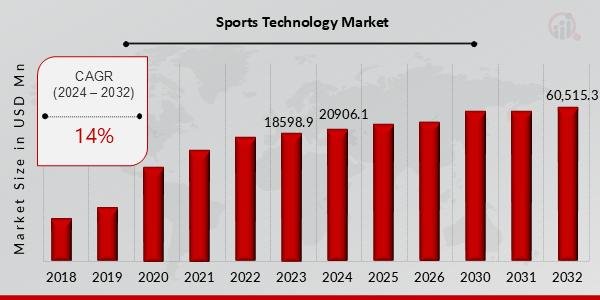

The Global Sports Technology Market: A Rapid Ascent Towards $60 Billion by 2032

The worldwide sports activities expertise market is on a meteoric rise, demonstrating the profound affect of innovation on athletic efficiency, fan engagement, and the very infrastructure of sports activities. Valued at a powerful USD 18,598.9 million in 2023, the market is projected to skyrocket to USD 60,515.3 million by 2032, exhibiting a strong Compound Annual Development Price (CAGR) of 14% from 2024 to 2032. This dynamic progress is a testomony to the growing integration of cutting-edge applied sciences throughout all aspects of the sports activities ecosystem.

Driving Forces Behind the Development:

A number of key elements are fueling this important enlargement:

• Enhancing Athletic Efficiency: The relentless pursuit of peak efficiency is a main driver. Applied sciences associated to gear, wearables, and superior analytics present athletes and coaches with unprecedented insights into coaching methodologies, harm prevention, and real-time efficiency optimization.

• Immersive Fan Engagement: Sports activities expertise is revolutionizing the fan expertise, each inside and outdoors stadiums. Sensible stadiums, enhanced broadcasting, digital and augmented actuality (VR/AR) experiences, and personalised content material supply are creating extra interactive and charming methods for followers to attach with their favourite sports activities and groups.

• Operational Effectivity and Information-Pushed Resolution Making: From managing large-scale occasions to optimizing group methods and participant recruitment, expertise affords instruments for better effectivity and knowledgeable decision-making. Information analytics is turning into indispensable for understanding participant statistics, recreation patterns, and market traits.

• Rising Adoption of AI/ML Applied sciences: Synthetic intelligence (AI) and machine studying (ML) are on the forefront of innovation in sports activities expertise. These applied sciences are being utilized in numerous areas akin to:

o Participant Efficiency Evaluation: AI/ML algorithms analyze huge quantities of information from wearables, video footage, and sensors to supply detailed insights into participant actions, biomechanics, fatigue ranges, and harm threat.

o Customized Coaching: AI-driven platforms create tailor-made coaching packages and restoration plans primarily based on particular person athlete knowledge, optimizing their growth and stopping overexertion.

o Recreation Technique: AI can analyze opponent weaknesses, predict recreation outcomes, and counsel in-game tactical changes, giving groups a aggressive edge.

o Expertise Identification and Scouting: AI helps determine promising expertise by analyzing efficiency knowledge from a wider pool of athletes, making scouting extra environment friendly and goal.

Get a Free PDF Pattern: https://www.marketresearchfuture.com/sample_request/10579

Market Segmentation Highlights:

• Sensible Stadiums Lead the Method: The “Sensible Stadium” section stands out as a dominant pressure out there. Holding a considerable 42.59% share in 2022, this section is anticipated to proceed its sturdy progress with a projected CAGR of 14.5%. Sensible stadiums combine a spread of applied sciences, together with high-speed connectivity (5G), IoT sensors, superior safety techniques, and digital shows, to reinforce fan expertise, optimize operations, and create new income streams.

• Complete Parts: The market encompasses a broad vary of parts, together with specialised gear for coaching and efficiency monitoring, superior amenities like sensible stadiums, and strong digital infrastructure to help knowledge processing and connectivity.

Browse Full Analysis Report: https://www.marketresearchfuture.com/reports/sports-technology-market-10579

Regional Dominance and Rising Markets:

• North America’s Stronghold: North America has traditionally dominated the worldwide sports activities expertise market, accounting for a major 32.9% share in 2022. This management is attributed to the area’s extremely developed sports activities trade, early adoption of technological improvements, presence of main sports activities leagues and tech corporations, and substantial investments in sports activities infrastructure.

• Europe’s Strong Presence: Europe follows North America with a strong market presence, pushed by its passionate sports activities tradition, well-established leagues (particularly in soccer), and growing funding in digital transformation inside sports activities.

• Asia-Pacific’s Speedy Ascent: The Asia-Pacific area is poised for strong progress, exhibiting the quickest progress charge within the sports activities expertise market. This surge is fueled by a quickly increasing e-commerce sector, growing disposable incomes, a burgeoning curiosity in varied sports activities (together with esports), widespread smartphone adoption, and important authorities and personal sector investments in growing sensible sports activities infrastructure. Nations like China and India are on the forefront of this progress.

Purchase Premium Analysis Report: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=10579

In conclusion, the worldwide sports activities expertise market is experiencing an unprecedented surge, pushed by the continual integration of superior applied sciences like AI/ML, the growing demand for enhanced fan experiences, and the persistent pursuit of athletic excellence. Whereas North America presently leads, the Asia-Pacific area is rising as a essential progress engine, indicating a very international transformation of the sports activities panorama.

Associated Experiences:

RF Duplexer Market https://www.marketresearchfuture.com/reports/rf-duplexer-market-37783

Shopper Electronics Sensor Market https://www.marketresearchfuture.com/reports/consumer-electronics-sensor-market-29209

Tank Gauging System Market https://www.marketresearchfuture.com/reports/tank-gauging-system-market-31709

Fiber Optic Stress Sensor Market https://www.marketresearchfuture.com/reports/fiber-optic-pressure-sensor-market-35778

Programmable Automation Controller Market https://www.marketresearchfuture.com/reports/programmable-automation-controller-market-39182

Discrete Capacitor Market https://www.marketresearchfuture.com/reports/discrete-capacitor-market-38546

Recreation Digital camera Market https://www.marketresearchfuture.com/reports/game-camera-market-40304

GPS Alarm Market https://www.marketresearchfuture.com/reports/gas-alarm-market-40343

Sheet Fed Scanner Market https://www.marketresearchfuture.com/reports/sheet-fed-scanner-market-40373

Silicon Interposers Market https://www.marketresearchfuture.com/reports/silicon-interposers-market-40387

Market Analysis Future (MRFR) is a worldwide market analysis firm that takes delight in its providers, providing an entire and correct evaluation relating to numerous markets and shoppers worldwide. Market Analysis Future has the distinguished goal of offering the optimum high quality analysis and granular analysis to purchasers. Our market analysis research by merchandise, providers, applied sciences, functions, finish customers, and market gamers for international, regional, and nation degree market segments, allow our purchasers to see extra, know extra, and do extra, which assist reply your most necessary questions.

Contact:

Market Analysis Future

99 Hudson Avenue,5Th Ground

New York, New York 10013

United States of America

Gross sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Electronic mail: gross sales@marketresearchfuture.com

This launch was revealed on openPR.