What happened in crypto today? Rate cuts, regulation, and the impact on Bitcoin

- The crypto market confirmed resilience, anticipating long-term positive factors from Trump’s commerce conflict.

- Bitcoin holds sturdy as pro-crypto sentiment builds in Washington.

Following the extremely anticipated “Liberation Day” tariffs, the cryptocurrency market has skilled notable volatility, pushed by geopolitical developments and regulatory actions.

Because the dominant asset by market capitalization, Bitcoin [BTC] continues to set the tone for broader crypto market sentiment.

Buying and selling at $84,121 at press time, BTC registered a modest 0.65% improve from the earlier shut.

Regardless of issues over a possible “market-wide” correction, the anticipated sell-off didn’t materialize. Consequently, the market stays within the inexperienced, sustaining its upward trajectory.

What occurred in crypto right this moment?

Let’s take a step again to investigate the aftermath of the commerce conflict. The Volatility Index (VIX) spiked to an eight-month excessive, reflecting a surge in market uncertainty and danger urge for food.

All three main U.S. inventory indices noticed huge sell-offs, erasing trillions in market capitalization, with the Magnificent Seven stocks trading 34% beneath their respective all-time highs.

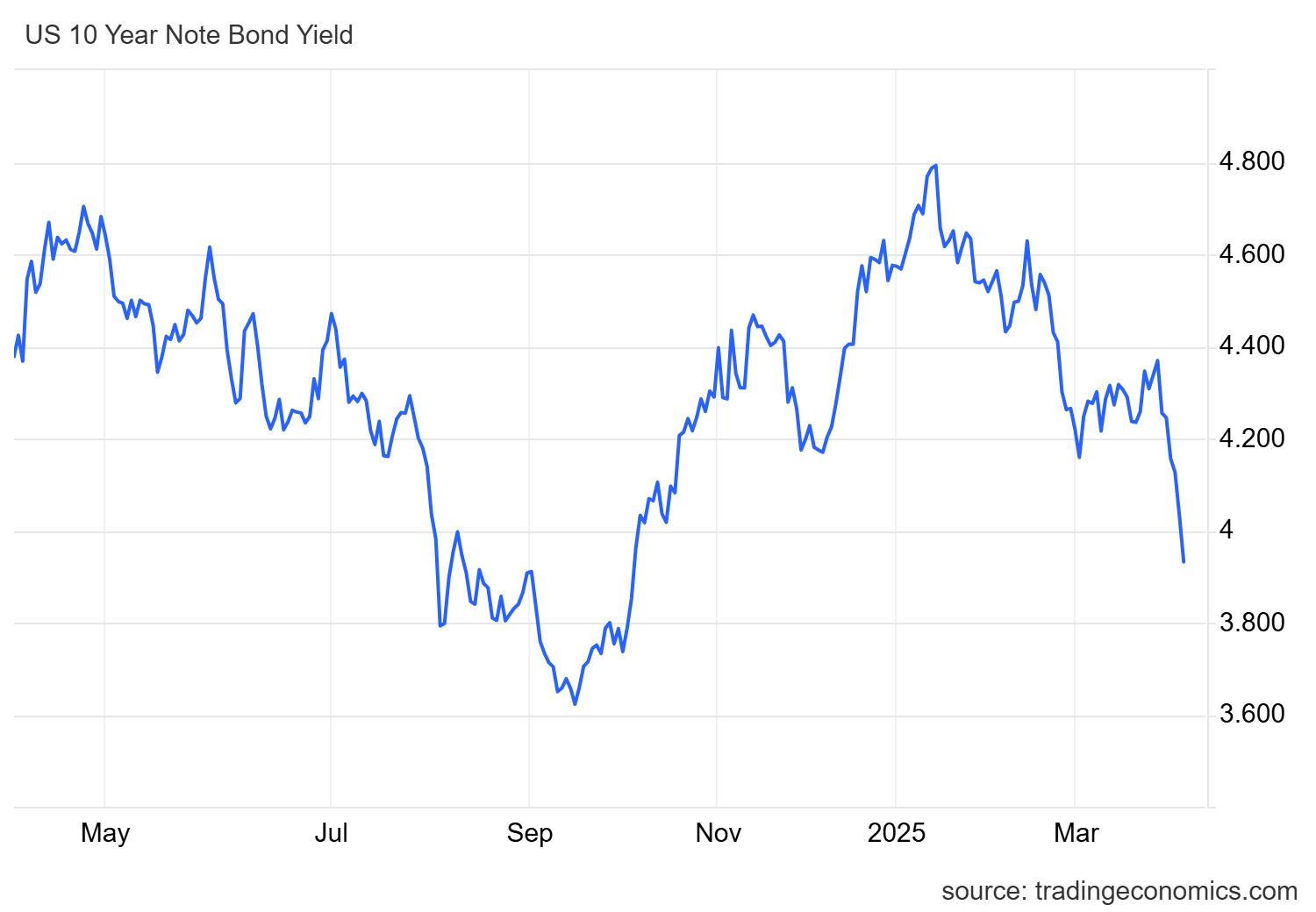

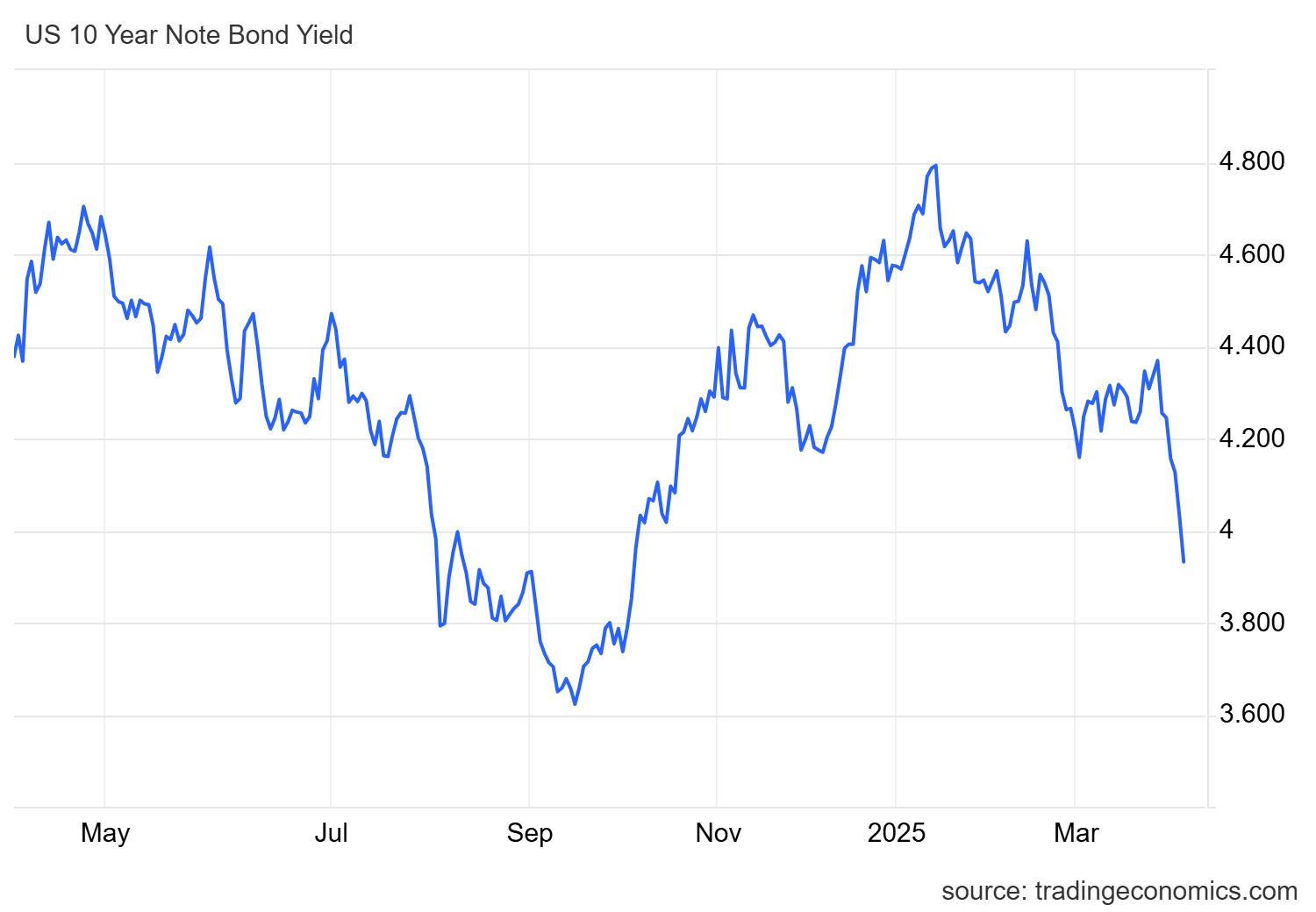

In the meantime, the 10-year Treasury yield (the rate of interest the U.S. authorities pays to borrow cash) retraced to pre-election ranges, dropping by -90 foundation factors (bps).

Usually, when yields fall, traders typically transfer cash into protected belongings like Treasury bonds, anticipating slower financial development in Q2.

