Ethereum: How $2.6k liquidation pool could decide ETH’s next move

- Ethereum’s $2,800 surge triggered quick liquidations, contrasting with Bitcoin’s stagnant value

- Geopolitical elements and ETF inflows contributed to the rising divergence between Ethereum and Bitcoin

Ethereum’s [ETH] current surge towards $2,800 has sparked vital consideration within the crypto markets, with merchants speeding to liquidate quick positions.

Nonetheless, regardless of Ethereum’s rally, Bitcoin has did not mirror this momentum, including volatility to the market.

In consequence, a brand new $2,600 liquidation pool has fashioned, heightening the unpredictability of the present value motion.

ETH’s value surge: Quick place liquidations and key ranges

ETH’s value surged to just about $2,800, sparking vital liquidations of quick positions. Quick curiosity elevated over 40% in per week and greater than 500% since November 2024, indicating sturdy bearish sentiment amongst merchants.

If ETH fails to maintain its upward motion, the $2,600 degree will seemingly function a key assist zone.

This might result in additional liquidations and consolidation. The excessive quick curiosity could amplify promoting stress if the worth revisits this degree.

Ethereum: Divergence with Bitcoin

Whereas ETH surged, Bitcoin’s value remained stagnant, highlighting a divergence between the 2 property.

Geopolitical elements, such because the Trump administration’s tariffs, have pushed traders towards Bitcoin, perceived as a safe-haven asset.

Ethereum, with its broader use circumstances, is seen as extra susceptible to regulatory scrutiny. Moreover, Bitcoin ETFs have seen over $40 billion in institutional investments, in comparison with Ethereum’s decrease inflows.

This has contributed to Bitcoin’s growing dominance and Ethereum’s shrinking market share.

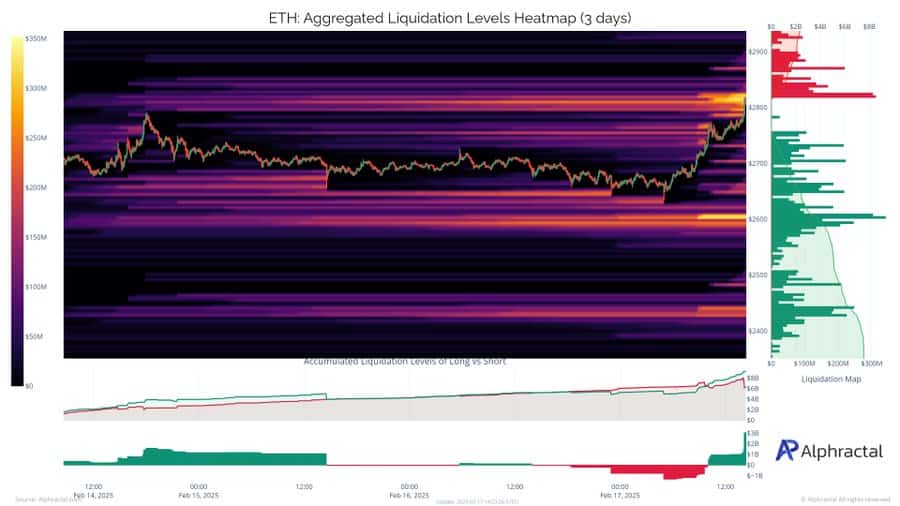

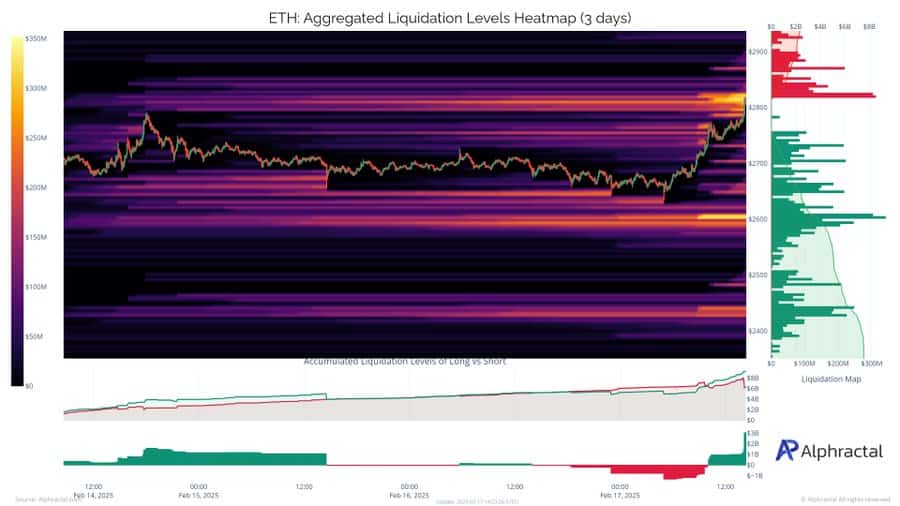

The aggregated liquidations heatmap

The ETH aggregated liquidations heatmap reveals vital liquidation clusters close to $2,800, aligning with Ethereum’s current surge.

Quick positions have been rapidly liquidated as the worth moved upward. On the draw back, the $2,600 liquidation pool stays a vital assist space to observe.

Supply: Alphractal

Key technical indicators sign warning

Supply: TradingView

Ethereum’s day by day value chart reveals a bearish bias, with ETH buying and selling at $2,670, after a 2.73% drop, at press time. The RSI stood at 39.71, signaling potential shopping for curiosity if the development persists.

Nonetheless, the OBV at 25.81 million prompt restricted shopping for momentum, leaving promoting stress in management.

The coin’s consolidation round $2,670 displays market indecision. A break beneath this degree might carry ETH to check the $2,600 liquidation pool, whereas a rebound would require a powerful quantity breach of the $2,800 resistance.