Solana falls to $90, indicator suggests potential for rally

Solana’s (SOL) value witnessed vital declines over the previous week after registering constant features in December.

SOL is down by 4.5% previously 24 hours and is buying and selling at $90.7 on the time of writing. The asset’s market cap fell to $39.2 billion, making a $6 billion hole with the fourth-largest cryptocurrency, BNB.

Nonetheless, Solana’s day by day buying and selling quantity recorded a 39% surge, reaching $2.9 billion.

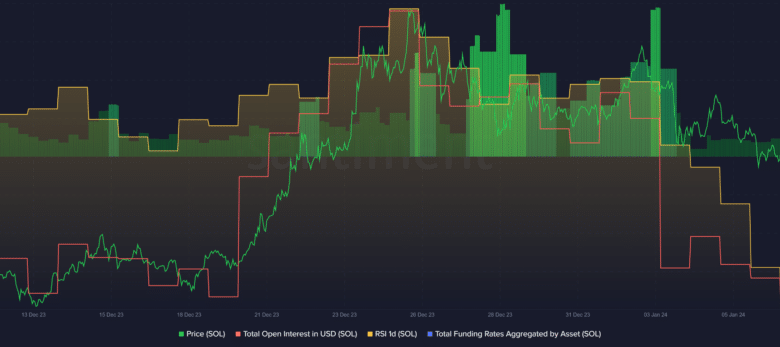

In keeping with knowledge supplied by Santiment, the Solana Relative Power Index (RSI) is presently hovering across the 35 mark. Per the information supplier, the asset’s RSI has been continually falling over the previous week — SOL’s RSI was 73 on Jan. 2.

This indicator exhibits that Solana might face a notable rally as there’s much less promoting stress than when the asset was buying and selling at round $110 final week.

Solana’s RSI would want to remain under the 50 mark to report a value rally.

Furthermore, knowledge from Santiment exhibits that the entire open curiosity (OI) in SOL declined from $1.3 billion on Jan. 1 to roughly $880 million on the reporting time.

The overall funding charges aggregated by Solana is presently standing at 0.008% — recording a 90% drop over the previous seven days. This exhibits that long-position holders have a slight dominance over short-position holders till additional actions.

The declining OI means that traders have both confronted robust liquidations or closed their buying and selling positions with Solana’s decline under the $100 mark.