Blur Founder Responds to Criticism Over NFT Market Floor Price Crash

Blur Founder Pacman has defended his platform towards allegations of it crashing the non-fungible token (NFT) market flooring value.

Whereas sure blue chip NFTs are close to their yearly lows, the neighborhood has blamed the NFT market Blur’s incentivization mannequin for the autumn out there. Blur founder Pacman took to Twitter to defend his platform.

Blur Founder Pacman Defends The Platform

Pacman quote retweeted a neighborhood member’s tweet who was talking towards the “Blur killing NFTs narrative.” The Blur founder defined that some flooring costs have gone up, whereas others have gone down.

He complained that the neighborhood wouldn’t give credit score when the ground value elevated with the Blur airdrop, which injected liquidity into the market.

What are the very best upcoming airdrops of 2023? Learn extra by clicking right here.

Lastly, Pacman lashed out:

“When asset costs are up, ppl don’t actually discuss concerning the root trigger (ie blur injecting liquidity), however when they’re down, the pitchforks come out.”

Blur’s Bid Incentivization Mechanism

The neighborhood members have blamed Blur’s bid incentivization mechanism. A Twitter person Trevor.btc argued:

“Within the present bear surroundings, the flywheel of Blur’s bid incentive permits mercenary capital to destroy a challenge’s flooring with none actual holders promoting, at the same time as holder counts improve

As a result of farmers ONLY earn factors by having bids energetic, they’re not incentivized to really *purchase* the NFTs they bid on

They NEED to dump as quickly as any bids get accepted, to allow them to get ETH and substitute the bids to earn max factors”

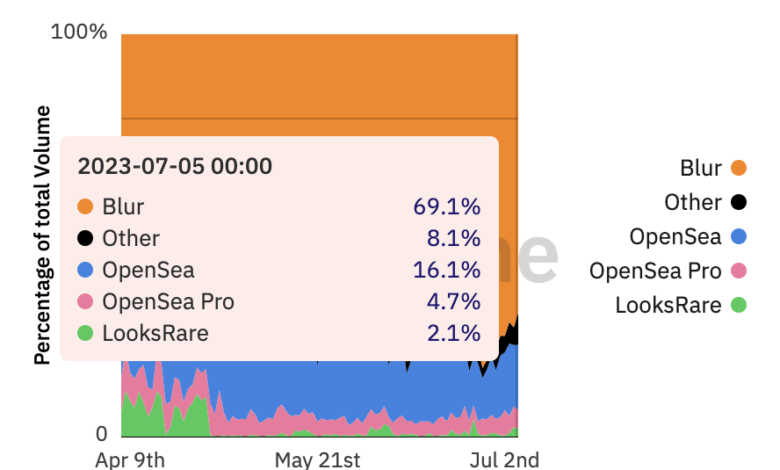

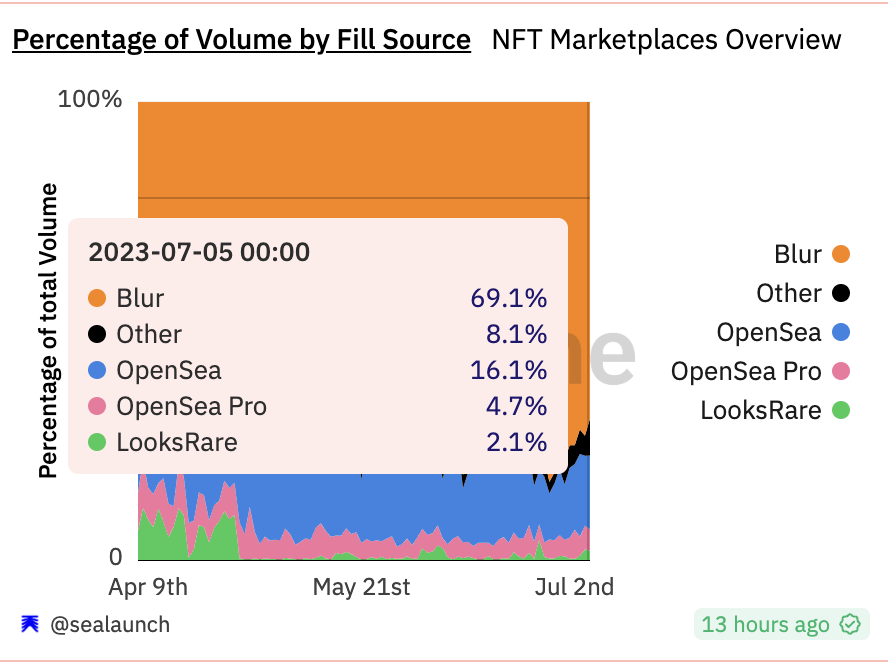

Certainly as a result of giant buying and selling actions, the Blur market dominates the NFT buying and selling quantity. In keeping with the most recent information from a Dune dashboard, Blur contributes 69.1% to the NFT buying and selling quantity.

