Why is crypto down today? Looking at Bitcoin, FED, and past week’s sell-off effects!

- Bitcoin retained a bearish construction on the 4-hour chart

- Regular promoting was seen not too long ago, however sentiment appeared to level in the direction of a worth bounce

Bitcoin [BTC] noticed its Christmas rally start to fade, and an try and climb previous the $100k-mark was halted on Boxing Day. The 2-day U.S. Federal Reserve assembly that started on 17 December resulted in a coverage assertion. One which forecasted simply two rate of interest cuts in 2025, as a substitute of the beforehand projected 4.

This noticed the Dow Jones fall by over 2.5%, or simply over 1,150 factors. These losses have since been recovered, however the market has not been as form to Bitcoin.

Danger-on asset standing slows restoration

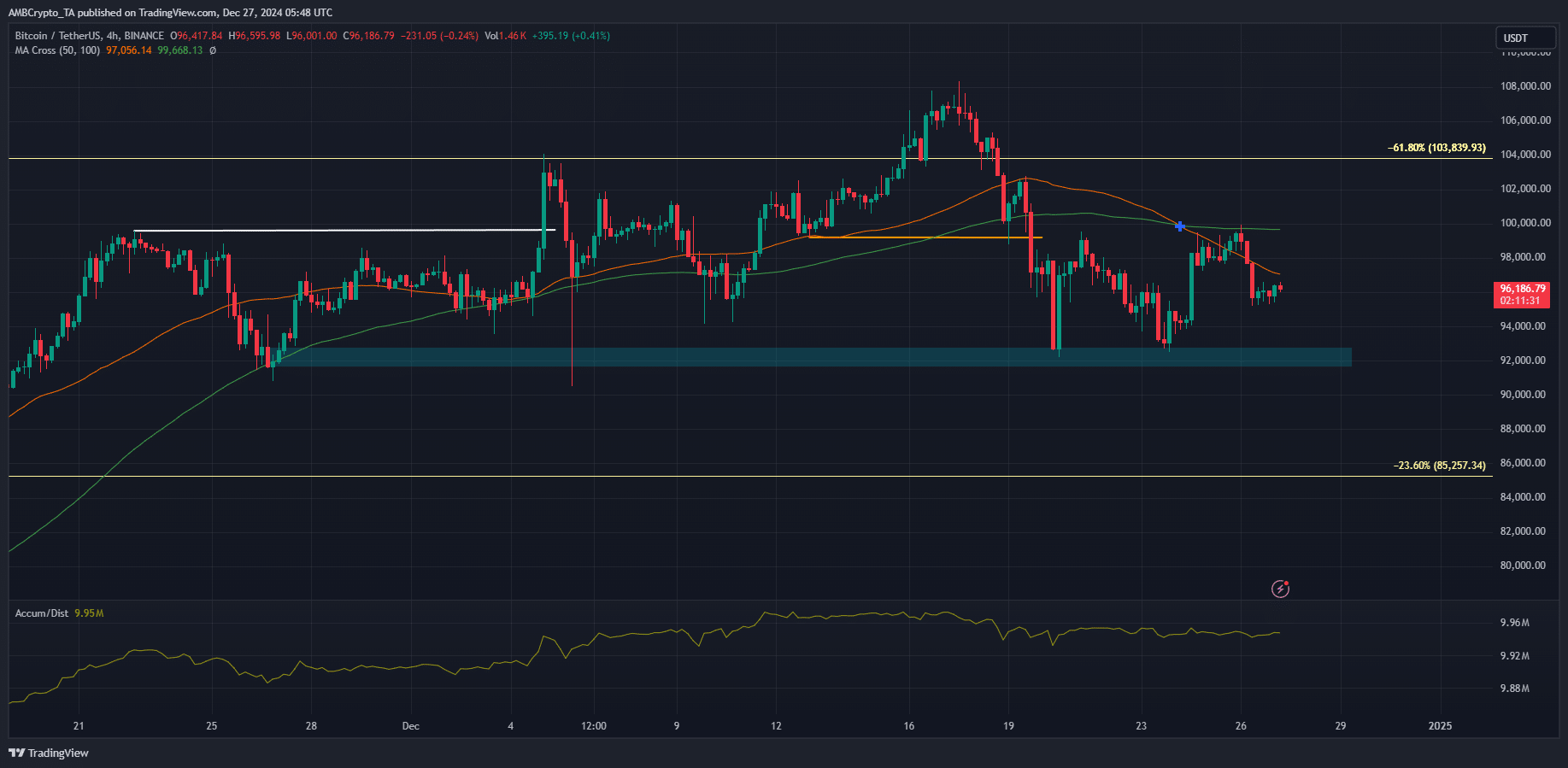

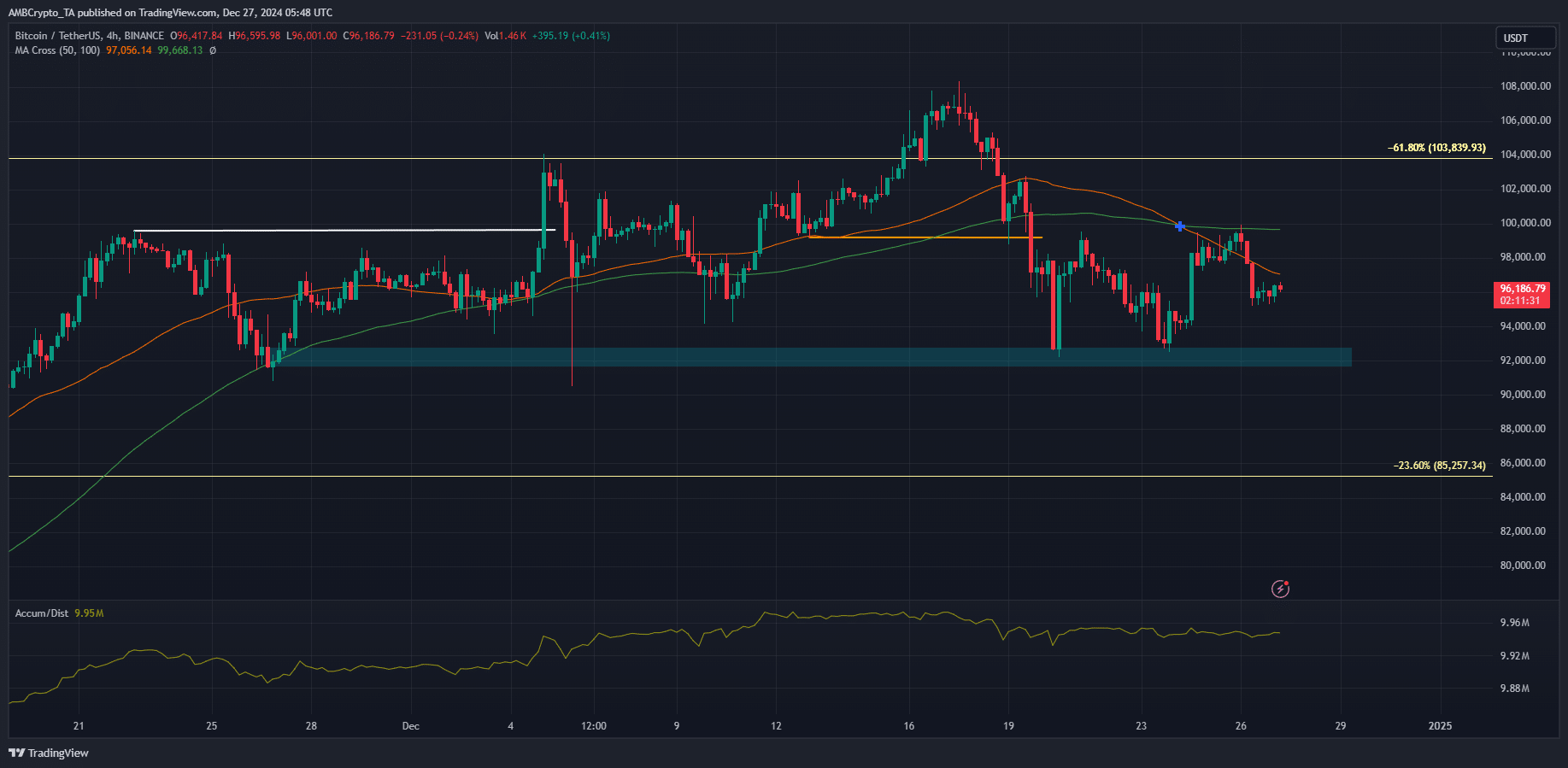

Supply: BTC/USDT on TradingView

The broader crypto market typically follows the development of Bitcoin. Within the Final 24 hours, BTC fell by 2.75% and the altcoin market shed 2.31% of its worth. Inspecting the development of BTC on the 4-hour chart, we are able to see that the bearish market construction was nonetheless in play.

It was flipped bearishly on 19 December, marked in orange. Since then, the A/D indicator has additionally been on a gradual decline, exhibiting lowered shopping for stress. The transferring common shaped a bearish crossover, additional highlighting downward momentum over the past ten days.

Crypto is down today- Will it regain the uptrend subsequent month?

