Ripple [XRP]: As bearish signals pile, will $2.05 hold? – Levels to watch are…

- If XRP can break above $3, it is going to invalidate the present head-and-shoulders sample, probably flipping the outlook bullish.

- XRP’s flip to bullish is hindered as stablecoin reserves throughout exchanges elevated, signaling profit-taking available in the market.

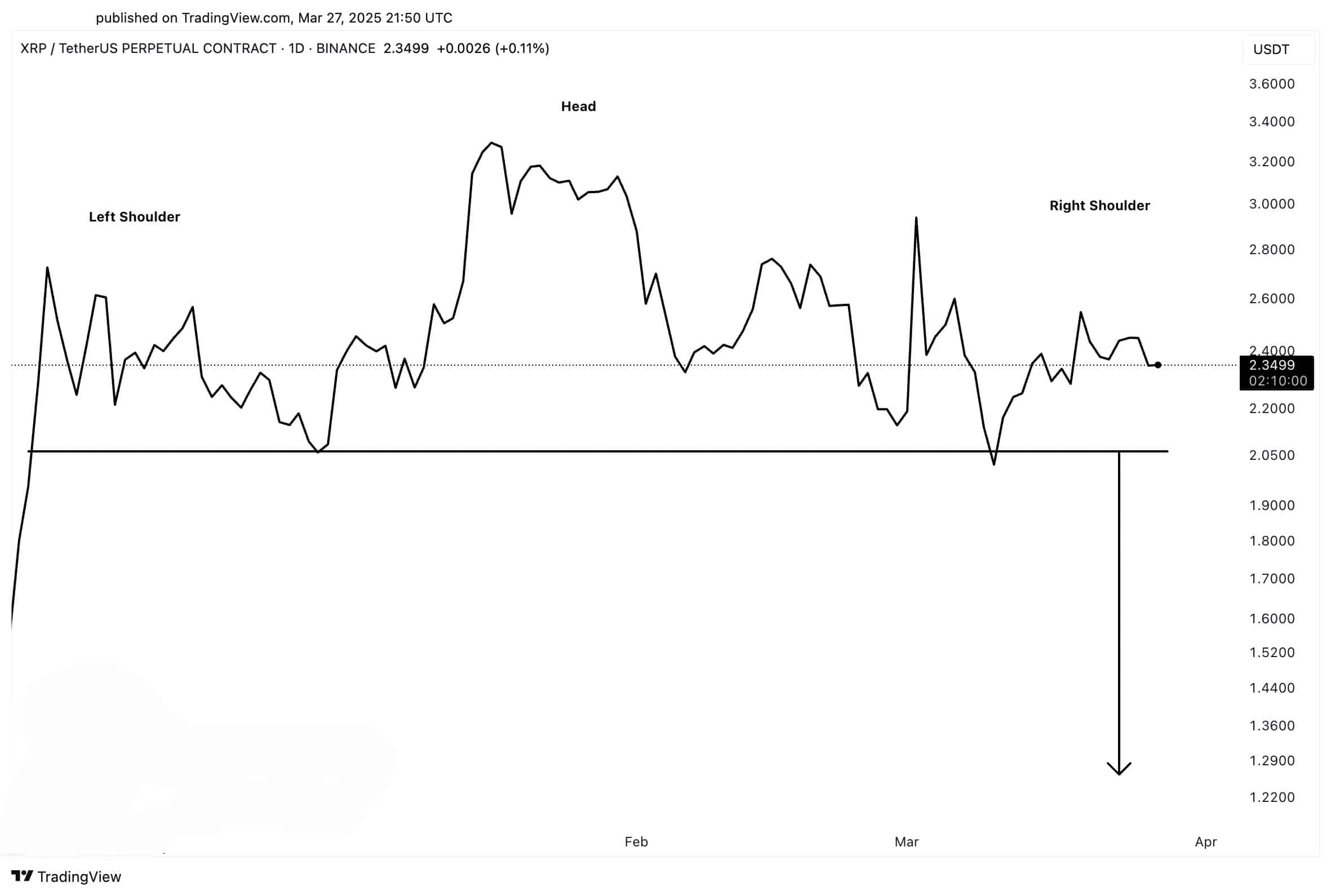

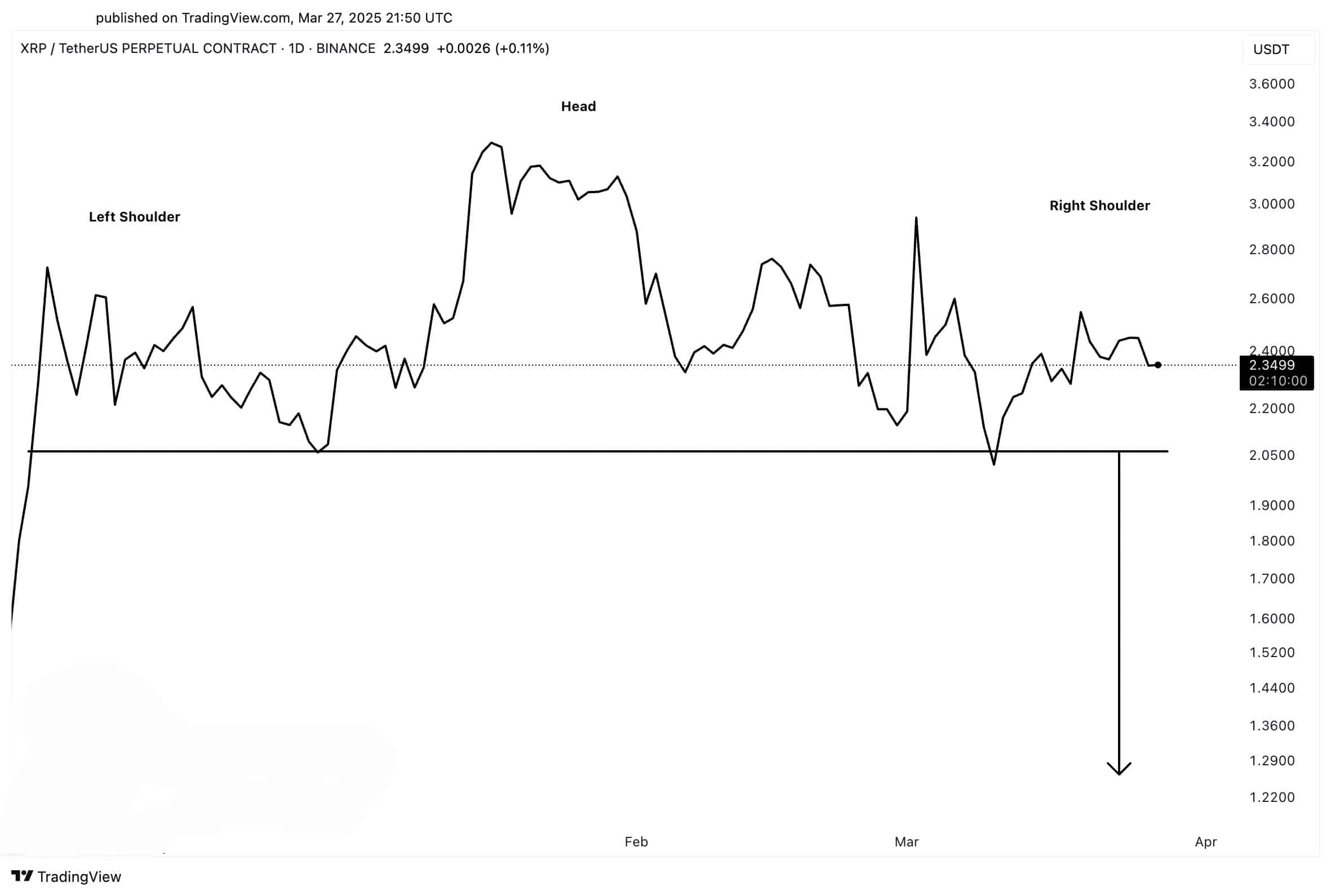

Ripple[XRP] developed a standard bearish sample, head-and-shoulders signaling of an oncoming bearish pattern that had its principal help level at $2.05.

A confirmed breakdown below this part may induce quick depreciation to push XRP costs towards the $1.30-$1.20 area, which matched a earlier turning level.

XRP sustaining above $2.05 might delay the bearish breakdown, as temporary upward actions could happen between $2.40-$2.60 earlier than the worth continues its descent.

