Ethereum Coinbase Premium Gap dips after spot ETF approval

- Since ETFs had been accepted, the Ethereum Coinbase Premium Hole has declined.

- The coin’s value remained susceptible to swings regardless of the lower in volatility.

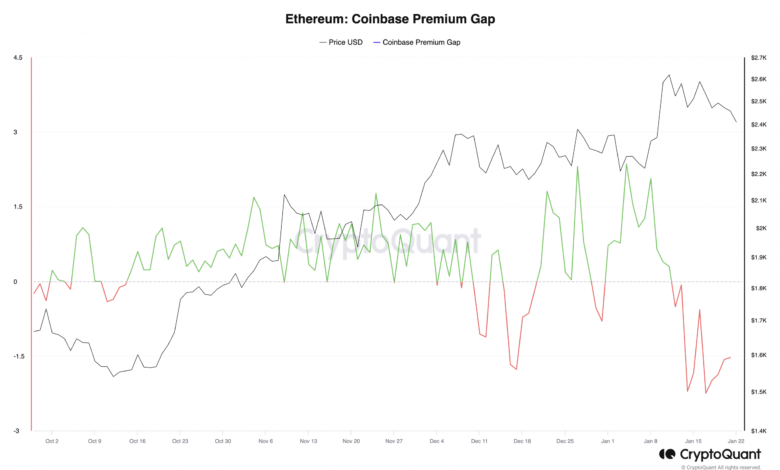

Ethereum’s [ETH] Coinbase Premium Hole has shrunk for the reason that launch of Bitcoin [BTC] spot exchange-traded fund (ETF) on the tenth of January, information from CryptoQuant revealed.

This metric tracks the distinction between ETH’s value on Coinbase and Binance. When this indicator returns a optimistic worth and rises, it signifies that the coin is buying and selling at a premium on Coinbase.

Conversely, when it declines, it signifies that the coin trades at a a lot cheaper price on Coinbase than on Binance, principally as a result of a shift in sentiment or shopping for stress between US-based traders.

In line with information from CryptoQuant, ETH’s Coinbase Premium Hole was -1.53 at press time, declining by over 450% since BTC ETF went reside.

Supply: CryptoQuant

An evaluation of the Asian markets revealed that the coin’s Korean Premium Hole stayed optimistic after BTC ETFs grew to become tradable.

ETH’s Korean Premium Hole measures the value hole between South Korean exchanges and different exchanges. When it climbs, it signifies the presence of robust shopping for stress amongst Korean retail traders.

As of this writing, ETH’s Korean Premium Hole was 3.32, per information from CryptoQuant.

Supply: CryptoQuant

Impending value volatility?

Coinbase ranks because the second-largest cryptocurrency change by quantity. Therefore, the sustained decline in ETH’s Premium Hole on the change is one to be aware of.

It’s because a sustained discrepancy between change costs may improve Ethereum’s market volatility.

An evaluation of the coin’s Bollinger Bands (BB) indicator on a each day chart confirmed a gradual widening of the hole between this indicator’s higher and decrease bands.

Each time this hole widens, it alerts that an asset’s value deviates extra from its common.

Nevertheless, on the identical time, ETH’s Common True Vary (ATR) and its Chaikin Volatility, that are additionally market volatility markers, have trended downward.

At press time, ETH’s ATR was 102.20, falling by 18% for the reason that twelfth of January. Likewise, the coin’s Chaikin Volatility has since plunged by over 150%.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

When these indicators development downward, it suggests a lower within the volatility of an asset’s value actions.

Supply: TradingView

Due to this fact, whereas ETH’s BB indicator hints at potential value swings, the declining ATR and Chaikin Volatility recommend that the development has turn out to be much less risky.