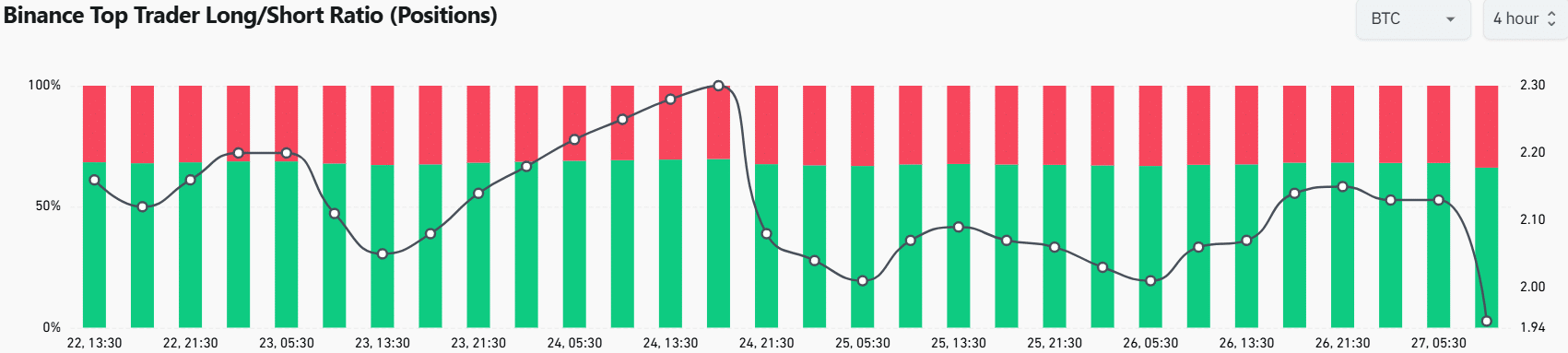

Evaluation of prime dealer positions on Binance utilizing Coinglass knowledge confirmed that there’s some short-term hope. AMBCrypto discovered that this metric, which measures the lengthy or brief positions held by the highest 20% of merchants, was at 1.95.

Lengthy positions accounted for 66.12%, and shorts for 33.88% – An indication of bullish sentiment among the many prime merchants.

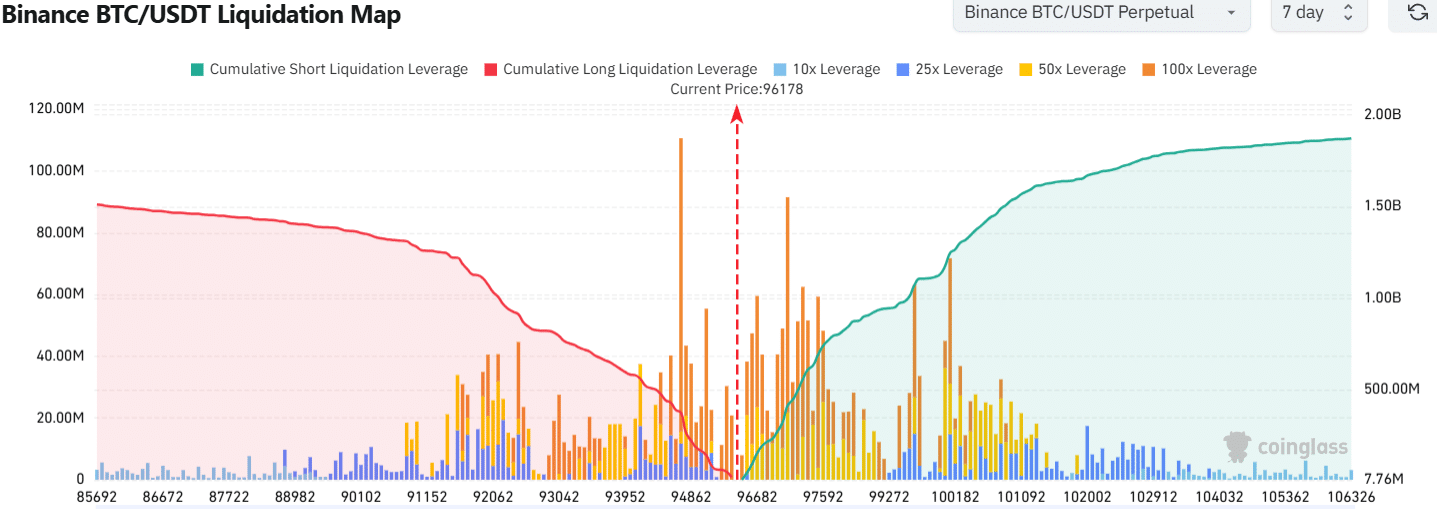

The liquidation map helped cement this bullish short-term thought. The liquidations to the north have been extra quite a few, which means {that a} liquidity hunt north was extra probably within the coming days.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

Based mostly on the information from the previous week, AMBCrypto discovered {that a} worth transfer is perhaps checked on the $97.6k-mark and rebuffed by sellers. Additional volatility could be anticipated as 2024 nears its finish.