A Trump win is good for Ethereum ETFs – Analyst

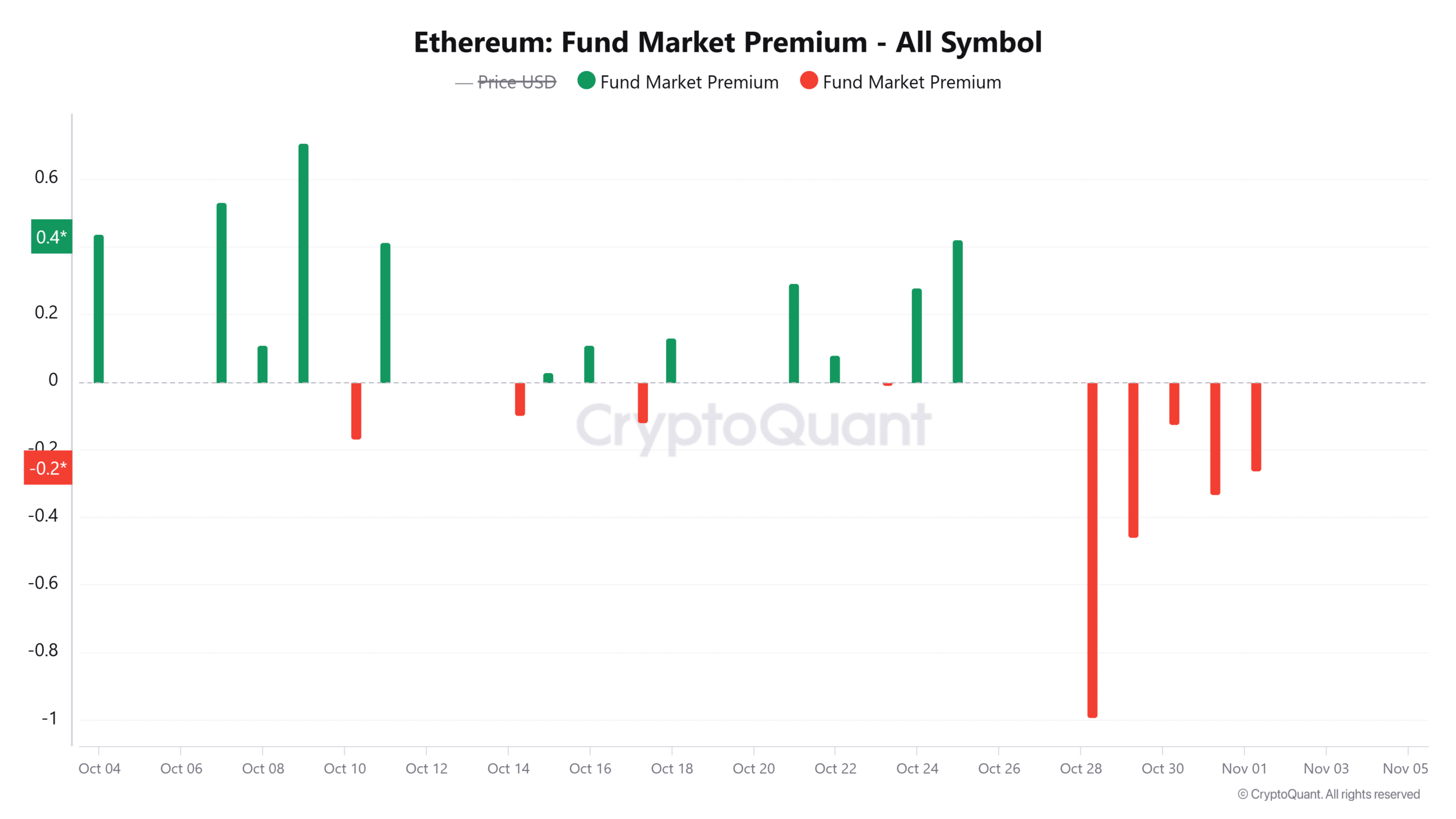

- The Ethereum Fund Market Premium flipped damaging, exhibiting weak institutional demand for ETH merchandise

- Nate Geraci believes staking for Ethereum ETFs might occur sooner below the Trump administration

Ethereum (ETH) has dropped by 10% within the final two weeks amid bearish strain. Attributable to its underwhelming efficiency in comparison with Bitcoin (BTC), ETH’s dominance has plunged to vary lows of under 13% too.

One issue contributing to Ethereum’s lack of beneficial properties is weak institutional demand. This may be seen within the suppressed inflows to identify ETH exchange-traded funds (ETFs). Ethereum ETFs have seen solely 4 weeks of whole optimistic netflows since launch in accordance with SoSoValue. This lack of demand has led to a declining fund market premium.

In reality, information from CryptoQuant revealed that the Ethereum fund market premium was predominantly damaging final week. This may be interpreted as an indication that ETH has been buying and selling at a reduction on the ETF market.

(Supply: CryptoQuant)

The damaging information additional revealed that there’s promoting strain and weak demand for ETH within the ETF market. This pointed in direction of bearish sentiment as massive buyers have remained cautious.

Nevertheless, provided that Bitcoin ETFs proceed to publish sturdy numbers with greater than $2 billion in inflows final week alone, why are Ethereum ETFs underperforming?

