Is Ethereum’s price bottom in sight? Key data points to…

- ETH’s worth tapped its realized worth, elevating hopes of a possible backside.

- Weak demand for spot ETH ETFs and flat community progress may derail such an consequence

Ethereum’s [ETH] worth is within the information after it tagged a key degree that flagged earlier long-term market bottoms, elevating hopes of potential reversal for the altcoin.

In accordance with CryptoQuant analyst Kriptolik, ETH dropped under its ‘realized worth,’ the typical value foundation for many patrons. This degree usually marks a possible market shift. The analyst claimed,

“These intervals have persistently been adopted by sturdy recoveries — making them strategic accumulation factors for long-term traders.”

Supply: CryptoQuant

The hooked up chart additionally revealed that the realized worth noticed market rebounds in 2018-2020.

Nonetheless, the extent may additionally act as a resistance within the quick time period when ETH’s worth drops under it. In such a case, the analyst warned {that a} hike in panic promoting of ETH could possibly be probably within the close to time period.

What’s subsequent for ETH?

Even so, U.S shares and crypto, together with ETH, have reacted like risk-on property to Trump tariff updates. As such, a possible backside could possibly be accelerated solely by way of a constructive macro shift.

In truth, even institutional traders exited the altcoin for six consecutive weeks, as proven by the constant outflows from U.S spot ETH ETFs.

