417K ETH converted into BTC – Why the next few days could shape market volatility

- Among the stolen Bybit funds are traceable, whereas others have vanished into untraceable channels

- Within the meantime, the crypto neighborhood stays on excessive alert.

The notorious Bybit hack triggered a serious FUD second throughout the crypto market.

A complete of $1.4 billion (round 500,000 ETH) was compromised, with 77% nonetheless traceable, 20% gone darkish, and three% frozen. Right here’s a breakdown of how the funds have been moved.

A breakdown of the hacked funds

Out of the $1.4 billion stolen within the hack, an intensive evaluation uncovered the next key insights – 77% of the stolen funds stay traceable, offering some hope for restoration.

Nonetheless, 20% of the funds have disappeared from the radar, making them exceedingly troublesome, if not unattainable, to trace. On a extra constructive observe, 3% of the funds have already been efficiently frozen.

The hacker employed a collection of refined methods to maneuver and obscure the stolen belongings. Hackers quickly transformed a considerable 417,348 ETH into Bitcoin throughout 6,954 wallets, averaging 1.71 BTC per pockets.

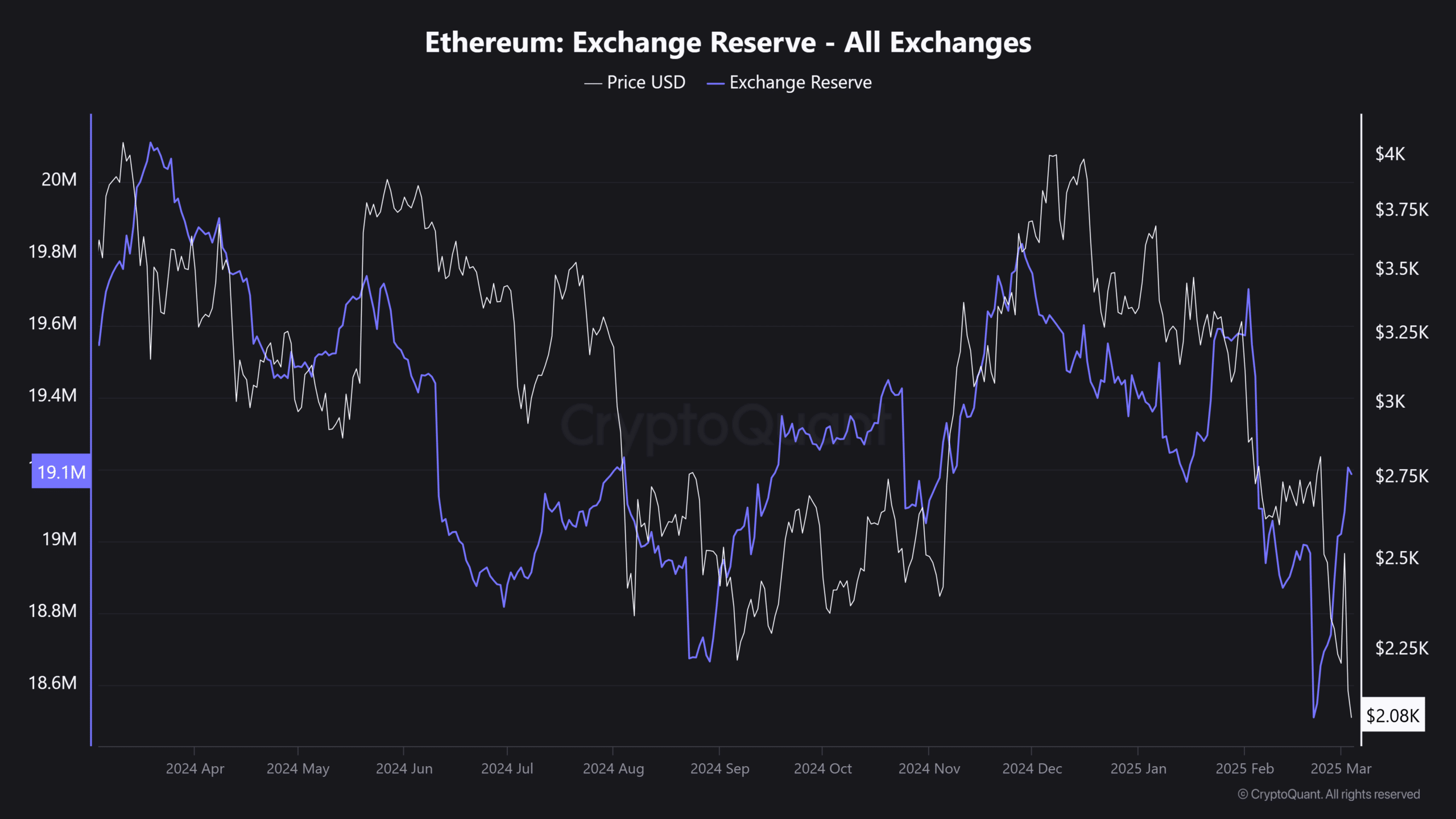

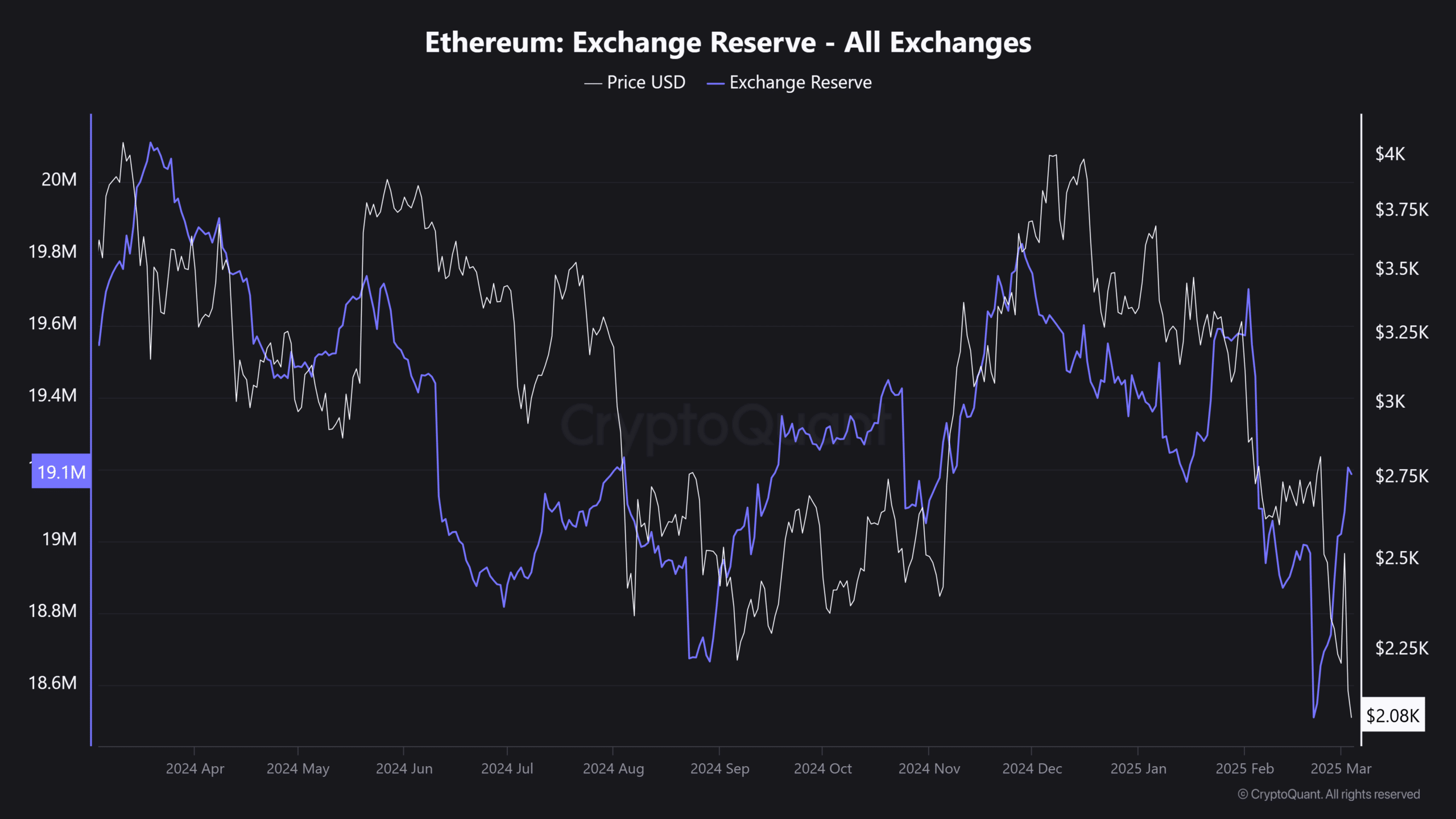

The sheer quantity of Ethereum [ETH] transformed into Bitcoin is more likely to have a big influence on BTC’s market liquidity. This huge-scale conversion may enhance the provision of Bitcoin on exchanges.

With uncertainty surrounding BTC’s subsequent transfer, this inflow of liquidity may intensify market volatility within the coming days.

Potential for ETH/BTC volatility

The Bybit hack has set the stage for a turbulent interval within the crypto market. The motion of $1.4 billion in compromised funds – significantly the large conversion of ETH into Bitcoin – will create a big ripple impact on market liquidity.

For one, with funds distributed throughout 6,954 wallets, transactions may unfold throughout a number of exchanges, growing the complexity of monitoring the funds.

On high of that, there’s rising stress over the dearth of affirmation of Trump’s pro-ETH/BTC positon. Critics are already speculating that it might be a part of a broader market manipulation technique, stirring doubts amongst buyers.

Furthermore, ETH reserves, after hitting a yearly low, at the moment are starting to rise once more, which solely provides gas to the hearth. On this local weather of heightened stress, absorbing the sell-side liquidity will probably be something however simple.

Supply: CryptoQuant

Tread fastidiously! Merchants and buyers might want to navigate a risky panorama, the place sudden strikes can set off sharp market reactions within the coming days.