Why crypto is down today – FOMC, CPI spur decline

- The crypto market maintained its over $2 trillion capitalization.

- Anticipation concerning the FOMC and CPI stories have contributed to the crypto decline.

The crypto market has skilled an enormous decline within the final 24 hours, with hundreds of thousands of {dollars} wiped off the market capitalization.

The declines in Bitcoin [BTC] and Ethereum [ETH] have performed a big position on this downturn.

Extra particularly, the upcoming U.S. Federal Open Market Committee (FOMC) assembly and Client Worth Index (CPI) stories have contributed largely to the decline of the 2 largest crypto belongings.

The rationale why crypto is down at present

AMBCrypto’s evaluation of the crypto market capitalization on CoinMarketCap confirmed a big decline in the previous few days.

Previously 48 hours, the market cap has dropped from over $2.5 trillion to round $2.47 trillion as of this writing.

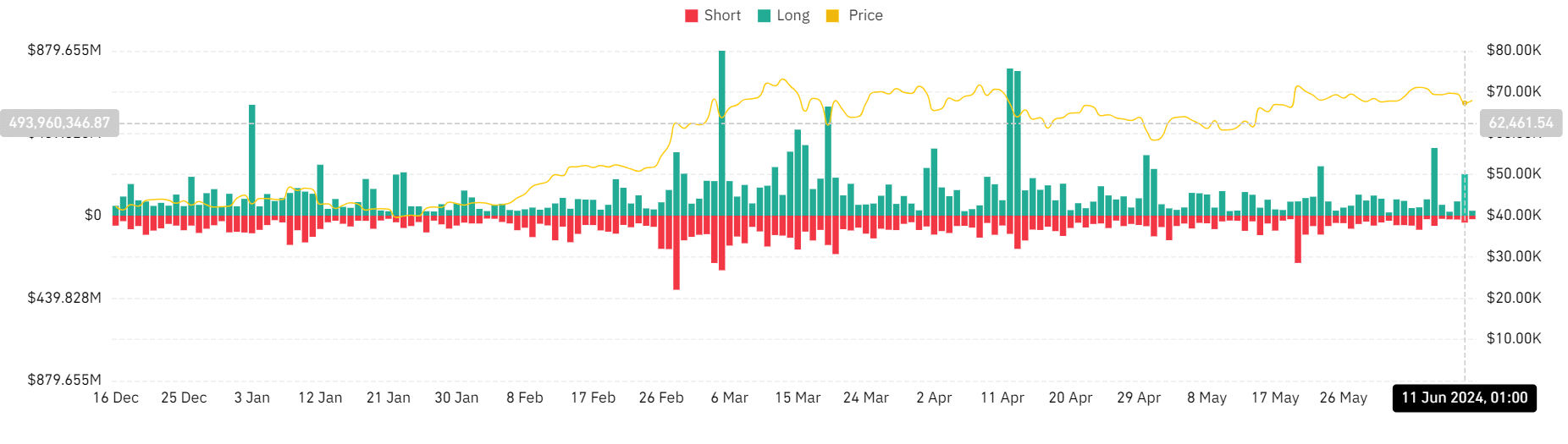

Additionally, the liquidation chart on Coinglass confirmed that crypto liquidations on the eleventh of June had been fairly vital. The chart indicated that lengthy positions skilled extra liquidations than brief ones as costs sharply declined.

Supply: Coinglass

Lengthy liquidation quantity was over $221 million, whereas the brief liquidation quantity was round $37 million.