Supply: TradingView

A value transfer above $3 would cancel out the validity of the head-and-shoulders construction, thus altering the overall market sentiment to bullish. XRP value may take a look at this level as resistance at $3.40 and $3.60 earlier than it shows elevated upward motion potential.

The upcoming buying and selling classes may show important as a result of steady bulk shopping for is required to each cancel the bearish sample and validate exceeding vital resistance ranges.

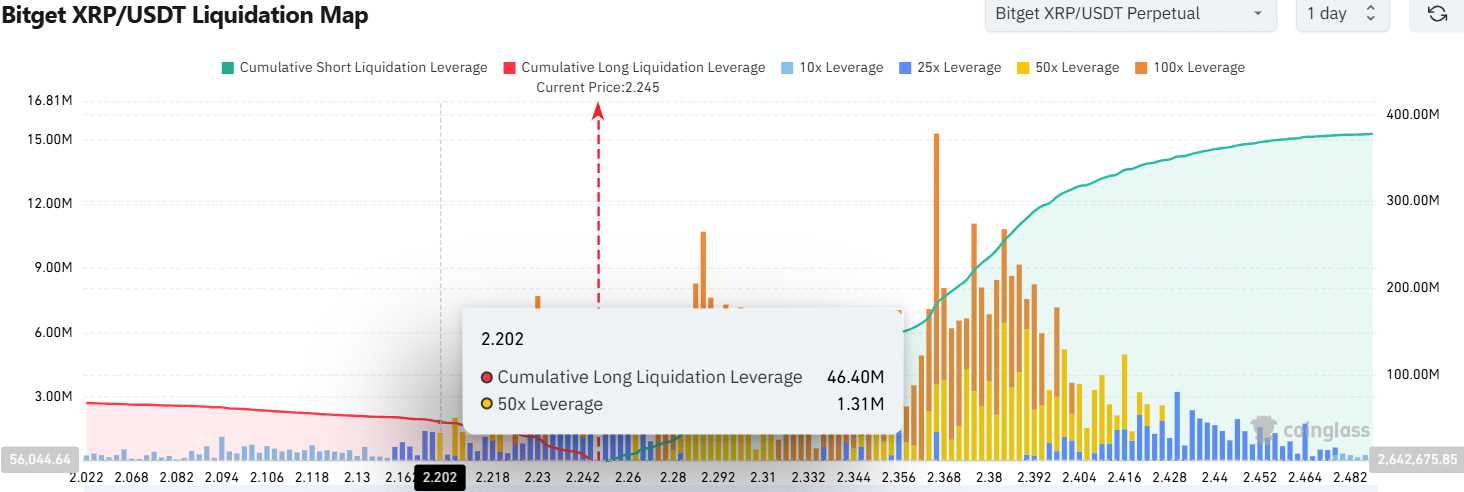

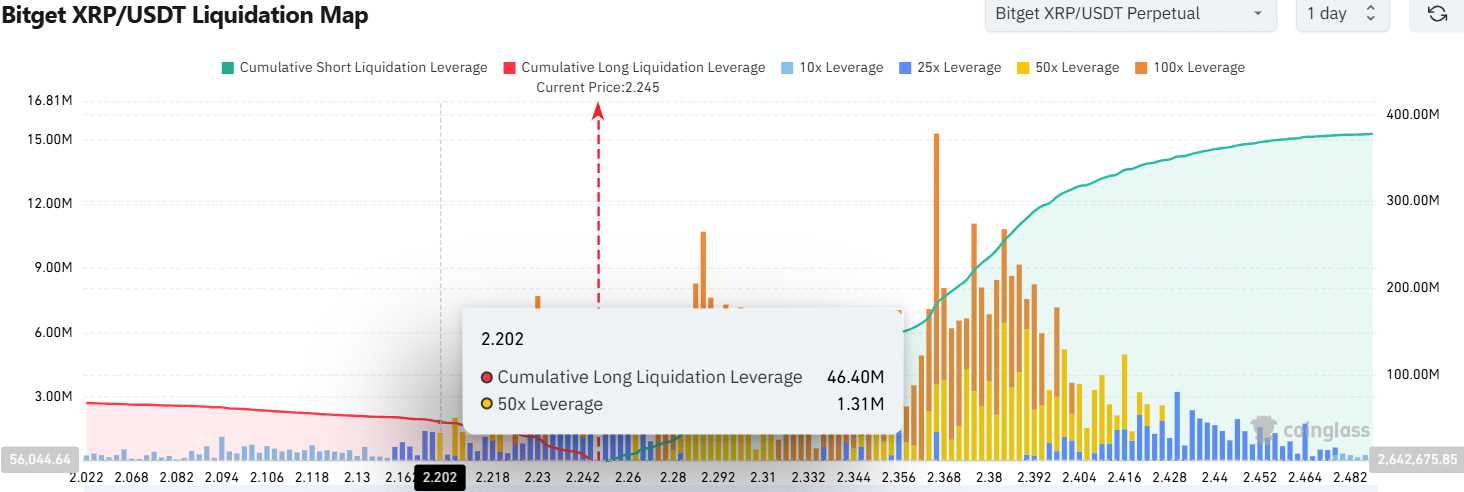

Lengthy liquidations and profit-taking surge

The bearish sample is supported by the rise in cumulative lengthy liquidation leverage worth to $46.4 million on the $2.20 zone.

The variety of compelled liquidations amongst lengthy merchants may attain this excessive level, reinforcing the rising promote strain available in the market.

On the identical time, leveraged quick positions saved rising, demonstrating mounting destructive sentiment and thereby rising the chance of a continued downtrend.

XRP at $2.245 struggled to interrupt help, which may set off liquidations and push the worth to $2.10 or decrease.

As soon as XRP hits the $2.20 liquidity zone, liquidations may aggressively wipe out leveraged merchants, accelerating the worth decline.

Supply: Coinglass

