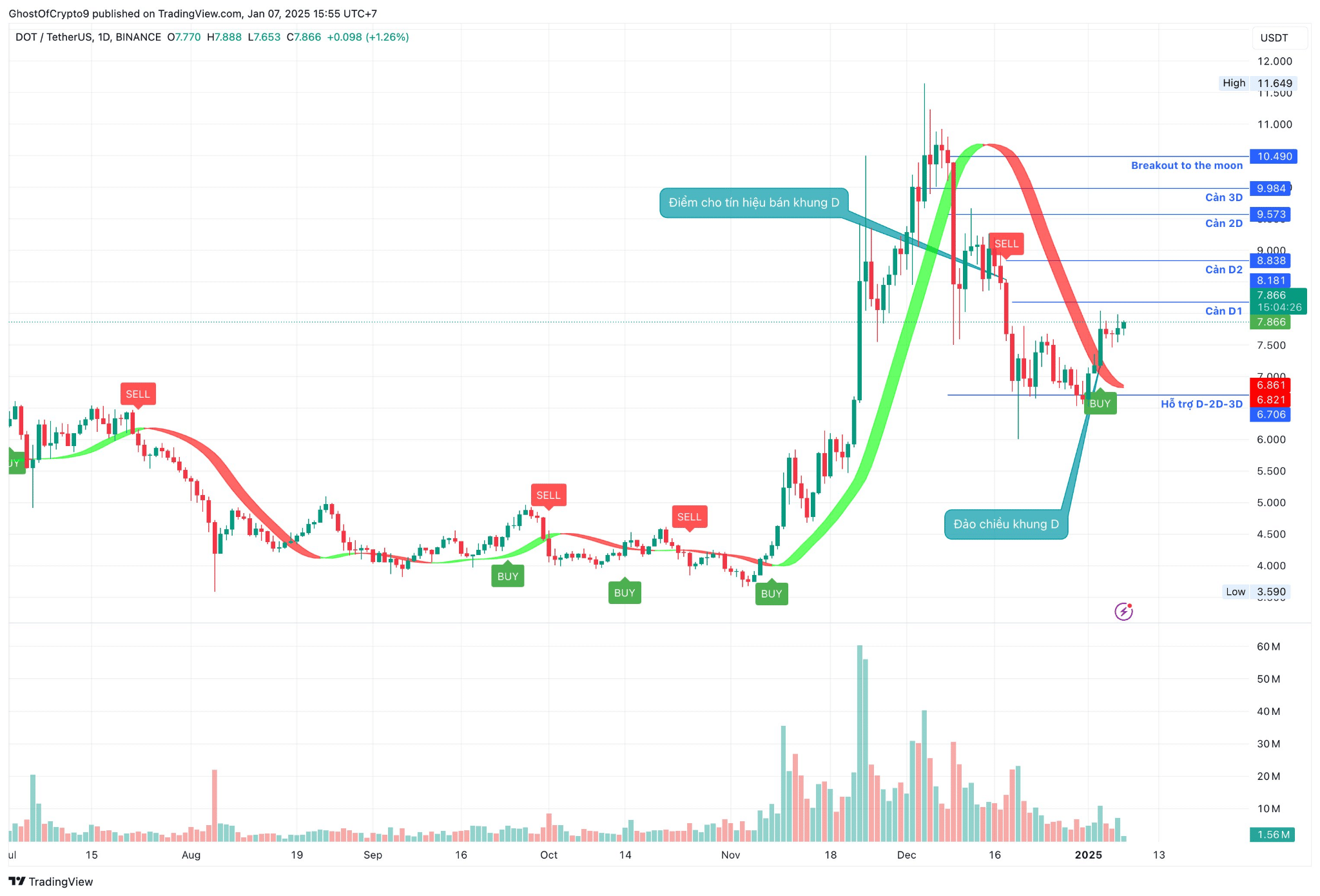

Polkadot’s $10 roadmap: Traders watch out for THESE levels

- A big breakout led to a peak, adopted by a correction, with assist recognized at $6.861.

- The RSI hovered round 50, indicating a steadiness between shopping for and promoting forces.

Polkadot [DOT] has proven dynamic value actions, attracting dealer curiosity with key resistance, assist ranges, and on-chain metrics.

