Temple Digital Group launches 24/7 institutional trading built on Canton

Temple Digital Group has launched a non-public, institutional buying and selling platform constructed on the Canton Community, providing steady, 24/7 buying and selling of digital property utilizing a central restrict order ebook and non-custodial market construction.

In accordance with an announcement shared with Cointelegraph on Thursday, the platform helps buying and selling in cryptocurrencies and stablecoins and is designed to permit establishments to transact with authorised counterparties whereas sustaining privateness and regulatory oversight, with contributors retaining custody of property slightly than counting on a central middleman.

The system is constructed round a price-time precedence central restrict order ebook with sub-second matching and contains execution monitoring and transaction price evaluation instruments supposed for institutional buying and selling desks, the corporate stated.

The platform is stay and onboarding institutional customers, together with asset managers, market makers and monetary establishments, with assist for tokenized equities and commodities deliberate for 2026.

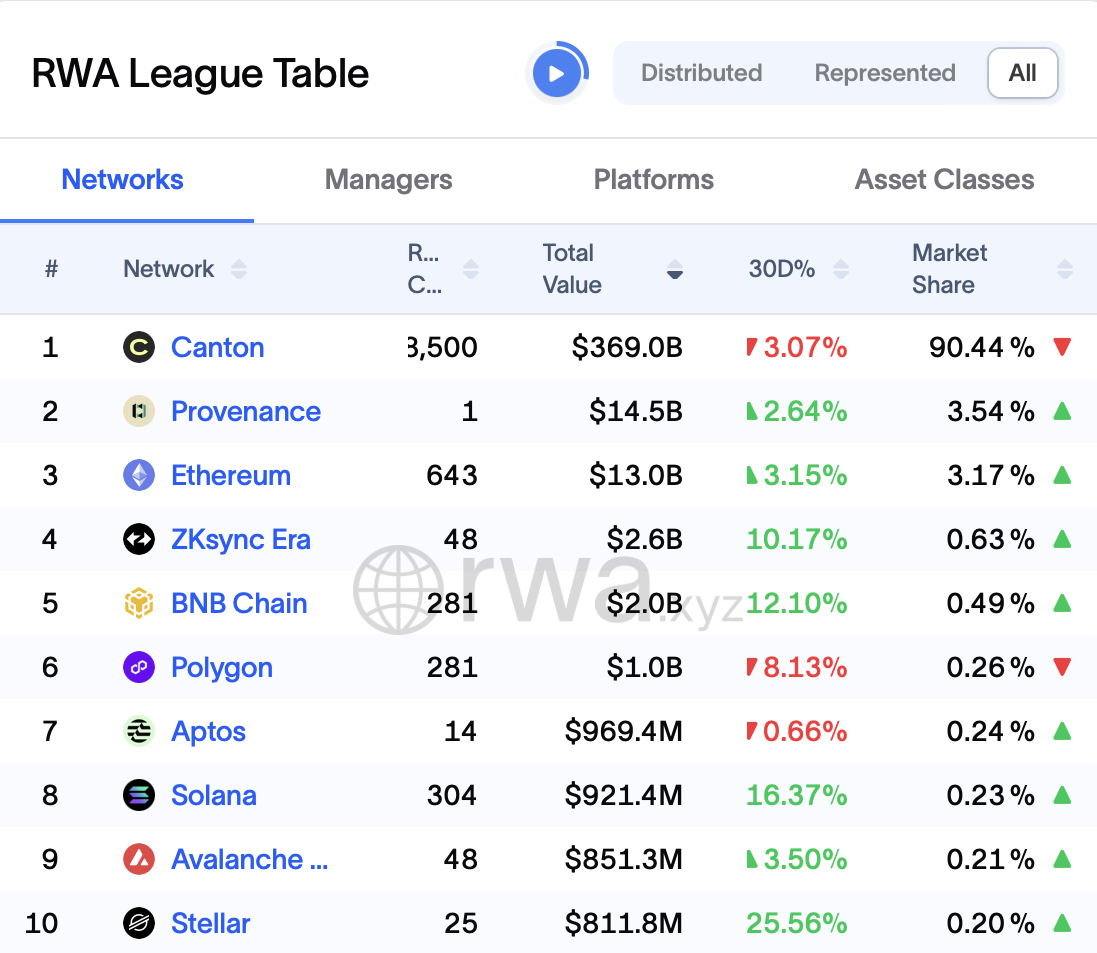

High blockchains for tokenized real-world property. Supply: RWA.xyz

Temple Digital Group is a New York–based mostly digital asset infrastructure firm that builds non-custodial buying and selling infrastructure for institutional digital asset markets.

The Canton Community is a permissioned blockchain created by Digital Asset that permits regulated establishments to transact and settle tokenized property onchain.