Additionally, Stablecoin reserves on all exchanges reached $32.8 billion in 24 hours, as of press time. This indicated a number of market individuals had been promoting their holdings for income, as Ali noted on X (previously Twitter).

Sturdy promoting strain grew to become extra possible due to diminishing bullish indicators. The rising reserve holdings of stablecoins may set off XRP costs to interrupt by way of its help at $2.05.

A failure to defend the help stage would result in the worth dropping between $1.30 and $1.20.

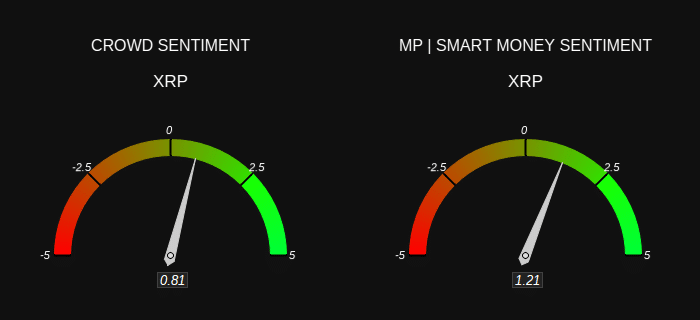

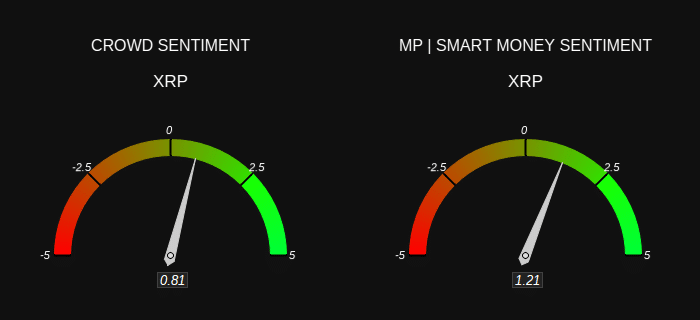

Can sentiment flip XRP’s bearish alerts?

The bearish sentiment towards XRP due to its head-and-shoulders sample worsened as a result of liquidity flowing out of the market. Nonetheless, sentiment for XRP pointed towards bullishness. The group sentiment reached a worth of 0.81 whereas good cash sentiment stood at 1.21.

Knowledge confirmed that retail and institutional merchants had a desire for ascending value motion throughout this time. Nonetheless, these may not be adequate to change the bear circumstances.

It is because good cash steadily makes use of manipulation to lure traders forward of serious value drops.

Supply: CryptoQuant

XRP failing to interrupt resistance could set off a liquidity sweep, pushing costs down till skilled merchants exit earlier than market enlargement begins.

Market sentiment confirmed optimism, though further value drops remained possible due to liquidation dangers.