Supply: Soso Worth

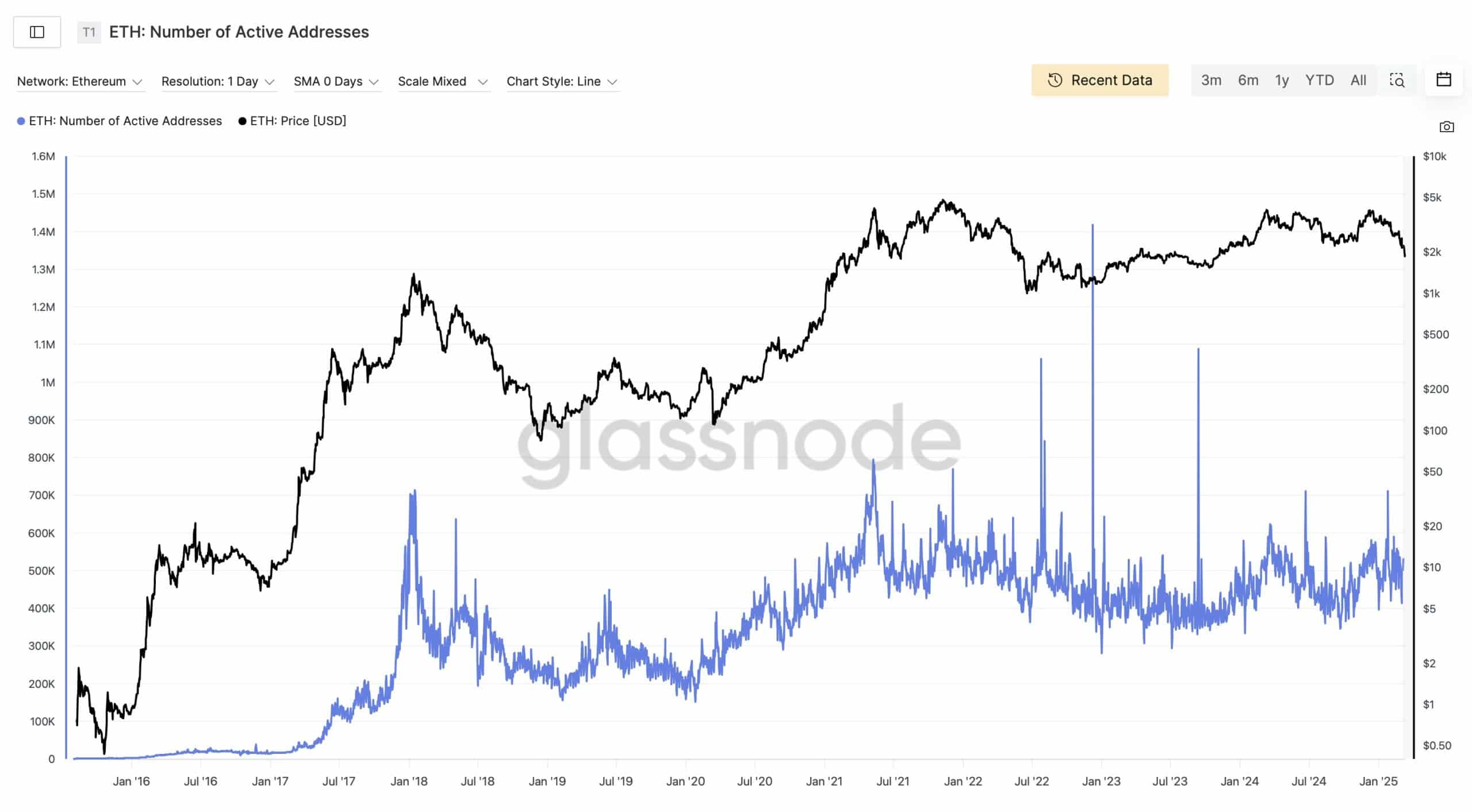

One other cautious data level, in response to analyst Stacy Muur, is stagnant energetic customers. She famous that Ethereum energetic addresses have been flat for 4 years.

Though some critics have argued that customers migrated to L2s, stagnant community progress may cap ETH’s restoration prospects.