Bitcoin, Ethereum lead market dip

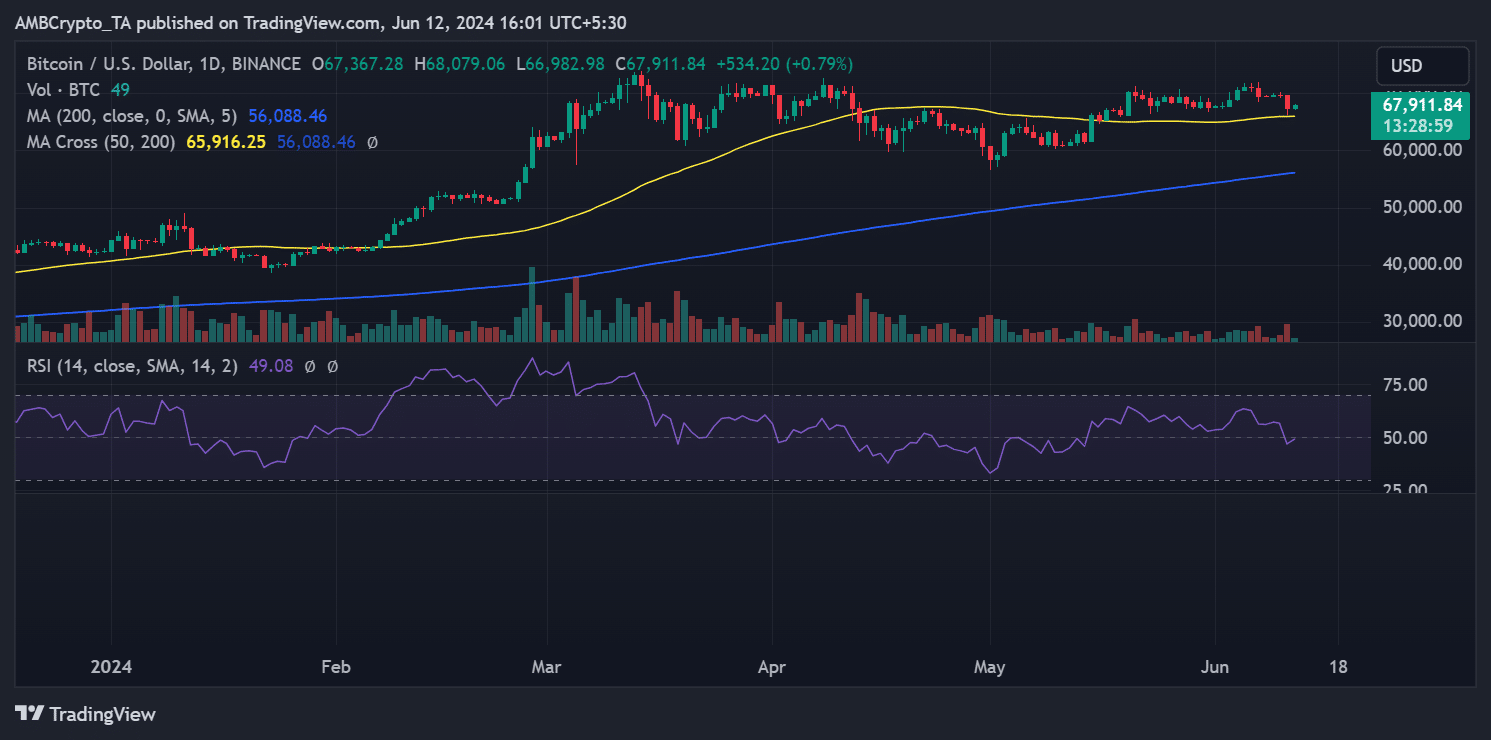

Taking a look at Bitcoin on a day by day timeframe confirmed, AMBCrypto noticed that on the eleventh of June, it declined by over 3%. The chart indicated that this drop decreased its value to round $67,377.

BTC’s liquidation chart revealed that this decline led to over $66 million in liquidation quantity.

Supply: TradingView

Particularly, lengthy liquidations accounted for over $52 million, whereas brief liquidations had been over $14 million.

