Crypto Analyst Issues Solana (SOL) Warning, Gives Updates on Bitcoin (BTC) and Chainlink (LINK)

A carefully adopted crypto analyst is giving his newest takes on Ethereum (ETH) rival Solana (SOL), decentralized oracle community Chainlink (LINK) and high digital asset Bitcoin (BTC).

The pseudonymous analyst often known as Inmortal tells his 195,000 Twitter followers that Solana is ready for a giant breakout, however not after a critical fakeout to the draw back.

He predicts SOL will briefly plunge beneath $20 someday in August, earlier than rebounding above $30.

“Sub $20 subsequent month.

SOL.”

At time of writing, SOL is value $24.49.

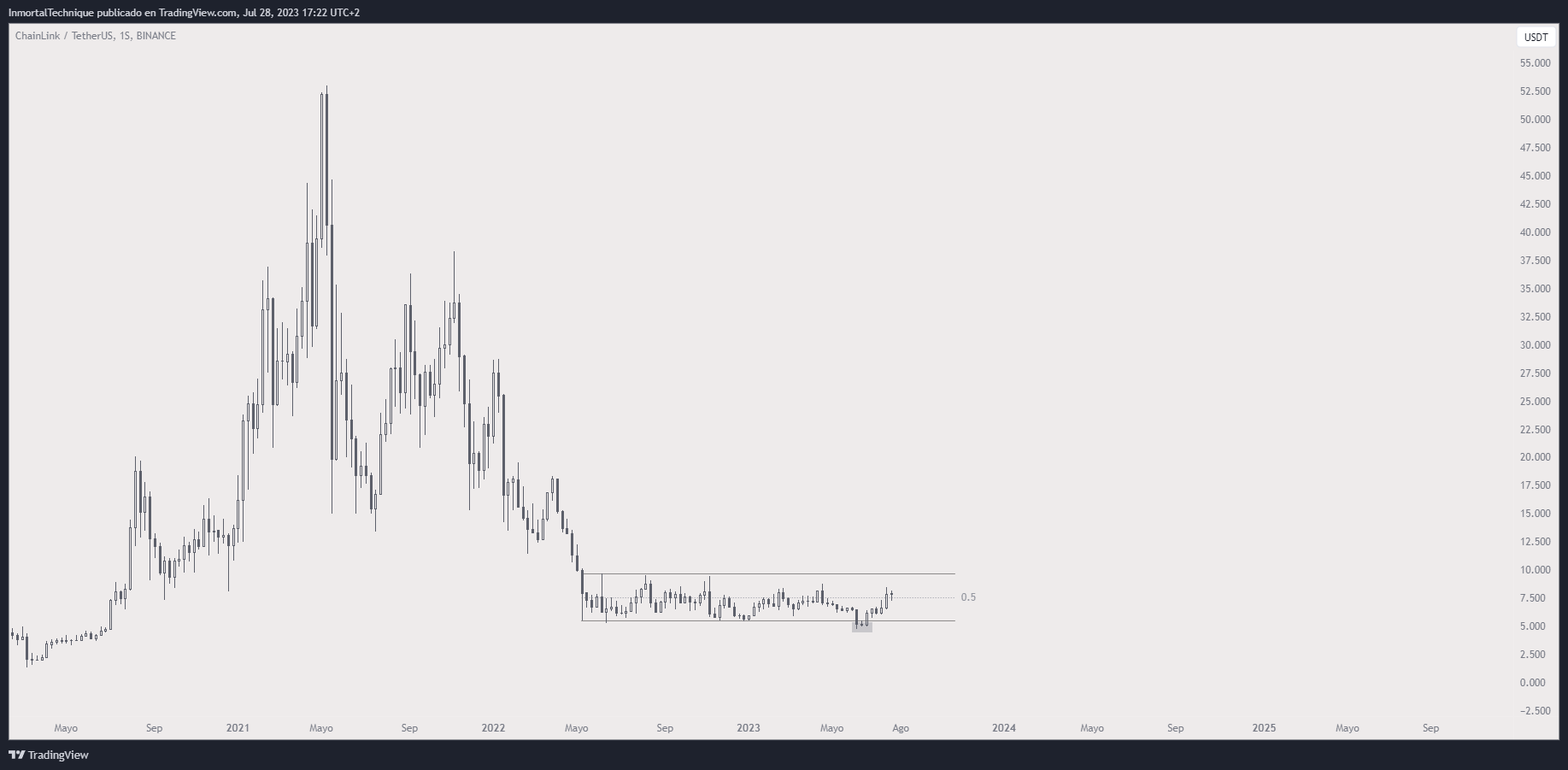

The analyst additionally has his radar locked on Chainlink and says that the decentralized oracle community has been buying and selling inside a uniquely lengthy accumulation zone. He says that Chainlink’s prolonged consolidation interval means that LINK will seemingly see a large breakout.

