Negative Nirvana? Decoding The First Bitcoin Funding Rate Dip Of 2024

The current Bitcoin halving occasion, which minimize the block reward for miners in half on April 20, 2024, has sparked a wave of optimism within the cryptocurrency market. Whereas a short dip in a key futures metric hinted at potential short-term bearishness, general market indicators counsel a bullish development taking maintain.

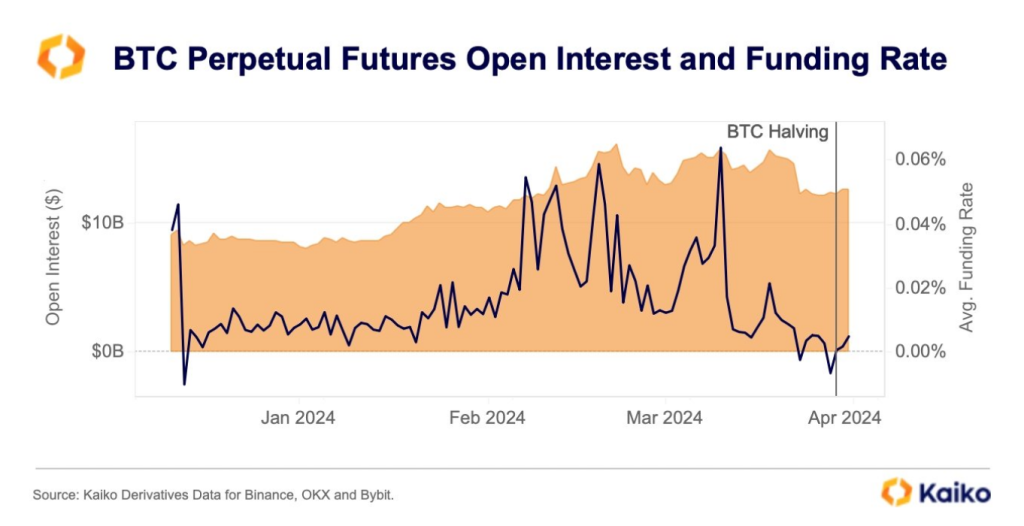

Analysts at Kaiko, a market information supplier specializing in crypto derivatives and futures, reported a shift in Bitcoin’s funding fee main as much as the halving. The funding fee is a payment paid between lengthy and quick place holders in futures contracts.

A unfavorable fee signifies that quick positions are compensating lengthy positions, probably indicating a bearish outlook. Notably, Bitcoin’s funding fee dipped into unfavorable territory for the primary time this 12 months on April 18th, simply two days earlier than the halving.

Bitcoin Bounces Again With Renewed Bullishness

Nevertheless, this short-lived bearishness appears to have been overshadowed by a broader sense of optimism. Following the halving, Bitcoin’s funding fee swiftly recovered and presently sits at a constructive 0.0051. This implies a return to the established order the place lengthy positions are incentivized, reflecting a extra bullish market sentiment.

Funding charges for $BTC perps turned unfavorable for the primary time since late 2023 within the lead as much as the halving. pic.twitter.com/MjiU4C1L5m

— Kaiko (@KaikoData) April 24, 2024

Additional bolstering this constructive outlook is the uptick in Bitcoin’s Open Curiosity (OI), a metric that represents the full quantity of excellent futures contracts. Regardless of a dip final week, OI has since rebounded to over $17 billion, indicating continued investor engagement within the Bitcoin market.

Bitcoin is now buying and selling at 64.250. Chart: TradingView

Halving Affect Exceeds Historic Traits

Maybe essentially the most intriguing discovering from Kaiko’s evaluation is the suggestion that this halving occasion is perhaps having a extra constructive influence on Bitcoin’s worth in comparison with earlier halvings.

On the time of the report, Bitcoin was up 2.8% for the reason that halving, exceeding the worth will increase noticed instantly after the 2012, 2016, and 2020 halving occasions. Regardless of a slight worth correction within the following days, Bitcoin stays almost 3% up for the reason that halving.

Nevertheless, analysts warning towards drawing definitive conclusions from this preliminary information. The cryptocurrency market is inherently risky, and short-term fluctuations are to be anticipated.

Some specialists level to historic developments the place worth will increase following a halving occasion had been usually adopted by intervals of consolidation or correction. The true influence of the halving on Bitcoin’s long-term worth trajectory may not be totally evident for a number of months.

Bullish Sentiment Fueled By Macroeconomic Elements

Past technical indicators, some analysts imagine that broader macroeconomic elements are additionally contributing to the present bullish sentiment surrounding Bitcoin.

The continuing international inflationary pressures and geopolitical uncertainties have pushed buyers in direction of belongings perceived as hedges towards inflation. Bitcoin, with its finite provide because of the halving mechanism, matches this profile for some buyers.

Moreover, the rising institutional adoption of cryptocurrency is seen as a constructive signal for Bitcoin’s long-term prospects. Main monetary establishments are actively exploring methods to supply Bitcoin publicity to their shoppers, suggesting a rising degree of confidence within the asset class.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual danger.