Why is Ethereum down today despite spot ETF debut?

- ETH plunged by 8% regardless of the outstanding US spot ETH ETF debut.

- Analysts supply blended views on the ETH’s downward stress.

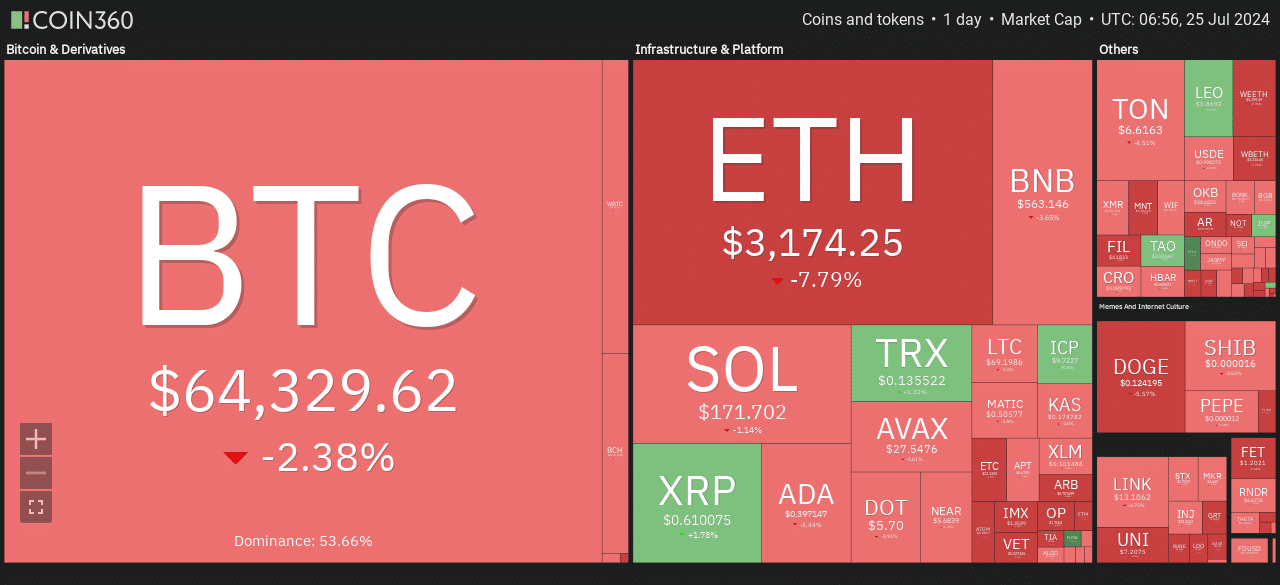

Ethereum [ETH] dropped by over 7% on twenty fourth July’s intraday buying and selling session, following an general meltdown throughout US equities that reportedly worn out over $1 trillion in worth.

Amidst the market crash, the biggest altcoin, which has been consolidating beneath $3.5k earlier than and after the US spot ETH ETF debut, inched nearer to the $3000 mark.

Supply: Coin360

Curiously, the outstanding efficiency of ETH ETF the final couple of days didn’t deter the huge plunge. So, why is Ethereum down?

Market observers had blended views on the plunge. In line with Hsaka, a famend altcoin dealer and market analyst, the US inventory market crash might have dragged ETH costs.

‘Ethereum lastly will get built-in with TradFi. Inside 24hrs, Nasdaq worst shut in 2 years, $1.1 trillion worn out from the US inventory market immediately.’

Nevertheless, the dump was not completely surprising, in line with Charles Edwards, founding father of crypto hedge fund Capriole Investments. Edwards argued that the ETH ETF was ‘bad’ for each Bitcoin and ETH.

‘The ETH ETF launch has been unhealthy for BTC and unhealthy for ETH. ETH has been languishing this whole cycle, and now it’s muddied the waters on the institutional degree with the ETF launch.’

