SEI market watch: Long-to-short ratios indicate bullish sentiment, but…

- The value has examined the underside of its ascending channel, a possible indicator of an upward transfer.

- Nevertheless liquidity motion inside SEI’s blockchain and to exchanges, tells a decline could possibly be close to.

Sei [SEI] has seen a gentle decline from a significant resistance zone, resulting in a 9.48% drop over the previous month. Within the final 24 hours, the asset has fallen additional, shedding 5.95%.

Market developments stay inconclusive, leaving merchants to weigh key technical ranges and metrics for clearer path which AMBCrypto has recognized.

An upward path emerges

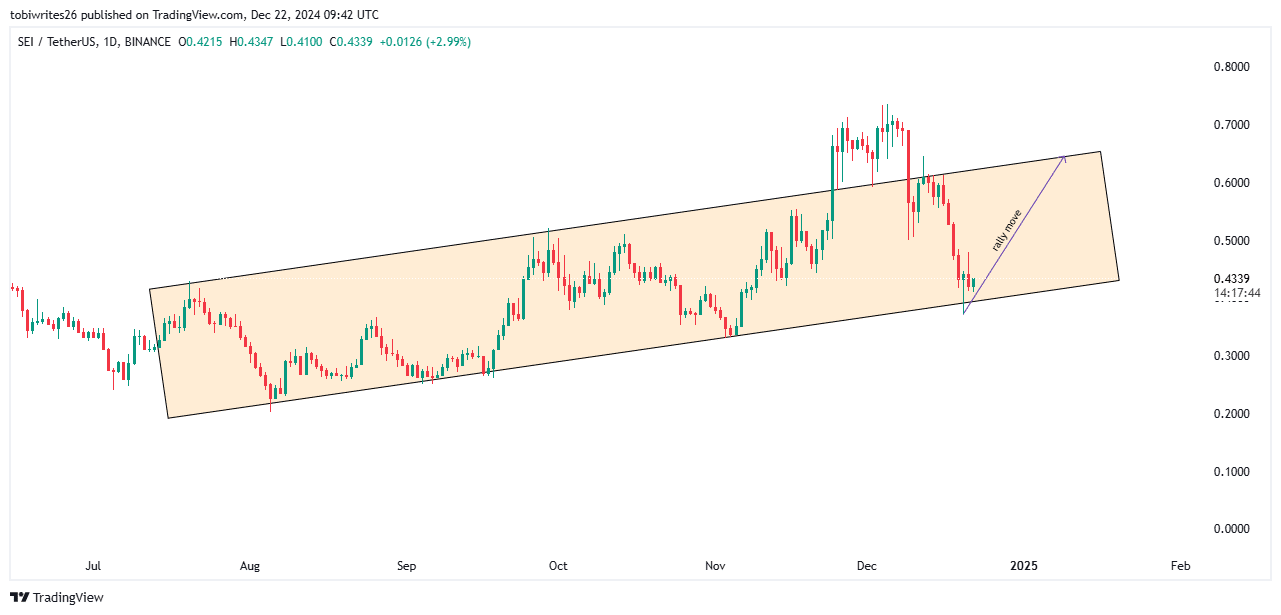

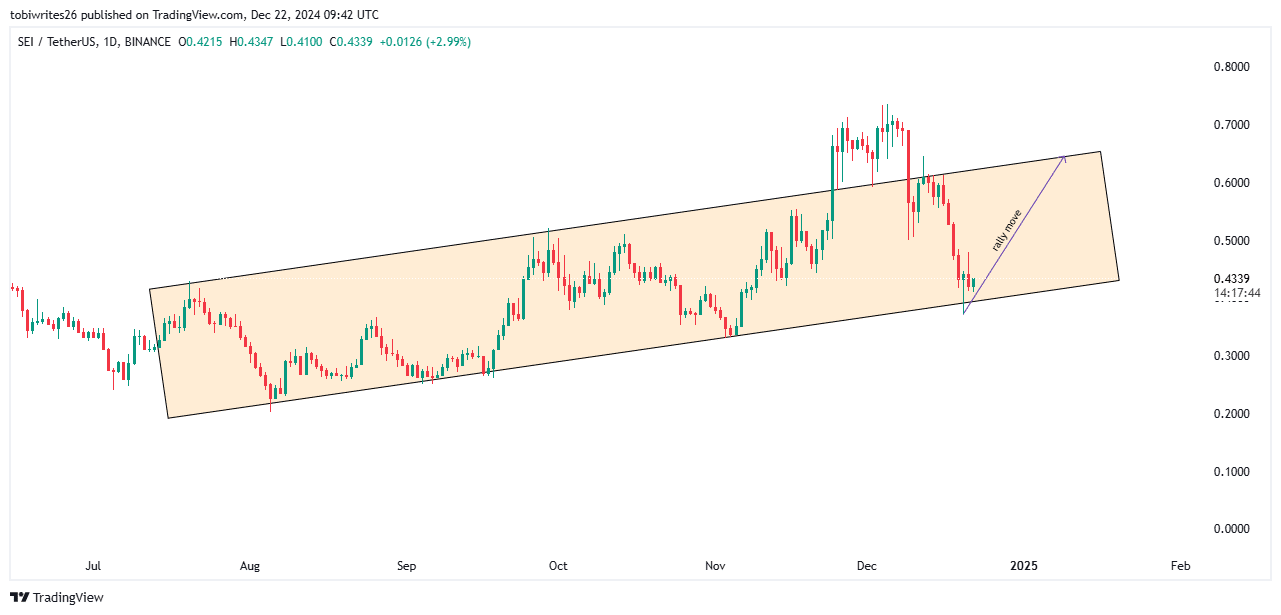

On the chart, SEI has retreated to the decrease boundary of its ascending channel, in any other case often known as help, after experiencing a pointy rejection on the channel’s resistance degree.

From this help degree, the asset’s probably transfer, based mostly on technical patterns, can be an upward pattern, probably focusing on $0.65.

Supply: TradingView

Nevertheless, its subsequent important transfer for the brand new goal—whether or not a rally or a pullback—will rely upon the extent of promoting strain at that resistance level.

Prime merchants place for an upswing