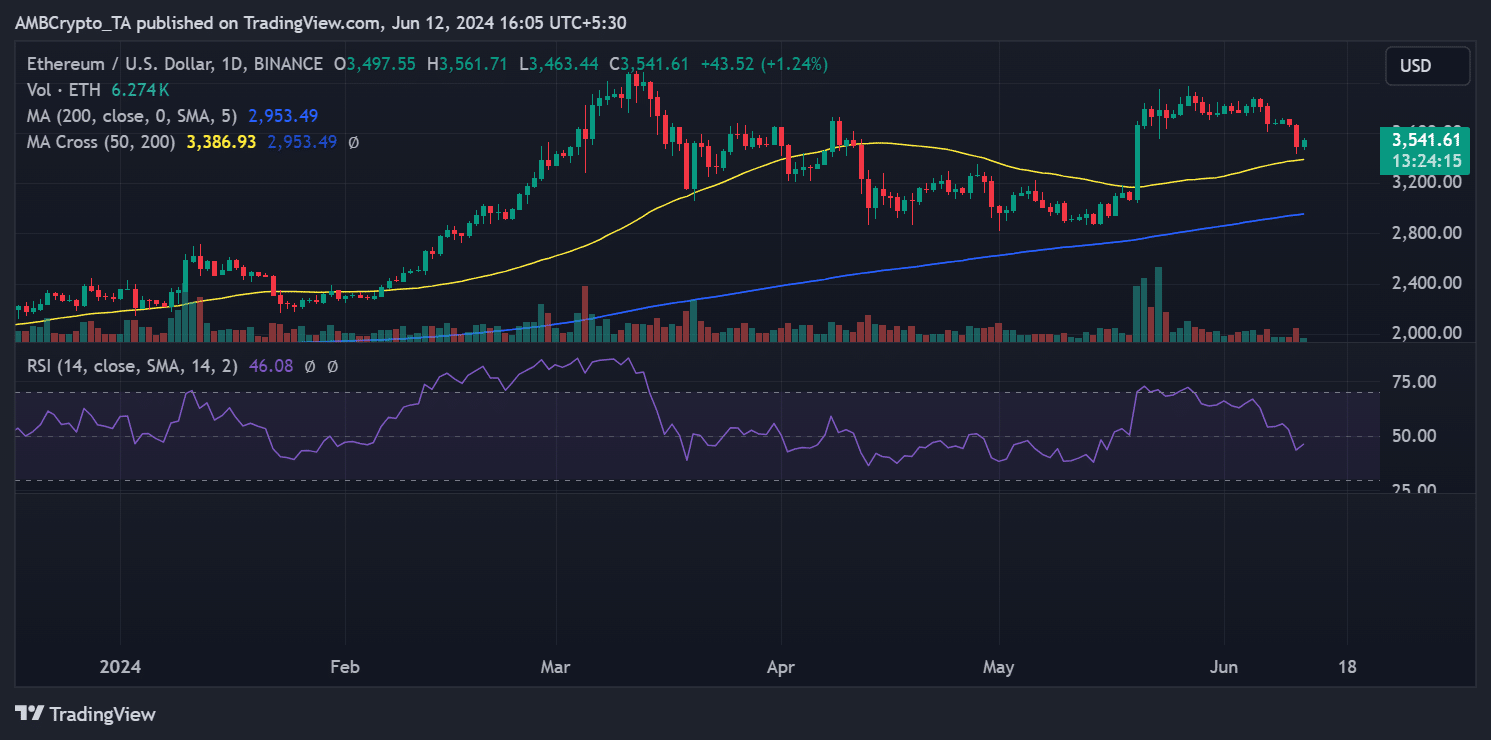

Ethereum, in the identical timeframe, confirmed an nearly 4.6% decline as its value fell to round $3,500. The liquidation chart confirmed that over $69 million was liquidated as a result of decline.

Of this, lengthy liquidations accounted for round $62 million, whereas brief liquidations had been over $7 million.

Supply: TradingView

CPI and FOMC inflicting panic

Traditionally, when the Client Worth Index (CPI) knowledge is launched or the Federal Open Market Committee (FOMC) adjusts rates of interest, the crypto market usually experiences vital fluctuations.

It is because traders modify their danger publicity in response to those financial indicators. Usually, an increase in CPI correlates with a drop in Bitcoin’s value.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Will increase in important items cut back the quantity of disposable revenue folks have, resulting in decreased funding in crypto.

The FOMC is anticipated to keep up the present rates of interest between 5.25% and 5.50%. In the meantime, the CPI is predicted to point out a modest improve, staying throughout the vary of 0.1% to 0.3%.