Associated:Digital Asset raises contemporary funding to scale Canton Community adoption

Institutional adoption accelerates on the Canton Community

The Canton Community drew elevated institutional consideration in late 2025, as corporations introduced new deployments involving tokenized funds, collateral and financing infrastructure.

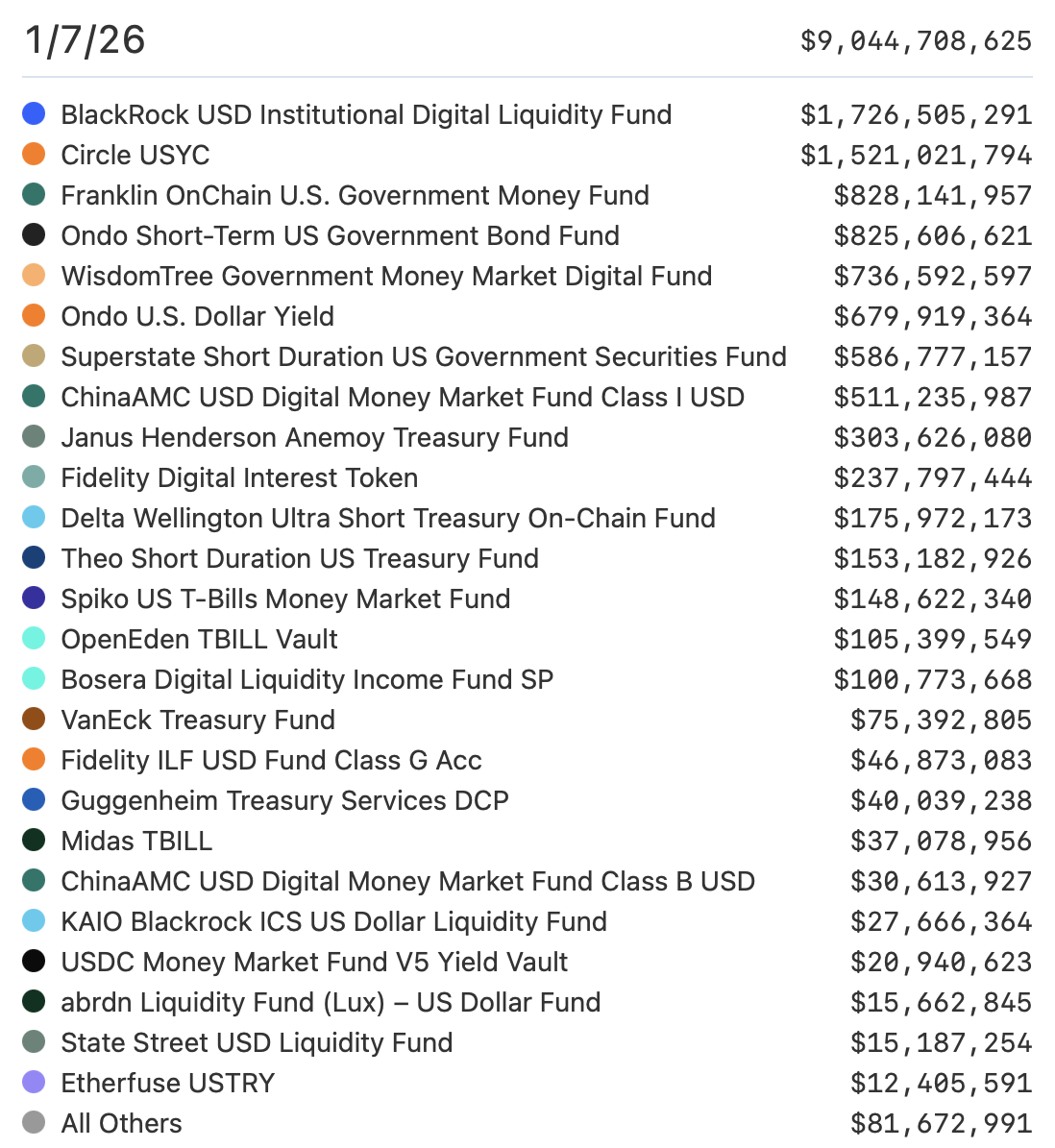

In December, Franklin Templeton expanded its Benji tokenization platform to Canton, permitting its tokenized US authorities cash market fund for use as collateral inside Canton’s institutional ecosystem. The fund held $828 million in property at time of writing, in accordance with business information.

Tokenized US Treasury Funds. Supply: RWA.xyz

On Dec. 9, Canton Community’s creator, Digital Asset, and a gaggle of main monetary establishments accomplished a second spherical of onchain US Treasury financing on Canton. The trial confirmed that tokenized Treasurys will be reused as collateral in actual time, highlighting how blockchain-based infrastructure can scale back frictions in conventional collateral and financing markets.