Dune dashboard displaying quantity dominance of NFT marketplaces

NFT Market Crash

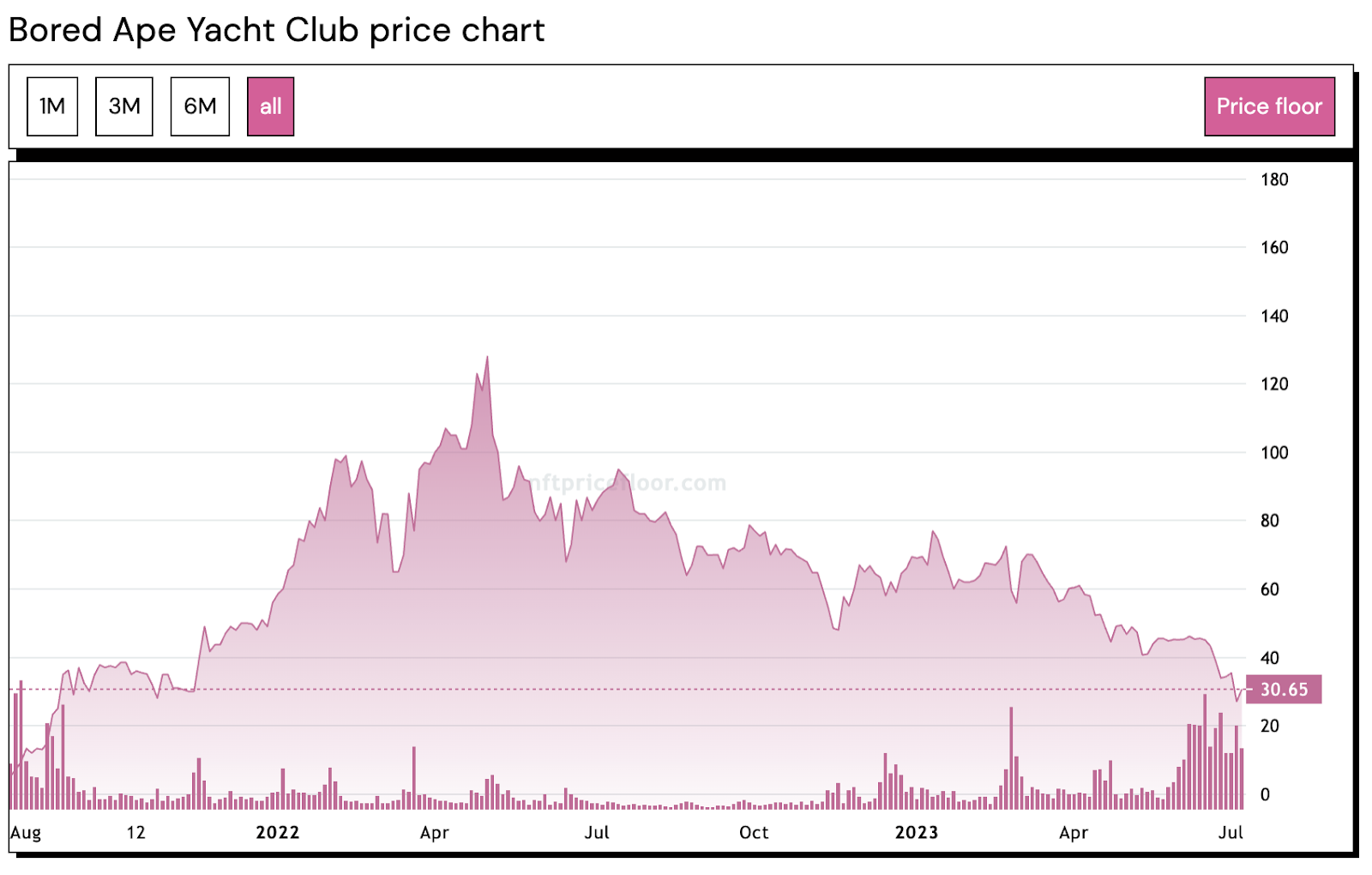

Significantly after the controversial launch of the Azuki Elementals, the ground value of blue chip NFT collections began plummeting. On Sunday, BeInCrypto reported that the ground value of Yuga Lab’s Bored Ape Yacht Membership (BAYC) fell by over 7% in 24 hours.

As of writing, the ground value of BAYC is round 30.65 Ethereum (ETH), virtually buying and selling at two-year lows.

BAYC flooring value chart. Supply: NFTPRICEFLOOR