Why Is Bitcoin Price Up Today?

The Bitcoin worth tagged a brand new yearly excessive yesterday at $31,840, leaving market contributors questioning concerning the driving forces behind this bullish momentum.

The Energy of Financial Indicators

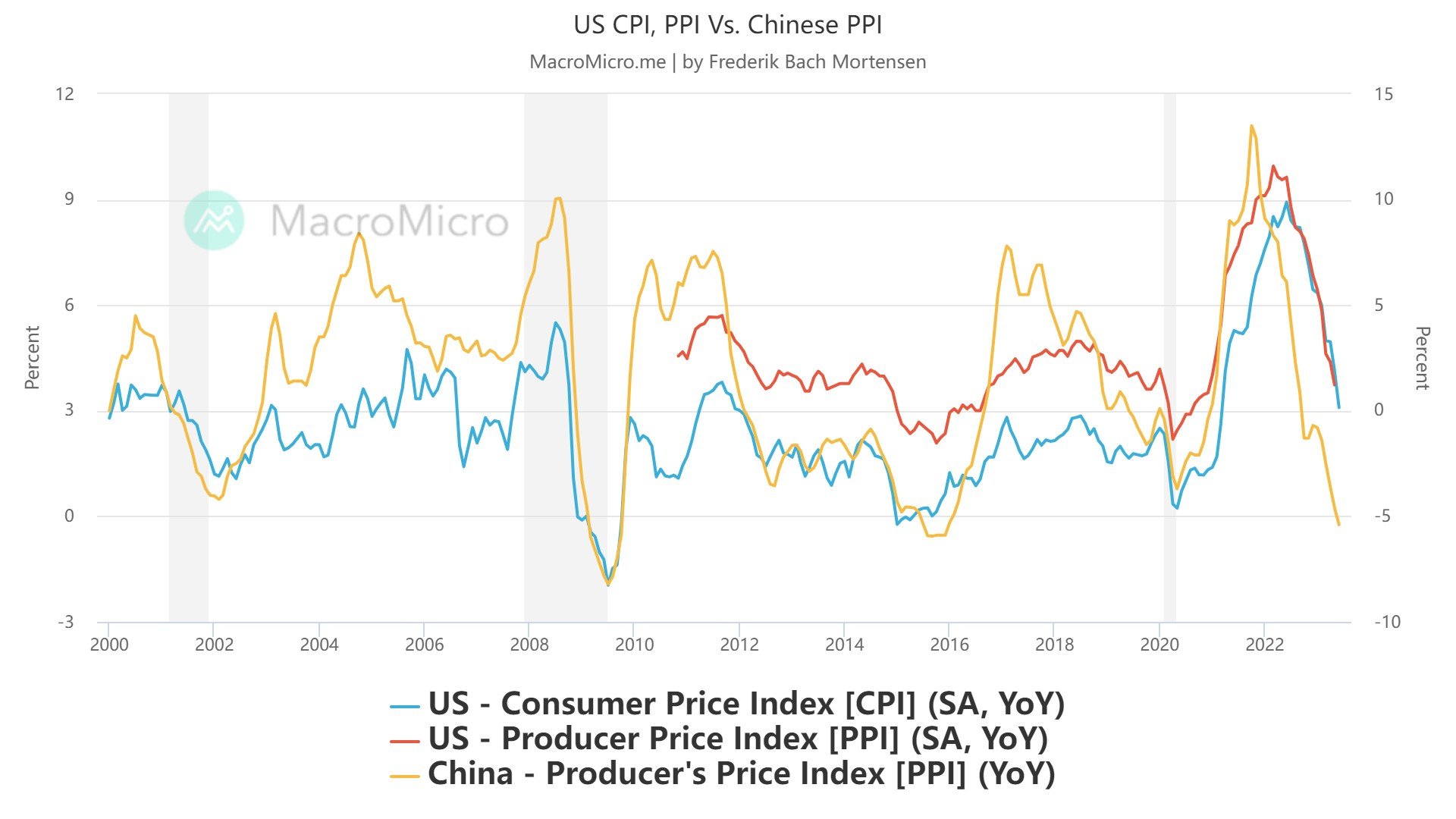

One of many essential elements contributing to Bitcoin’s upward trajectory was the discharge of the US Producer Worth Index (PPI) information. The newest figures revealed a major slowdown in inflation, with PPI YoY dropping to 0.1% in June, surpassing expectations and marking the smallest tempo since August 2020. Notably, the Core PPI YoY got here in at 2.4%, barely under the estimated 2.6%, reinforcing the notion of a diminishing inflationary atmosphere.

This lower in PPI is seen as a optimistic signal for the Shopper Worth Index (CPI), offering hope for a extra secure financial panorama. Macro researcher Mortensen Bach emphasized the importance of the PPI’s affect, stating, “PPI all the time leads CPI. Inflation is now not a factor and enter costs clearly point out that! Deflation stays the first danger going ahead. That is what occurs when you’ve a Federal Reserve who’s blindly targeted on backward-looking information!”

Echoing these sentiments, macro analyst Ted added, “PPI inflation leads CPI by a couple of months… and immediately’s PPI numbers have YoY operating at +0.24%. Nearly in deflation! Fed pivot anybody?”

Additionally value noting is that, Might PPI inflation was revised decrease from 1.1% to 0.9%. Might Core PPI inflation was revised decrease from 2.8% to 2.6%. The drop and revision decrease in Core PPI is what the US Federal Reserve needs to see.

Inverse Correlation With The DXY

One other pivotal issue driving Bitcoin’s surge is the latest drop within the US Greenback Index (DXY) under 100.00, a degree not seen in 15 months. This growth has sparked renewed curiosity in danger property like Bitcoin as a hedge towards a weakening greenback.

The inverse correlation between the DXY and Bitcoin has traditionally performed a major function within the cryptocurrency’s worth actions, and this latest drop within the DXY has acted as one more bullish catalyst.

Ripple’s Partial Victory

The continued authorized battle between Ripple Labs and the US Securities and Alternate Fee (SEC) has in all probability offered one other enhance to Bitcoin’s worth. Ripple’s partial victory within the case has generated optimism within the crypto neighborhood and may be seen as a web optimistic occasion for Coinbase, which is embroiled in its personal authorized dispute with the SEC.

Apparently, Coinbase serves because the alternate companion for all U.S. Bitcoin spot Alternate-Traded Funds (ETFs) at present filed with the SEC. Lately, chair Gary Gensler’s feedback on Coinbase’s involvement in ETF filings have raised issues concerning the suitability of the alternate as a market surveillance sharing companion, as Bitcoinist reported.

Eric Balchunas, a Senior ETF analyst for Bloomberg, expressed his apprehension, suggesting that “SSA could possibly be pointless if it is a drawback for him.” With this in thoughts, the Ripple victory may also be seen as extraordinarily optimistic information for the approval of a Bitcoin spot ETF, as Coinbase may gain advantage from the ruling in its case towards the SEC.

At press time, the BTC worth retraced to $31,250, up 2.6% within the final 24 hours.

Featured picture from iStock, chart from TradingView.com