Why is crypto down today? How FOMC, geopolitics impacted BTC

- BTC has been caught throughout the $80K-$85K vary for some time.

- Analysts remained cautious regardless of hopes of a possible Fed’s dovish tilt.

On Tuesday, Bitcoin [BTC] triggered one other bout of crypto market sell-off after dipping to $81K from $84K and closed the every day session with a 1.54% loss.

It was the primary day of the FOMC (Federal Open Market Committee) assembly, and analysts additionally linked the sell-off to geopolitical tensions.

Based on the crypto choices buying and selling desk QCP Capital, renewed tensions within the Center East fueled the sell-off. A part of its every day market report read,

“Within the absence of recent tariff headlines, geopolitics has returned to the forefront. Israel’s renewed strikes on Gaza following a brief truce have pushed gold hovering previous $3,000, whereas BTC continues to exhibit a unfavourable correlation.”

What’s subsequent post-FOMC?

The BTC decline noticed prime altcoins put up different retracements. Solana [SOL] dropped 5% however closed the session with solely 2%. XRP additionally posted a 2.2% loss on Tuesday, just like ADA.

Solely Ethereum [ETH] stabilized with a 0.27% acquire through the buying and selling session.

Quite the opposite, EOS [EOS] and Hyperliquid [HYPE] had been prime performers with 17% and seven% features, respectively, over the identical interval.

