Why Is The Crypto Market Down Today?

Este artículo también está disponible en español.

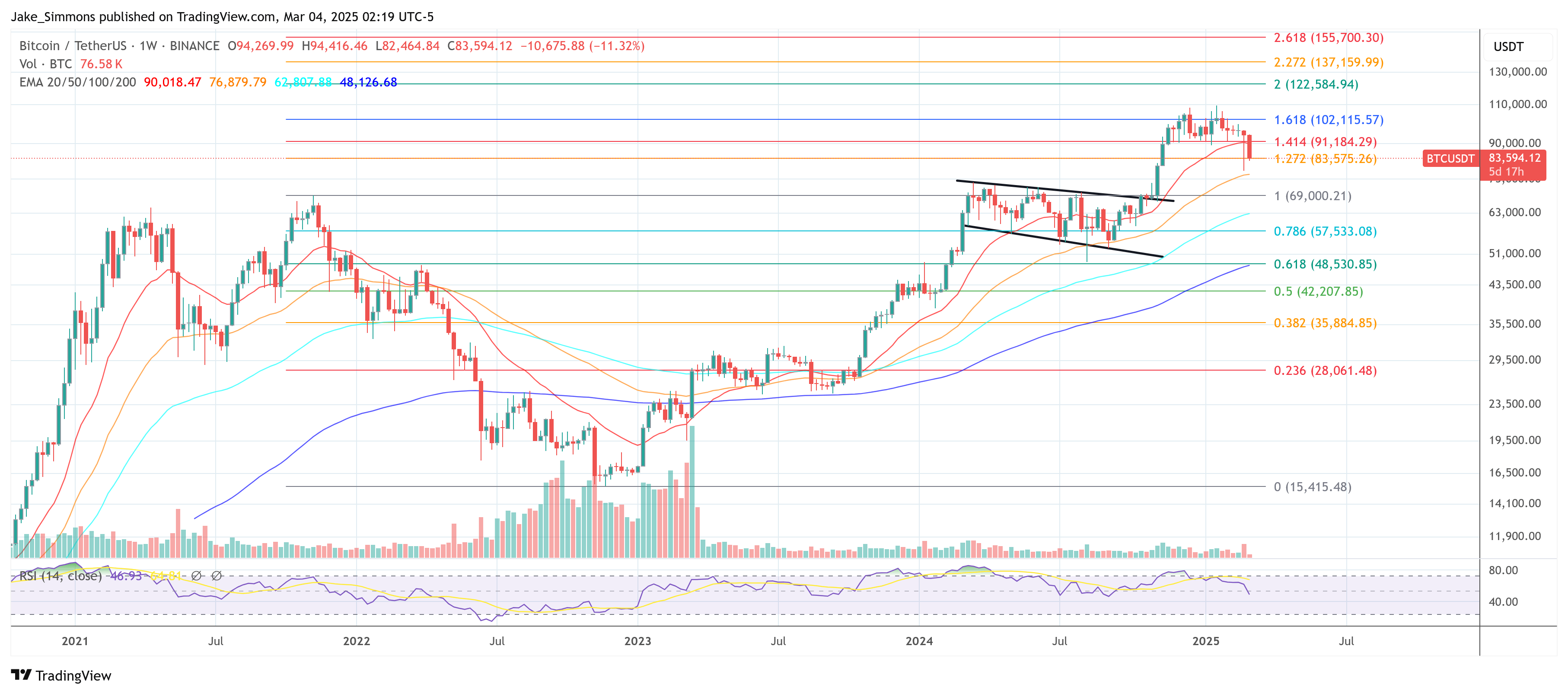

In a swift and dramatic reversal, crypto markets have shed a whole lot of billions of {dollars} within the area of simply in the future, elevating questions concerning the sustainability of latest positive aspects spurred by the shock announcement of a brand new US Crypto Reserve. On the peak of the preliminary rally—shortly after former President Donald Trump’s Sunday assertion unveiling the Reserve—complete crypto market capitalization soared from roughly $2.7 trillion to $3.1 trillion. However, as of the most recent readings, these positive aspects haven’t simply evaporated; the market now stands at round $2.6 trillion, even decrease than it was earlier than the announcement.

Why Is Crypto Down In the present day?

“The true driver right here is the GLOBAL transfer in the direction of the risk-off commerce,” writes The Kobeissi Letter (@KobeissiLetter) by way of X. In line with this evaluation, heightened commerce battle tensions and broad financial coverage uncertainty have prompted “ALL dangerous property” to retrace sharply, together with shares, oil, and crypto. Against this, conventional secure havens comparable to gold have continued to put up positive aspects, reinforcing the notion that cryptocurrencies are removed from being a refuge in turbulent instances.

Associated Studying

This sudden downturn has been accompanied by staggering figures. “During the last 24 hours, crypto has erased -$500 BILLION of market cap in a large reversal,” The Kobeissi Letter notes. Bitcoin, which initially appeared poised for a serious rally, has tumbled roughly 3% under its pre-announcement ranges, shedding practically $250 billion in market worth in simply 12 hours.

Ethereum (ETH) has seen a good sharper retreat. Previous to the US Crypto Reserve information on Sunday, ETH touched an area low of $2,173 on March 2. Quickly after the announcement, it climbed to $2,550 earlier than plunging to $2,002—about 8% decrease than its pre-announcement backside. “This got here with an enormous swing in sentiment in what seems to have been a colossal retail lure,” The Kobeissi Letter provides, noting that the Crypto Worry & Greed Index surged from round 20 (excessive concern) to just about 55 (near greed) earlier than cratering again to the low 20s.

Including to those indicators, the ultimate week of February registered a document $2.6 billion in crypto fund outflows—an alarming statistic that surpassed the earlier excessive by $500 million. Observers counsel that, regardless of the “most bullish bulletins ever,” capital is rotating out of cryptocurrencies primarily due to intensifying macroeconomic headwinds.

Associated Studying

In the meantime, secure haven property proceed to outperform. “Our premium members have been shopping for gold for months,” The Kobeissi Letter indicated, referring to a technique that noticed gold purchases throughout January’s dip. For the reason that begin of the 12 months, gold has climbed round 10%, with analysts forecasting additional upside. “We purchased the dip into January and referred to as for $2,850+. On Friday, we referred to as for one more larger low at $2850 and gold is nearing $2900+ once more now,” the market commentary said.

The place crypto was as soon as thought of an rising hedge towards financial uncertainty, present market habits suggests it’s now lumped in with different “dangerous property,” pushed a minimum of as a lot by world sentiment shifts and macroeconomic pressures as by sector-specific developments.

At press time, Bitcoin traded at $83,594.

Featured picture from Shutterstock, chart from TradingView.com