Supply: Buying and selling Economics

In response, market members rapidly priced in a 20% probability of three charge cuts in 2025, up from earlier expectations of two.

Why? Analysts speculate that U.S. mixture demand might gradual as the results of the tariffs take maintain, which might immediate the Federal Reserve to chop charges. This could permit extra low-cost capital to circulation into the market.

Within the crypto market, traders clearly recognized long-term worth, notably in Bitcoin, given the shifting financial panorama. Not like equities, cryptocurrencies confirmed resilience.

Bitcoin dominance noticed a 0.30% uptick following the announcement, reflecting a shift in investor sentiment and a flight to “digital belongings” in its place retailer of worth.

Crypto market optimism amid regulatory shift

The U.S. Senate Banking Committee has authorized Paul Atkins as the following SEC Chair in a 13-11 vote, setting the stage for a serious shift in crypto regulation.

Recognized for his pro-market strategy, Atkins is anticipated to steer the SEC away from strict enforcement and towards clearer, industry-friendly insurance policies. This shift has strengthened long-term investor confidence in crypto markets.

Bitcoin stays above $80k, main altcoins are holding important help ranges, and the excessive chance of Federal Reserve quantitative easing — mixed with a regulatory shift on the SEC — has allowed crypto markets to soak up latest macro volatility.

Supply: CoinMarketCap

Ought to these situations persist, danger urge for food could improve, setting the stage for stronger institutional inflows and a possible market-wide rally within the coming quarters.