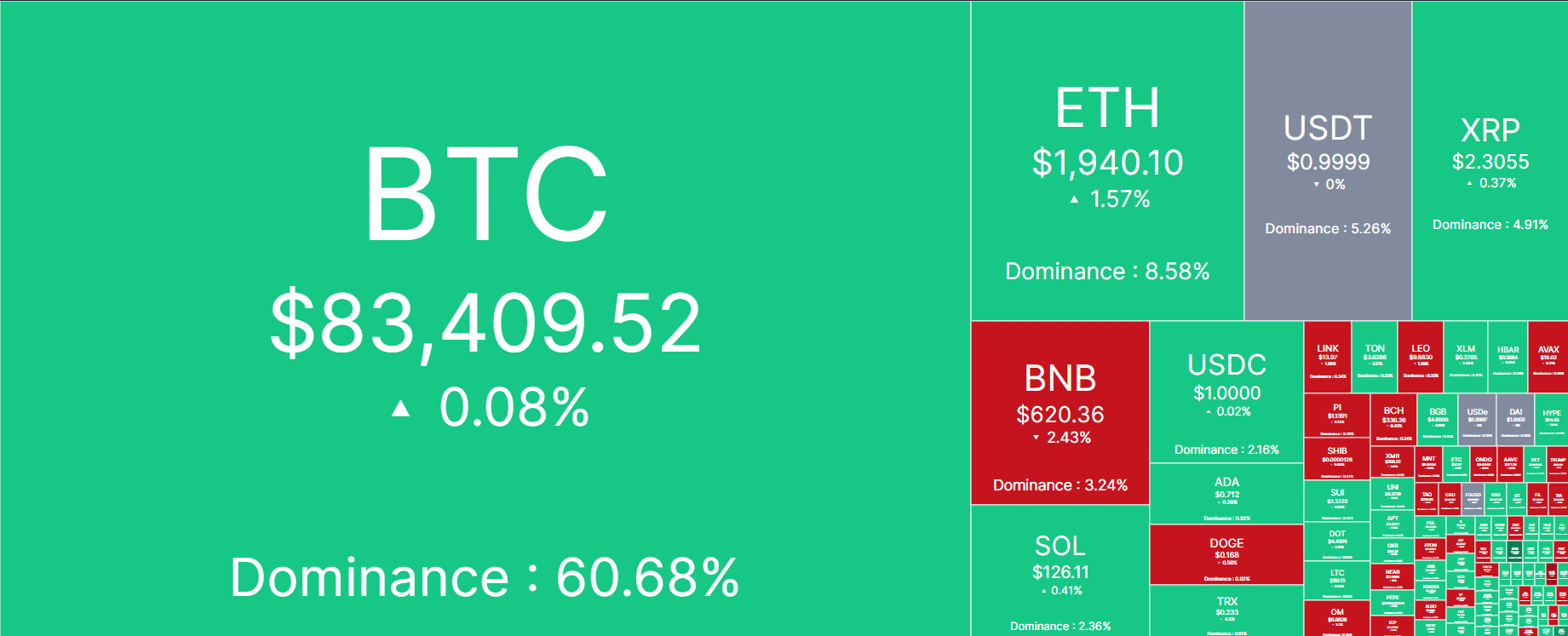

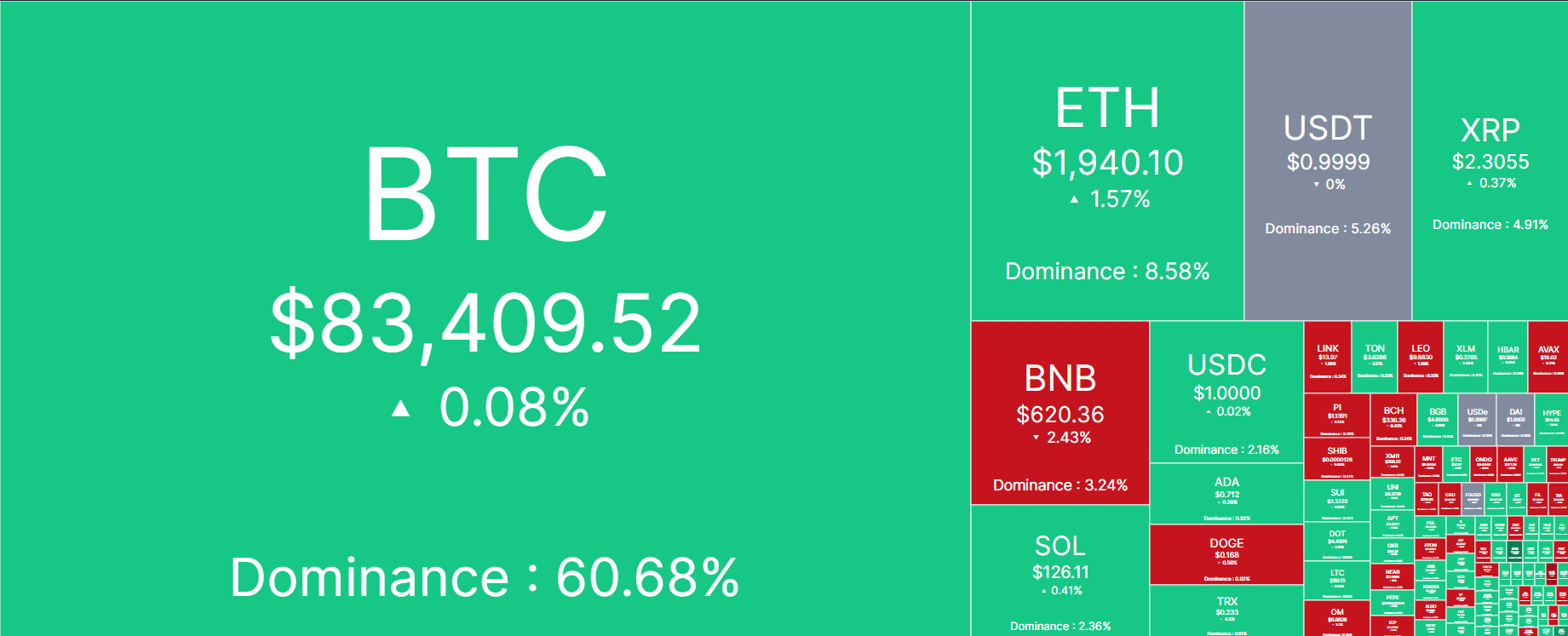

At press time, BTC reclaimed $83K, whereas ETH was above $1.9K a number of hours earlier than the FOMC announcement. However Binance Coin [BNB] and Dogecoin [DOGE] nonetheless had sustained sell-offs as of this writing.

Supply: CoinMarketCap

Whether or not the Fed price resolution will gas crypto restoration or lengthen the decline stays to be seen.

That mentioned, Jake Ostrovskis, an OTC (over-the-counter) dealer at Wintermute, noted that BTC and crypto would stay capped given its optimistic correlation with risk-on U.S. equities than gold.

“With correlations agency with the previous (Nasdaq), the market will wrestle to show greater with out being led by wider threat. You can’t commerce Crypto in a vacuum.”

For its half, the Swissblock blockchain analytics agency reiterated that the market was in a ‘high-risk’ state and that draw back threat couldn’t be overruled.

The chance-off sentiment was corroborated by the crypto worry and greed index, which was at ‘fear’ ranges of 32. Whereas this might be a ‘purchase’ alternative for long-term buyers, the Fed coverage outlook may provide clues for such a transfer.

Within the meantime, QCP Capital cautioned that President Trump’s new spherical of tariffs scheduled for the 2nd of April might be key knowledge to look at after the Fed assembly. It stated,

“BTC at $80K: An actual flooring or a mirage? Momentum & carry trades are unwinding. Whereas BTC has discovered some help, the macro backdrop suggests it might be short-lived. Trying forward, we stay cautious…”