Right here’s why Ethereum ETFs are struggling

Nate Geraci, President of ETF Retailer, shared his insights on some components that might be driving weak inflows to ETH ETFs, aside from the bearish market sentiment.

He famous that since Bitcoin ETFs launched first, they’d a first-mover benefit and “stole some thunder” from Ethereum.

Moreover, outflows from the Grayscale Ethereum Belief (ETHE) ETF have additionally dampened the outlook of ETH ETFs. Since its launch, ETHE has posted $20 billion in outflows. Geraci additionally mentioned there’s insufficient advisor training round ETH. As such, establishments are much less drawn in direction of the asset.

“Suppose solely a matter of time earlier than spot ETH ETF inflows begin choosing up. Simply would possibly take some time.”

A Trump win is sweet for ETH ETFs

Geraci additional opined that if former U.S President Donald Trump wins the fifth November elections, it might bode effectively for Ethereum ETFs.

Earlier than the U.S Securities and Trade Fee (SEC) permitted Spot ETH ETFs, it ordered issuers to take away the availability round staking. Nevertheless, Geraci believes that staking would probably be allowed below the Trump administration.

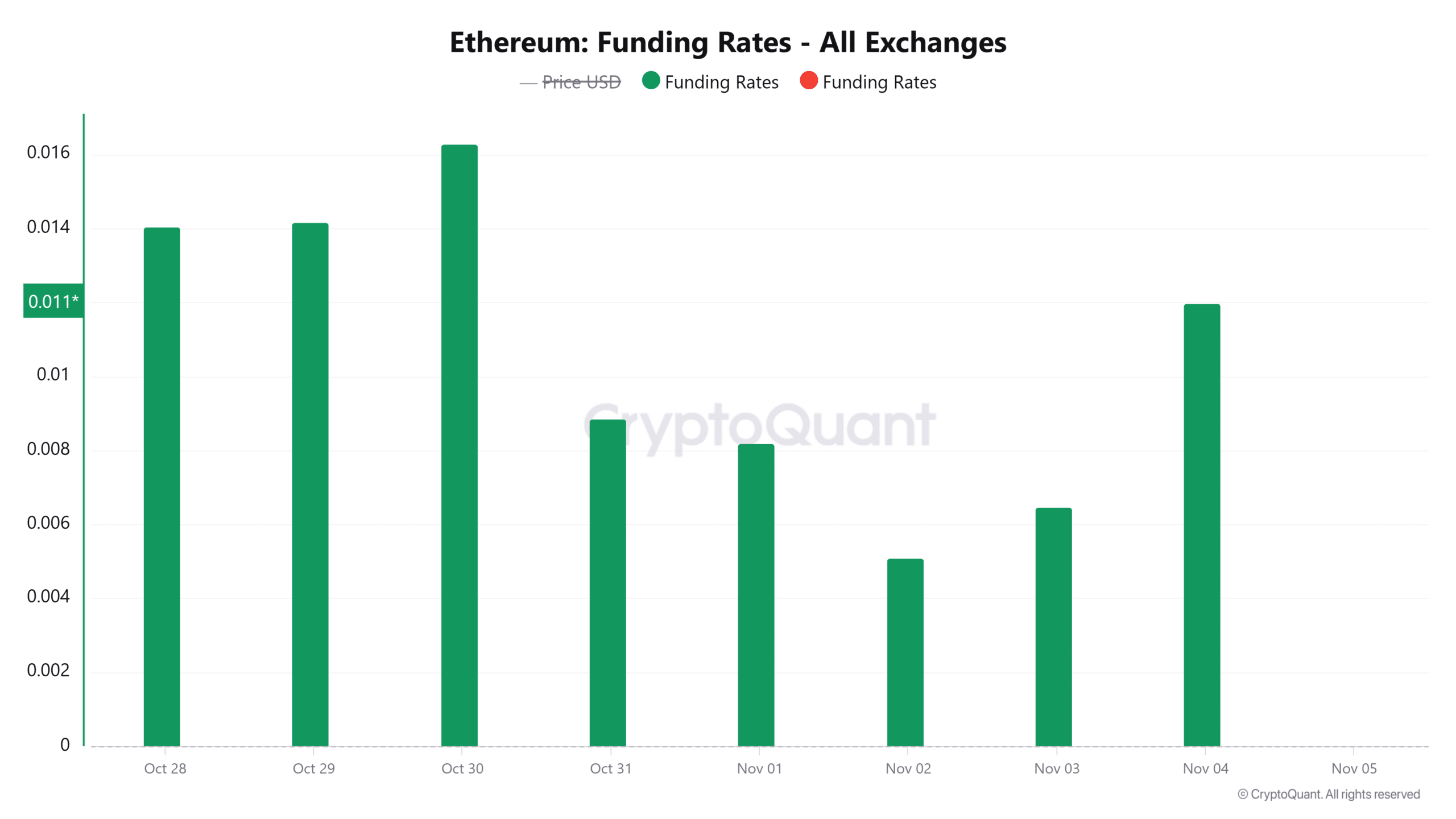

Ethereum merchants seem like pricing in a Trump win for the U.S presidency. At press time, Ethereum funding charges had risen by 85% to 0.0119. This instructed rising bullish sentiment within the Futures market the place the demand for lengthy positions has been excessive.

(Supply: CryptoQuant)