“This weekly chart has me obsessed.

As a result of the longer the buildup, the larger the enlargement.

LINK.”

At time of writing, LINK is value $7.62.

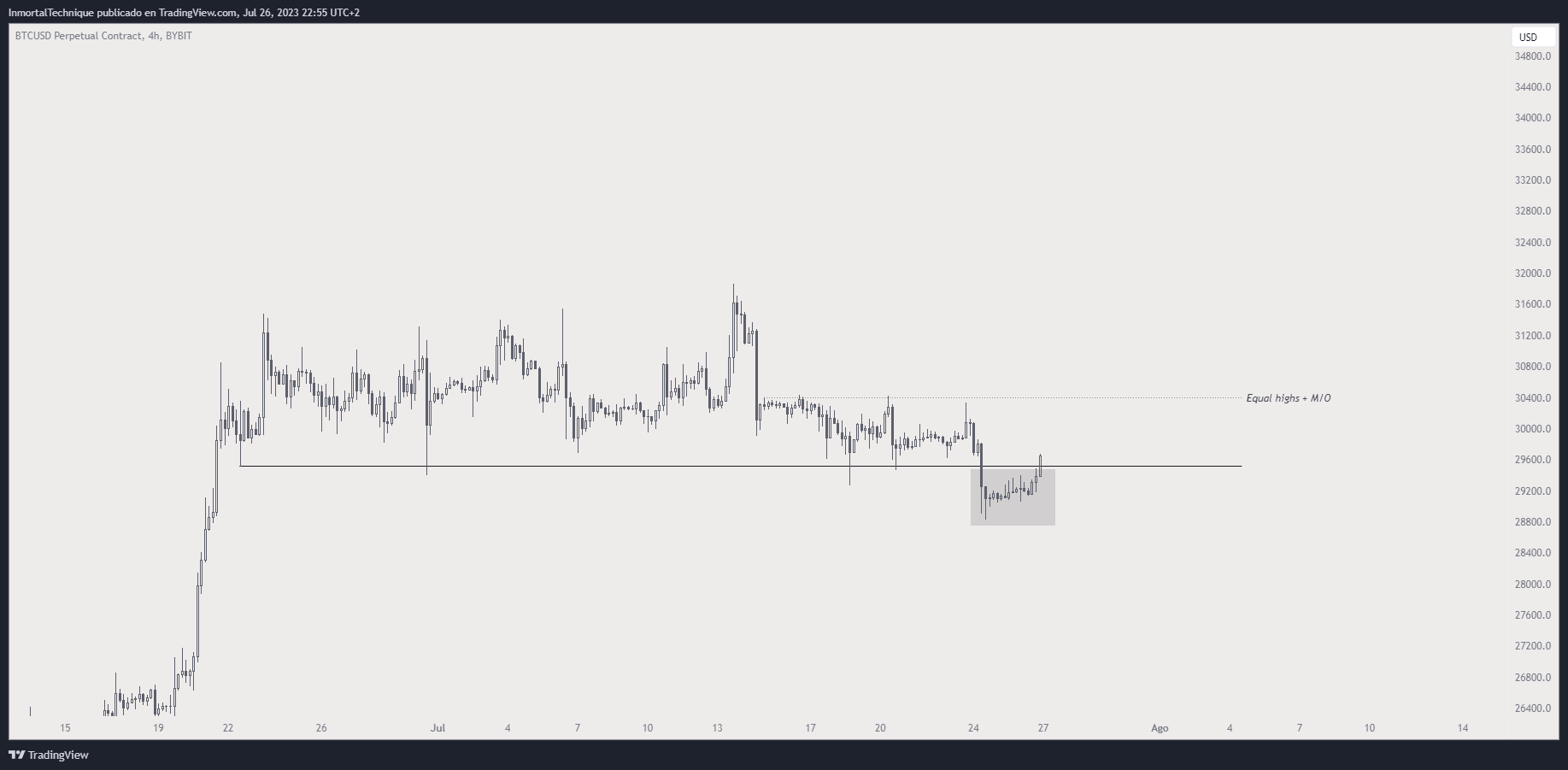

Bitcoin, Inmortal says the crypto king simply printed a “traditional deviation setup” whereby worth dips beneath an apparent help stage, tricking bears into flipping quick earlier than popping again up the help stage. He additionally says that BTC’s present worth provides it a strong risk-to-reward (R:R) issue.

“I’ll solely say this.

R:R is nice.

Basic deviation setup.

Clear invalidation.

BTC.”

At time of writing, BTC is buying and selling at $29,403.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Featured Picture: Shutterstock/NextMarsMedia