Based on Coinglass, prime merchants on Binance are displaying a bullish bias towards SEI. This conclusion is drawn from the long-to-short ratios based mostly on account sizes and place sizes amongst these merchants.

The long-to-short (accounts) ratio for prime merchants on Binance at the moment stands at 3.65, indicating that extra accounts are betting on SEI’s worth shifting greater.

Equally, the long-to-short (positions) ratio, which measures the quantity of capital allotted to lengthy positions versus shorts, is at 2.2286. This implies that bullish merchants have invested considerably extra capital in lengthy positions in comparison with shorts.

Additional proof of this bullish sentiment comes from liquidation knowledge. Over the previous 4 hours, brief liquidations totaled $14,230, in comparison with $1,340 in lengthy liquidations.

This imbalance displays elevated strain on brief merchants as SEI’s worth exhibits upward momentum.

Liquidity movement opposes SEI

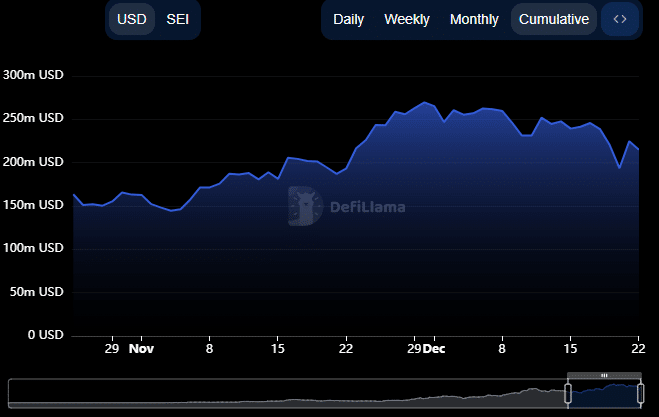

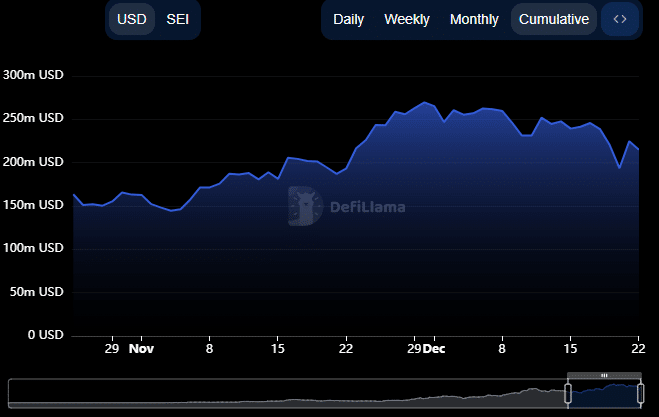

The present liquidity movement available in the market is towards SEI, with minimal exercise indicating that funds should not being directed towards the asset.

The Whole Worth Locked (TVL), a metric that represents the whole capital deposited into SEI-related protocols for actions like staking, lending, and liquidity provision, has dropped to $216.44 million up to now 24 hours.