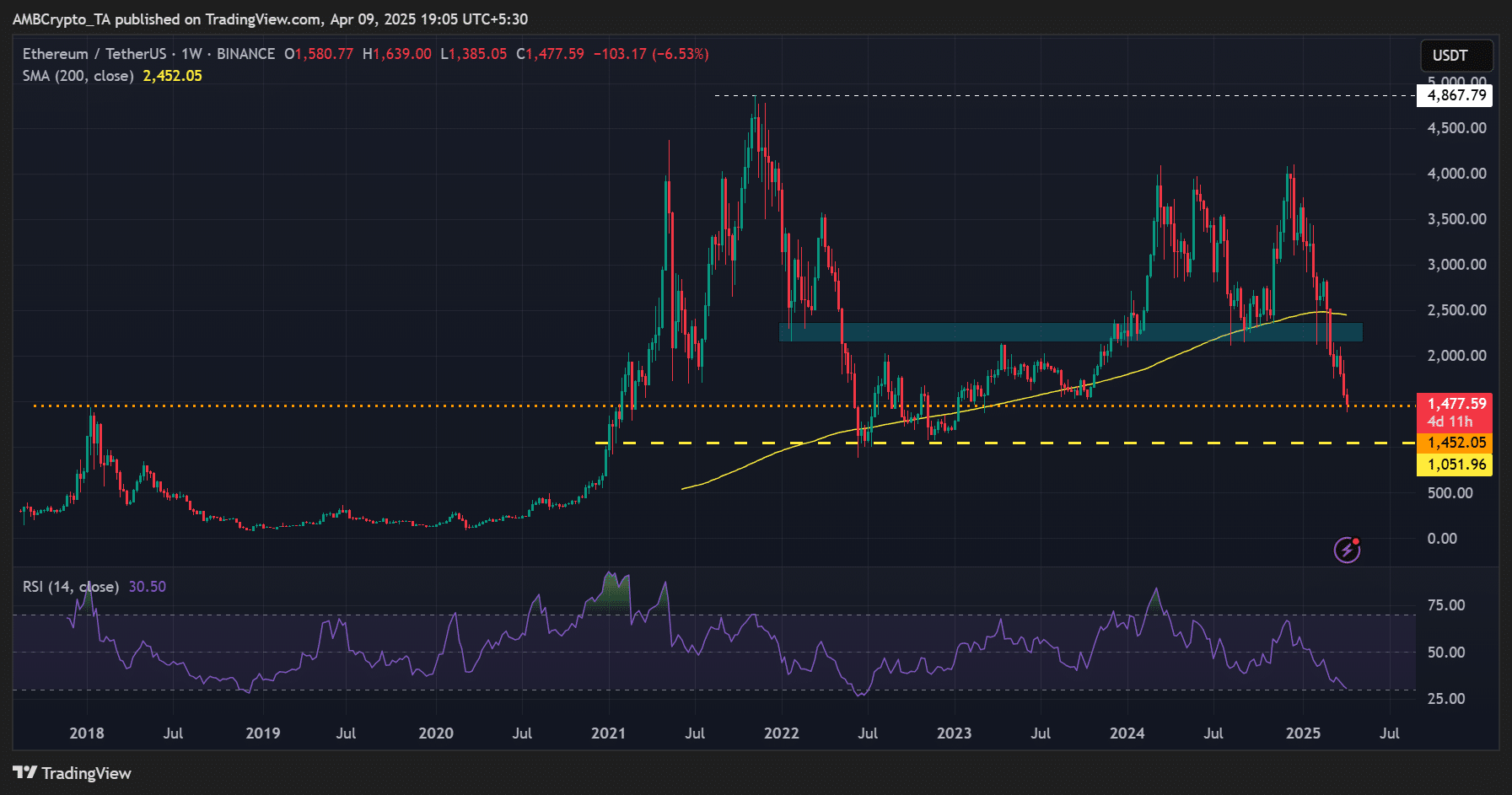

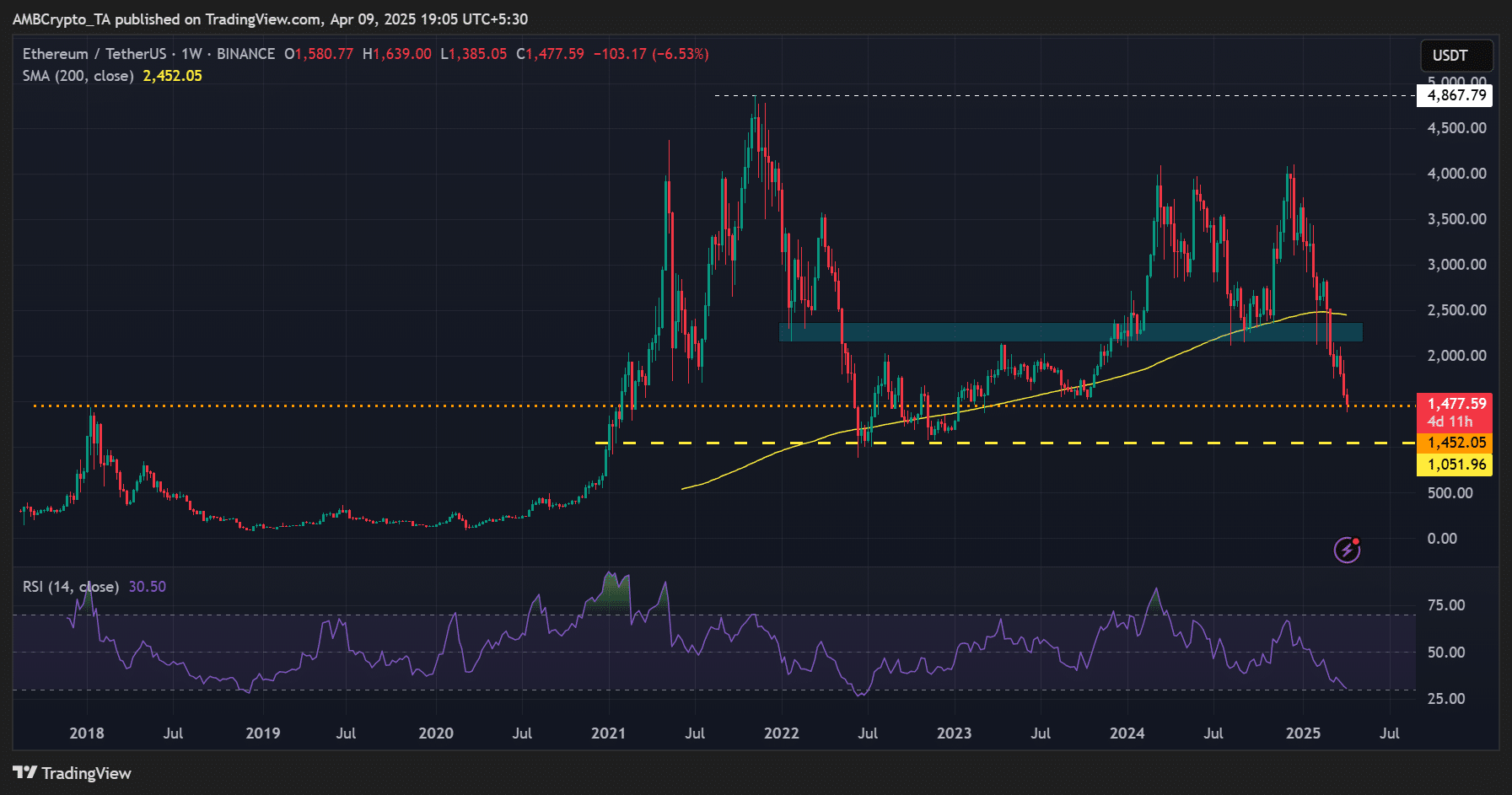

From a worth chart perspective, ETH dropped to a two-year low under $1.5k. In truth, it was down 64% from its press time cycle peak of $4k.

With ongoing macro uncertainty, an prolonged decline to $1k can’t be overruled within the quick time period.

Supply: ETH/USDT, TradingView

Merely put, the altcoin hit a pivotal level, particularly when tracked from a realized worth perspective.

Nonetheless, the macro entrance at the moment dominates market path and will delay a possible ETH rebound if the uncertainty persists within the quick time period. Apart from, as revealed by a 7-week streak of ETH ETF outflows, the weak demand didn’t paint a robust restoration outlook.