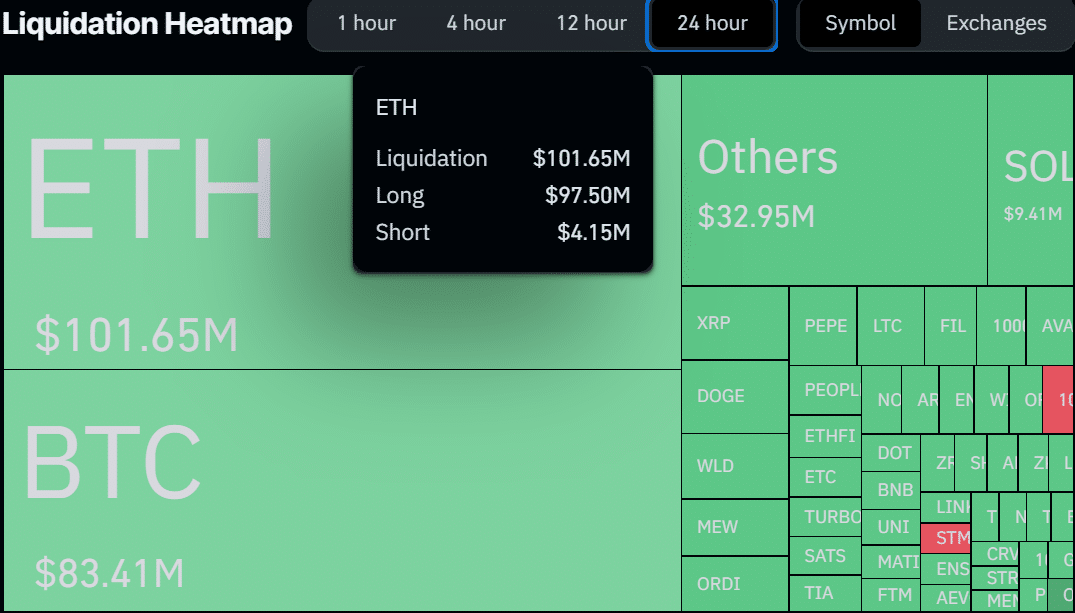

Ethereum dump set off $100 million in liquidations

The 7% plunge triggered over $100 million in liquidation previously 24 hours, with the leveraged bulls struggling essentially the most.

Per Coinglass knowledge, lengthy positions price $97.5 million had been rekt, whereas bears solely skilled a blip, price about $4.15 million.

Supply: Coinglass

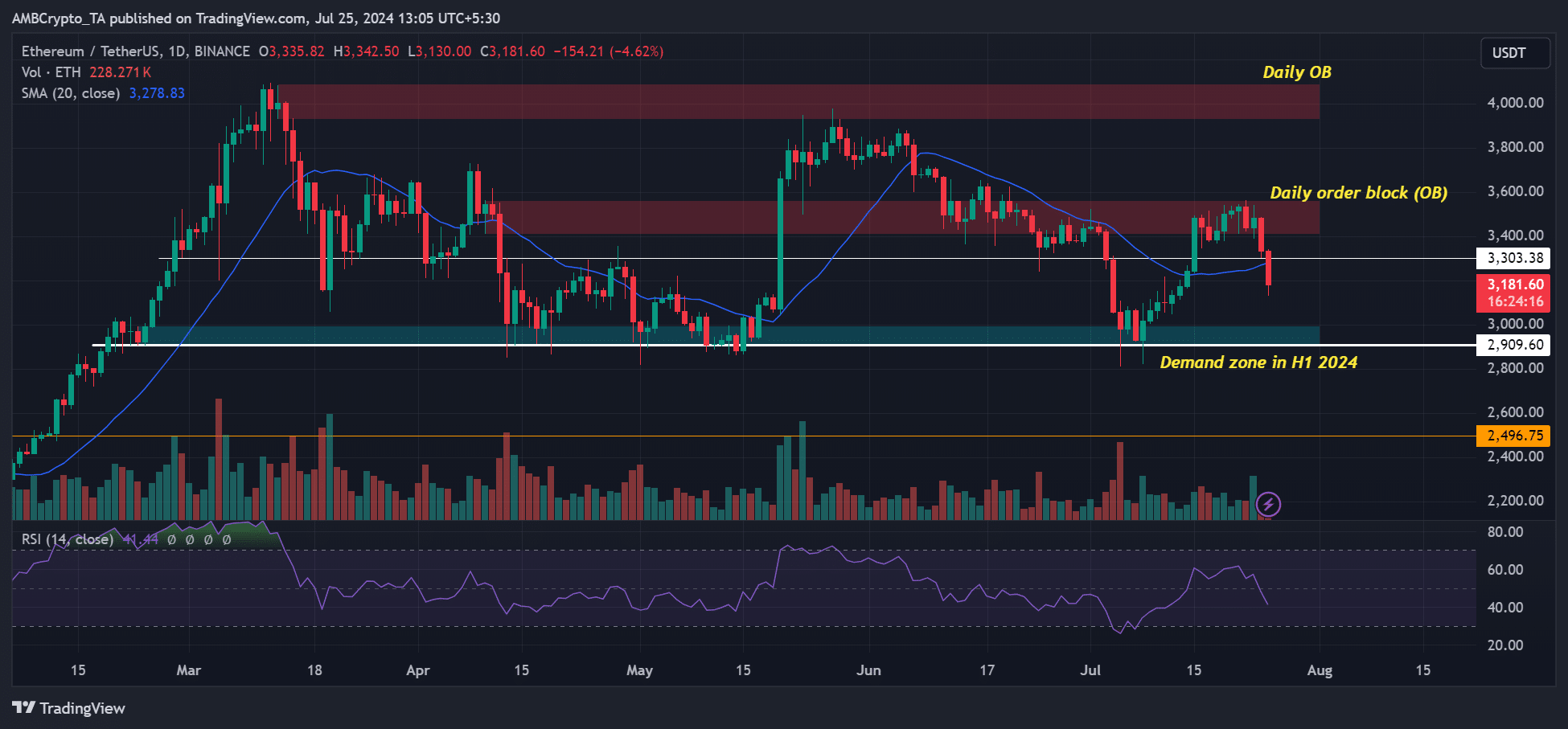

Moreover, as of press time, key derivatives signals, from quantity to open curiosity (OI) charges, had been in crimson, underscoring bearish sentiment on the futures facet of the market.

This meant that the ETH value could possibly be subdued into the weekend if the unfavourable market sentiment persists.

If the downward stress was sustained, then a retest of $3000 could possibly be possible. The psychological degree has been a key demand zone in 2024 and has been defended throughout previous dumps.

A every day candlestick shut beneath the 20-day SMA (Easy Shifting Common) might speed up a drop to the $3k demand degree.

Supply: ETH/USDT, TradingView