling BTC of their reserves, the rest of the market is witnessing an infinite outflow of capital from Bitcoin ETFs.

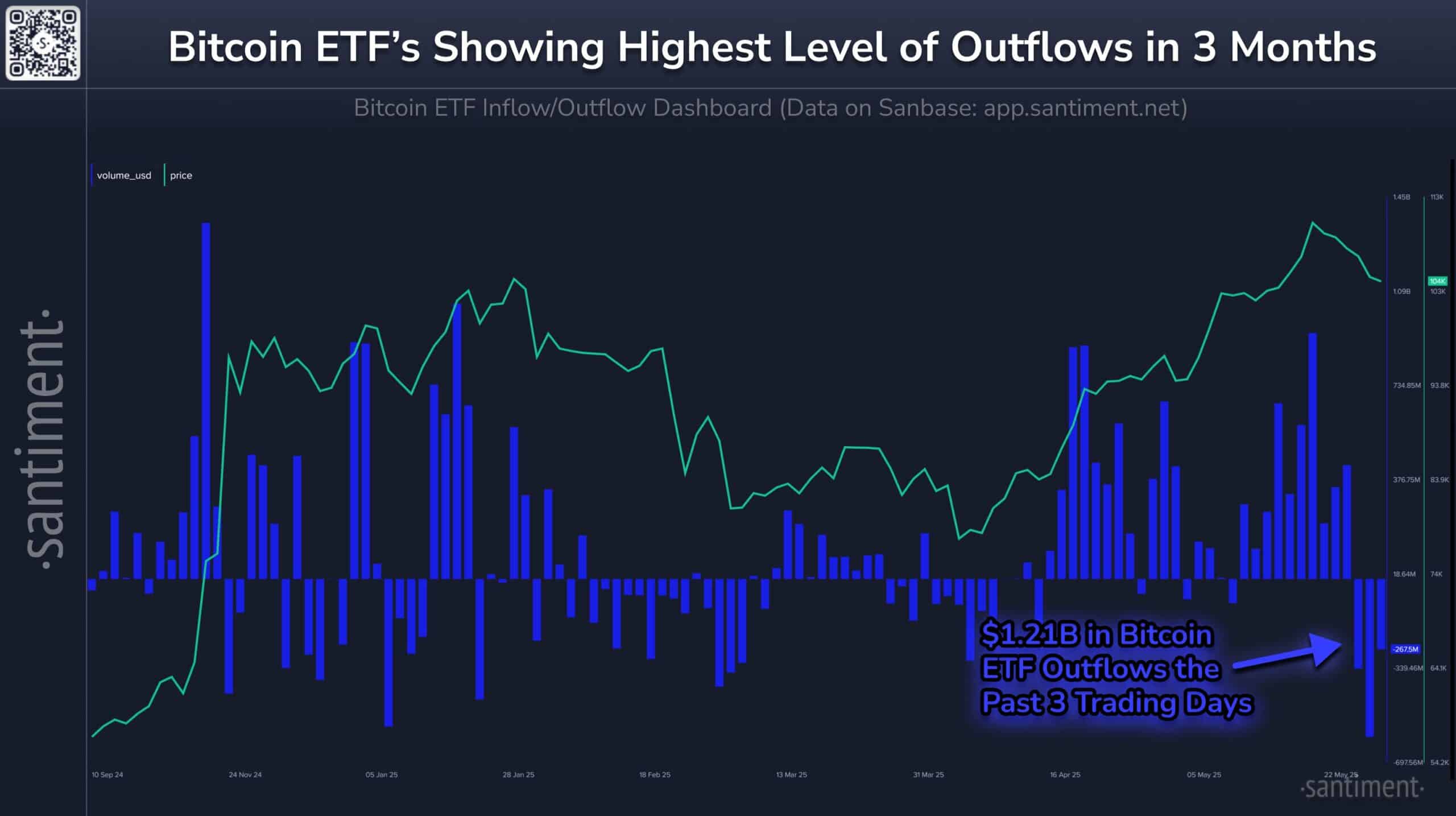

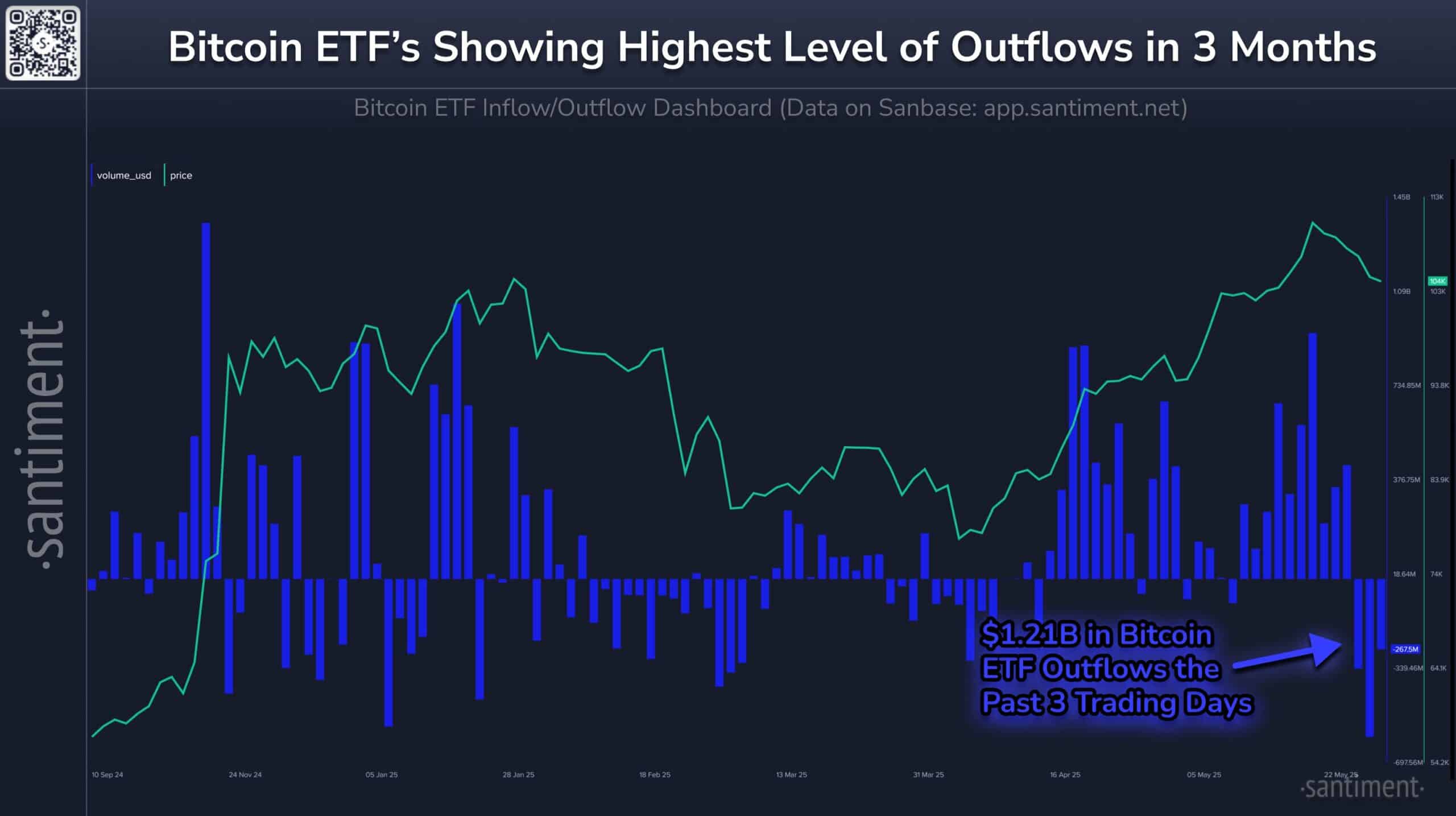

In accordance with Santiment, Bitcoin ETFs saw $1.21 billion in web outflows over simply three buying and selling days, marking the sharpest drawdown in three months.

The divergent theme—miners hoarding whereas ETFs offloading—can turn into a principal balancing affect for the market.

Offered that ETF outflows proceed to happen, on-chain miner exercise may more and more play a vital function in stabilizing costs sooner or later.

In different phrases, we’re watching a uncommon tug-of-war play out: institutional redemptions on one facet, miner self-discipline on the opposite.

Supply: Santiment

Can miners resist Bitcoin ETF stress?

The miner inflows surge may supply short-term respite as Bitcoin makes an attempt to regain its bullish momentum.

Traditionally, surges in Miner Influx coupled with reserve accumulation have front-run native bottoms or stabilization durations.

It doesn’t imply a rally is assured—however it does tilt the steadiness towards resilience.

The larger query is whether or not this miner assist can stand up to continued ETF capital flight. If outflows intensify, even robust miners could wrestle to carry the road.

Supply: CryptoQuant

Miner sentiment might be an necessary gauge

With Bitcoin close to main assist ranges, the approaching weeks will hinge upon the steadiness between Miner Reserves and ETF flows.

MARA’s Might stories add a bullish hope to in any other case anxious floor.

Whereas the market waits for a directional breakout, miner inflows could show to be a quiet stabilizer.

Whether or not miner influx is sufficient to offset ETF outflows is anybody’s guess—however for now, it gives a bullish undertone to the near-term outlook for Bitcoin.