DOT has exhibited notable value actions, with key resistance ranges at $8.181, $9.573, and $10.490.

Supply: TradingView

A big breakout led to a peak, adopted by a correction, with assist recognized at $6.861.

Quantity spikes throughout the uptrend indicated robust shopping for curiosity, whereas consolidation close to $7.866 advised a possible restoration.

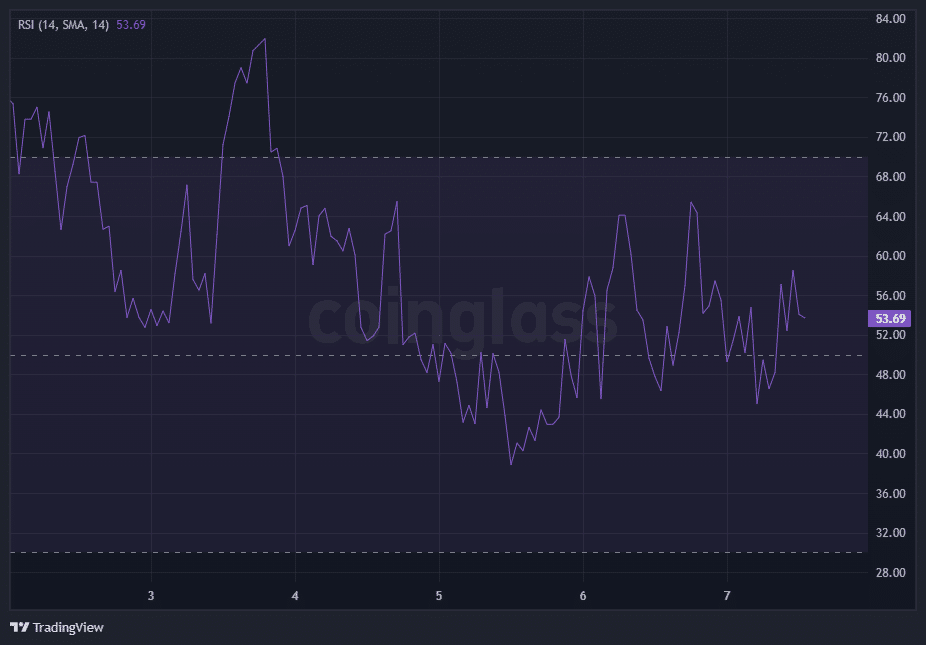

Assessing Polkadot’s momentum utilizing RSI

Historically, an RSI above 70 signifies overbought circumstances, suggesting a possible value reversal or pullback, whereas an RSI beneath 30 signifies oversold circumstances, implying a potential value improve.

