Bitcoin: Whales hoard BTC as market gets ready for a big next week

- Whale transactions jumped to their highest stage since June 2o22.

- Clearance for spot Bitcoin ETFs was anticipated subsequent week.

Bitcoin [BTC] misplaced a number of the features established earlier within the week because the crypto market went into maybe one of the suspenseful weekends in a while.

In keeping with AMBCrypto’s studying of CoinMarketCap knowledge, the king forex was buying and selling at $43,700 as of this writing, dropping from the upper $45,000 zone.

Curiously, the decline corresponded with a interval of great buying and selling exercise by whale traders.

Whales stocking up Bitcoin

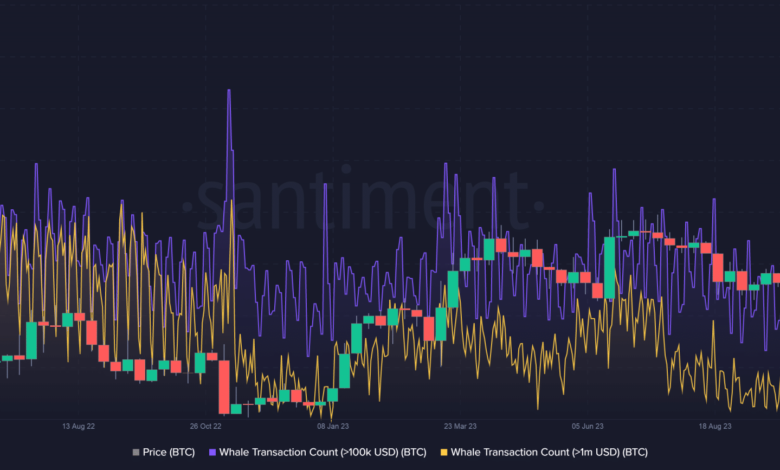

As per on-chain analytics agency Santiment, a complete of 34,874 transactions value over $100,000 have been recorded on the third and 4th of January. Notably, this was the best stage since June 2022.

The earlier report was set within the two days between eleventh June and twelfth June, when extra over 39,000 transactions have been registered.

Supply: Santiment

Apparently, the frenzy was pushed by small whales. After digging additional, AMBCrypto noticed a noticeable spike within the addresses holding between 100 and 10,000 BTCs.

Supply: Santiment

It was extremely seemingly that whales introduced the dip as short-term holders determined to money in on BTC’s surge previous $45,000.

Whales have been additionally having greater lengthy publicity than retail traders on prime crypto exchanges as of this writing. AMBCrypto’s evaluation of Hyblock Capital’s knowledge confirmed constructive values of Whale vs Retail Delta Indicator.

Supply: Hyblock Capital

Prepared for celebrations?

The buildup mirrored whales’ persevering with optimism on BTC. Observe that the date for a call on the 11 spot ETF functions was across the nook.

Bloomberg analyst James Seyffart reported that every one the 11 issuers submitted a ultimate model of a key doc known as 19b-4 filings.

Learn BTC’s Worth Prediction 2023-24

This introduced spot Bitcoin ETFs one step nearer to turning into a actuality in america.

The final and ultimate formality of submitting the ultimate S-1s was due 8 am ET Monday, paving manner for the official clearance by the U.S. Securities and Trade Fee (SEC) on the eleventh of January, Bloomberg ETF analyst Eric Balchunas talked about.