This drop follows a surge the day before today and continues the downward pattern that started on November 30 in response to DeFiLlama.

Supply: DeFiLlama

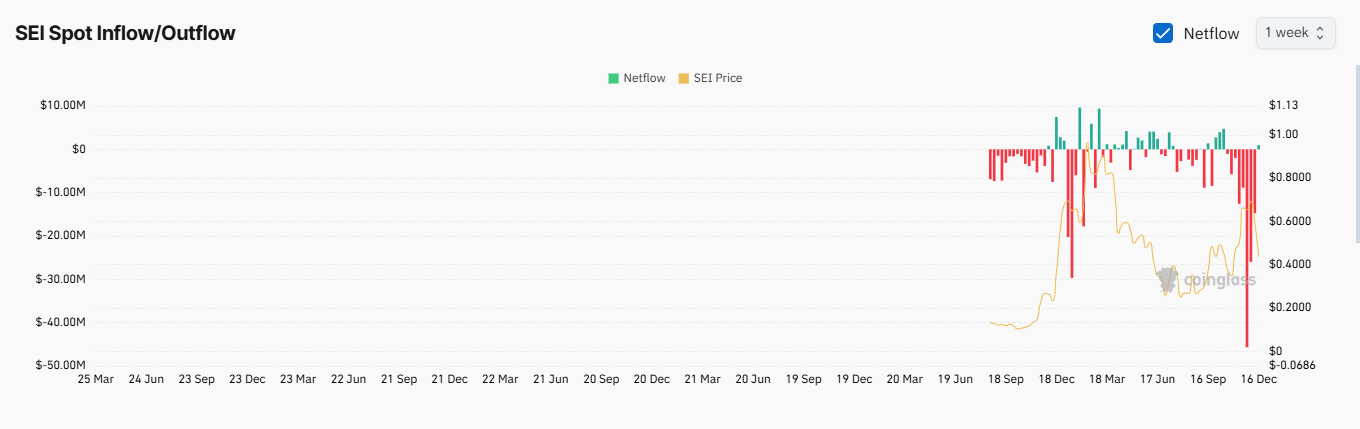

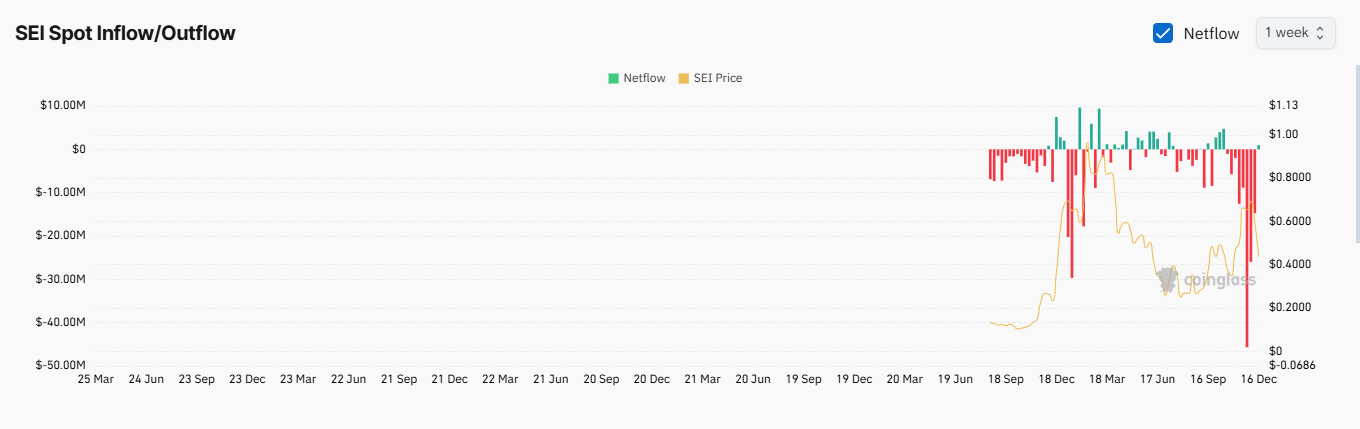

Concurrently, on Coinglass, the quantity of SEI out there on crypto exchanges has surged. Notably, the amount of SEI moved to exchanges has turned constructive for the primary time since October 14.

Real looking or not, right here’s SEI’s market cap in BTC’s phrases

A constructive Alternate Netflow, as noticed with SEI, signifies that spot merchants are transferring their funds to exchanges in preparation to promote.

Supply: Coinglass

If this pattern persists, the value of SEI might decline farther from its present buying and selling degree, with the help line remaining tenuous.