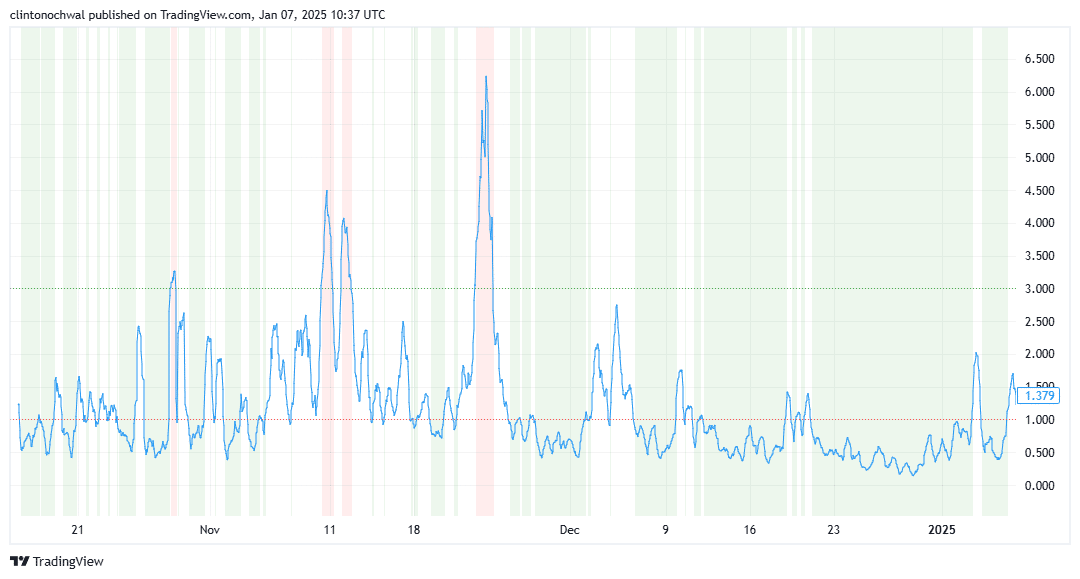

Supply: CoinGlass

In Polkadot’s latest chart, the RSI approached overbought territory throughout the uptrend, signaling robust bullish momentum. As the value peaked and corrected, the RSI declined in direction of impartial ranges, reflecting the easing of shopping for stress.

On the time of writing, the RSI hovered round 50, indicating a steadiness between shopping for and promoting forces. If the RSI strikes above 70 once more, it might counsel renewed bullish momentum, doubtlessly resulting in a retest of resistance ranges.

Conversely, a drop beneath 30 would possibly point out elevated promoting stress and a potential decline in direction of assist ranges.

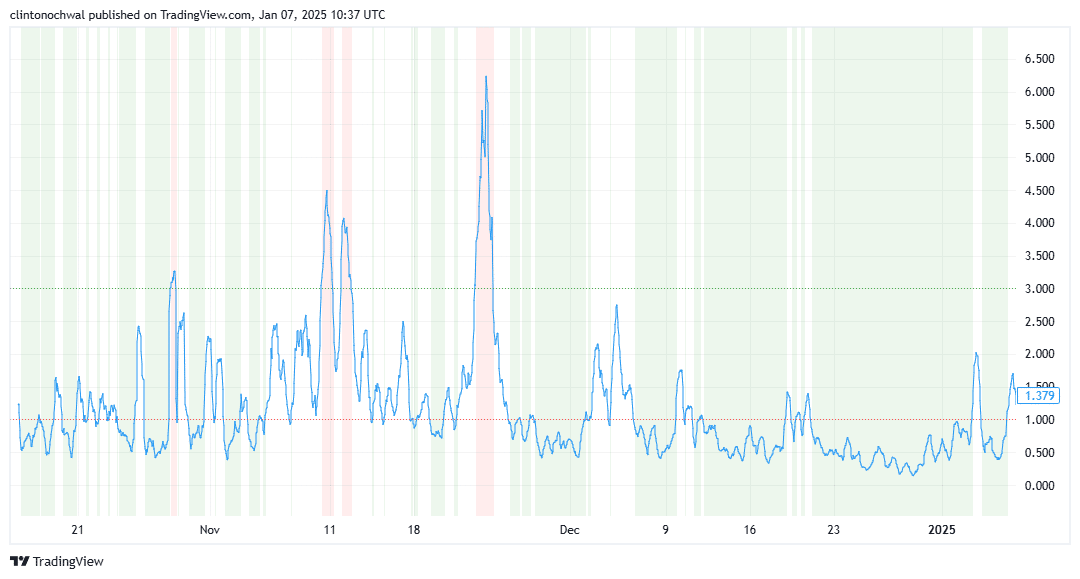

DOT’s MVRV Ratio: Is it overvalued or undervalued?

An MVRV Ratio above one indicated that the market worth exceeds the realized worth, suggesting potential overvaluation, whereas a ratio beneath one implies undervaluation.

Supply: TradingView

For Polkadot, the MVRV ratio rose above 1 throughout the latest uptrend, indicating that the market worth was increased than the realized worth, which is typical in bullish phases.

As the value corrected, the MVRV ratio declined in direction of 1, reflecting a transfer in direction of a extra impartial valuation. Presently, the MVRV ratio is barely above 1, suggesting that Polkadot is modestly overvalued.

Learn Polkadot [DOT] Value Prediction 2024-2025

A big improve within the MVRV ratio might point out heightened bullish sentiment and potential value appreciation, whereas a decline beneath 1 would possibly sign bearish developments and additional value corrections.

Polkadot’s latest value actions have been characterised by vital fluctuations, with key resistance and assist ranges taking part in essential roles.

The RSI and MVRV ratios present invaluable insights into the asset’s momentum and valuation, respectively.