A couple of week later, the Depository Belief and Clearing Company (DTCC) stated it plans to mint a subset of US Treasury securities on the Canton Community, extending blockchain-based settlement into market infrastructure that processed $3.7 quadrillion in transactions in 2024.

On Wednesday, Digital Asset and Kinexys by JPMorgan introduced plans to convey JPMorgan’s US greenback deposit token, JPM Coin, natively onto the community.

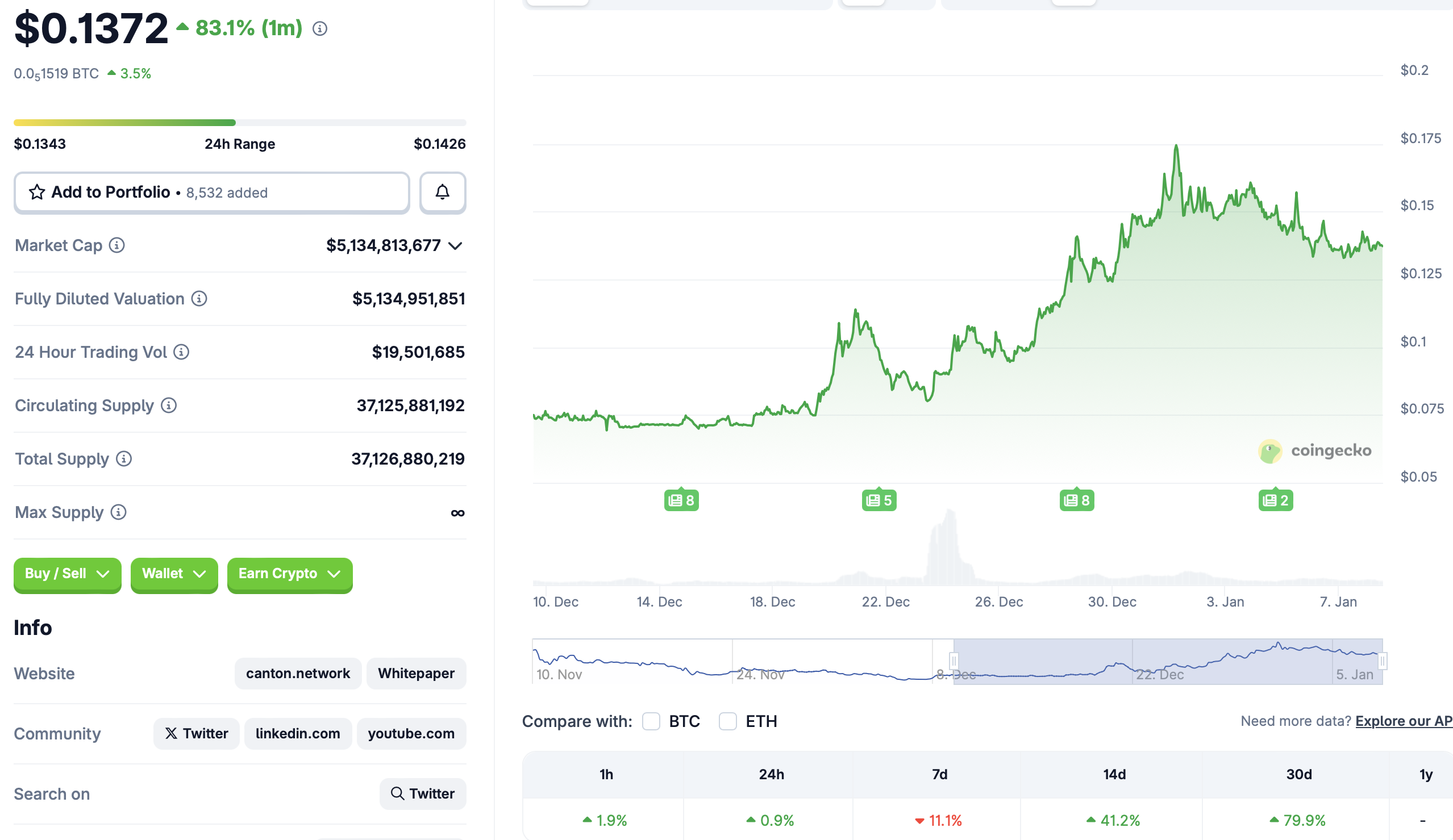

The Canton Coin (CC) has risen sharply not too long ago. It’s up greater than 40% over the previous two weeks and greater than 80% over the previous month, in accordance with CoinGecko information on the time of writing.

Supply: CoinGecko

Journal: Davinci Jeremie purchased Bitcoin at $1… however $100K BTC doesn’t excite him